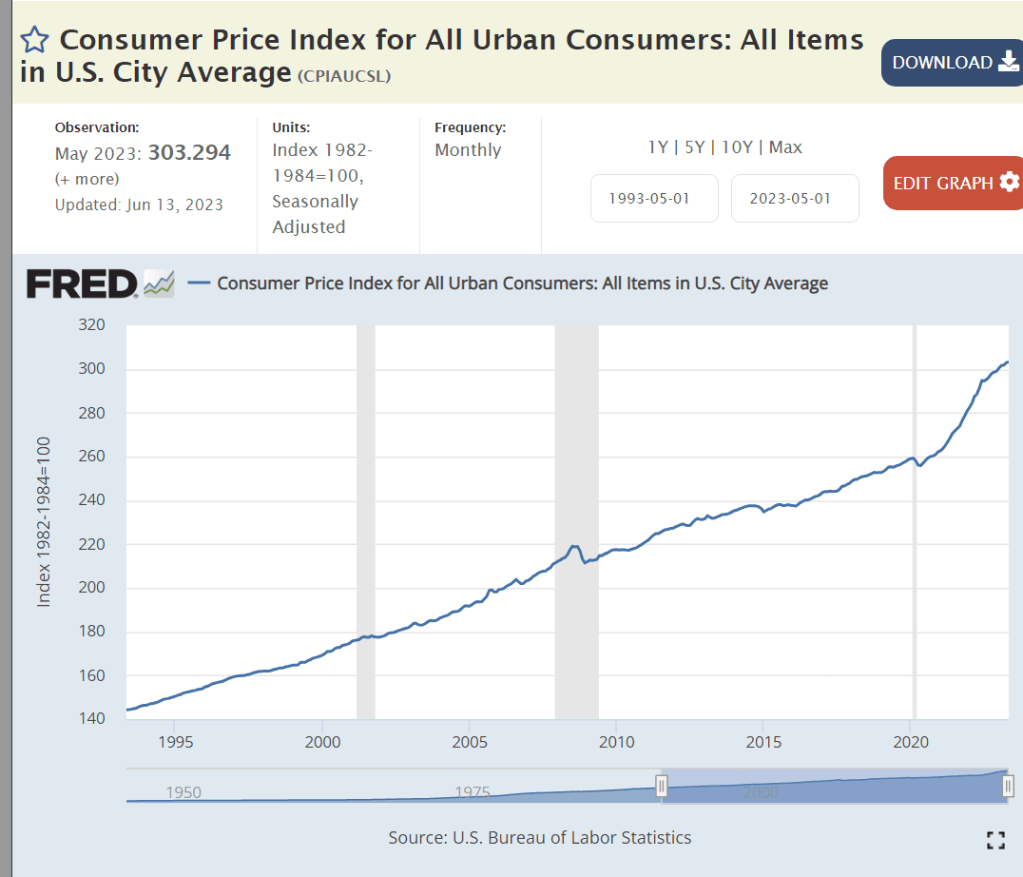

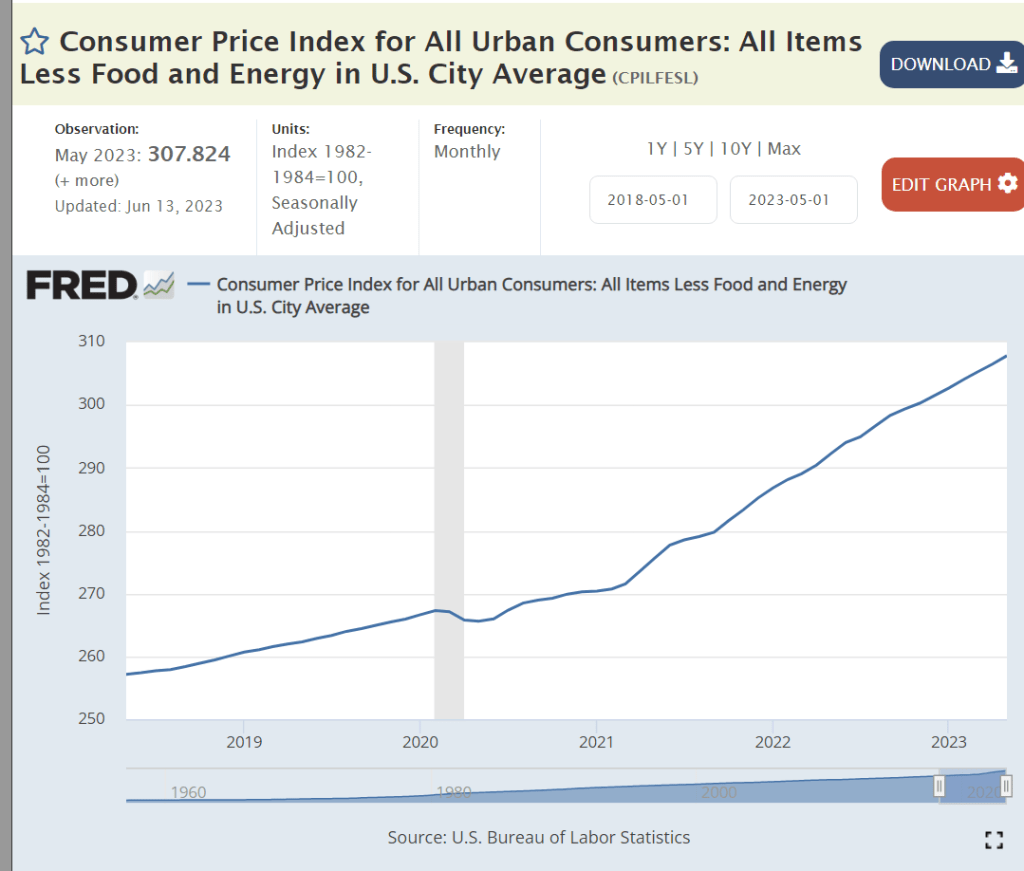

The overall CPI index increased smoothly during the last 30 years until the pandemic. The Great Recession created a small blip up and down. Prices have recently increased by a very large 15% in less than 3 years versus the usual 5% in that time.

