Many people complain that the US economy does not create enough new jobs or soon won’t create enough jobs or won’t create enough good jobs or … People worry about employment. Writers and politicians cater to that worry. Fortunately for us, the US economy creates jobs year after year after year, only briefly interrupted by increasingly less frequent and brief periods of economic recession. I’ll share the core numbers on healthy firms and new jobs and provide some context and history which indicates that this is inherent in the modern US economy. The economy is not relying upon any major political change or special insight to continue adding jobs. It just happens.

For 9 straight years, from 2011-2020, across 3 presidential terms and 5 congresses, the US economy added 2 million new jobs each year. In the 1980’s, it added 2-4M per year. In the 1990’s it added 3M per year. In the “oughts”, it added 2M per year. 30 years of expansion, 7 lesser years that averaged more than zero. 4 strong years for every 1 weak year..

The recovery since the pandemic has been even stronger, starting at 8M new jobs per year in 2021 before sliding to 6M per year and most recently 4.5M per year.

The total number of firms in the US grew slowly in the last 40 years, from 3.5 million to 5 million. The growth rate was much faster prior to the Great Recession (2007-9). Much of this growth was accounted for by single employee firms. Despite this tame 1% growth per year, the economy was able to add more than 2 million jobs per year.

The number of establishments (locations) grew almost twice as fast, just under 2% per year.

The US economy requires some growth in the number of firms or establishments each year to drive job growth. Fortunately, it does not require heroic growth rates.

