https://www.nrel.gov/computational-science/artificial-intelligence.html

The US economy became the largest in the world in 1890. It still leads the world today 134 years later.

Of 10 largest economies in the world, the US has the 3rd highest GDP growth rate at 3.0%. Less developed China (5%) and India (8%) lead the way. The median growth rate is 1.2%. The UK and Germany have negative annual growth rates (recession)! The US has the second lowest unemployment rate at 3.8%, only bettered by Japan at 2.6%. The median is between China at 5.2% and Canada at 6.1%. France and Italy record 7.5% while Brazil and India trail at 8%.

The US economy is as large as China, Germany and Japan combined or as large as the 3rd through 10th largest economies combined.

https://www.usnews.com/news/best-countries/articles/the-top-10-economies-in-the-world

The US dollar is worth 10% more than before the pandemic, reflecting its above average recovery.

The US stock market has overperformed for 15 years, growing from 30% to 45% of global stock market value.

Despite its high wages, high standard of living and highly valued currency, real dollar US exports exceed the pre-pandemic level.

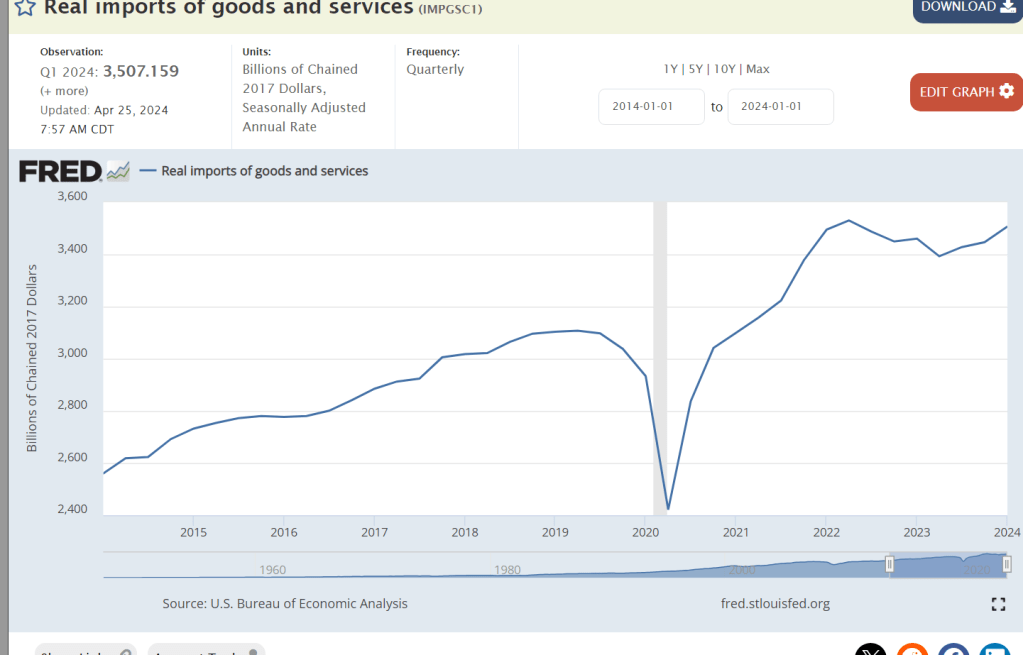

Real dollar imports have returned to their growth trend level, allowing US consumers to take advantage of the differentiated global economy’s strengths.

https://www.axios.com/2023/12/21/misery-index-economy

The misery index, the sum of the inflation and unemployment rates, is down to 7% and trending lower, materially below the 8% average of this century.

