https://www.eso.org/public/news/eso1225/

I encourage us to always “look at the big picture”: across time, nations, industries, occupations, institutions and political views when considering the “state of the economy”.

Recent surveys indicate that many (partisan) Americans believe that the economy is in recession, the stock market is down, and unemployment is up (false). The US economy continues to lead the world out of the pandemic driven recession. I’ve documented the tremendous strength of the US economy in GDP growth, job creation, wage growth, profit growth and wealth creation. Today I’d like to focus on entrepreneurship and new firm creation, where the US once again leads the world.

The US economy led the world in creativity, technology, job growth and firm creation in the 1990’s as it recovered from the global economic challenges of the late post-war era. The deregulation and technology driven changes produced benefits into the “oughts”, the first decade of the new century. Unfortunately, the dynamic pace of new firm creation based on economic, trade, relocation and technological changes did not strongly continue in the first 20 years of 21st century. New firm creation lagged. Larger firms held onto jobs as they consolidated industries and protected their positions. Venture capital firms facilitated the most successful new companies to quickly expand market share and vanquish weaker competitors. Many Schumpeter disciples worried that the engines of “creative destruction” had lost their momentum and effectiveness.

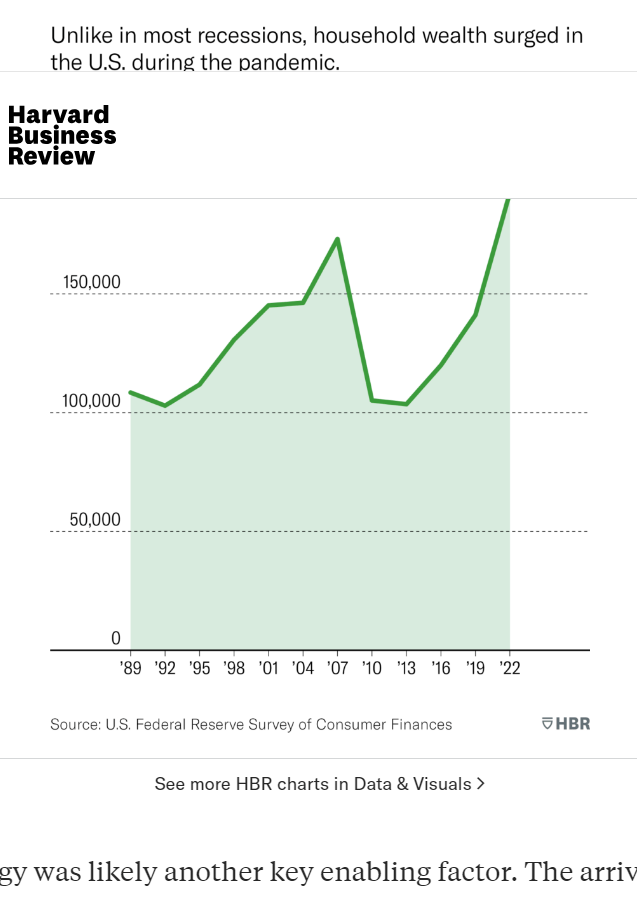

The Great Recession of 2007-10 destroyed wealth, slowed economic growth, job creation and new firm starts. The Obama-Trump expansion was longer than expected by historical standards, but slower growing. Many critics and commentators concluded that the US had “lost its entrepreneurial spirit”.

