https://www.yourobserver.com/news/2023/dec/01/construction-begins-legacy-trail-overpasses/

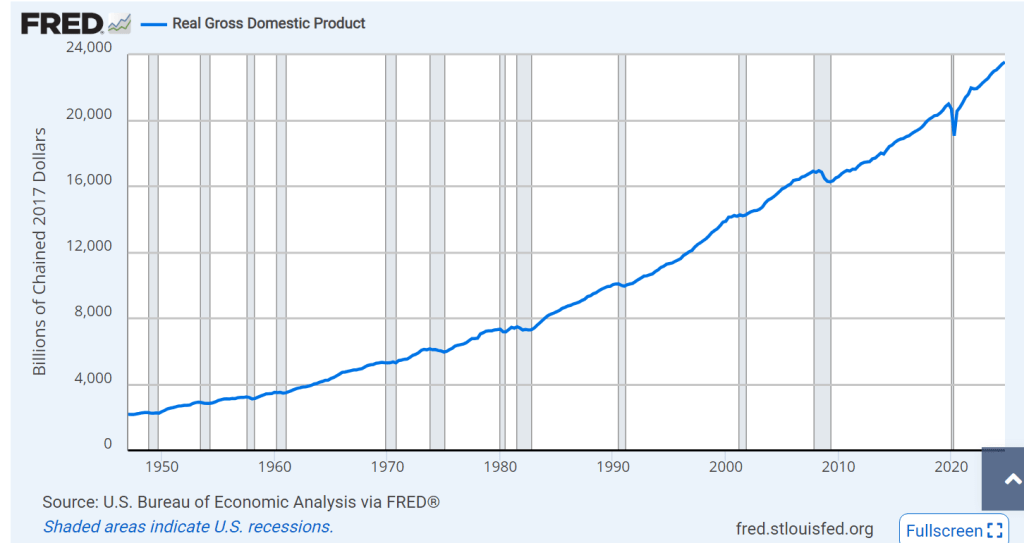

From 1945 through 1985 the US economy regularly accelerated its growth, reached a peak, fell back and then recovered. Businesses, economists, politicians and the public expected that this 3-5 year business cycle would continue forever.

Looking back, it seems like the business cycle was broken by 1985. All of the subsequent downturns have been prompted by extraneous, outside of the system, shocks. In 1990 a second global oil shortage shock.

https://en.wikipedia.org/wiki/Early_1990s_recession_in_the_United_States

In 2000-2001, a stock market bubble popped.

In 2007, a mortgage lending bubble popped.

https://en.wikipedia.org/wiki/Great_Recession

In 2020, a pandemic driven recession, followed by a very unexpected rapid recovery.

https://en.wikipedia.org/wiki/COVID-19_recession

40 years without a classic business cycle recession is long enough to claim victory.

How could this happen? The independent Federal Reserve Bank has maintained a neutral monetary policy. We have not “shot ourselves in the foot” and we have implemented reasonable policies to offset external shocks. The federal government budget deficit has generally returned towards zero following depression periods. Automatic stabilizers and congressional action have addressed recessionary periods with enough stimulus to stop economic decline and restart recovery.

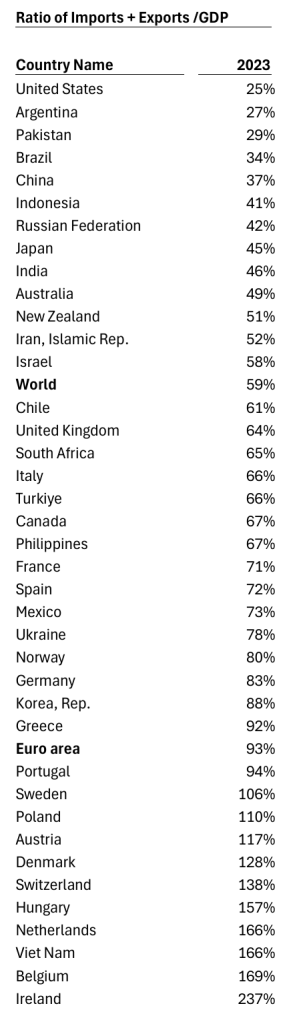

More importantly, the structure of the US economy has changed. The share of high fixed cost manufacturing has declined as “services” has increased as a share of the total economy. The share of international trade (imports and exports) less directly connected to the domestic economy alone, has increased. The power of labor (unionized or not) has fallen, allowing firms to reduce hours and real wages during a downturn. In most recent times, firms better recognize the cost of attracting and developing highly skilled labor in a complex production world, so they retain key staff even during downturns. Vertical integration has been reduced, allowing firms to respond to minor demand changes more effectively. Based upon the quality revolution, major firms have reset their capacity utilization targets to 80% rather than 95%, providing firms with greater flexibility in managing variable demand and not reaching the point where internal costs increase and the need to increase prices occurs.

Financial leverage has also decreased. US firms have access to deep bond markets so are they able to incur only necessary levels of indebtedness.

Even with a much greater level of imported goods, retailers hold lower levels of inventory, allowing them to not overreact to changes in demand. Firms have more effective supply chain management processes.

The unemployment rate also shows this structural change. When it was pushed below 5% in the 1960’s, inflation increased and was not permanently checked for 20 years. By 2000 the economy was able to expand and keep unemployment below 5% for extended periods of time without triggering “cost-push” inflation. Unemployment still increases during an economic downturn, but low unemployment does not seem to trigger a recession.

From the 1950’s through the 1980’s inflation tended to increase as the economy overheated before a reduction in credit availability would slow the overall economy. Aside from the Covid pandemic shortages, we no longer see major inflation increases.

Impact

The business cycle caused firms to underinvest because the best available forecast was always that the boom period would be interrupted in 1-5 years. Sales, margins and profits could not be assumed to increase forever.

The business cycle caused firms to follow a stop-start pattern for capital investment projects, process improvement, research & development, new product introduction, new markets, new channels and mergers & acquisitions. Seeing a downturn, firms would cancel existing initiatives, even at a significant cost, in order to conserve cash and signal to stakeholders that management was actively managing the business. Projects would slowly resume after it was clear that the business cycle recovery was under way 2 years later.

For individuals, the “last hired, first fired” cycle applied. Firms froze open position hiring. They released interns and summer workers. They prohibited overtime. They cancel contracts with temporary labor firms. Less experienced workers and minority groups suffered. Labor intensive industries, especially construction, were hard hit. Smaller firms closed. The hiring cycle would resume 2 years later.

Historically, stock market values also followed the pattern of the business cycle closely. Stock market declines were seen as an “early warning” indicator by forecasters. Since stock market values are theoretically determined by a risk-adjusted discount rate, the reduction of business cycle variability allows investors to use a lower interest/discount rate and value future earnings at a higher net present value.

Summary

The business cycle appears to be gone. The modern economy does not have the same high fixed costs it once had. Firms are able to increase their sales, profits and capacities in tandem without greatly overshooting the mark. Our national institutions help to keep growth at a sustainable level. Workers, firms, investors and society all benefit from this great advance, even if it is not publicly celebrated.