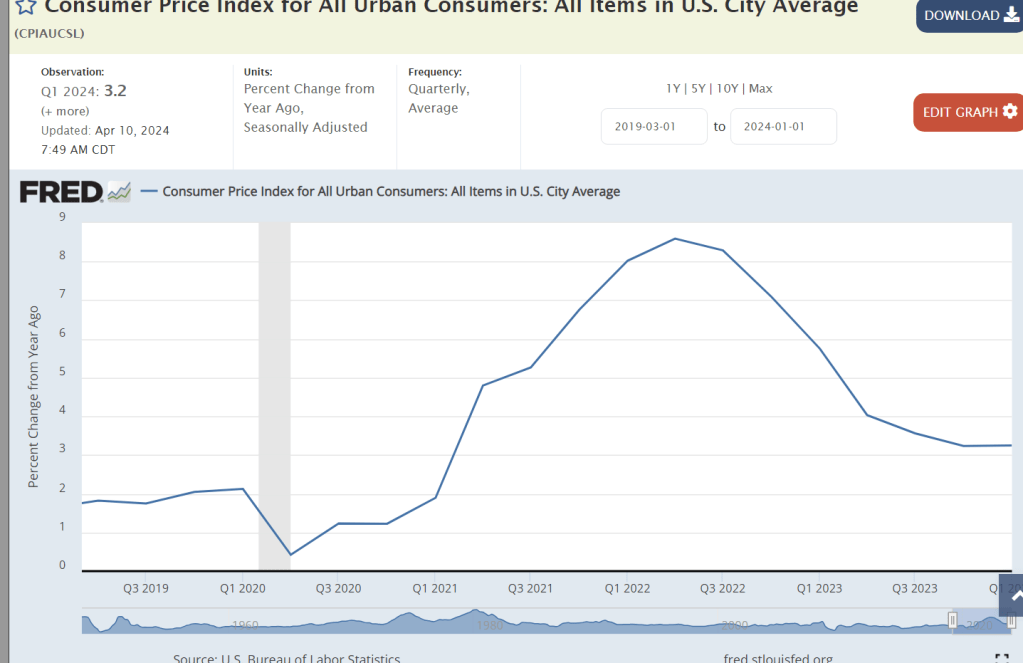

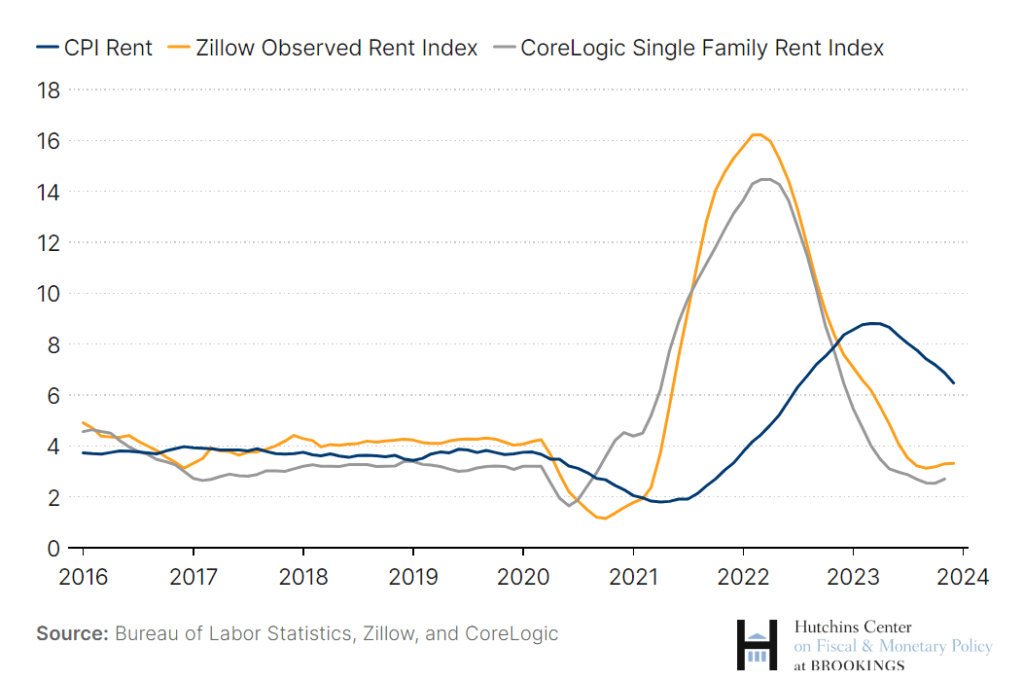

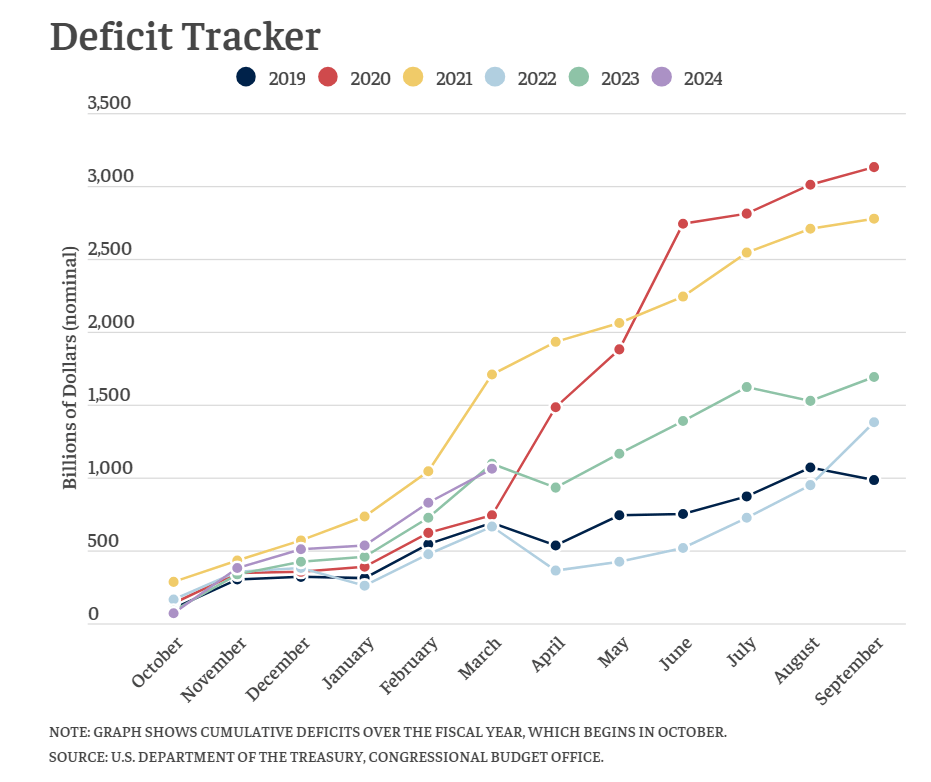

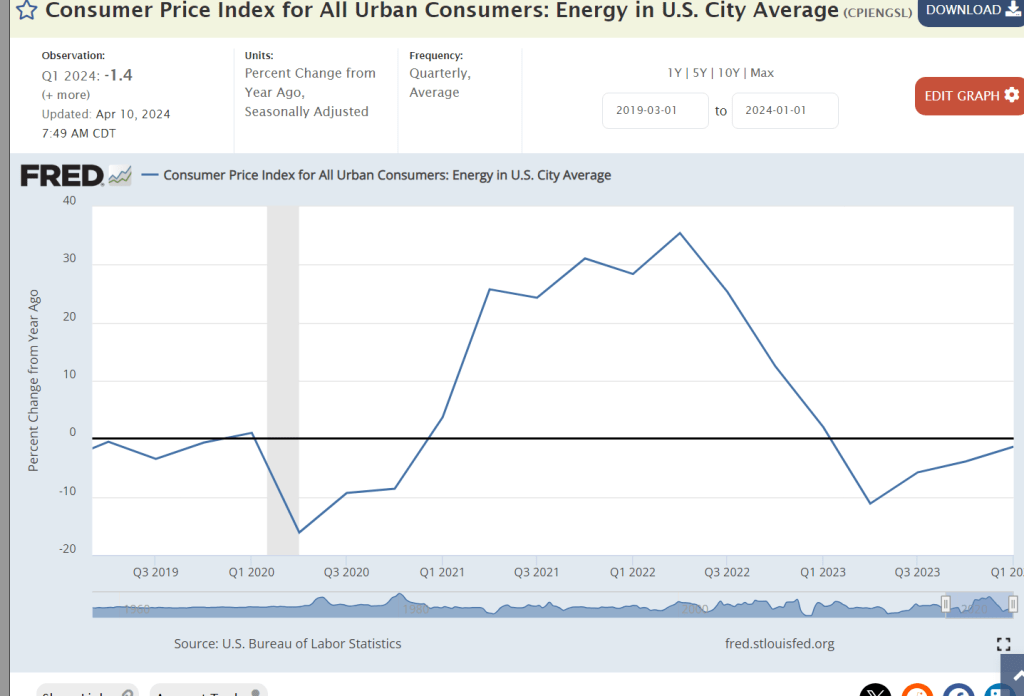

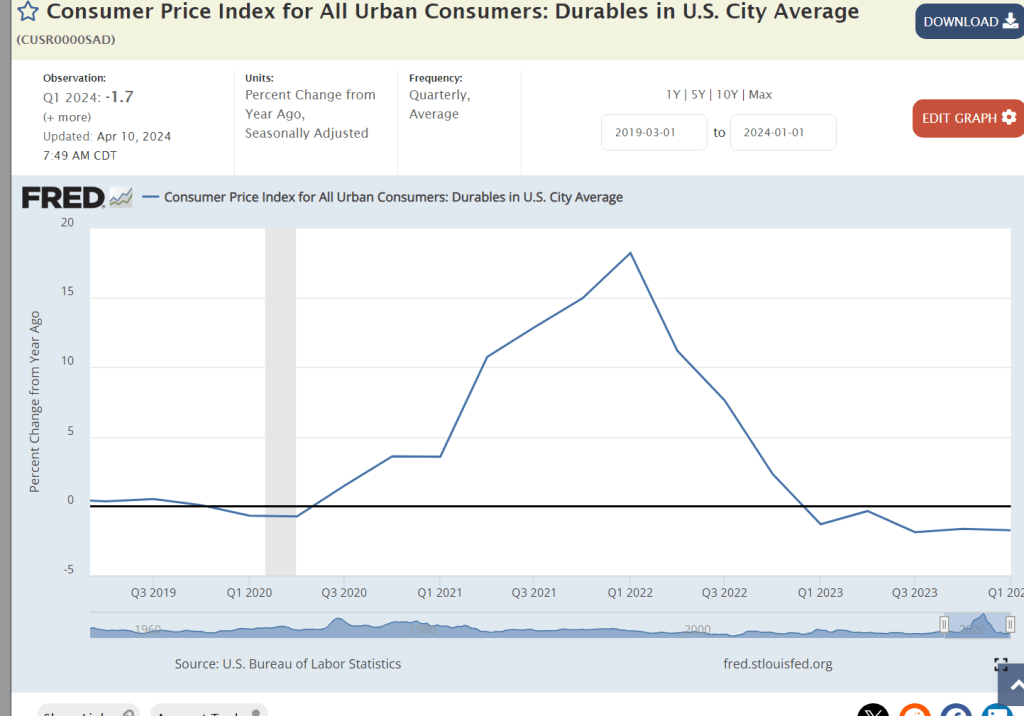

US inflation reached 8-9% in 2022 and has