https://hbr.org/2024/01/how-the-pandemic-rebooted-entrepreneurship-in-the-u-s

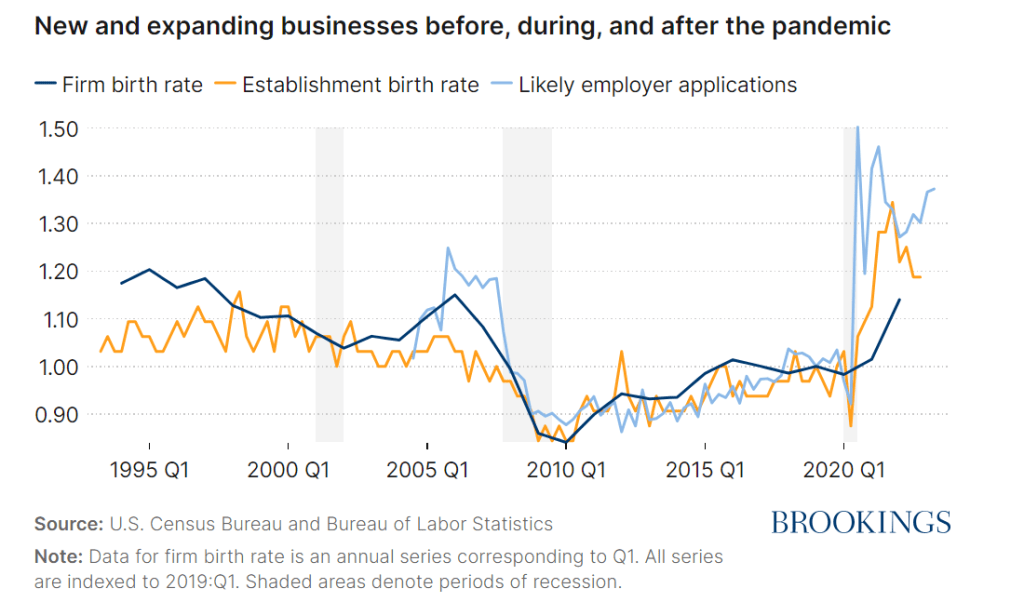

New firm creation since the pandemic has basically been 50% higher than before the pandemic.

This is an AMAZING and unexpected result for the US. During the pandemic, economic activity ground to a halt. Supply chains stopped functioning. People stayed home. 20 million jobs were lost. 1 million lives were lost in the US. Many firms closed. Global trade and military tensions increased. Trust in governments, corporations and other institutions was damaged. In 2020, there was no reason to believe that the pandemic would be medically controlled soon, or that economic growth would quickly rebound and resume its trend growth rate. But it did!

https://www.census.gov/econ/bfs/current/index.html

The IRS tracks new firm tax license applications. Most firms never really do business, but the ratio of initial applications to real firm creations has been stable through history. The Census Bureau has determined which subset of IRS license applications leads to real new firm creations. Both measures show the tremendous 50% increase between the pre-pandemic and post-pandemic eras.

As Wendy’s Clara spokeswoman exclaimed long ago, “show me the beef”. Did the increased rate of tax applications during 2021-22-23-24 result in new firm creation?

Firms less than one year old are up 16%, not 50%, still a significant increase.

New firms are up by about one-third by this measure.

https://www.bls.gov/news.release/cewbd.t08.htm

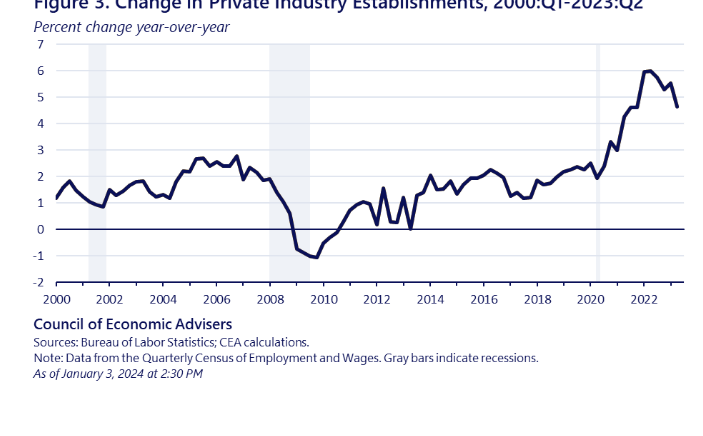

The growth rate of private industry establishments has accelerated.

Three measures reinforce the growth of new firms.

Overall, small businesses have prospered following the pandemic.

