https://www.oecd-ilibrary.org/sites/c6217390-en/index.html?itemId=/content/component/c6217390-en

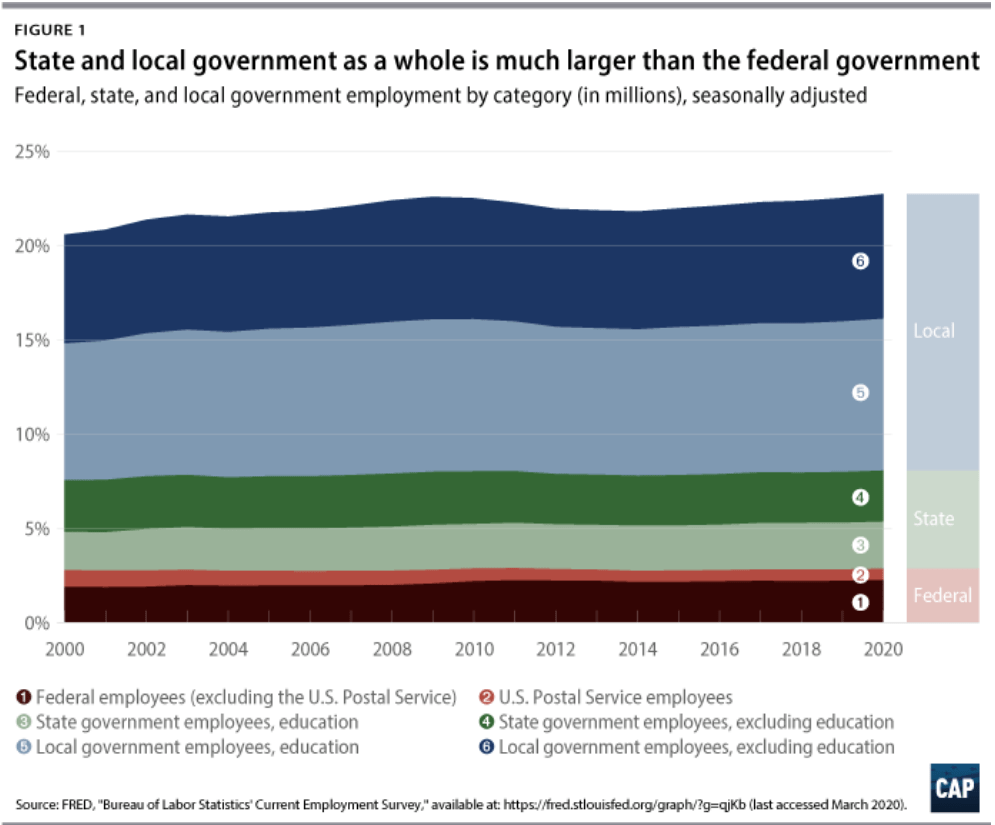

One-half of US government spending is managed at the state and local level. Only 3 OECD (developed economy) countries have a higher share at the local level. The median level is one-third of the total and some countries limit local spending to just 10-20% of the total. The US federal government model ensures that a significant share of government is managed closer to “the people”, which is even more important today with 330 million people than it was 200 years ago.

State and local expenditures as a percentage of GDP is 19% for the US, on the high side compared with other OECD nations as expected based on the 50/50 local/national split.