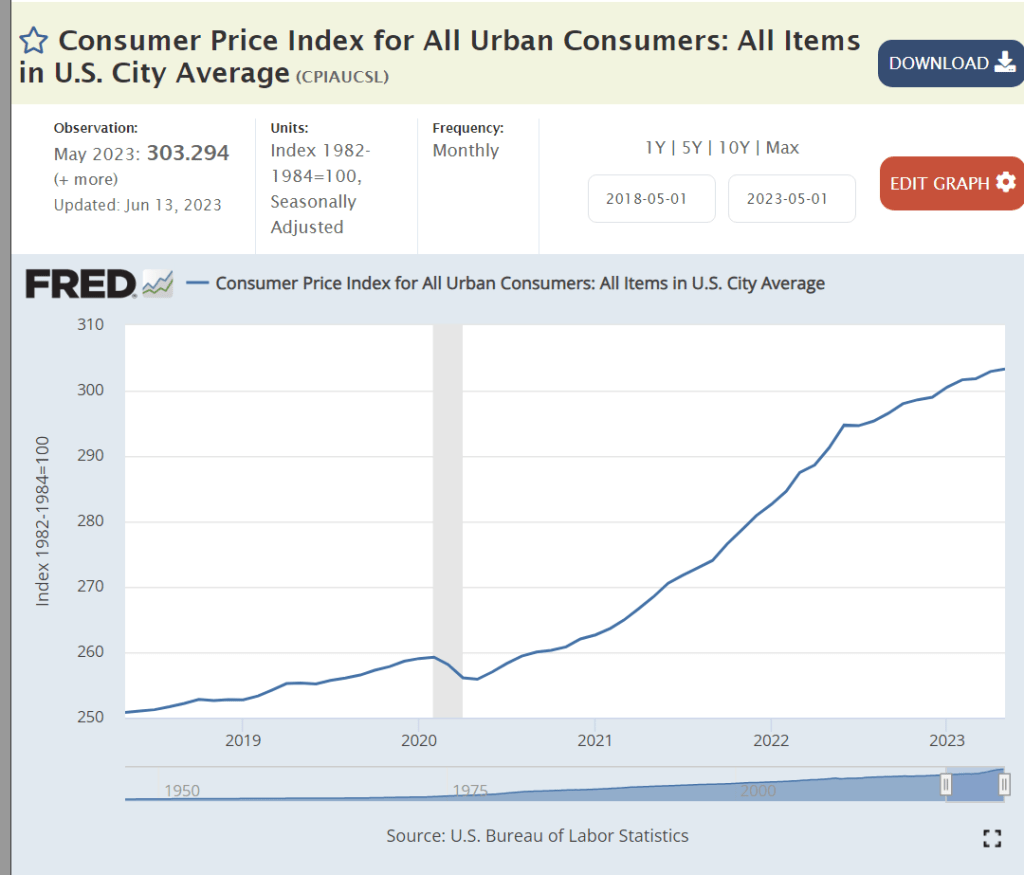

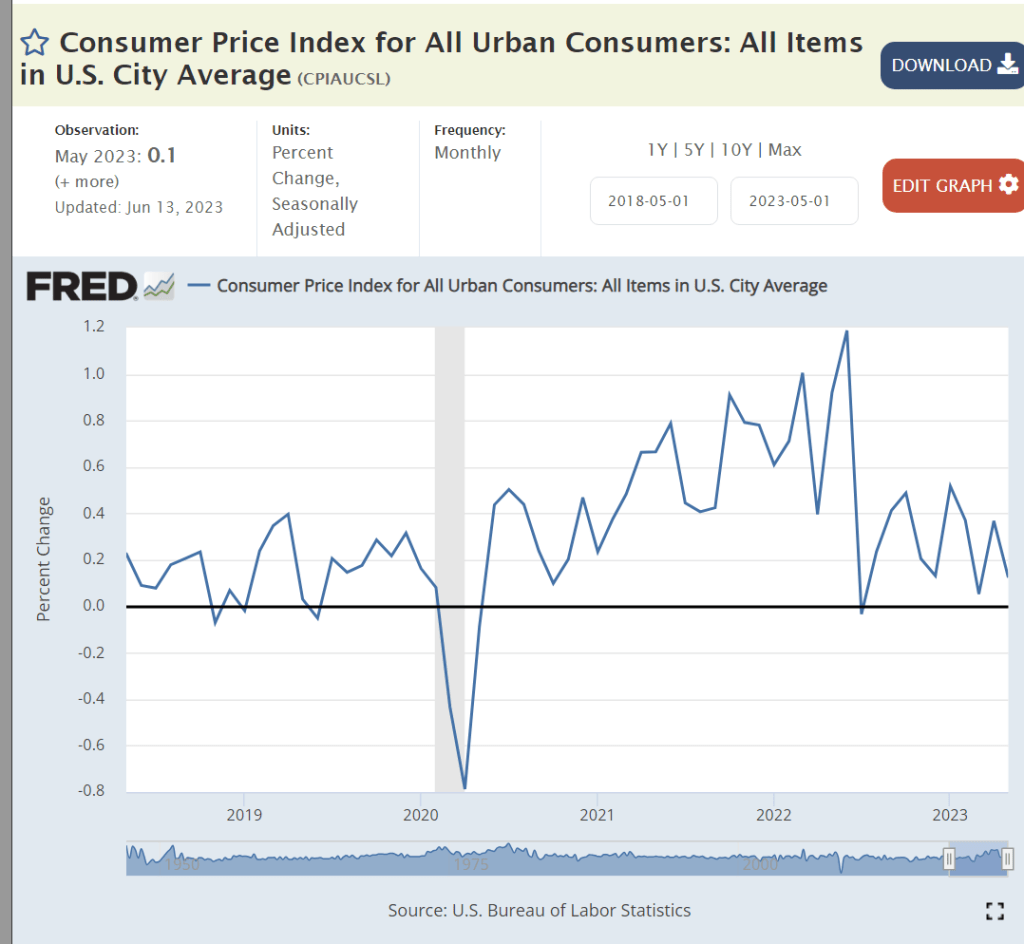

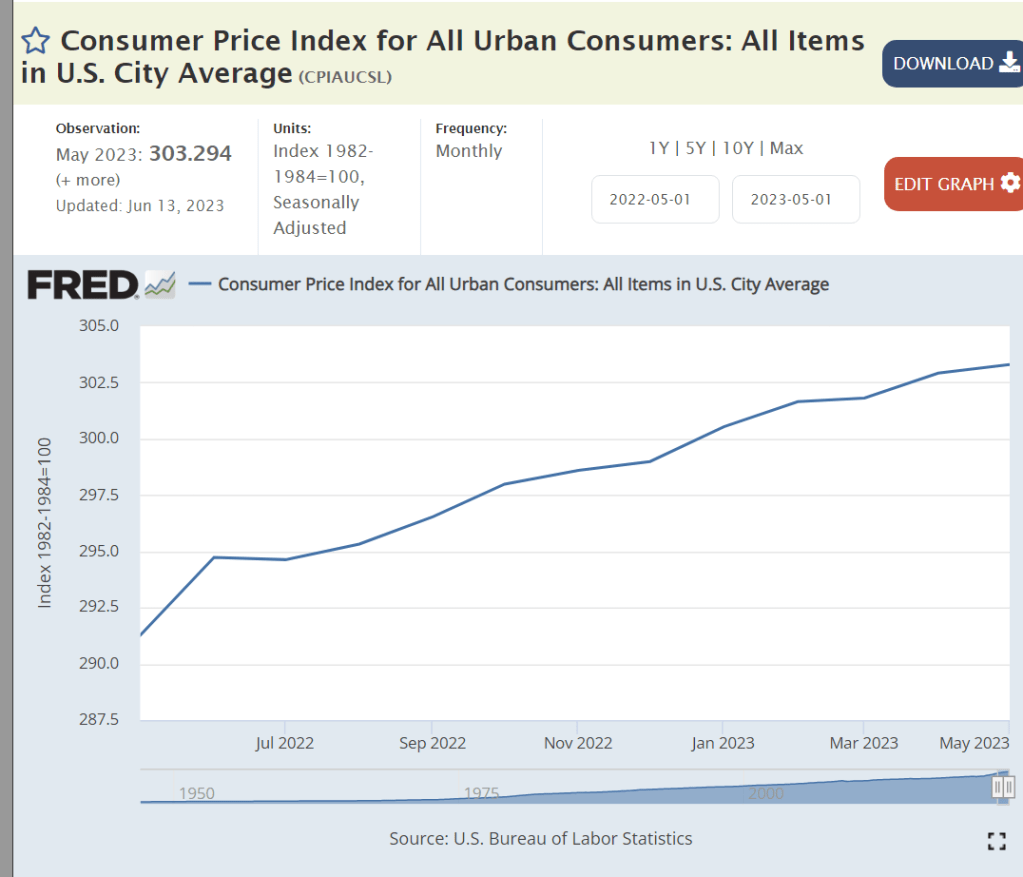

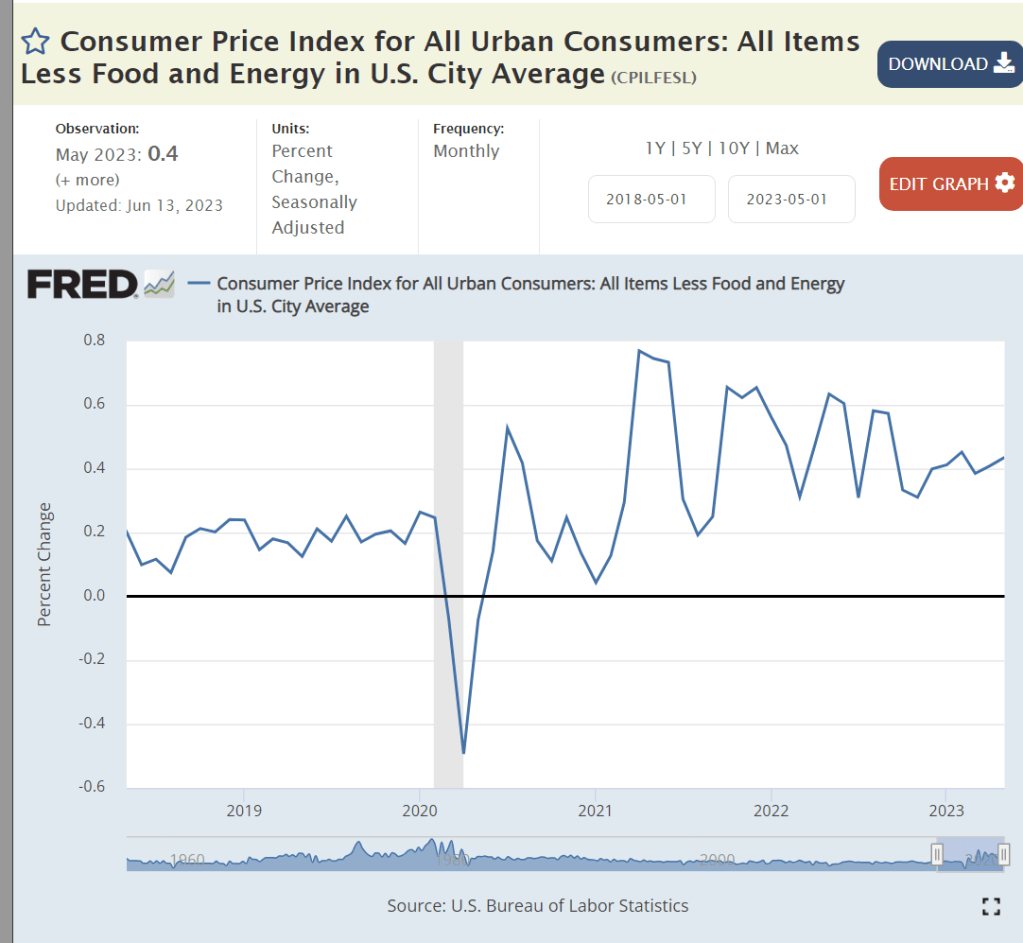

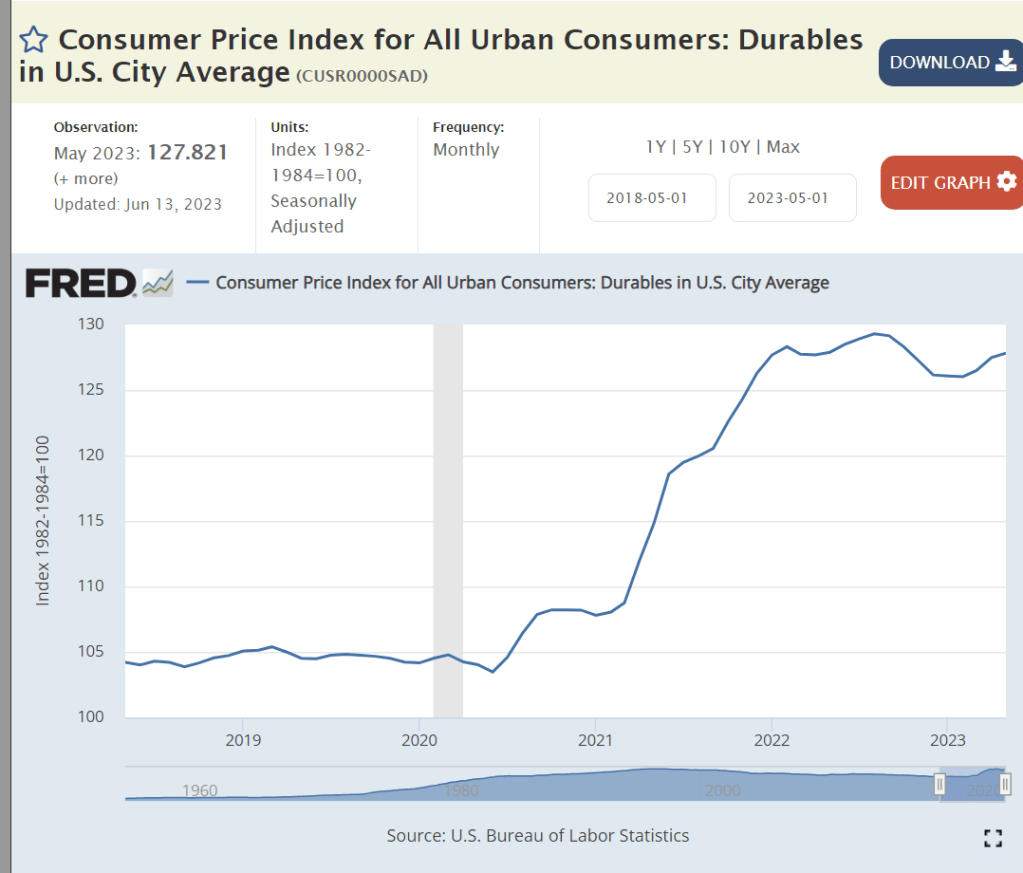

From June, 2020 through September, 2021 annual inflation jumped up to 5%. In the 9 months from October, 2021 through June, 2022, annual inflation spiked up to 10%.! This was mainly driven by durable goods prices as the unexpected rapid recovery from the pandemic encouraged consumers to buy “stuff” since they could not buy services. Since July, 2022 annual inflation is CLEARLY much lower, just 3% to 4% depending on the exact months chosen. Inflation appears to be decelerating as the May, November and May indices are 291, 299 and 303. The last 6 months’ inflation is just two-thirds of the prior 6 months.

Unfortunately, the core inflation measure, excluding food and energy, remains near 5%.

Energy prices have fallen quickly from their peak in June, 2022.