fallen to 3%. The “stickiness” is half caused by the lag in housing and rental prices in the index and half due to the continued high 6% federal government budget deficit as a percent of GDP.

https://bipartisanpolicy.org/report/deficit-tracker/

There is nominal inflation or actual deflation in most sectors of the US economy today!!!!

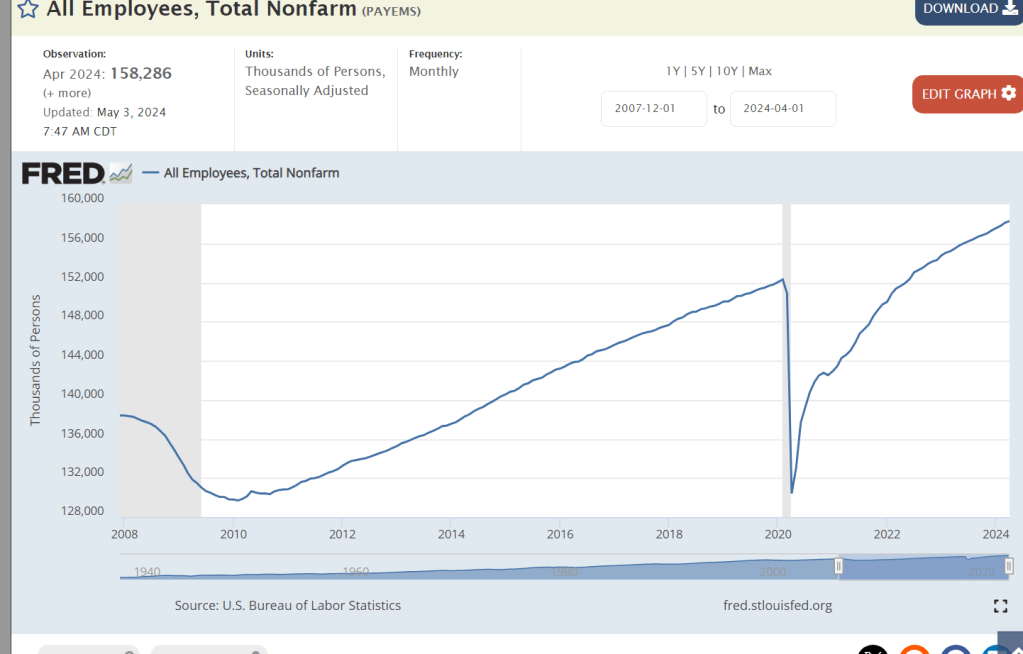

On average, the US economy has been adding 2 million new jobs per year for 14 years. 28 million jobs. This is an amazing result.