https://fred.stlouisfed.org/series/PAYEMS#0

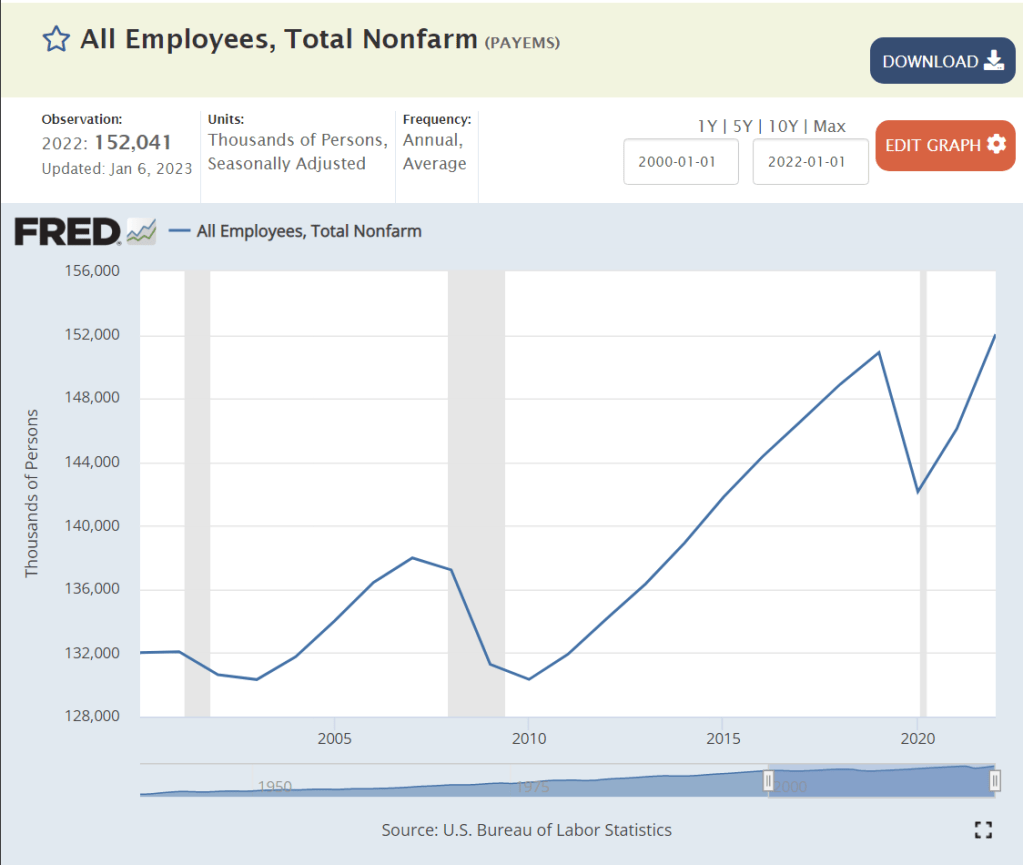

Federal government employment has been essentially flat for many decades.

https://www.cbpp.org/research/state-budget-and-tax/its-time-for-states-to-invest-in-infrastructure

Setting aside land and defense assets, states and local governments hold a supermajority of government assets.

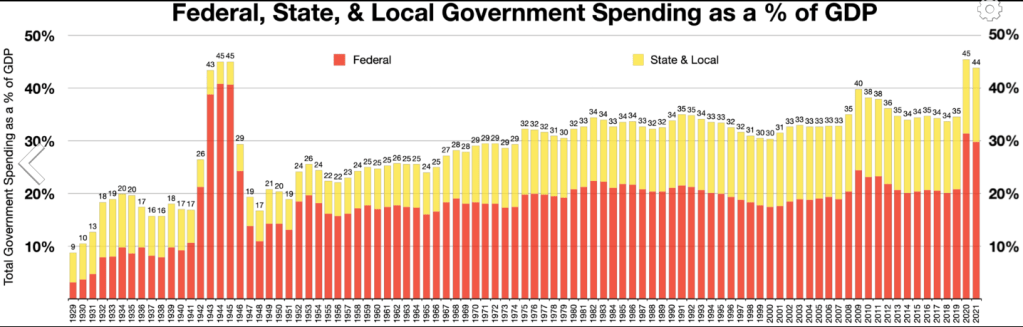

The share of total government spending to GDP is the most important ratio to track. Since the 1960’s the federal government has moved spending responsibilities to the state for many programs. Spending drifted up to 25% of a growing post-war GDP by 1966. The Vietnam War and the Great Society programs pushed this up to 29% in 1975. The oil crisis, Japanese competition, inflation and recession pushed it up to 32% in 1976. Spending was still 33% of GDP 30 years later in 2007. The Great Recession drove spending up to 40% of GDP and then it declined back to 34% in 2014. State and local government spending has been relatively constant since 1976.

