https://www.amazon.com/Janesville-American-Story-Amy-Goldstein/dp/1501102265

This 2017 bestseller was applauded by the WSJ, The Economist, Harvard sociologist Robert Putnam, JD Vance (as a complement to Hillbilly Elegy) and Barrack Obama. It tells the story of Janesville, Wisconsin as a General Motors assembly plant with 3,000 workers was permanently closed in the turmoil of the Great Recession. It focuses on the impact on real people and the community’s response. The author concludes that neither the liberal response of job training nor the conservative response of economic redevelopment incentives was adequate to meet the community’s needs. What could work?

The Core Issue

The US economic and legal system protects the property rights of investors, corporations, and banks. It doesn’t protect or promote the property rights of the other actors in society quite so well: workers, suppliers, local governments, charities, retirees, and children. It is the fundamental discrepancy between different groups that is highlighted in this book, catalyzing the last 15 year’s populist reaction against our system, and begging for a practical solution.

The Core Challenge

Financial interests are flexible. They can be bought, sold and mortgaged. They are geographically mobile. Money and financial instruments are fungible. They can be exchanged with zero to small loss of value.

Other interests are much less flexible and mobile. Labor assets are tied to an individual. Individual labor assets may be tied to a specific situation OR broadly applicable. Real property is tied to a local and regional location. Local governments and charities are tied to a geography. Families are emotionally tied to a location.

The historical political conflict was between the wealthy and the non-wealthy. Landed aristocracy and peasants. Capitalists and workers.

Wealth still matters. The advantages of financial wealth have multiplied in the modern world. Financial rates of return are higher. International opportunities exist. Financial markets are effective and efficient. Risk can be managed through portfolios and derivatives. The shear amount of wealth, and wealth per person, is large enough to be scientifically managed. Generational wealth is preserved. Wealthy interests have effectively “captured” the political system to ensure they are not over-taxed or over-regulated. Network effects from neighborhoods and elite colleges accumulate. The network effects from large metropolitan areas accumulate.

As the advantages of financial wealth have compounded in our society, the distribution of income and wealth has become more and more unequal. For the good of our whole society, it’s time to take some steps to “level the playing field”. This is not strictly about protecting the poor or “fairly” taxing the rich. It is about providing “roughly” equal protection to the various property interests in our society.

The Pinches

In a meritocratic, capitalist society, there will be an unequal distribution of income and wealth. It is difficult to find an obvious “rule of thumb” to limit this dispersion. The higher income and wealth individuals are sure that they have “earned” their returns. Many libertarians and conservatives believe that the “job creators” and “value creators” in society are under rewarded, even before progressive taxation claims a greater share. Most working, middle and professional class earners are sure that they are underpaid compared to their value-added and that the tax system is designed to benefit “others”. Many vote for the conservative political party because they accept this as unavoidable, see disincentives and unintended consequences from attempts to change this, or aspire to become one of the winners. Economists and psychologists report that individuals are much more motivated by economic losses, taxes, risks or takeaways than gains. Hence, any kind of straightforward income or wealth redistribution system is difficult to achieve or maintain. The incentives to pull towards one end or the other are very strong. The philosopher John Rawls’ argument that everyone can, should, will agree to a set of reasonable policies pointing towards limiting income and wealth inequality has been applauded by the left, criticized by the right and ignored by most everyone. We need to find a different framework aside from the “tug of war”.

A dynamic capitalist economic system will include Schumpeterian “creative destruction”. There is enough new wealth to be made and captured that competitors will disrupt and compete with existing leaders in all markets. Firms will grow and die. New firms will be founded. Some will succeed. The real and financial capital within some firms at some times will be destroyed. For some firms this will be part of the portfolio of growing, stable and dying components. For some firms, this will be death. Capitalists will focus on the core goals of value creation, value capture and value preservation. They will do whatever is required to meet these goals. As Milton Friedman argued, at the extreme times they will not look out for the interests of other stakeholders. In good times, perhaps, a little. Based on social pressures, in good times, perhaps, a little. We need to clearly separate “what is” from “what should be”.