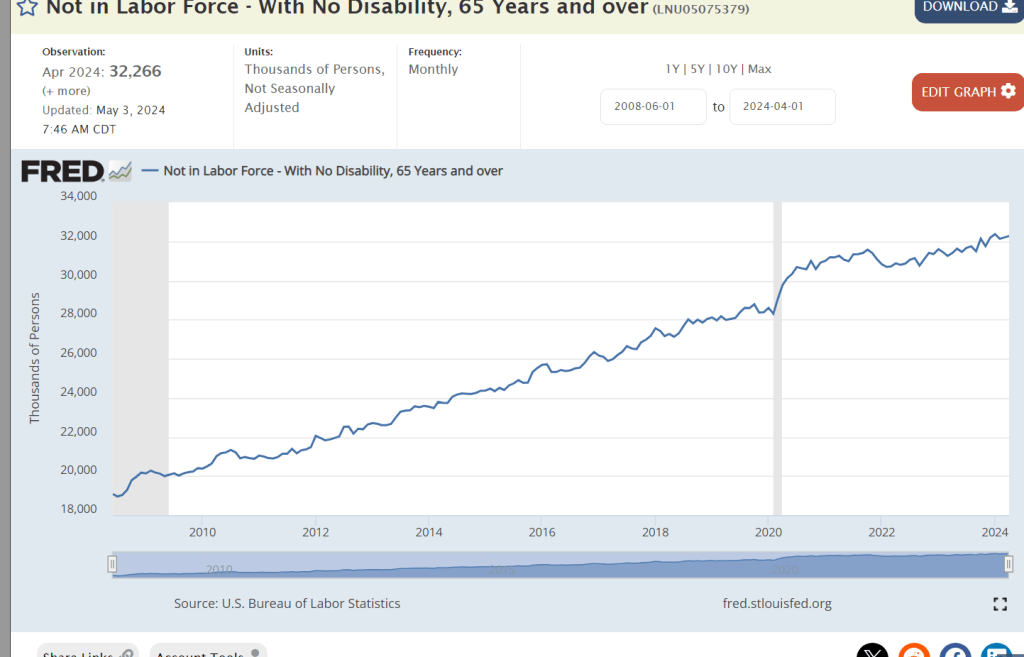

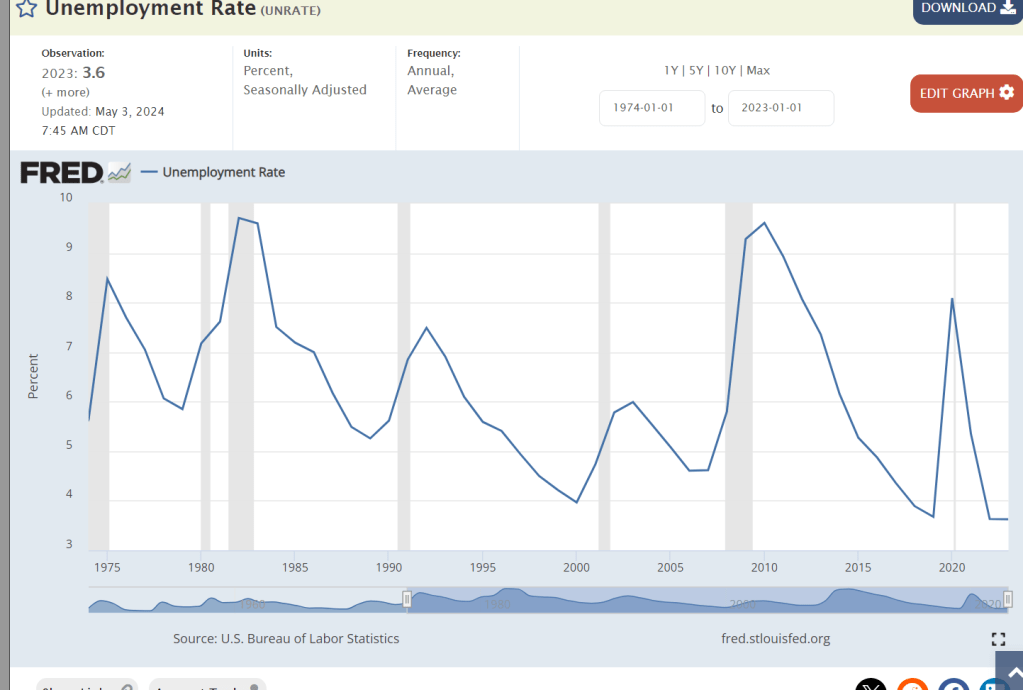

During the same period, 12 million more people have retired.

The unemployment rate is at a 50-year low. When I was studying economics in 1974-78, there was a big debate about 5% becoming the lowest possible “structural” unemployment rate possible without escalating inflation. 1997-2007 established that a 4.5% to 5.0% unemployment rate was possible. We raced back up to 9% during the Great Recession. The 35-year average was 6.5%. We experienced 3 years of sub-4% in 2017-19 as economists claimed that this was simply impossible. Unemployment rates are still below 4%.

The Black unemployment rate has been chopped in half, from 11% to 5.5%.

