https://itsamoneything.com/money/beatles-taxman-lyrics/

State and local taxes are mostly driven by the state. In Indiana, state sales and income taxes account for 63% of the total. Local taxes account for 37% of the total.

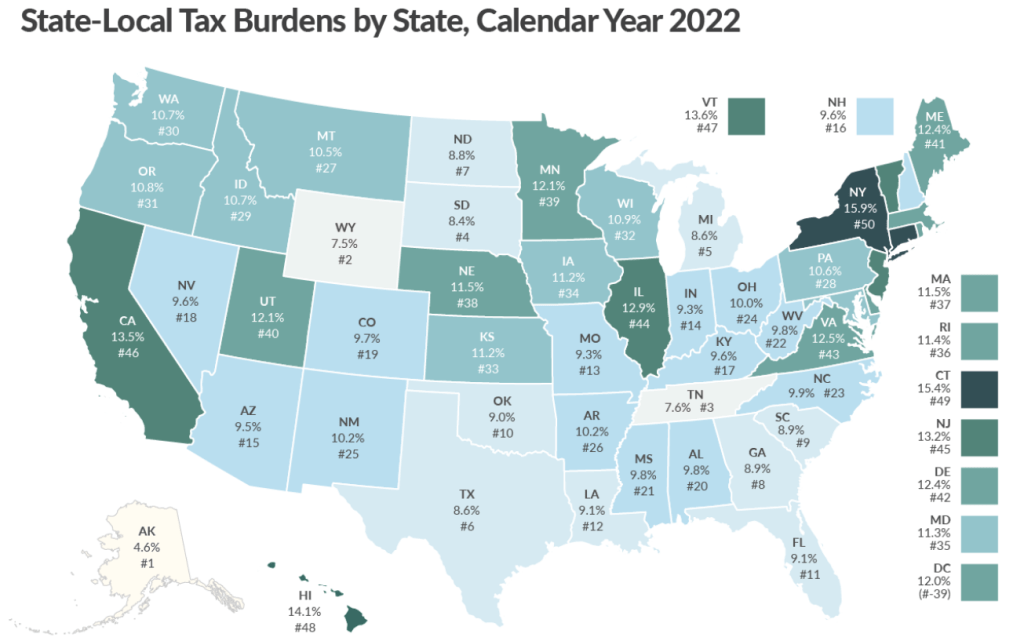

Indiana is a lower tax state. Various sources rank it 11th to 18th lowest, with a median ranking of 14th. Hoosiers pay 9.3% of their income for taxes.

https://wallethub.com/edu/states-with-highest-lowest-tax-burden/20494

https://www.nolo.com/legal-encyclopedia/a-comparison-state-tax-rates.html

Indiana’s 9.3% paid is a little higher than 10th rated Oklahoma’s 9.0% and a little less than 25th rated New Mexico’s 10.2%. It is significantly lower than 40th rated Utah’s 12.1%.

https://www.stats.indiana.edu/dms4/propertytaxes.asp

Hamilton County’s 1.1% income tax rate is the 12th lowest of 92 counties in Indiana, 31% lower than the average of 1.6%. The median is 1.75%. Its median property tax rate is 5% higher than the state average. The weighted average total state and local tax rate for Hamilton County is 2% lower than the state average. The Hamilton County total taxes paid as a percent of income is comparable to 12th ranked Louisiana and Florida at 9.1%.

Hamilton County has lower taxes compared with its Indiana peer counties, the top 10 in population plus Indy metro Johnson, Boone and Hancock counties. Its 1.1% income tax rate is lower than all except Porter County; significantly (26%) below the 1.48% average. Its median property tax rate is 5th lowest of the 13, 5% below the peer average. The peer counties’ total tax rate is 2% above the Indiana average. Hamilton County is 2% below the Indiana average.

[…] Our Hamilton County: Low Taxes […]

[…] Hamilton County: Health Resources and Outcomes Our Hamilton County: Healthy Behavior Our Hamilton County: Low Taxes Our Hamilton County: Affordable Housing Our Hamilton County: Cost of Living Our […]