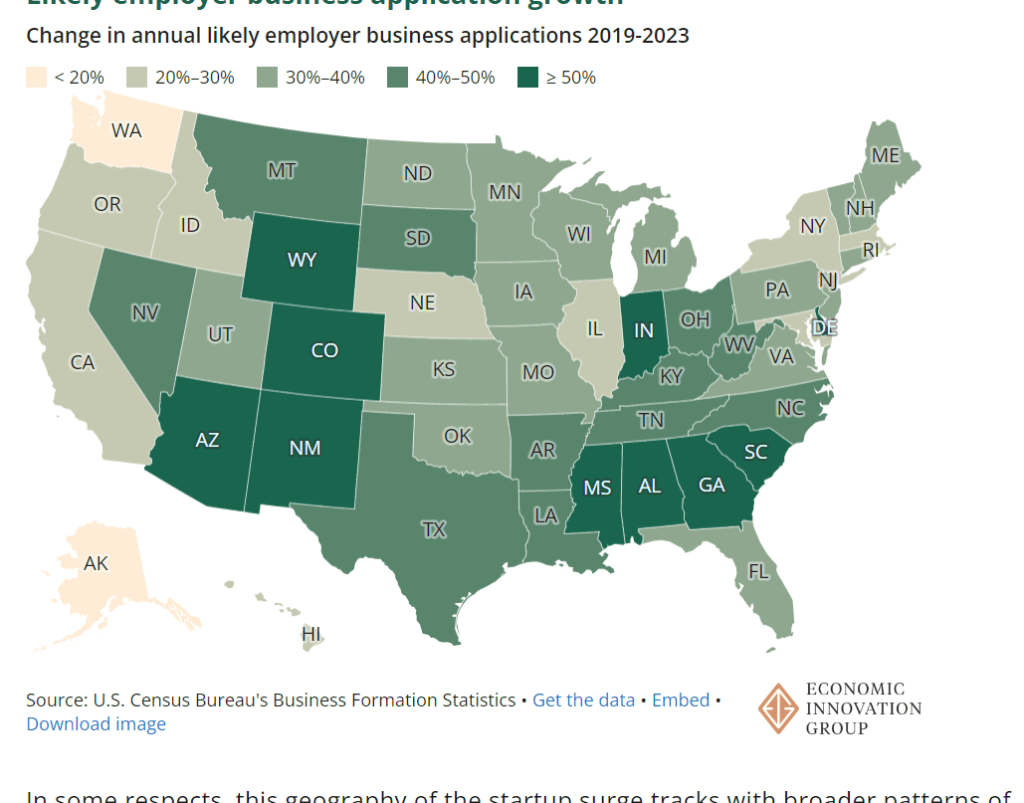

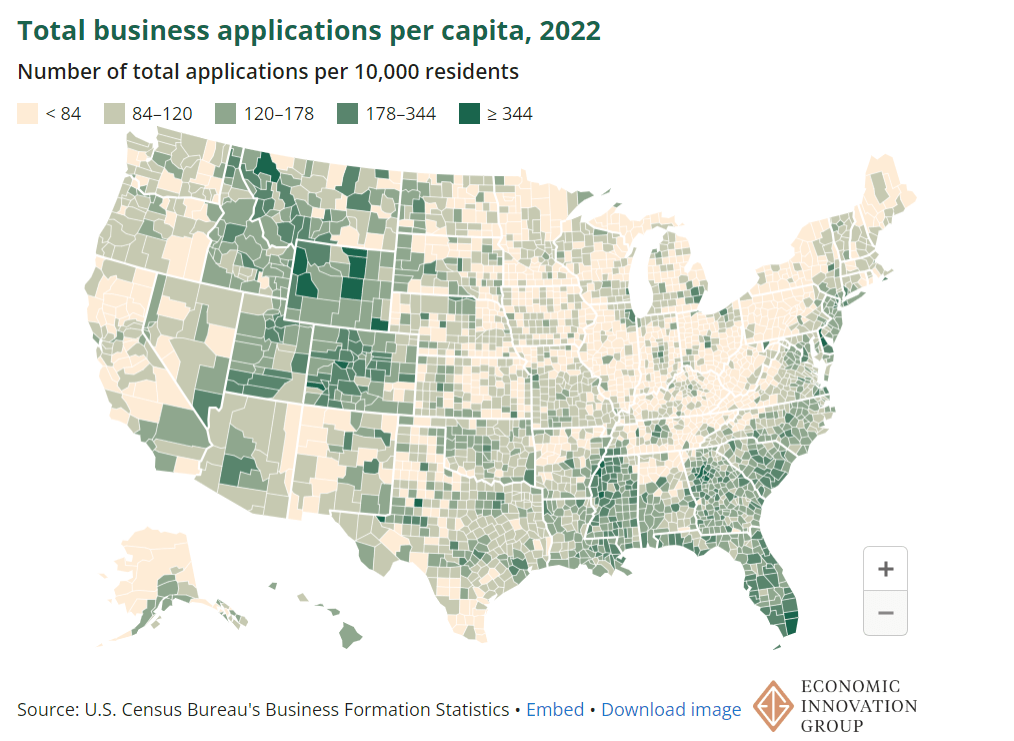

The growth in new business formation is real, solid and sustained. Who benefitted?