Auto gas prices are volatile, determined by the global oil market. The spike from $2/gallon to $4.50/gallon impacted American consumers. The return to $3.50/gallon is welcome, but prices are still 50% higher than the 2015-20 period.

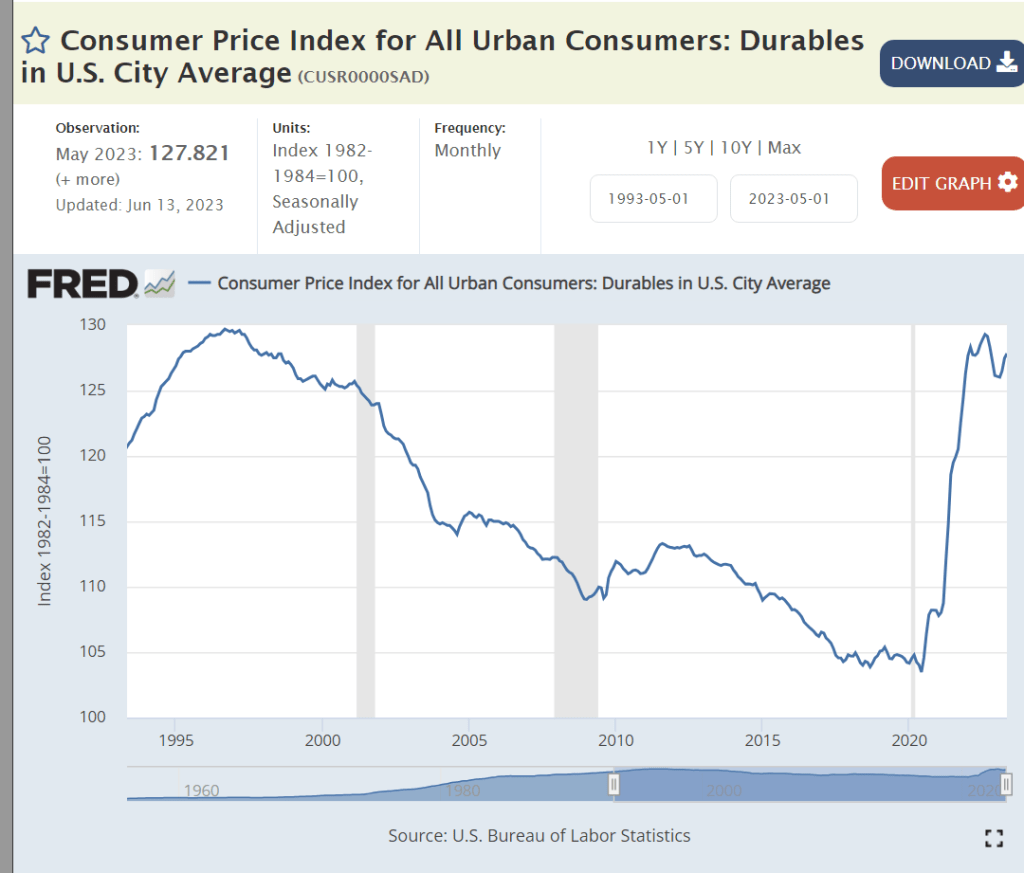

In 25 years, durable goods prices had dropped by 25% due to globalization. In 2 years, they spiked up by 25% as global manufacturers were unprepared for the rapid recovery in demand. Manufacturers, wholesalers and retailers have NOT given back any of that 25% increase in prices, but durable goods inflation has returned to zero.

Nondurable goods followed a similar pattern with a 19% increase followed by flat prices.

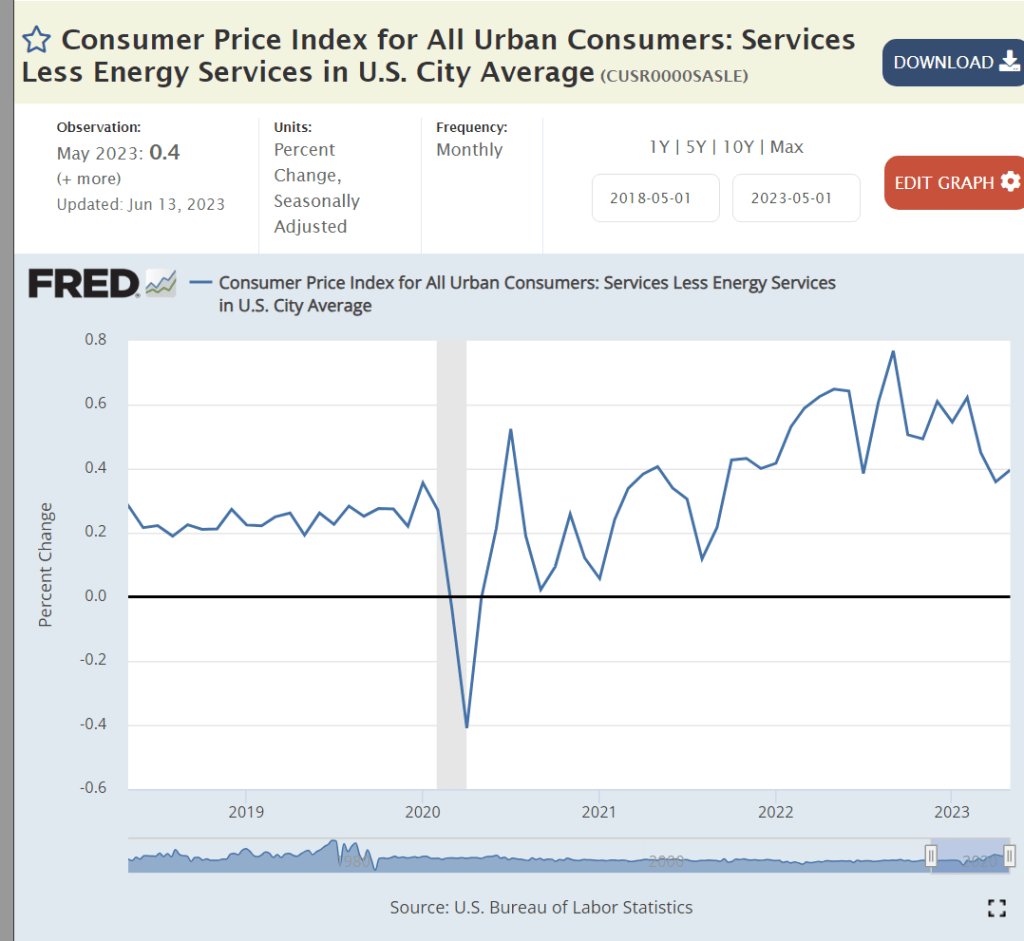

The services sector experienced mild inflation during the first 18 months of the pandemic, but has increased to a 6% annual rate as businesses re-established their business models and labor supplies. This sector has slowed to 5%, but remains the greatest concern for reducing the overall inflation rate.