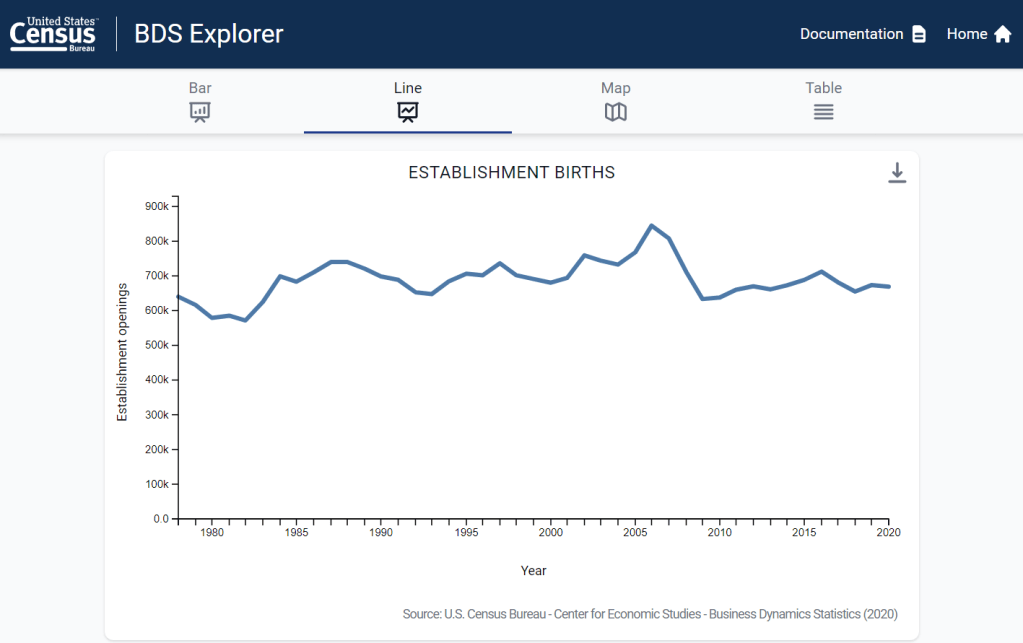

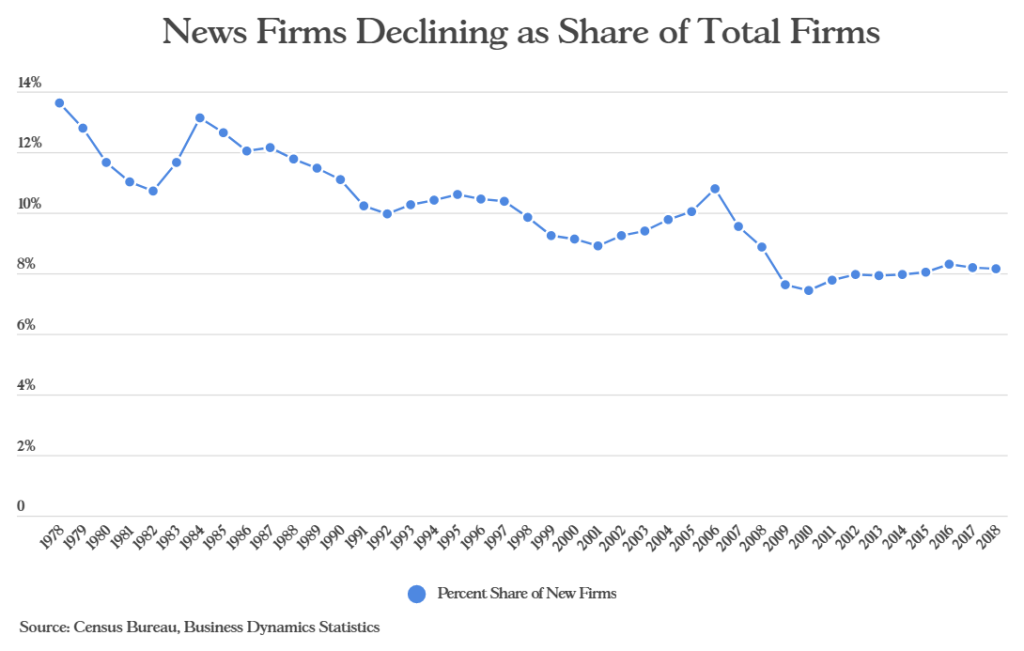

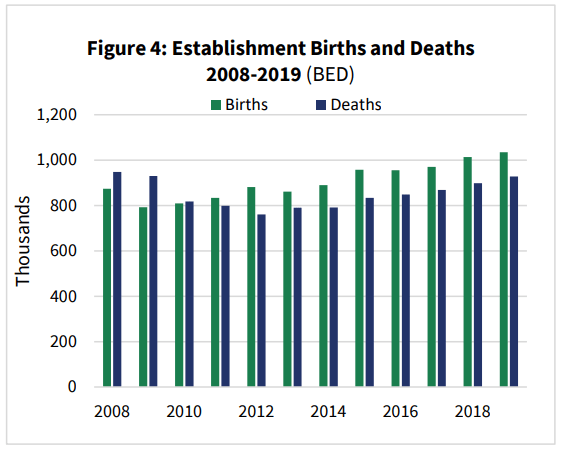

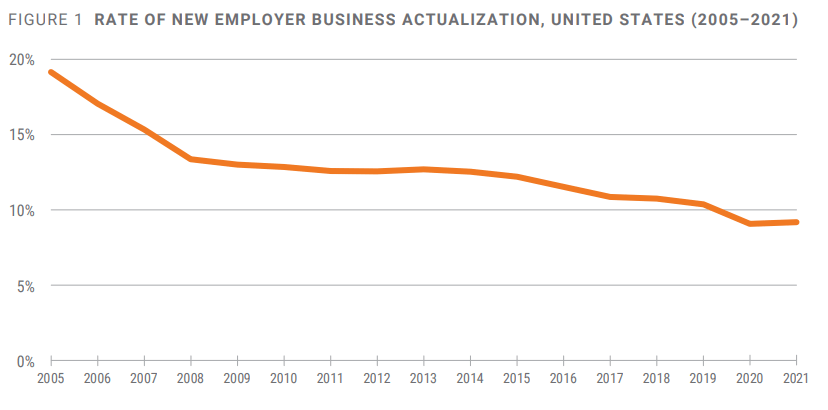

The number of new establishments added per year is remarkably consistent, averaging about 700,000 per year on a base of 5-7M. Of course, this means that the RATE of new establishments is shrinking, from 14% to less than 10%.

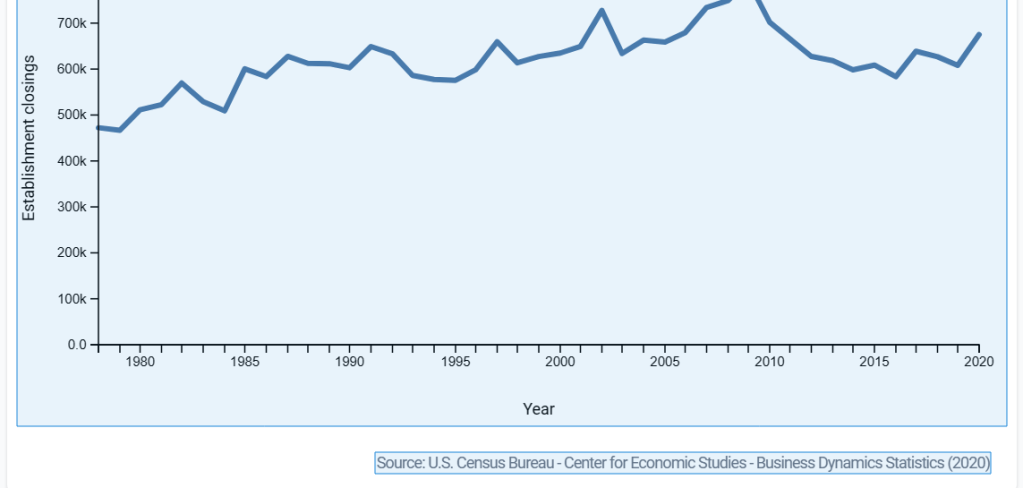

Establishment exits have increased from 500K to 600K to 700K before returning back to 600K per year. Big picture, 700K new establishments and 600K lost establishments each year across 4 decades.