Financial investors do not have geographical responsibilities. They have financial responsibilities to owners and lenders. They have secondary interests in maintaining positive relations with suppliers, customers, key employees, key executives and regulators. Large organizations will close low performing assets as required, be they small stores or 3,000 employee factories. New and existing businesses locate plants, offices and distribution centers based on expected costs and benefits, risks and rewards. They are also guided by the convenience and views of their senior executives who generally prefer to live in cosmopolitan surroundings. Firms will decentralize and decentralize to meet various needs. For most firms, local economic incentives are a very minor factor.

Employees, suppliers, governments and charities are fundamentally local. They live real lives with a small number of interactions. They stay in place and appreciate the familiarity of their home, church, school and community. They might move when they finish college or before they have children in school or to meet an extreme need. The move from the east coast to the Midwest to the west took centuries. The move from the farms to the cities has continued for more than a century. The consolidation of the population into less than 100 metro areas has accelerated in the last 75 years. The move from the Midwest, northeast and Middle-Atlantic states to the sunbelt has continued for 75 years. Individuals move based on circumstances and incentives. A fair society provides support for individuals who do not wish to move because economic situations have changed.

The Solution: Protected Assets for All

Individuals who honestly review the growth of incomes, wealth and standards of living in the US for the last 75 years must celebrate the amazing 6-fold increase in real per capita Gross Domestic Product (GDP). Labor productivity and overall productivity have improved similarly. Median incomes rose with GDP and productivity until 1975, stalled for 25 years and have since slowly resumed their climb. Quality of life, including health, economic choices, economic security, leisure, safety, product quality, entertainment, and product choices has continued to improve, even when income growth lagged behind output growth. The US economic system produces great wealth and benefits. There is an inherent tendency for the owners of financial wealth to capture an increasing share. We need to find a balanced solution, not undermine the economic system through misguided taxation or regulation.

Health Assets

The US is an outlier in the developed world in not managing health care as a public good. Liberals see health care as a human right. A majority of Americans disagree. We will not soon adopt “socialized health care”. We can work together to adopt policies that reduce the total cost of health care, and which prevent health care costs from bankrupting our fellow citizens.

- Provide catastrophic health care coverage for all, covering single event expenses exceeding $25,000.

- Provide payroll contribution funded ($200,000 max) annual income catastrophic family medical insurance (>$100,000/year) to all citizens. (alternative to $25K government provided fund)

- Invest in nominal co-pay front-line mental health screening, intervention, listening, training, group sessions and counseling services for less critical conditions.

- Allow any group of 10 states to create a “medicare for all” health care program as a substitute for the Affordable Care Act.

- Allow any group of 10 states to create a private insurance-based (qualify in 2 states, qualifies for all states to ensure competition) health care program as a substitute for the Affordable Care Act.

- Pay-off all student loan debt for professional degree medical professionals serving 5 years in non-metropolitan county or metropolitan county with less than 300,000 population.

- Require states to provide tuition free medical care and residency spots for one doctor per 10,000 citizens each year.

- Reduce medical school preparation requirement to 3 years.

- Offer reciprocal medical licensing arrangements with 30 leading countries and expedited review and specific qualifications training and experience requirement defined for all others within 90 days of application.

Family Assets

- Provide an annual $10,000 childcare funding source for up to 4 children aged 0-6.

- Provide home childcare volunteer refundable tax credit up to $100 per week.

- Offer a supplemental 5% Earned Income Tax Credit for two-income families with combined family income below $60,000, phased out to zero at $90,000.

- Exclude the first $100K of owned homestead property from taxation and prohibit property taxes on first $250,000 for those aged 70 or above.