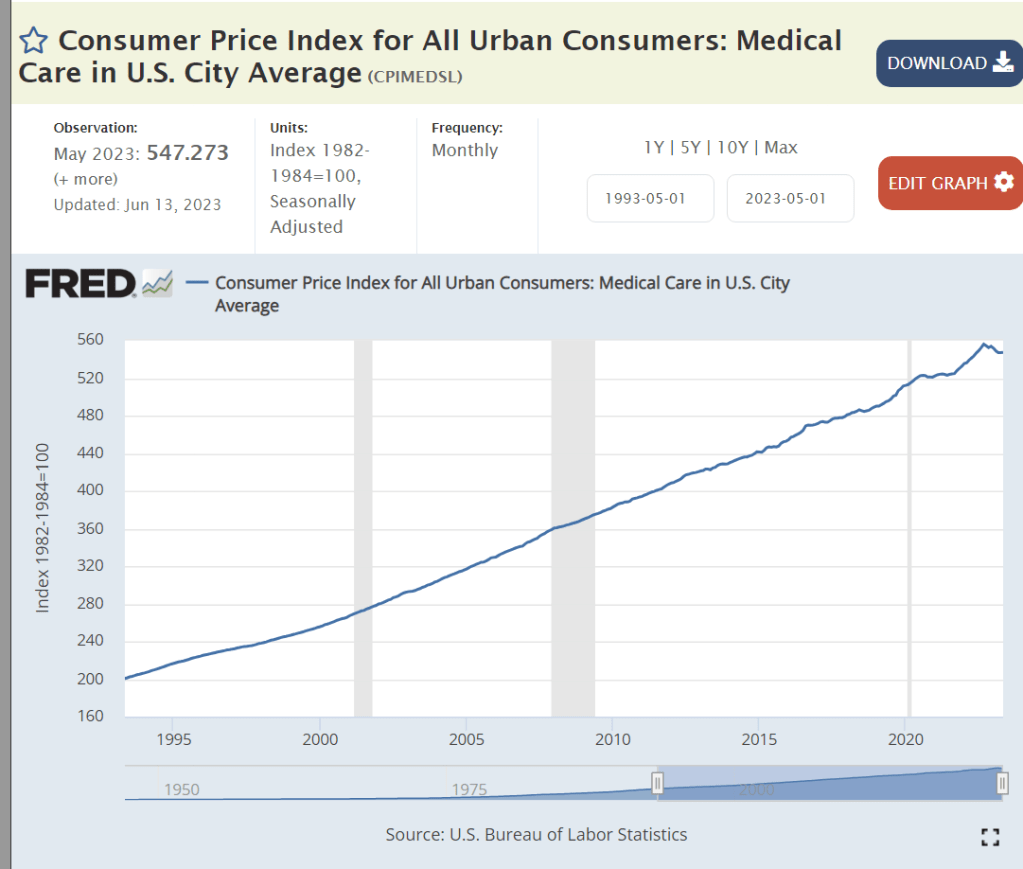

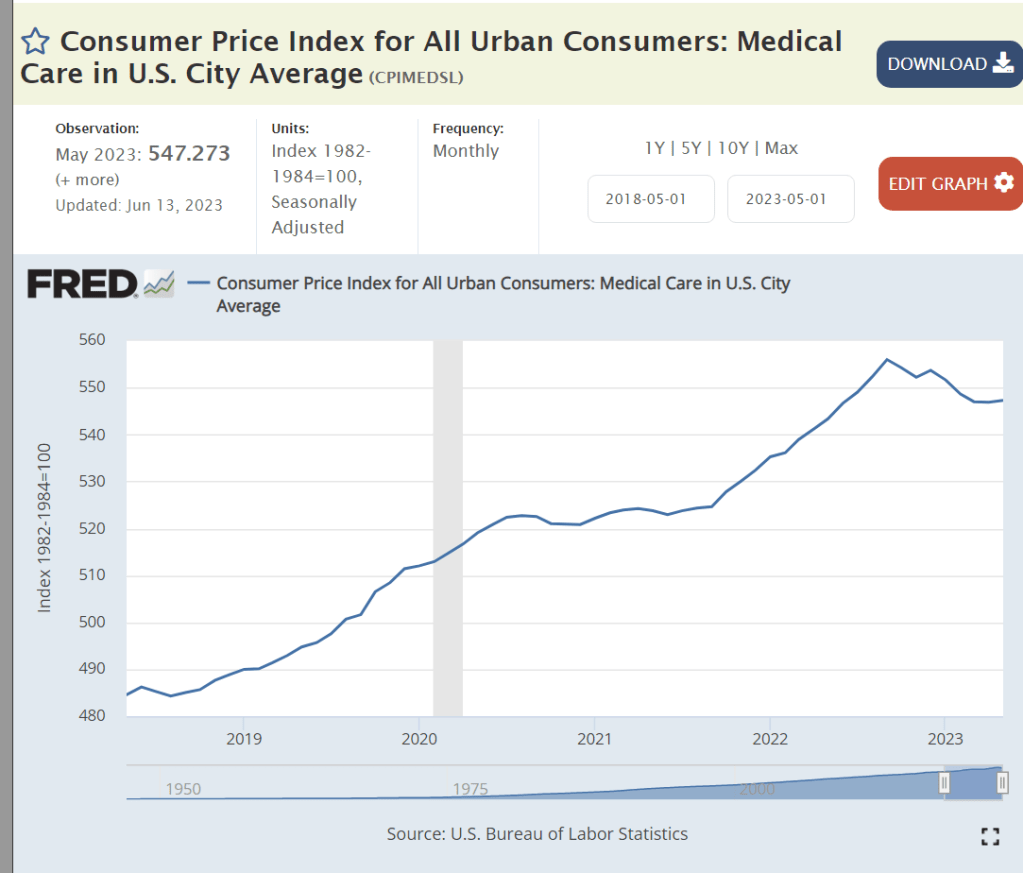

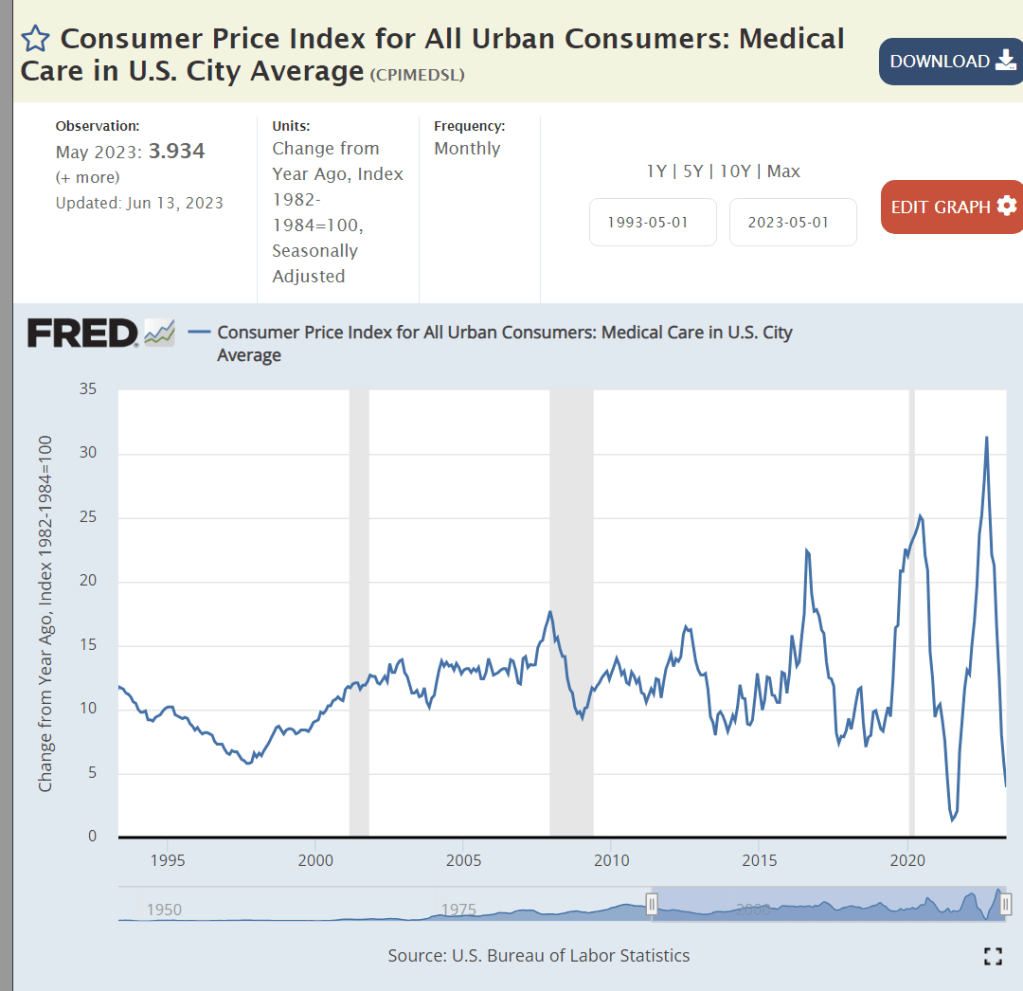

Medical care inflation remains at its 20-year level of 10% or more per year. As medical care has grown significantly as a share of the economy, it’s inflationary disease further infects the economy. Labor shortages play a minor role in this industry. The lack of competition or other incentives for real productivity improvements (Baumol’s disease) drive massive inflation even as US health results such as lifespans decline.

Transportation includes both durable goods and energy prices. A 25% price increase before it flattened off.

