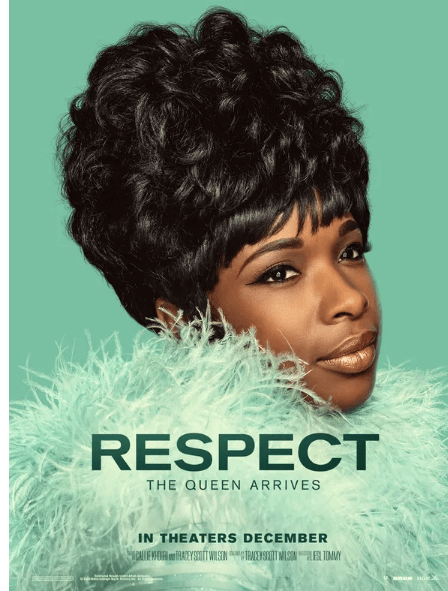

Many Americans today cry out for “respect”. They see a social, economic and political system that does not work for them. A political party that really understands this situation would take strong action, IMHO. Some thoughts …

Reform unemployment insurance to provide 75% of historical income for 6 months and 50% of income for 12 months. Limit coverage to $60,000 of base income.

Provide a 50% “bridging subsidy” for individuals whose income has dropped by more than 25% for up to 3 years. This would handle the effects of international trade and firm bankruptcies.

Provide catastrophic health care coverage for all, covering single event expenses exceeding $25,000.

Set a $15/hour adult minimum wage, indexed to 70% of the median income.

Set a separate 10% income tax rate on hourly earned overtime income, excluding it from regular “adjusted gross income”.

Exclude the first $100K of owned homestead property from taxation and prohibit property taxes on first $250,000 for those aged 70 or above.

Offer $10,000 for 2 years for high school graduates for their education and training, including “career and technical” training.

Provide an annual $10,000 childcare funding source for up to 4 children aged 0-6.

Overhaul the “welfare system” to combine various programs into a single program combining a universal basic income (UBI) and the earned income tax credit (EITC).

Provide a $15/hour volunteer hour tax credit for up to 200 hours annually, including service with religious organizations.

Provide a government funded 100% matching for 401(k) plan contributions up to $10,000 annually.

Limit corporate type taxation to 10% for revenues below $1 million and 20% for revenues below $5 million.

Offer a 50% federal tax credit for first $10,000 of cross-state moving expenses.

Set all import tariffs at zero percent, eliminating the effective tax on purchases.

Limit combined state and local sales taxes to 5% of purchase values.

Provide a 50% federal 401(k) match on the first $5,000 of savings. Offer a federally backed guaranteed return fund for 401(k) accounts with an after-inflation return of 3%.

Revise the “independent contractors” social security law to require the 12.4% self-employed contribution to be identified and deposited for all income.

Changes like these would reduce income equality, provide income security, and better engage citizens in our economic, political and social systems. In total, they would require a 5-10% reduction in net income for the top one-third of income earners. Addressing a 40-50 year period of increased income and wealth inequality requires major changes to the system that has evolved.

How to Fund These Changes

Eliminate the “carried interest” loophole benefit for investors.

Limit the reduction of “capital gains” taxes versus labor income to a maximum of 20%. Increase the minimum period for long-term capital gains to 3 years. Provide a 50% of annual inflation above 4% credit in the detailed calculation.

Require income earners to pay social security taxes on $1 million annually.

Eliminate the mortgage interest deduction on second homes.

Levy an annual 0.25% of assets tax on banks and financial institutions.

Levy a 0.25% financial transactions tax on stock and bond investors and traders.

Levy a 20% tax on inherited assets above $5 million, allowing a 10-year tax payment plan.

Set a 10% “luxury tax” on all transportation asset transactions worth $1 million or more.

Set a 0.25% annual federal “luxury” real estate tax on all residences worth more than $2 million.