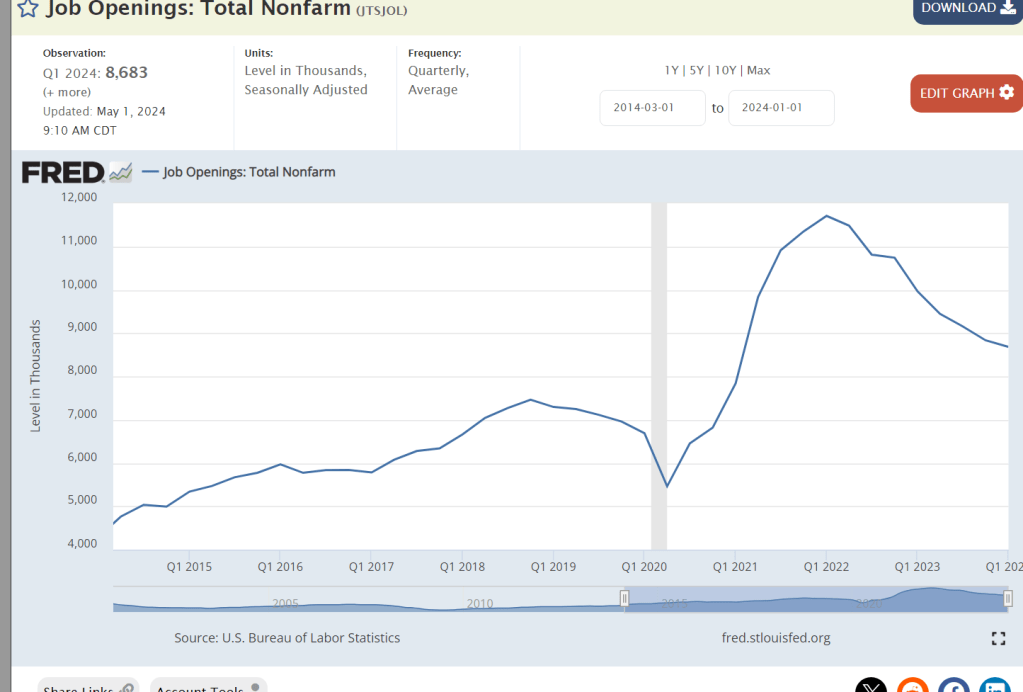

The demand for labor remains high. Job openings peaked at 7.5 million before the pandemic. Job openings remain 20% higher at 9 million 5 years later.

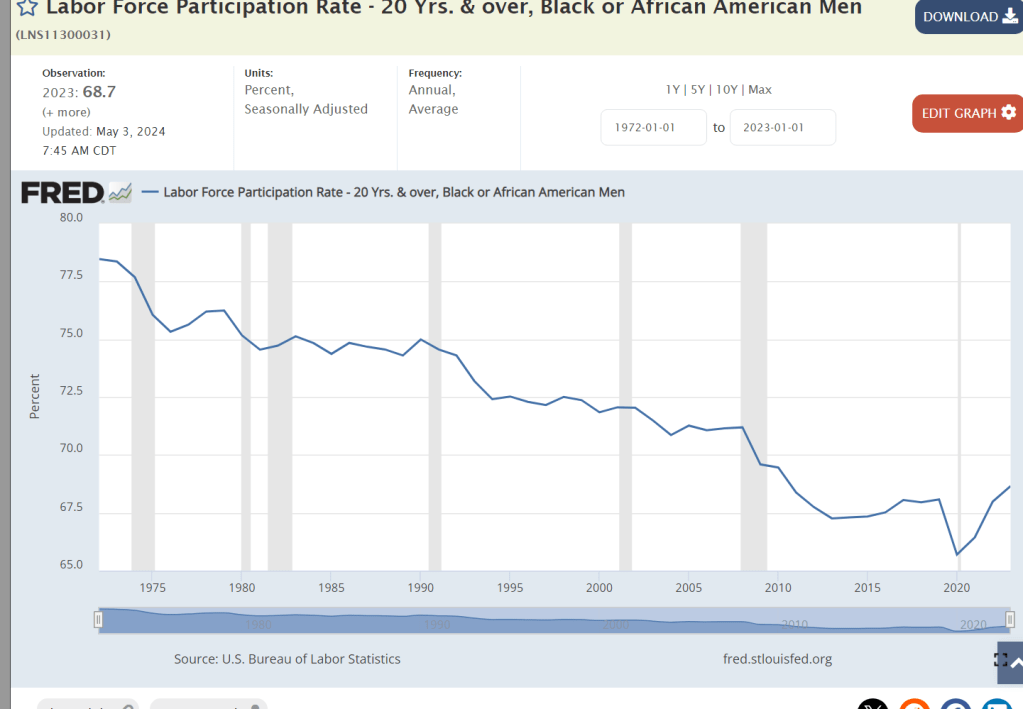

The core labor force participation rate has rebounded from the pandemic reaching a level last seen in 2008.