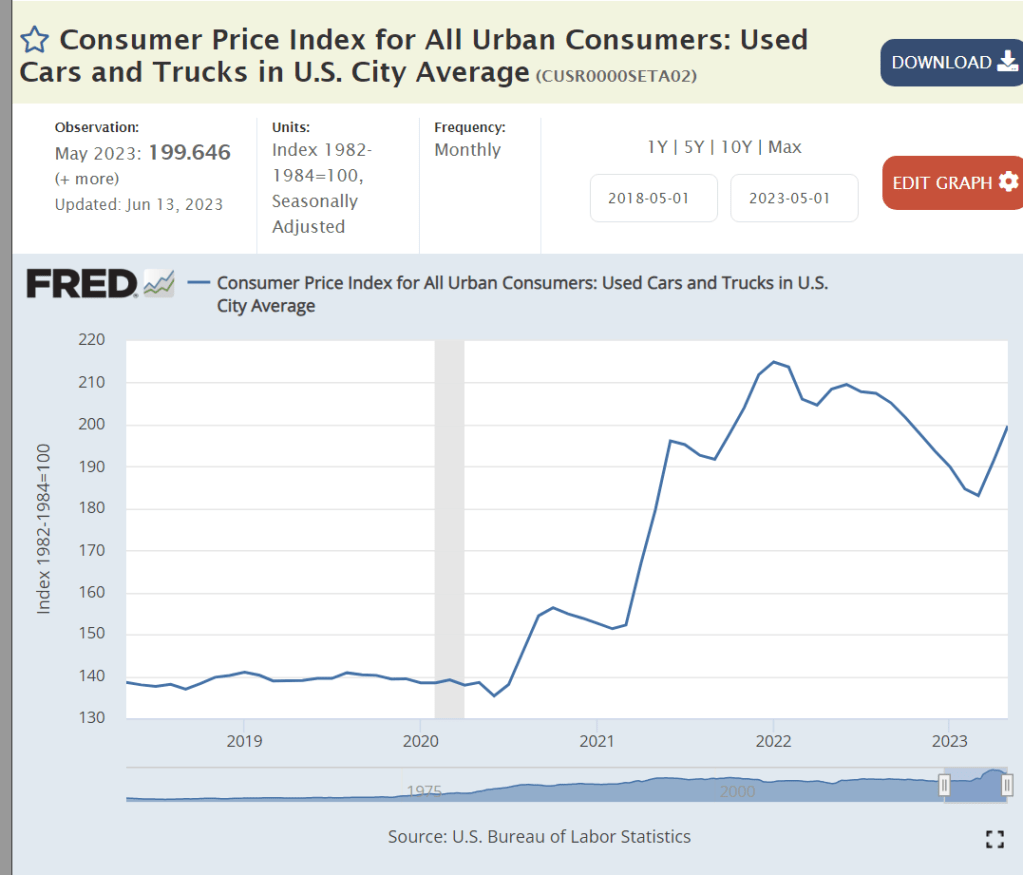

The used car and truck market experienced 50% price increases when the new car and truck pipeline was disrupted. Once again, prices have flattened, but not declined significantly to return to the pre-pandemic level.