Community Assets

We live in a society that prefers to support communities locally and not rely upon government support. We can fine-tune our laws to encourage local support.

- Provide a $15/hour volunteer hour tax credit for up to 200 hours annually, including service with religious organizations.

- Remove the limits on charitable donation tax deductions for gifts made to public charities and local governments (not private foundations).

- Allow large employers to setup new employees with default 1% contribution to local United Way/Community Chest umbrella funding services.

- Determine paternity for all births, set and enforce child support agreements, provide basic level support from the state as required.

- Subsidize high-speed internet for rural counties.

- Offer 10 year T-bill interest rate financing for qualified “low cost” retailers to build stores more than 15 miles away from any existing qualified store.

- Levy a $500 per employee annual “closing costs” fee on large employers (250+) for a maximum 20 years to fund local redevelopment programs starting with $5,000 per discontinued employee.

- Levy a 0.5% of annual rentals fee on landlords to fund local redevelopment of abandoned properties and areas.

- Limit state and local economic development incentives to no more than $10 million per project or location.

- Offer a 50% federal tax credit for first $10,000 of cross-state moving expenses.

- Offer workers up to $5,000 for relocation or temporary housing as an alternative to up to 2 years of unemployment benefits. (alternative to tax credit for moving expenses)

- Restrict issuance of new building permits in counties that do not have one-third of affordable housing permits proposed for units below the existing median unit property value.

- Greatly expand availability of 1-2 year National Service programs for young adults and senior citizens.

- Invest in prison to work transition programs.

- Increase the minimum foundation endowment spending from 5% to 6% to provide more current social benefits and limit the accumulation of assets by universities and other not for profits with $100 million plus of invested assets. Provide an option to pay a 0.5% of assets annual fee to keep 5% or a 1% fee to only spend 4%.

Financial Assets

In our modern world we have to ensure that all individuals are financially prepared for 30 years of retirement. Early and constant savings. Wise investments. Good advisors. For everyone.

- Provide a 50% federal 401(k) match on the first $5,000 of savings. Offer a federally backed guaranteed return fund for 401(k) accounts with an after-inflation return of 3%.

- Make social security employee tax payments optional after age 62.

- Remove social security payment offsets from earned income after age 65.

- Auction to private firms the right to offer standard 401(k) financial advisory services for 0.5% of asset value with 100% federal match below $50,000 and 50% federal match below $100,000.

- Create voluntary 5% of income home down payment savings program that accumulates to $50,000 after 10 years of full-time employment contributions.

Financial Security

Lifetime employment is gone. Fixed benefits pensions are gone. We live 20 years longer. We need a more robust unemployment insurance system. Individuals may secure a position that pays 25% – 33% – 50% more than their “second best” alternatives. When individuals lose their jobs, we need to buffer their losses and nudge them towards their “next best” options in a timely manner.

- Reform unemployment insurance to provide 75% of historical income for 6 months and 50% of income for 12 months. Limit coverage to $60,000 of base income.

- Provide a 50% “bridging subsidy” for individuals whose income has dropped by more than 25% for up to 3 years. This would handle the effects of international trade and firm bankruptcies.

- Overhaul the “welfare system” to combine various programs into a single program combining a universal basic income (UBI) and the earned income tax credit (EITC).

- Create a self-funded unemployment lump-sum payment system based on prior 5 years earnings. 4 months award available after 10 years. 6 months after 15 years. 8 months after 20 years. (Alternative to higher benefits and bridging option)

- Maintain a present value of future social security benefits asset balance for each participant. After age 35, allow once per decade 10-year term loan at 10-year T-bill plus 2% for up to 20% of balance, maximum of $50,000 loan balance. Repayment through social security system earnings.

- Set a $15/hour adult minimum wage, indexed to 70% of the median income.

Consumer Assets

In the modern world, consumers face sophisticated marketers and professional services firms. They can benefit from centralized support.

- Set all import tariffs at zero percent, eliminating the effective tax on purchases.