https://www.usgovernmentspending.com/local_spending_chart

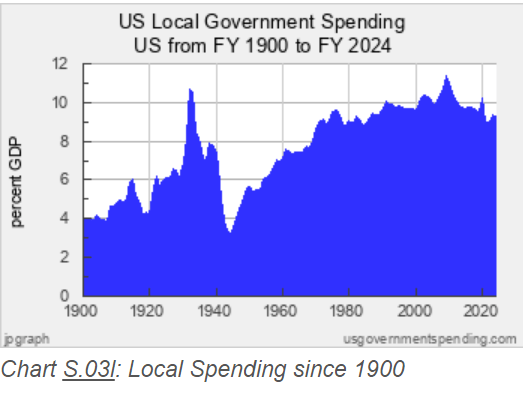

Local government spending reached its modern level at 9-10% of GDP by 1990 and has mostly remained at that level.

federalism.us

https://www.pgpf.org/budget-basics/how-is-k-12-education-funded

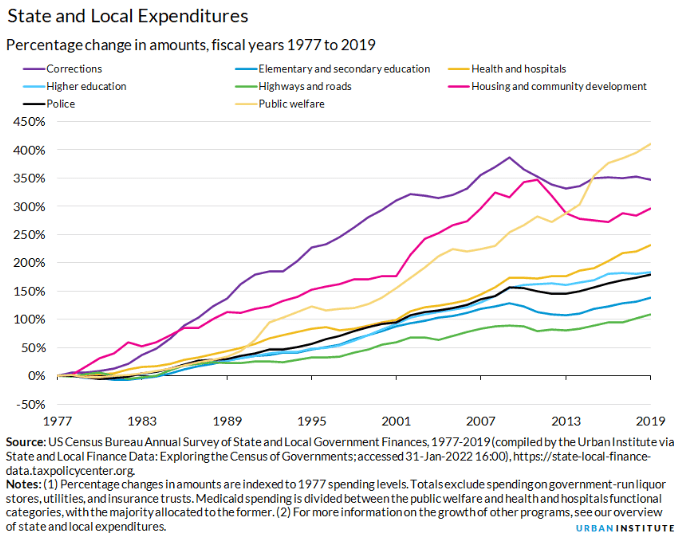

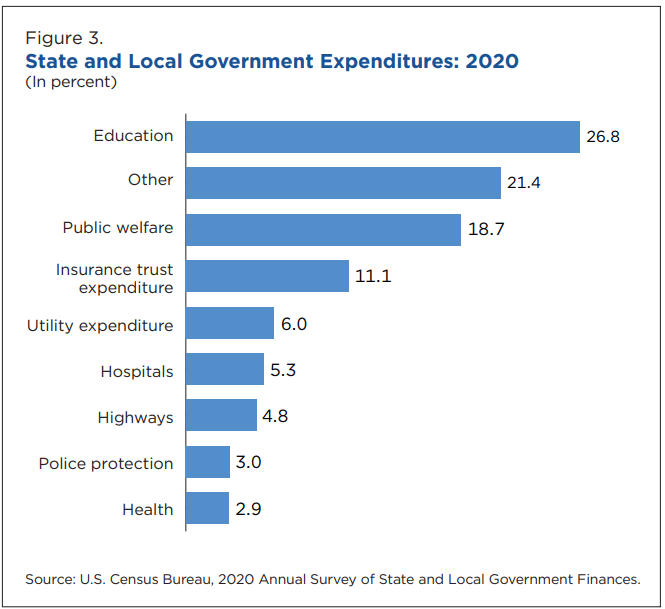

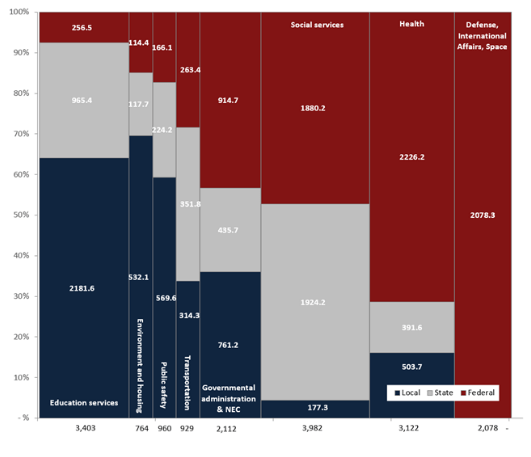

State and local governments provide a wide variety of services.

https://fred.stlouisfed.org/series/L319411A027NBEA

States and local governments routinely deliver solid budget surpluses in normal years and greatly exceeding the deficits encountered in recessionary years. State and local governments rely more on property and sales taxes which do not vary as much as income taxes. States have proactively reduced spending budgets whenever they have encountered recessions.