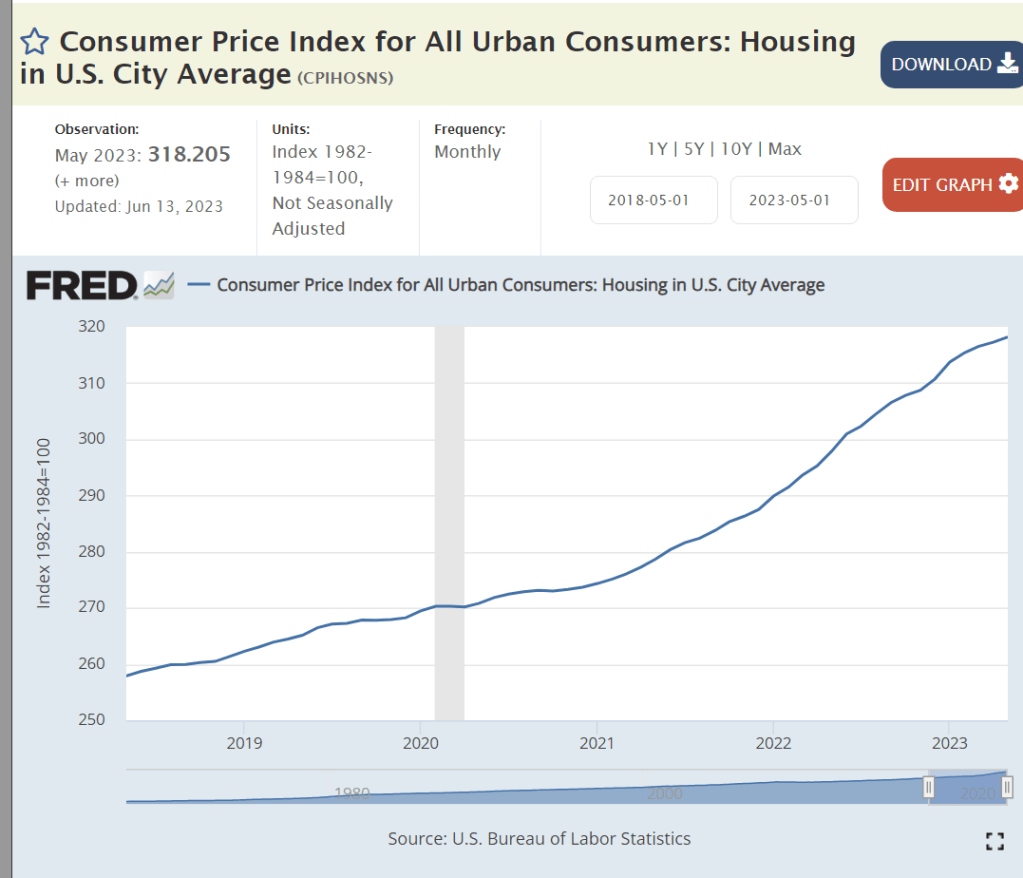

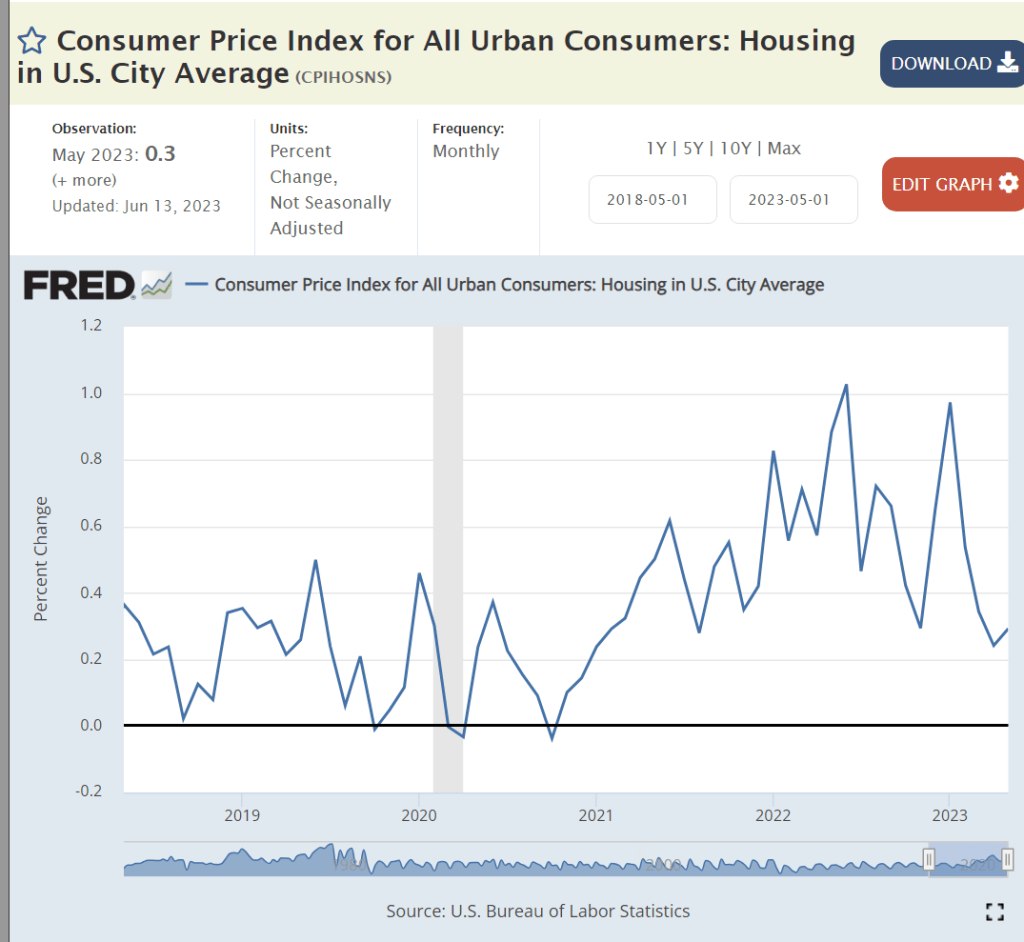

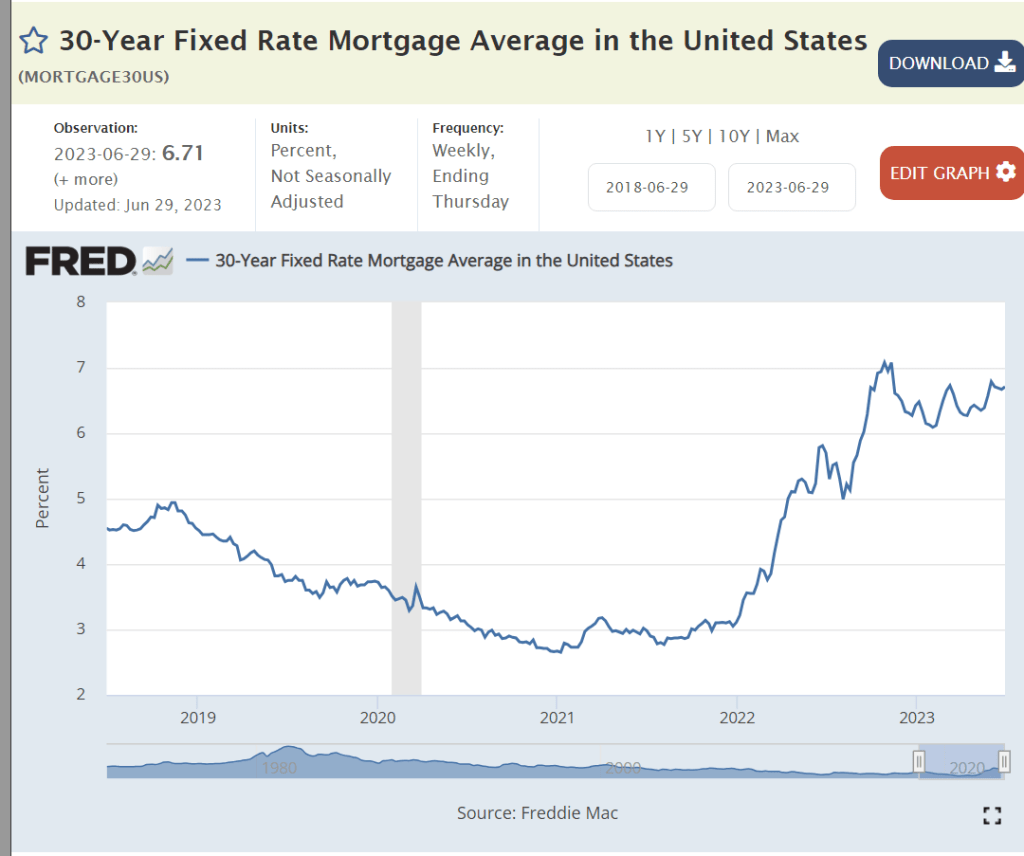

Housing inflation jumped up from 2% to 7% as the pandemic and subsequent Federal Reserve Bank mortgage interest rate increase disrupted the housing construction market. While housing inflation has declined from its peak, the long-term imbalance between supply and demand predicts some future inflation.

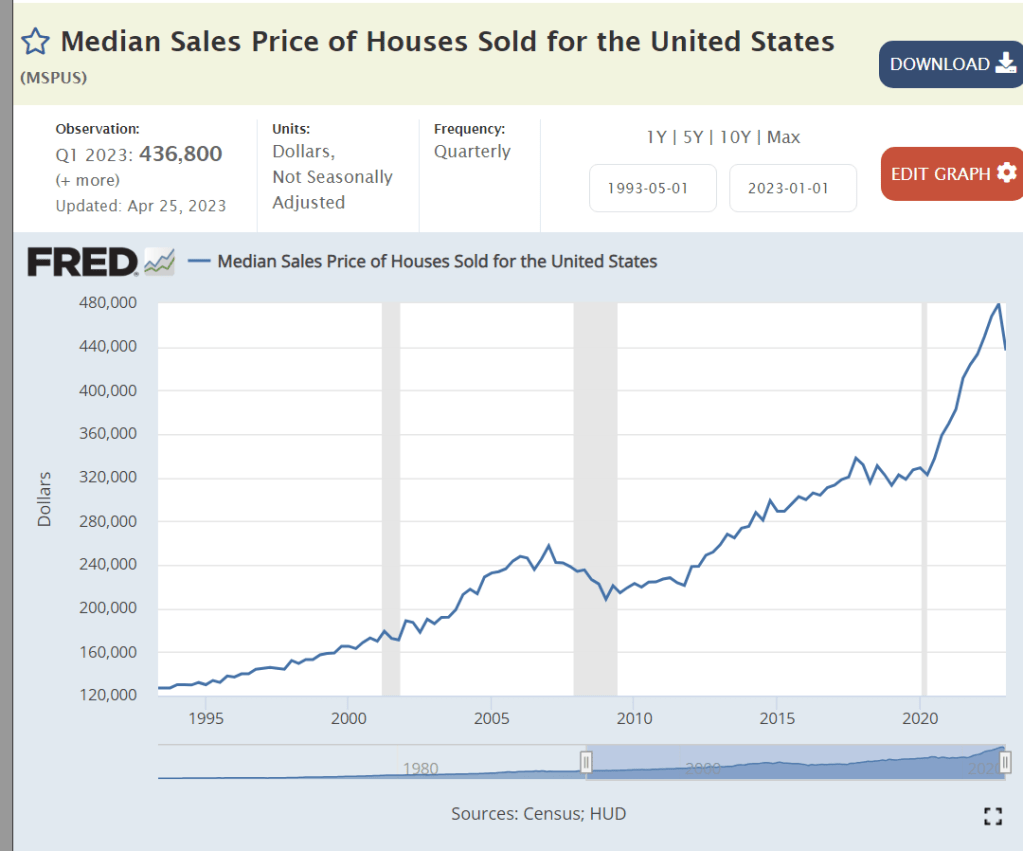

The 40% spike in home values was even higher than that shown for durable and nondurable goods. Flat prices make sense for the next year or two.

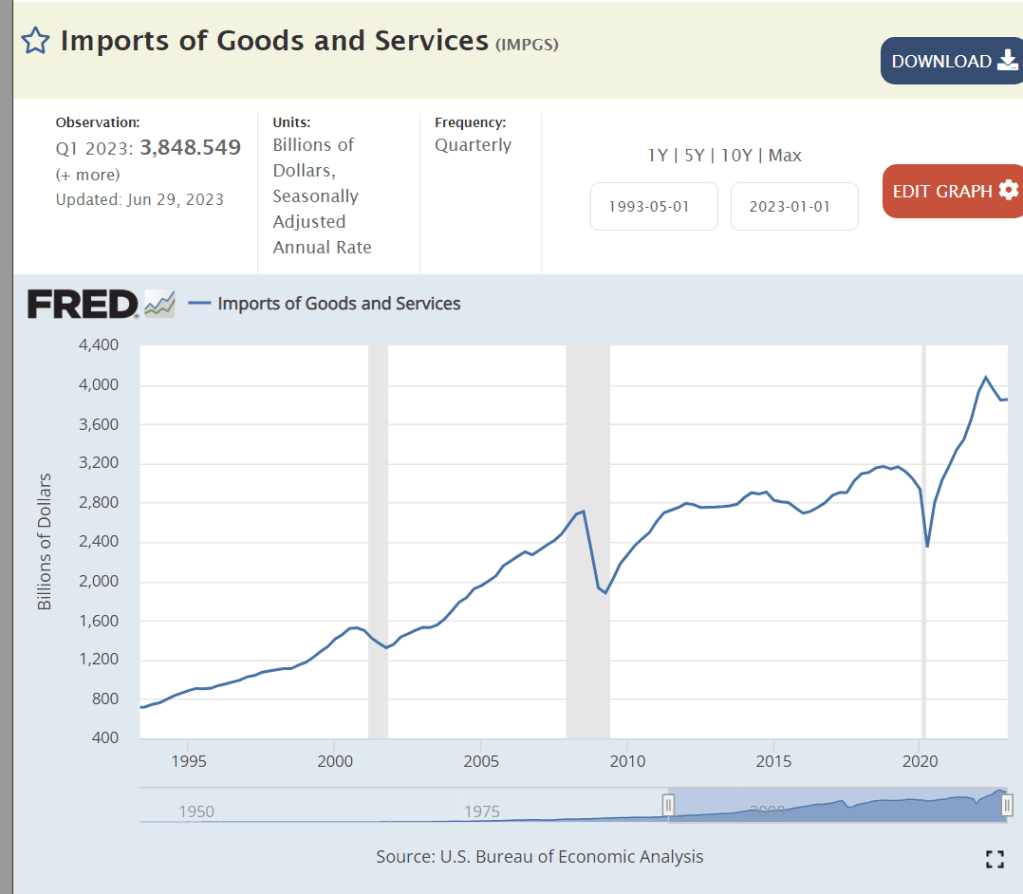

The jump in imports was driven by the increased demand for durable goods.