Levy a 0.25% of deal value fee on all “mergers and acquisitions” transactions of $100 million or more.

Levy a 0.25% excess profits tax on earnings above a 5% real, inflation adjusted return on assets (ROA) for firms with revenues of $100 million or more.

Reduce the depletion allowance base on mineral assets by 10% of the acquisition cost.

Increase the minimum foundation endowment spending from 5% to 6% to provide more current social benefits and limit the accumulation of assets by universities and other not for profits with $100 million plus of invested assets. Provide an option to pay a 0.5% of assets annual fee to keep 5% or a 1% fee to only spend 4%.

Increase the IRS audit budget by 50%.

Ouch, ouch, ouch! I’ve taught economics at 4 universities across the last 40 years. When we get to the “policy” weeks, I’ve always shared Ronald Reagan’s story about the disincentive effect of a 90% marginal income tax as a legitimate lesson in “toxic” income redistribution. There is certainly a limit to “progressive taxation” which undercuts the incentive of highly productive individuals to fully engage in the economy. The left is burdened with “the details”. Is a 50% income tax rate too much? 40%? 35%? 33%? 30%? I don’t think that Americans are ready, willing and able to embrace an increase in tax rates from 10-22-32-37% to 15-25-35-40%. Changes in the details of the tax code are easier to understand and support.

Analysis

Since the second world war, the US has greatly succeeded as an economic and military superpower. Productivity gains were widely shared as increased real incomes from 1945 to 1975, but not since that time. Real, inflation adjusted, gross domestic product (GDP) has increased 10-fold since 1945. The population is 2.43 times larger, up from 140 to 340 million. Real GDP per capita has increased 4-fold.

Let that sink in. The US economy is 10 times larger (in real terms) than the end of the FDR era when “the arsenal of democracy” was victorious in a truly existential conflict. 10 times as large. The population is now 2 and 1/2 times larger. In 1950 the US had just 15 metro areas with 1 million people totaling 50 million (1/3rd). Today we have 35 metro areas with at least 2 million people totaling 162 million (1/2). We are now a metropolitan society. Productivity, income and competition are much higher in the metro areas. Non-metro areas lag behind with limited hope for the future. This is the inevitable result of a capitalist, technical, global, meritocratic, neo-liberal economy.

Imports and exports have grown from a combined 6% of GDP to 30% of GDP. We all compete in a global economy.

https://fred.stlouisfed.org/series/B021RE1A156NBEA

The college degreed population has grown 6-fold since WWII, from 6% to 36%.

For better or for worse, we live in a “meritocracy”. Large organizations dominate the economy. They require “talented” individuals to perform key functions. They pay a premium for “talented” individuals. The increased inequality of income and wealth is partly due to the larger, global, complex, competitive economy better compensating the college educated and partly due to the “top 1%”, “top 0.1% and “top 5%” capturing a greater share due to their powerful roles.

Average income and lower income citizens broadly understand our situation. We have moved from 60% to 90% high school graduation rates. Average measured IQs have improved by 15 points. The “bottom 2/3rds” have not shared much of the four-fold growth in real output per person, even though they have greatly invested in their human capital, become two-income earning families, engaged at work and delivered for their employers in more demanding and strictly measured roles.

We have strong “populist” pressures today because our system has not delivered economically, politically or socially for the average family in the last 50 years.

“I work hard but I never get ahead”.

The Democratic party coalition of labor, immigrants, Catholics and southerners was shattered by the Civil Rights Act of 1964, the cumulative restriction of immigrants from 1910-70, the 1960’s counterculture, and the postwar decline of manufacturing from 30% to 10% of the economy. The party reassembled a new coalition of labor, minorities, urbanites and highly educated philosophical liberals in response to Reagan’s victory in 1980. Bill Clinton triangulated a “third way” in 1992 to win the presidency and to be re-elected in 1996. Newt Gingrich orchestrated a Republican revolution in 1994-98 that blocked any rebuilding of a solid Democratic majority. Other than “Obamacare”, Democrats have delivered few program results for their constituents or the broadly defined working and middle classes. Democratic apologists argue that they tried but were stopped by the other party, yet the public always focuses on “results”.