10% fewer black men participated in the labor force between 1973 and 2013. Participation is now solidly increasing.

Real wages stagnated from 2000-14. They have increased by 10% since then.

Real GDP per capita continues to grow.

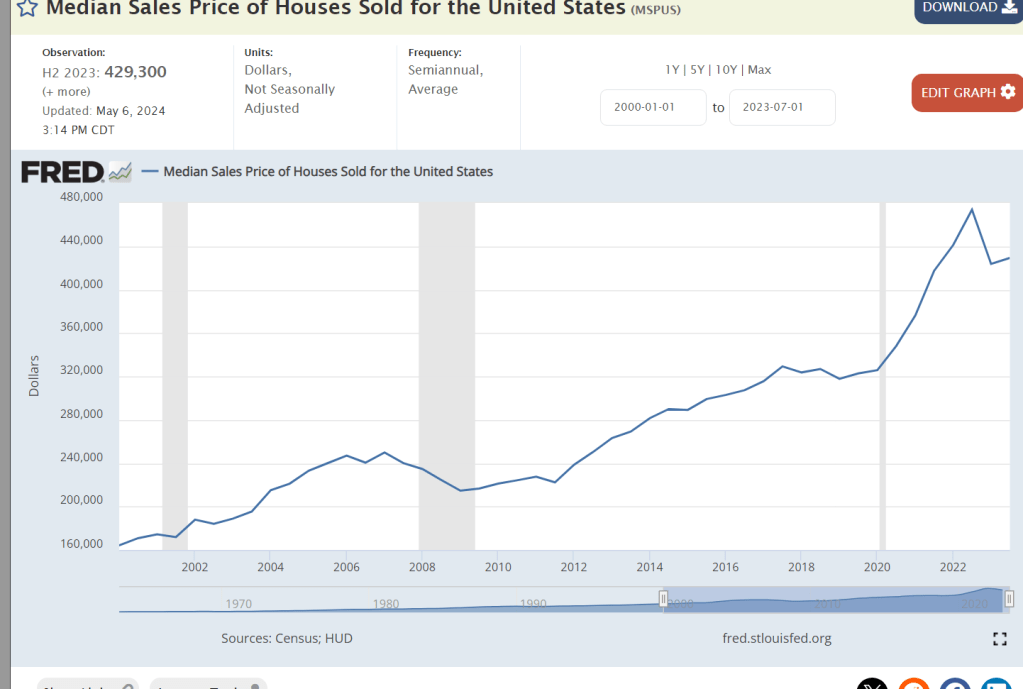

If you’re a homeowner, the recent one-third increase in home values is a windfall. If you’re a prospective buyer, housing is much less affordable.

US stock market values are up 50% in 5 years.

Coincidentally (?), corporate profits are up 50% in 5 years.

New business creation increased after the pandemic surpassing the pre-pandemic level and exceeding the pre-Great Recession level. Start-ups typically account for all job creation and ensure competition in product and service markets.

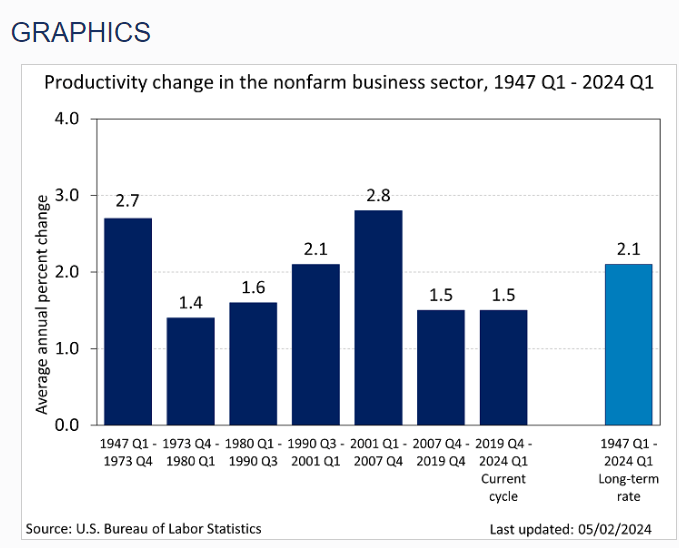

Overall productivity growth in the last 5 years has been the same as in 1973-1990 and 2007-19. In recent quarters productivity has begun to increase at a higher rate and many commentators believe that AI will drive productivity at a higher rate for the next 20 years.