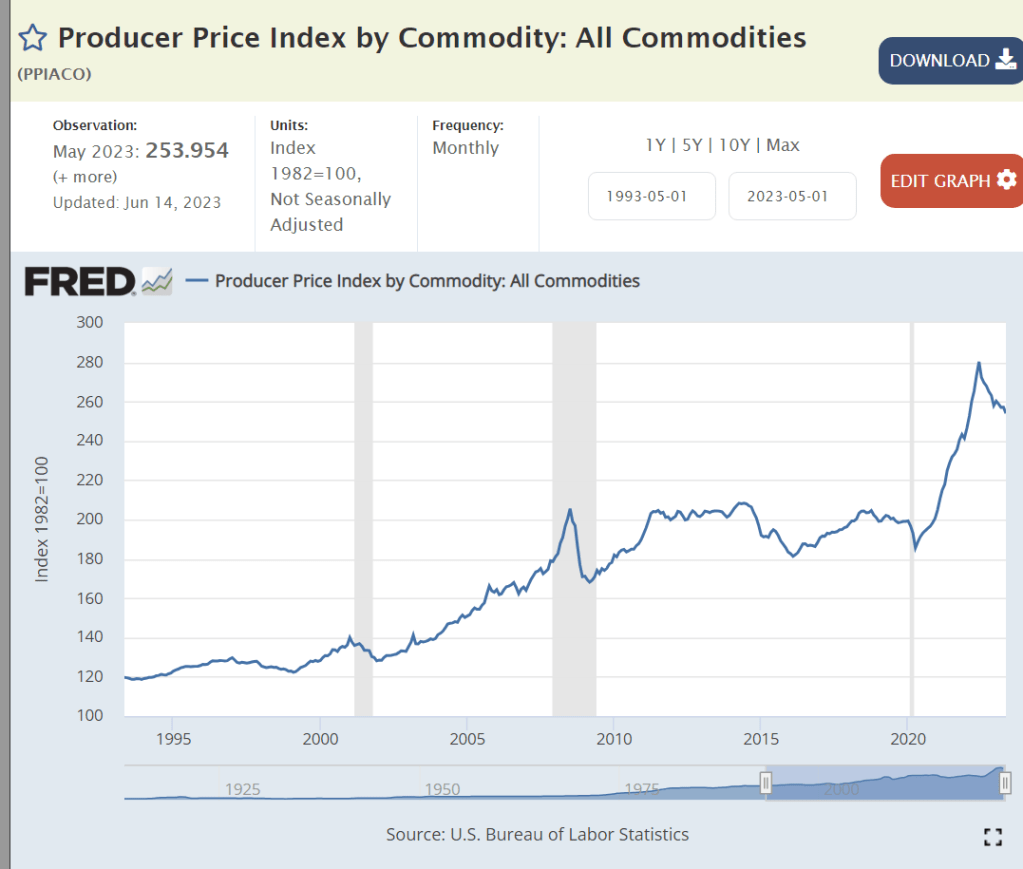

Producer prices were flat for 10 years, then up by 30%. No inflation remains, but some deflation is possible.

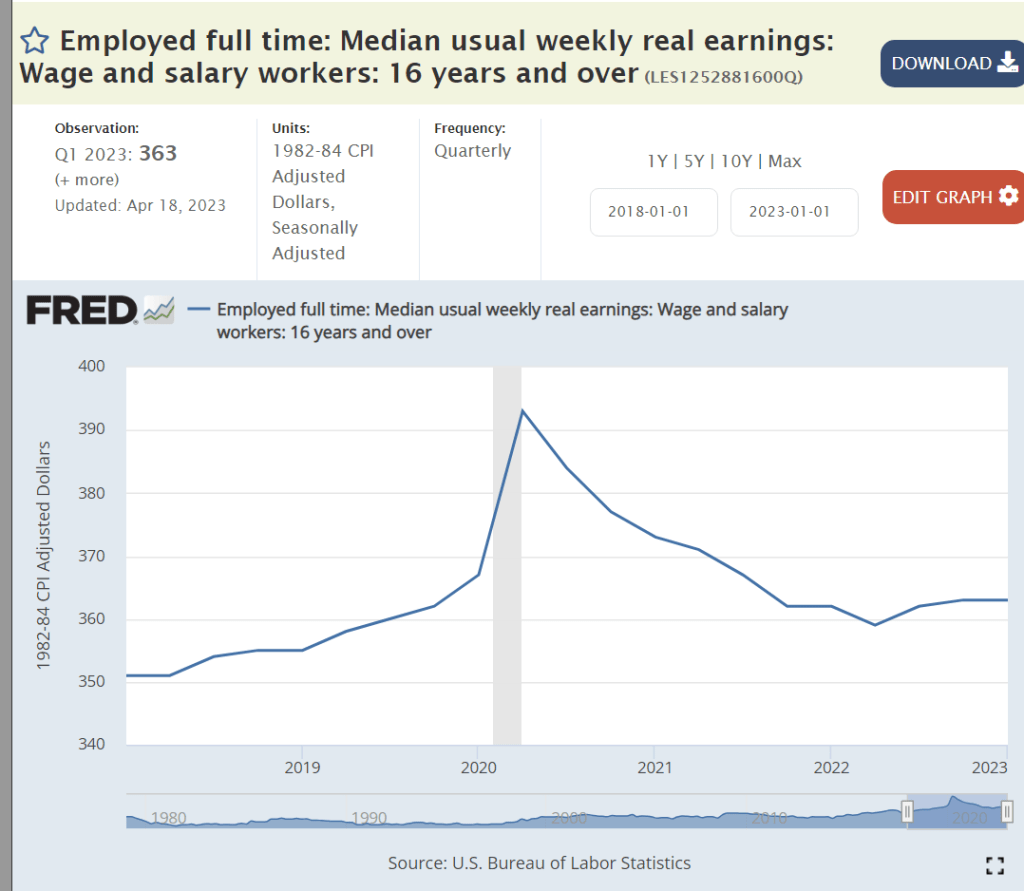

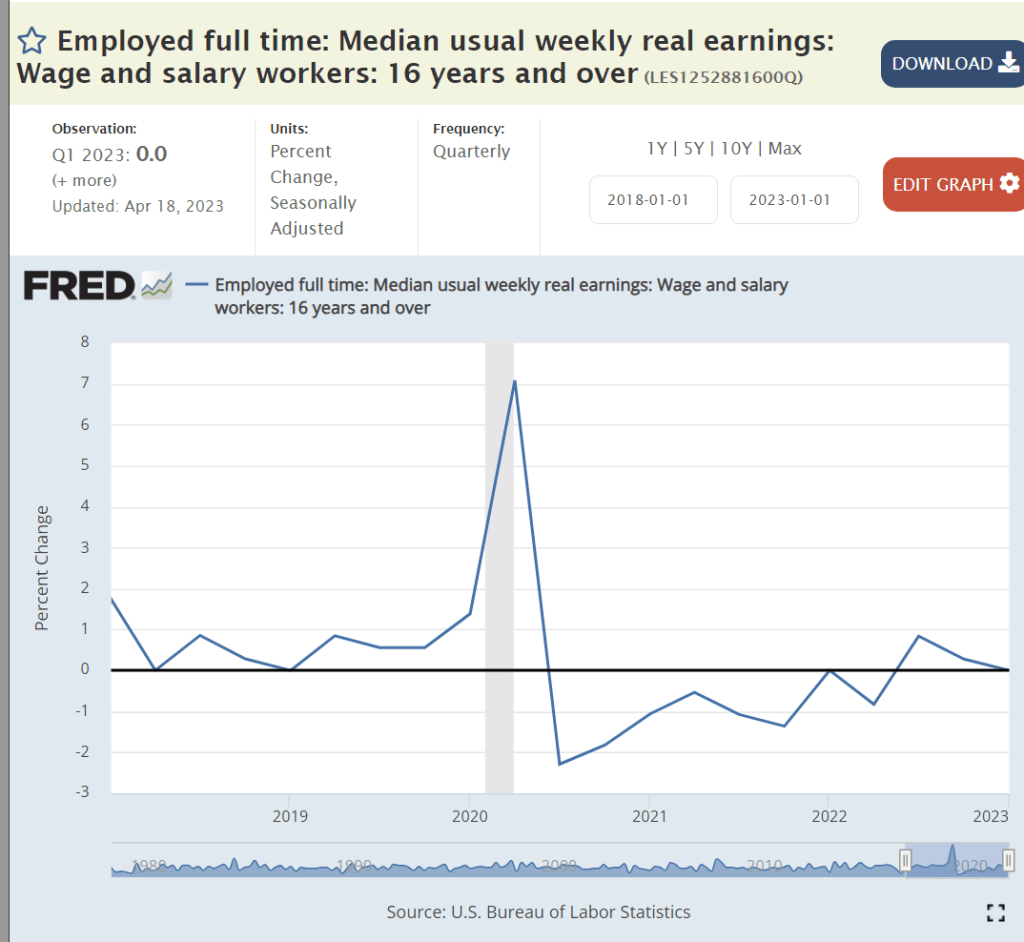

From 2015-20 historically high demand for labor drove a 7% increase in real wages as unemployment reached a 30 year low of 3.5%. For the last 3 years wages have trailed inflation. No wage-price spiral.

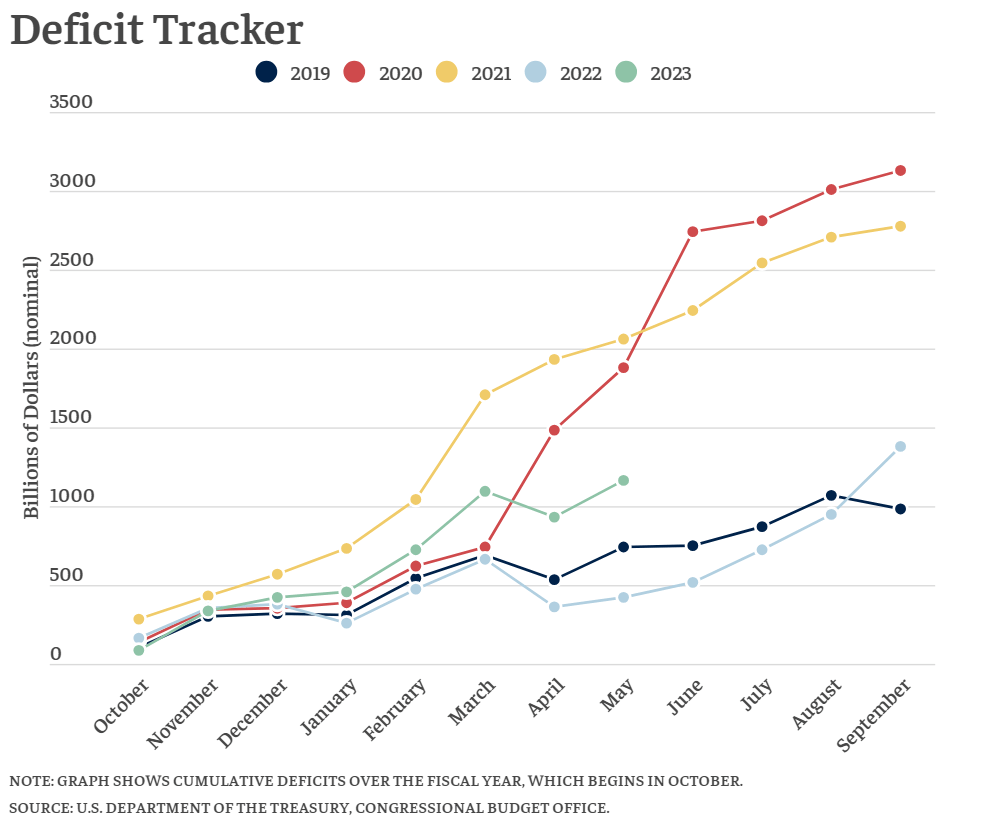

https://bipartisanpolicy.org/report/deficit-tracker/

Until February, the federal government budget deficit had returned to the pre-pandemic 2019 pattern. In the last 3 months spending has accelerated, adding to aggregate demand and causing the economy to expand faster, perhaps beyond its limits, supporting greater price inflation.