States have built up a nearly 3 month cushion of reserves to buffer recessionary periods. States and local governments did much better during the pandemic recession than anyone expected. They reacted quickly to ensure fiscal stability and found ways to put the federal government transfers to good use. Some states have provided rebates to their taxpayers.

https://fred.stlouisfed.org/series/SLGTFFQ027S

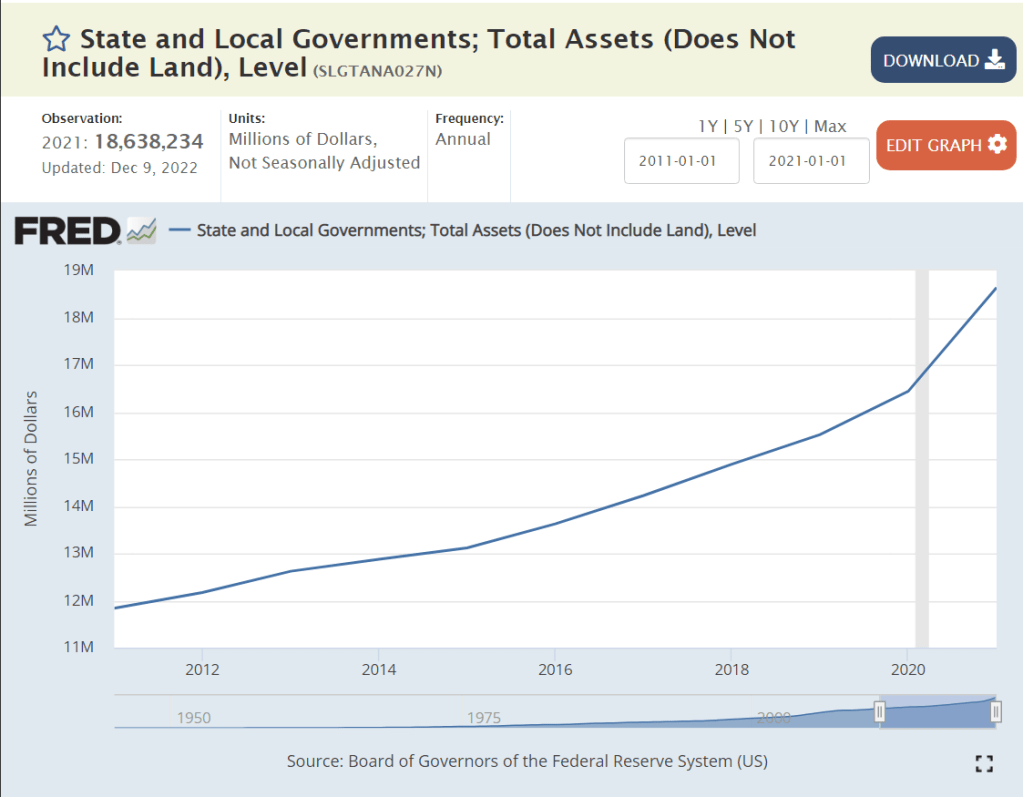

https://fred.stlouisfed.org/series/SLGTANA027N

State and local governments have continued to accumulate valuable assets, especially in the last 10 years.