The Republican Party went “all in” on a consistent economic, social and international conservatism with Reagan’s 1980 election win. Following the “misery index” and “malaise” of the Carter years, there was renewed economic growth during the Reagan years which accelerated in the Clinton years. “Lifestyles of the Rich and Famous”, “Dallas” and “Greed is Good” shaped public perceptions in the last 20 years of the century. Republicans very effectively sharpened their anti-tax and “government is evil” views. Social wedge issues of abortion, crime, welfare, gun rights, gays, atheists and immigrants rose in importance. Democratic overreach on affirmative action, abortion rights, gay rights and the priority of individual rights versus religious rights helped the Republicans to solidify their appeal to socially “traditional” Americans, irrespective of their economic interests.

Democrats continued to blame “big business” for the relative decline of “labor” throughout the last 50 years, but the party’s recent general support for capitalism, bankers and international trade, followed by the bank “bail-outs” of the “Great Recession” undercut its legitimacy as a spokesperson for the “working man”.

The Republican party slowly left behind it’s East Coast and Midwest Rockefeller and Hanna roots as the party of “big business”. It adopted a more extreme libertarian, wildcat natural resources, Goldwater, Friedman, technological, entrepreneurial, Western, Texan, Floridian, Southern, rural and sunbelt perspective. These groups were aligned by their commitment to individual economic rights and opposition to a central government counterweight. Bush, Sr. and Bush, Jr., supported by Dick Cheney and Donald Rumsfeld, served as transitional figures from a conventional Main Street New England to a more populist Texan Republican point of view.

The Republican Party has successfully portrayed itself as the people’s representative of the individual against the government, the regulators, the bureaucrats, the judges, the lawyers, the intellectuals, the universities, the bankers, the teachers, the internationalists, the socialists, the anarchists, the counterculture, the atheists, the communists, the globalists, the mayors, the journalists, the mass media, Hollywood, the criminals, the immigrants, the deviants, the “other”. This is a very powerful political philosophy and tactic. Hence, many working class and middle-class individuals have chosen to vote for a party that supports their individual economic and social rights.

Conclusion

The working class and middle class have been left behind in the post-WW II era. The Democrats have failed to offer an attractive center-left option such as that outlined above. Perhaps someone will lead the party to address these opportunities. The Republican party promotes radical individualism as the cure for all social needs. Many Americans want to believe in this view. They strongly want “RESPECT” for their individual selves. Democrats increasingly focus on the rights of minority and interest groups rather than individuals. STALEMATE???

[…] R-E-S-P-E-C-T […]

[…] Labels” Proposes a Centrist Third Party The Blind Men and the Elephant R-E-S-P-E-C-T R-E-S-P-E-C-T-2 Our American […]

[…] R-E-S-P-E-C-T The Paradox of Great Wealth in a Democracy Serve the […]

[…] Diagnosing the 2024 Presidential Election The Paradox of Great Wealth in a Democracy R-E-S-P-E-C-T R-E-S-P-E-C-T-2 Mostly Good News Since the 2008 Great Recession Framing What Matters […]

[…] the Root Cause of Our Problems?: Insecurity R-E-S-P-E-C-T R-E-S-P-E-C-T-2 The Janesville Plan: Economic Opportunity […]

[…] Don’t Be a Political Victim (Right) Don’t Be a Political Victim (Left) A Civility Pledge Civility Pledges Taking Back Our Government: Candidate Appraisal Boards (CAB) We Always Have a Choice Promoting the General Good: A Council of Advisors, Elders, Guardians or Wisdom The Janesville Plan: Economic Opportunity for All R-E-S-P-E-C-T-2 R-E-S-P-E-C-T […]