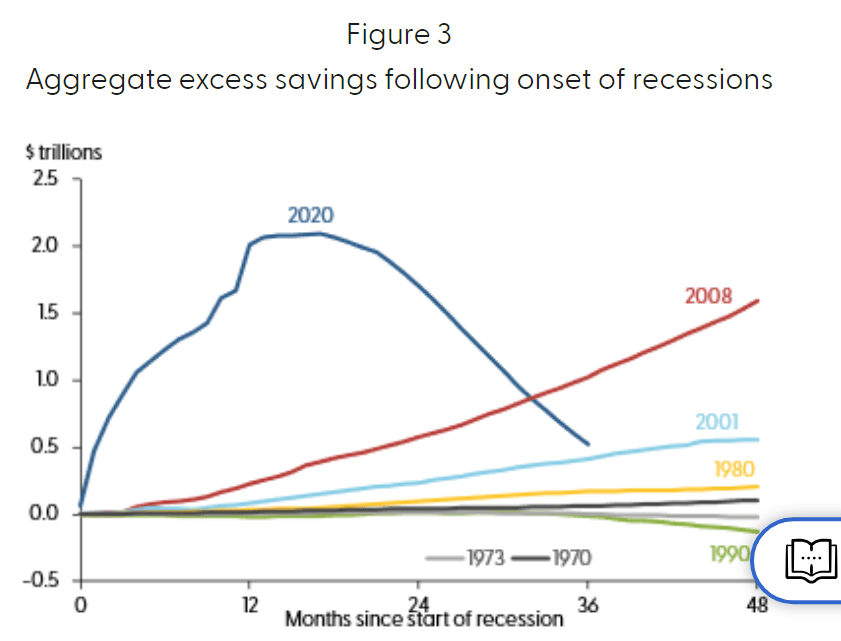

The government response to the pandemic threat generated much greater savings and subsequent spending/aggregate demand than any recent recession situation. The benefits have now mostly run out. Consumer demand has remained high but will likely decline.

The unprecedented expansion of the money supply by the Federal Reserve Bank in 2020 is difficult to explain or analyze. The Fed responded to the clear risk of a banking system collapse by providing “loose money” access to all entities. This monetary expansion did not result in immediate consumer inflation, but it did help to inflate asset prices: investments and housing. The Fed has begun to reduce its holdings of assets as it tries to increase interest rates.

The Fed has more than doubled interest rates. This has slowed down the housing, stock and acquisition markets.

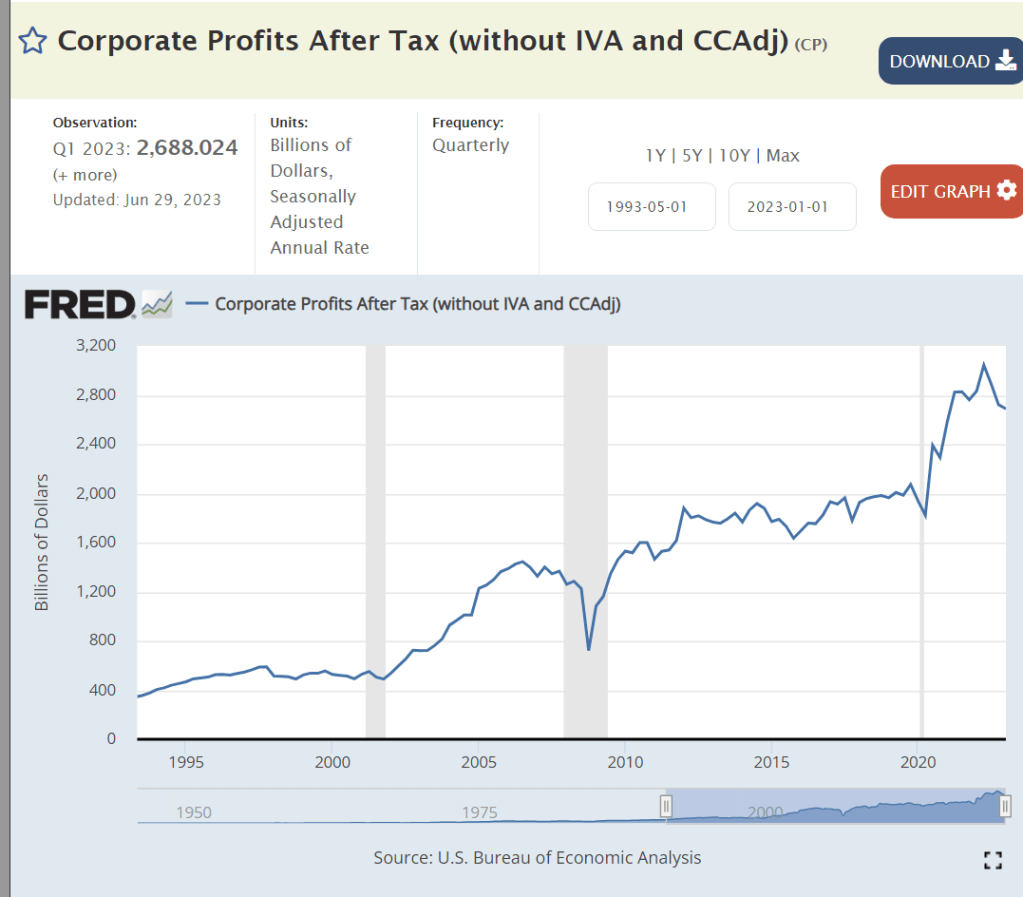

Corporate profits tripled from $500 billion in 2000 to $1.5 trillion in 2007. Profits slowly grew up to $2.0 trillion by 2019. Profits spiked by another 40% in response to the pandemic opportunities.

The drivers and components of inflation mostly point towards lower inflation in 2023 and 2024. The Fed is going to increase interest rates again this year which will reduce housing starts and corporate capital and inventory investments. The economy has so far resisted the higher interest rates, but the cumulative impact of tighter credit and lower savings will eventually offset the optimism of a historically positive labor market.

Summary

The pandemic caused producers to initially reduce their productive capacities. The unexpected rapid recovery of demand prompted by loose monetary and fiscal policies caused demand to greatly exceed supply. Inflation peaked at 7% and then began to drift back down. Corporations took advantage of the disruption to sharply increase prices, which have now flattened but not declined. Excessive fiscal policy (budget deficits) and high consumer spending driven by extremely tight labor markets driven by historically high corporate profits have maintained aggregate demand and prices.

There is a “tipping point” situation in this economy. The Fed is increasing interest rates. This is slowing consumer borrowing and housing demand in the face of demographic factors that normally promote new household formation and the economic benefits that typically accompany this investment. Consumers are using their pandemic driven savings to consume but are now running out of savings. The stock market very quickly recovered from the pandemic, but then declined and has since partially recovered based on a narrow set of AI based tech companies. The banking and credit sector is at risk, with several high-profile bankruptcies, but no clear evidence of a panic. Corporations are earning record profits, benefitting from prior low-cost debt, but struggling to hire employees. Overall, I think that prices will fall back to the 2% level by the middle of 2024.

Your conclusion in my view is very optimistic. Since the indices have only just started to “level off” and prices of most everything has not declined to prepandemic levels, I do not see a reduction in inflation. You cannot change labor shortages demographically like you can change prices or interest rates. We will not be able to meet demand and consequences are a further divide between rich and poor. Having a dwindling middle class to extinction does not make a stable economy. I do not see an immediate recovery to 2% inflation by next year.

Respectfully, Susan

Services at 4%-5% are a big risk, but I think that large and small firms have now adjusted their service, or non-service. models they now reflect the reality of labor availability and won’t force price increases. The post-pandemic “revenge travel” binge is over. Prices are so high people won’t travel in the next 12 months like the prior 12 months. On the other hand, the rest of the economy’s prices are falling: imports, durable goods, non-durable goods, energy, food, housing, rent. Net, net, that gets us close to 2%. Ironically, the “wealth” of the top 1% or top 20% has allowed that group to continue consuming at the same level, while price increases have caused the bottom 80% to reduce their demand for all goods and services. They have used up their pandemic gifts from the government and are starting to borrow on credit cards at 24%. They won’t do much of this.

[…] Low Unemployment Rates Good News: Exceptionally Low Metro Area Unemployment Rates Are We Heading Towards 2% Inflation? Firms and Jobs 3: It’s Complicated Good News: Firms and Jobs Good News: US […]

[…] Why is Inflation 7%? July, 2023. 2% is possible in 2024. I was overly optimistic. Are We Heading Towards 2% Inflation? […]