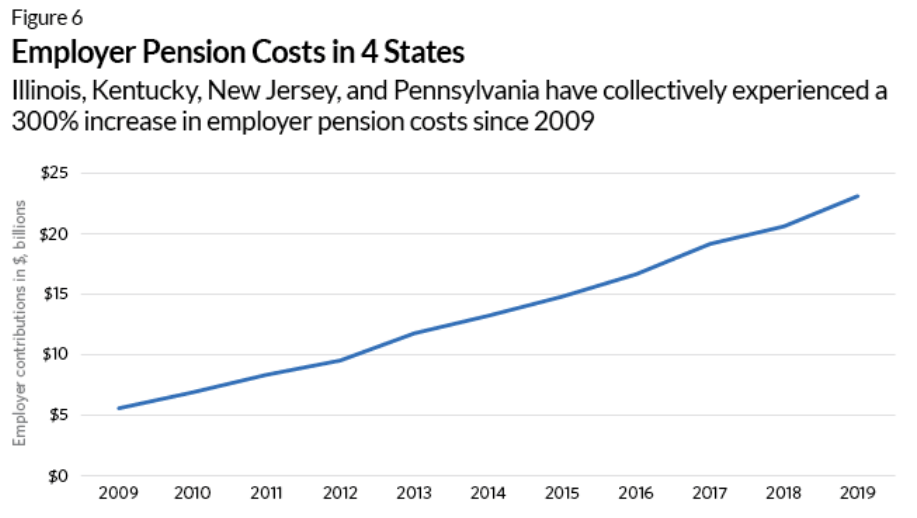

States have generally improved their credit ratings since 2006, before the Great Recession. At that time, 9 states had the very highest AAA rating. 39 held very strong AA ratings. Just 2, Louisiana and California held “upper medium” A ratings. Recent data shows 7 more states, for a total of 16, at AAA ratings. 29 have strong AA ratings. 3 are at single A: Pennsylvania, Connecticut and Kentucky. 2 have fallen a step lower to BBB: Illinois and New Jersey. The median rating has improved from AA to AA+.