- Eliminate all specific import tariffs but levy a 3% tariff on all goods to “protect” domestic producers and help fund government programs. (alternative to 0%)

- Set maximum prices per service and per hour for home and auto repair firms.

- States contract for metro and area multiple listing services and limit total real estate commissions to 4% of transaction value.

- Require financial advisors to meet the fiduciary standard of professional care, putting the client’s interests first.

- Certify public advisors to provide general advice on consumer economics, budgeting, banking, investing, real estate, insurance and health insurance for $100/hour to citizens, with a $50/hour, 8-hour maximum annual refundable tax credit.

- Staff state professional licensing boards with a minority of regulated active professionals. Reduce licensing requirements to meet public safety standards.

- Set a national cap on individual and class-action lawsuits at $2 million per person, adjusted for inflation.

- Auction regional licenses for private firms or states to offer low annual milage limit used car leases to low to medium credit score individuals using federal funding for the inventory.

Education/Human Capital Assets

It looks like our economic system is going to require one-thirds college educated and two-thirds less than college degreed adults. Economically and socially, we need to support all individuals to serve in their roles and for all of us to support the various roles. Think “essential workers” during the pandemic.

- Offer $10,000 for 2 years for high school graduates for their education and training, including “career and technical” training.

- Create German-style public-private partnerships for broad range of vocational training opportunities.

- Offer career and technical training grants for up to 2 years equal to state subsidy of college education.

- Provide alternate sets of courses and experience to meet minimum requirements for standard level high school diploma, rather than requiring gateway courses like Algebra II.

- Offer an all-industries state administered “career skills” certification program that can be earned in 3 years of employment and classes, including some classes for academic credit in high school.

- Require governments and large employers to justify any strict “BA needed” job requirements versus “education and experience” options.

- Tax university tuition income above $15,000 at 25% rate to fund public colleges.

- Expand veterans hiring preferences to state and local governments, government suppliers and large employers.

- Increase the minimum foundation endowment spending from 5% to 6% to provide more current social benefits and limit the accumulation of assets by universities and other not for profits with $100 million plus of invested assets. Provide an option to pay a 0.5% of assets annual fee to keep 5% or a 1% fee to only spend 4%.

Government Services Assets

The corporate world reduces costs and improves valued results by 1-2% year after year after year. We need to set the same expectations for local, state and federal governments.

- Sunset laws requiring reapproval of substantive changes after the first 10 years.

- Bipartisan staff recommended simplification and clean-up laws, one functional area per year, package approval, no amendments.

- Independent staff recommendation of lowest 10% benefit/cost ratios for regulations by agency every 10 years, package approval, no amendments.

- Implement balanced budget across the business cycle law that considers unemployment rate and debt to GDP levels.

- Require offsetting spending cuts or funding sources for new spending programs.

- Require federal programs to have a minimum 20-year payback from investments.

- Migrate to minimum 80% federal funding of all federal programs assigned to states.

- Outsource the USPS by region, maintaining 3 day per week delivery minimums.

Tax Fairness

- Set a separate 10% income tax rate on hourly earned overtime income, excluding it from regular “adjusted gross income”.

- Limit corporate type taxation to 10% for revenues below $1 million and 20% for revenues below $5 million.

- Limit combined state and local sales taxes to 5% of purchase values.

- Revise the “independent contractors” social security law to require the 12.4% self-employed contribution to be identified and deposited for all income.

- Eliminate the “carried interest” loophole benefit for investors.

- Limit the reduction of “capital gains” taxes versus labor income to a maximum of 20%. Increase the minimum period for long-term capital gains to 3 years. Provide a 50% of annual inflation above 4% credit in the detailed calculation.

- Require income earners to pay social security taxes on $1 million annually.

- Eliminate the mortgage interest deduction on second homes.

- Increase the IRS audit budget by 50%.