The US has achieved energy independence, doubling its production of natural gas in 20 years.

https://www.eia.gov/todayinenergy/detail.php?id=61242

Renewable energy accounts for 22% of US energy generation.

US manufacturing employment has increased by 15% since the Great Recession. It is higher than before the pandemic despite the increase in real median wages and the increase in the value of the US dollar.

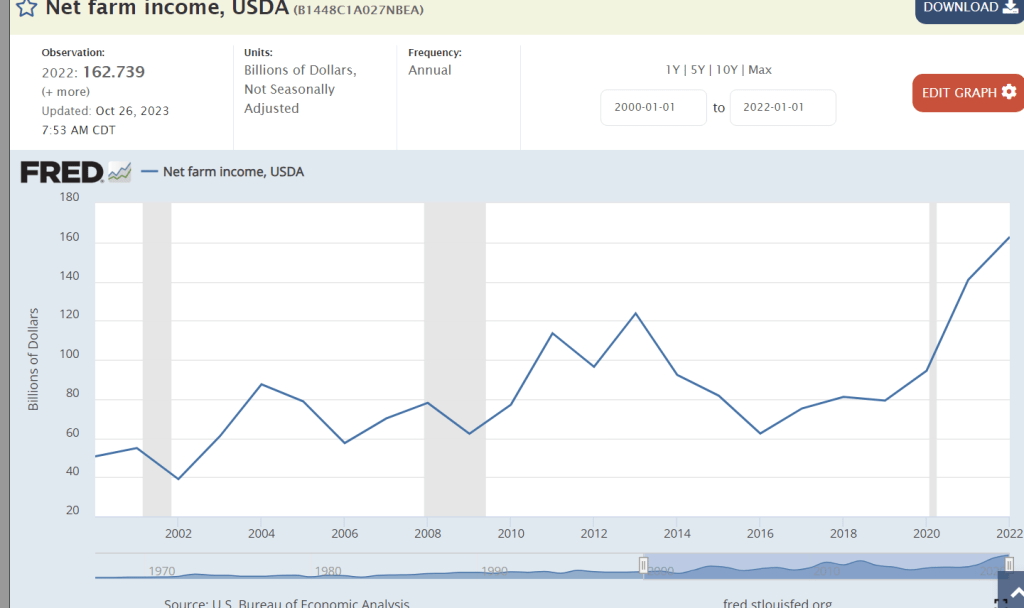

Net farm income has doubled since before the pandemic.

We have one-third more voluntary retirees in 2024 versus 2014.

Those retirees are receiving significantly higher incomes.

Retirement assets have increased by 50% in the last 10 years.

Income inequality has finally peaked in the last 5 years.

The poverty rate has declined by one-third in the last 10 years.

https://www.economist.com/finance-and-economics/2024/04/16/generation-z-is-unprecedentedly-rich

Each generation earns higher incomes in the productive US economy. My first post college job paid $800 per month, $9,600 per year in 1978.

US citizens pay very low taxes compared with their developed nation peers.

Summary

The US economy recovered from the uncertain pandemic period faster than other countries due to the combination of very loose fiscal and monetary policy. The fiscal policy boost was bipartisan. The monetary policy boost was nonpartisan. As the strength of the US recovery became apparent by the end of 2021, both Congress and the Federal Reserve Board should have reduced their stimulus levels. The FRB adapted slowly and increased rates. Congress and President Biden have not adapted.

The US economy is experiencing an extra year of excess inflation due to these actions.

It is important to look at the long-run trends and many indicators of economic health. Monetary policy in an independent Fed is effective. Fiscal policy is ineffective. Inflation is higher than ideal.

Let’s list the positive economic indicators. GDP growth, US dollar value, stock market value, exports, employment, retirees and incomes, unemployment, job openings, labor force participation, home values, corporate profits, startups, productivity, energy independence, green energy, manufacturing employment, farm incomes, income equality, poverty, generational progress, and tax burden.

The US economy continues to deliver very positive outcomes for our country. President Biden could do better on reducing the federal budget deficit by increasing taxes or reducing expenditures. Overall, his policies have allowed the economy to continue to deliver benefits.

[…] Mostly Good News Since the 2008 Great Recession November, 2022. The critics were looking for economic disaster. It was not coming. Recession!?, Recession!?, I Can’t Find Any Recession! May, 2024. The US exceeds expectations again. The US Economy Leads the World […]

[…] US Economy is Already Great: No Tariffs Required The US Economy Leads the World US Economy Consistently Exceeds […]

[…] The US Economy Leads the World […]