https://en.wikipedia.org/wiki/List_of_U.S._states_by_credit_rating

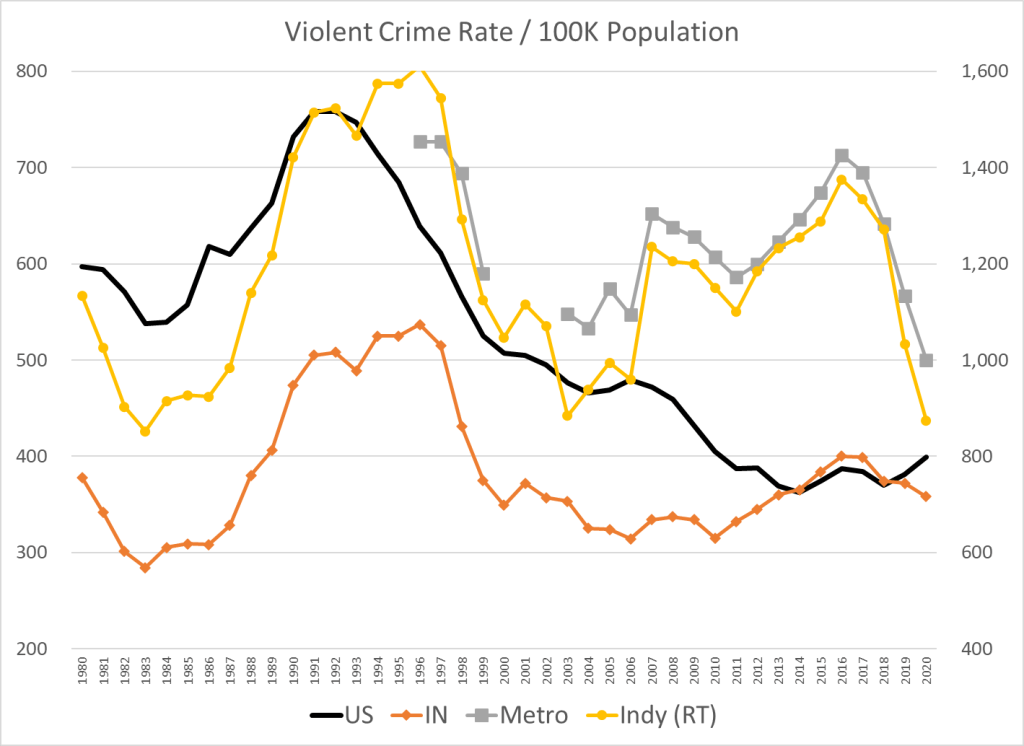

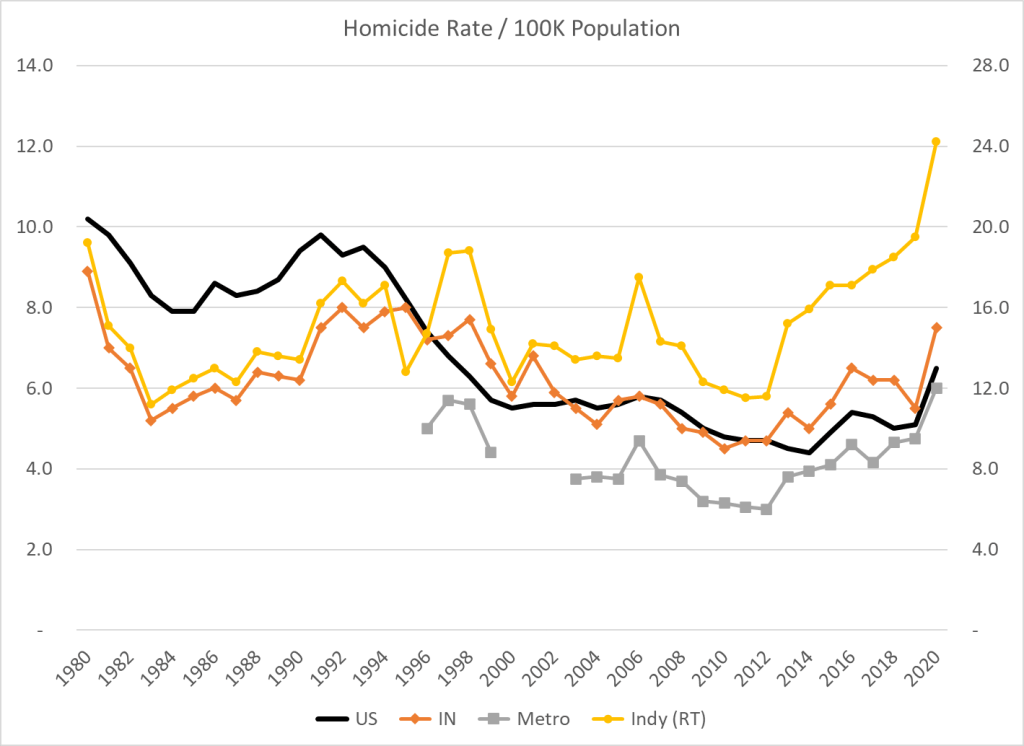

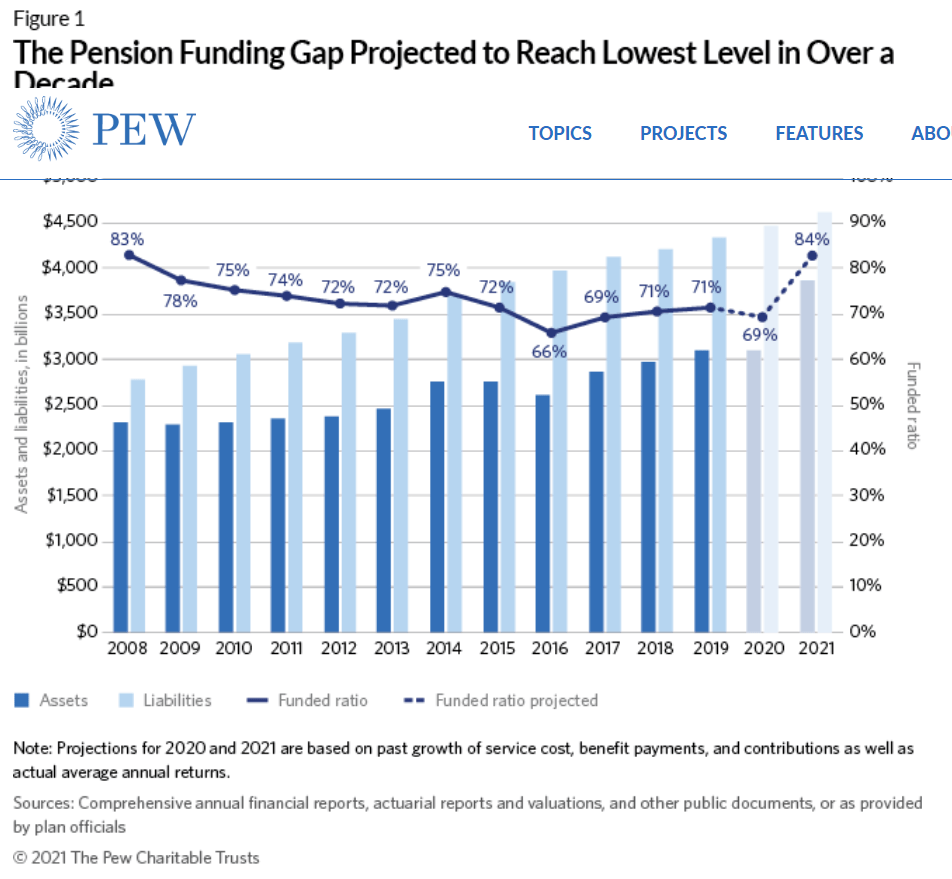

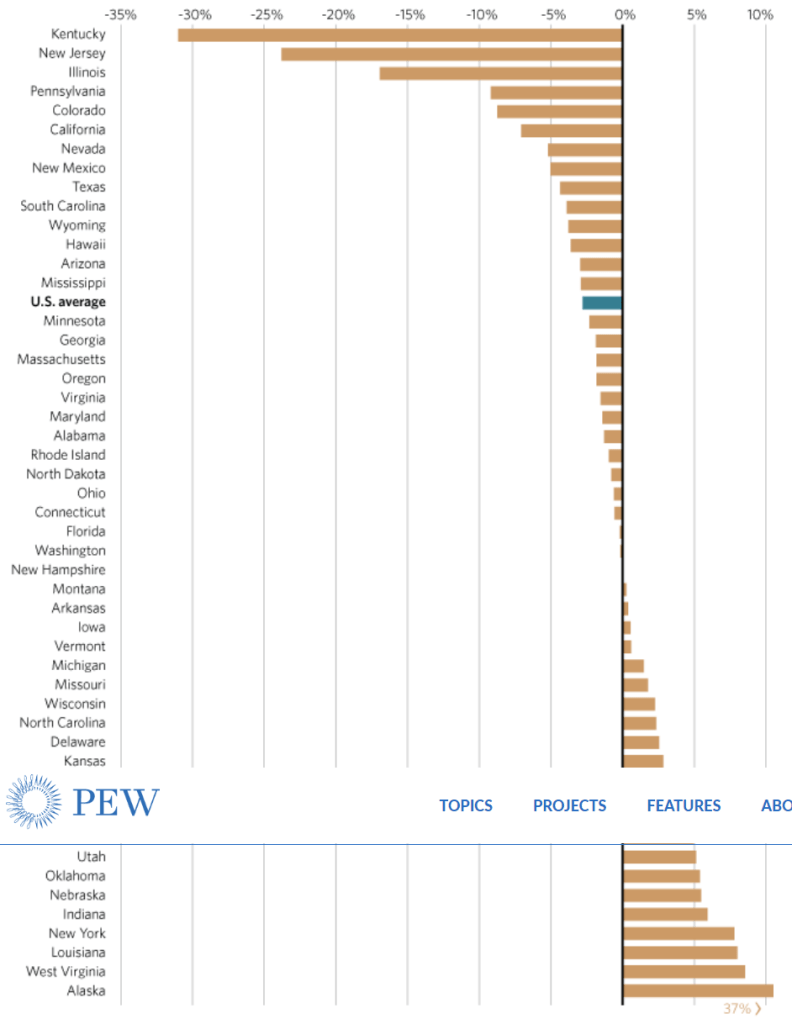

States have improved their pension fund percentage funding ratios, although some states remain at some risk of defaulting on their obligations.

federalism.us

https://www.taxpolicycenter.org/statistics/state-and-local-general-expenditures-capita