- Levy a 20% tax on inherited assets above $5 million, allowing a 10-year tax payment plan.

Funding Sources for “Everyone Has Assets”

- Levy an annual 0.25% of assets tax on banks and financial institutions.

- Levy a 0.25% financial transactions tax on stock and bond investors and traders.

- Set a 10% “luxury tax” on all transportation asset transactions worth $1 million or more.

- Set a 0.25% annual federal “luxury” real estate tax on all residences worth more than $2 million.

- Levy a 0.25% of deal value fee on all “mergers and acquisitions” transactions of $100 million or more.

- Levy a 0.25% excess profits tax on earnings above a 5% real, inflation adjusted return on assets (ROA) for firms with revenues of $100 million or more.

- Reduce the depletion allowance base on mineral assets by 10% of the acquisition cost.

- Starting with the 35% tax bracket ($462,501 married filing jointly), reduce allowable itemized tax deductions to 0 at $2 million of income.

- Add a 40% tax bracket at $2 million of income.

- Levy a 5% of excess price paid on personal vehicles sold for more than $50,000, boats for more than $100,000 and recreational vehicles for more than $100,000. (alternative to 10% above $1M)

- Add a 10% surcharge to property tax rates for residential properties larger than 5,000 square feet. (alternative to surtax above $2 million)

Setting Firm Limits on Taxes

I have separately proposed a set of constitutional amendments that limit taxation of the wealthy, allowing them to support steps like those above without fear of being fleeced.

Summary

Our society hasn’t found a clear organizing principle to guide it between the claims of the people and its leaders. We tend to lean towards the individual, liberty and freedom. This has led to a large number of modest initiatives. We have an opportunity to help our community embrace and support the political steps required to achieve our goals.

Dedications/Provocations

https://www.washingtonpost.com/people/amy-goldstein/

https://en.wikipedia.org/wiki/Paul_Ryan

https://en.wikipedia.org/wiki/Barack_Obama

Bernie Staller – National FFA leader (my supervisor from 2000-2004) Janesville leader.

https://www.agrimarketing.com/show_story.php?id=25007

https://wisconsinagconnection.com/news/staller-inducted-into-alpha-gamma-rho-hall-of-fame

https://www.agrimarketing.com/show_story.php?id=25005

https://www.newswise.com/articles/bernie-staller-to-retire-from-the-national-ffa-organization

The Painesville Plan (t) !!!

https://case.edu/ech/articles/d/diamond-shamrock-corp

https://cumulis.epa.gov/supercpad/cursites/csitinfo.cfm?id=0504696

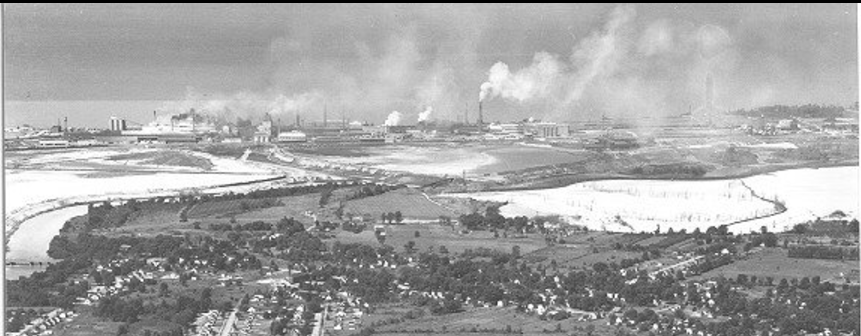

On a personal note, I grew up in Fairport Harbor, Ohio, a small village of 3-4,000 people. The Diamond Alkali chemical plant once employed 5,000 people. It shut down in 1976. My dad was a pipefitter and union leader. My uncle Joe was also an employee and a union and political leader. The negative community impact was very large. The negative impacts described by Amy Goldstein in Janesville were exactly the same in Painesville 40 years earlier.