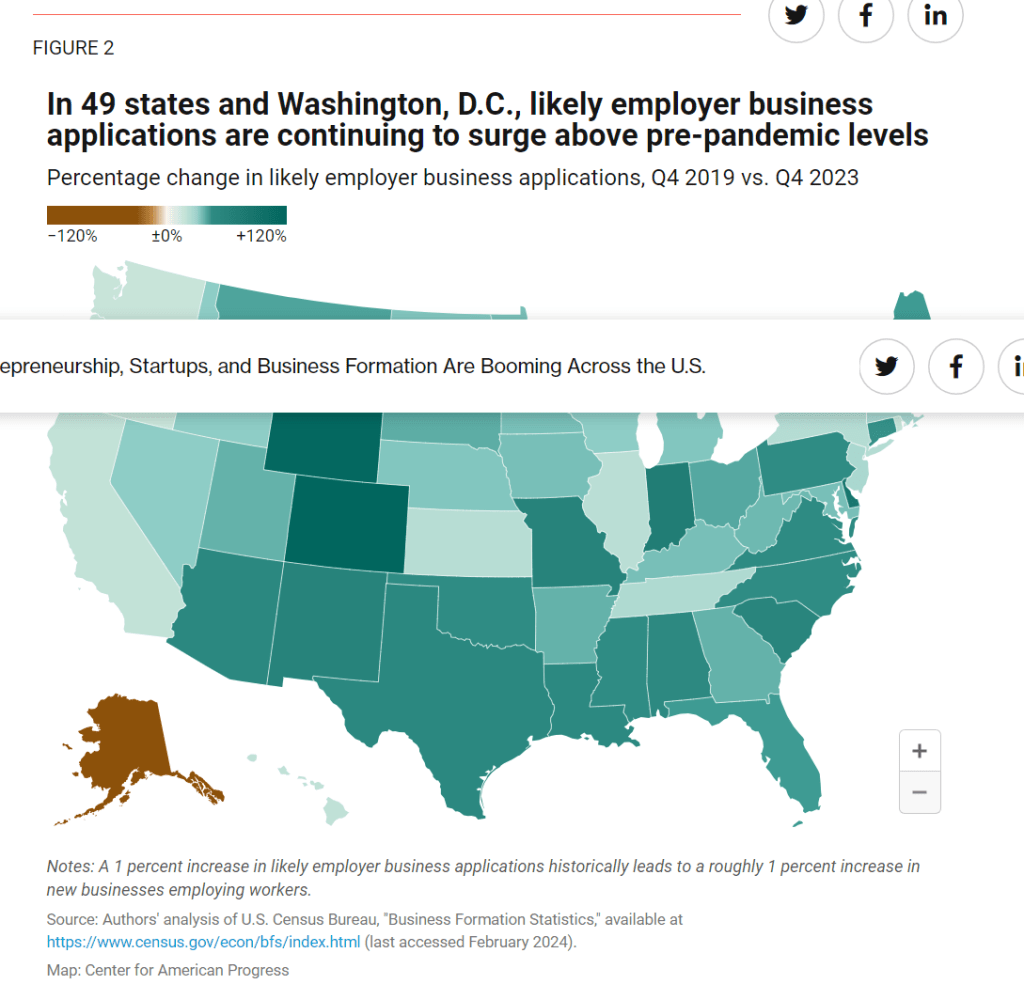

An unusual cluster of SE and SW US showed the highest percentage growth rate.

Once again, a very broad set of states adding new businesses.

The southeast is winning, but growth is widespread.

Nine out of 15 industries saw very strong growth out of the pandemic.

https://www.uschamber.com/small-business/new-business-applications-a-state-by-state-view

The initial surge in new businesses did NOT include the IT or manufacturing sectors which look ready to benefit from AI and government investment policies. Firm creation should continue at its record pace for the next 2-3 years.

https://hbr.org/2024/01/how-the-pandemic-rebooted-entrepreneurship-in-the-u-s

Why/how did this happen? US economy did not see wealth destruction during the pandemic as occurred in the Great Recession. Bipartisan government funding during the pandemic protected small businesses and individuals. The US labor market was strong before the pandemic and recovered very quickly to full employment with high quit rates, high job openings, low layoffs, wage growth, high labor force participation, and new immigrants included. There was no “credit crunch” destroying businesses. Venture capital firms were flush with capital, able to invest in the very best prospects. The US economy was mature as an “information age” economy, identifying opportunities. The virtual economy was mature, allowing individuals with minimal technical skills to easily create new businesses, market their services, and engage skilled resources. Individuals experienced being out of work and at home and determined that they could create new firms from home.

The Biden administration claims that its various public policies have leveraged the “natural” rebound.

Various moderate to conservative sources have documented this positive result.

https://www.uschamber.com/small-business/new-business-applications-a-state-by-state-view

https://www.forbes.com/sites/rhettbuttle/2024/01/12/three-year-small-business-boom-is-unprecedented/

https://www.entrepreneur.com/business-news/why-are-new-business-applications-at-all-time-high/474614

[…] Record US New Firm Creation in a Resilient Economy […]