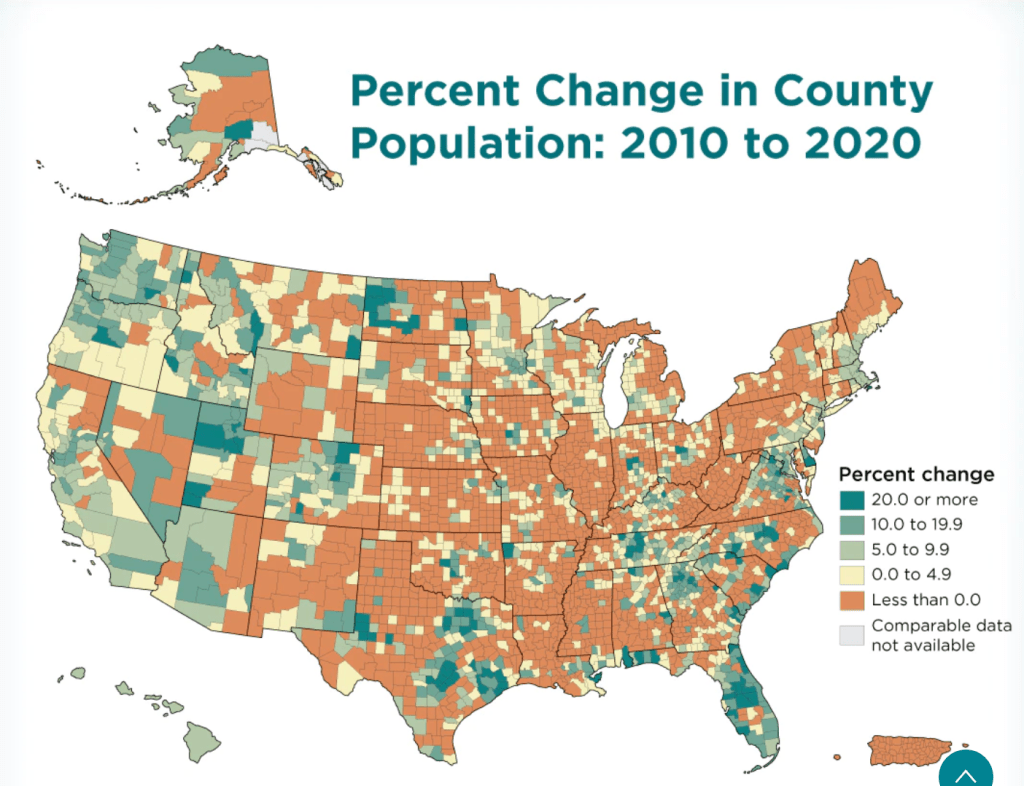

State and local government spending per capita varies widely, reflecting local preferences. The mideast and far west are 15% above the national average while the southeast and southwest are 10% below the national average.

State spending varies even more widely. The national average is $6,900 per capita. California is 12th highest at $9,000 but neighbor Washington is much lower at $7,000 (26th). Massachusetts is also at $9,000 but its neighbor New Hampshire is at a very low $5,000 (46th). New York is lower than might be expected at $8,600 (15th). Nearby New Jersey, Pennsylvania and Virginia spend $7,200-7,500, a bit above the national average. Michigan, Ohio and Illinois spend less than the national average at $6,100-6,300, but nearby Indiana ($5,500), Kentucky ($8,500) and West Virginia ($10,300) have much different priorities. Georgia ($5,700), Alabama ($6,300) and Mississippi ($6,700) spend less than the national average. Texas spends only $4,700 per capita (48th) while its neighbor Arkansas spends $9,200 (10th). Florida is the lowest spending state at just $4,000 per person, an amazing 42% less than the national average.

Another way to look at these differences is to compare the spending of 5 states. Rhode Island $10,400 (6th), Kentucky $8,500 (16th), Washington $7,000 (26th), Colorado $6,200 (36th) and New Hampshire $5,000 (46th). Rhode Island spends twice as much on state government than New Hampshire, a few miles away. This is the range in the US, reflecting vastly different local priorities.

Summary

In our federal system, state and local governments are called upon to manage one-half of total government spending. They routinely deliver budget surpluses and adapt during recessions, even the pandemic driven recession. They have accumulated significant real and financial assets to buffer difficult times. They have managed pension liabilities appropriately and improved their bond ratings and ability to borrow. They have taxed and spent to match local preferences. In aggregate, their spending has remained at the same percentage of GDP for many years.