Firm deaths have also been consistent at 450,000 per year.

Data calculated from BDS data. Direct graph not available.

Firm births have also averaged about 450,000 per year but present a different pattern. Firm births were much lower in the troubled time around 1980. Births ranged from 450-500,000 per year in the next 25 years. The Great Depression destroyed businesses, access to capital, personal net worth and aggregate demand. Hence, new firm creation dropped back to the 400,000 level. It recovered back to the 450,000 per year rate by 2015. As with firm deaths, the rate has fallen from 14%+ to less than 10%. Most importantly, the birth and death rates have been relatively consistent and have both been relatively flat, leading to a slow increase in the number of US firms.

https://www.bls.gov/spotlight/2022/business-employment-dynamics-by-age-and-size/home.htm

The BDS database shows that job gains and job losses generally move together, but that in a recession job gains fall and job losses increase. This is a very important result. Without active government or policy intervention, the economy creates 12-14M jobs each year and destroys 11-13M jobs each year. There is no guarantee that net jobs will be created in any given year, but overall that is the normal result.

https://bipartisanpolicy.org/blog/trends-in-new-business-creation/

Writers who wish to emphasize the decline of entrepreneurship focus on firms instead of establishments because of the slower growth rate. They emphasize the growth rate rather than the growth numbers because this is less positive. They don’t compare the growth and death rates or numbers, which move together. They focus on the aftermath of the Great Recession which did greatly slow firm creation, resulting in slower than historical numbers and rates of job creation from new firms. Nevertheless, the economy created 2M new jobs per year for 9 years. During that period, existing firms captured a larger than usual share of the job growth required to provide demanded goods and services.

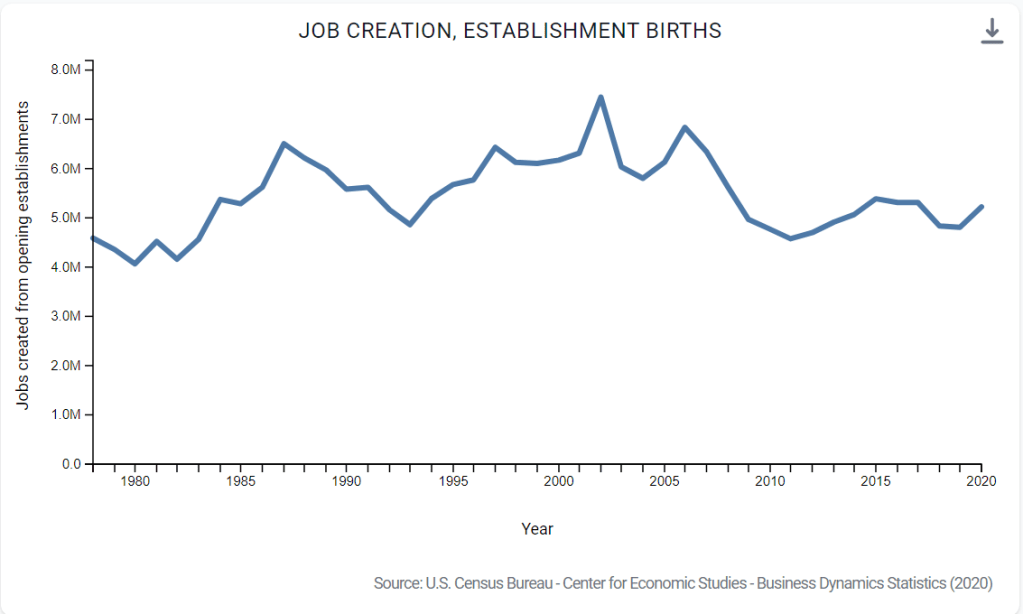

New establishments have driven 5-6M new jobs each year. The late nineties to early “oughts” reported the higher 6M per year figure.

Existing (continuing) establishments have added 10-12M gross new jobs each year.

Establishment deaths (including firm deaths) resulted in 4-5M jobs lost each year.

Continuing establishments trimmed 8-9M jobs each year, and many more during recessionary times. Although there are many moving parts, continuing firms eliminate more jobs than they create, especially during recessionary periods when they are adapting to lower demand. Firms die and they close locations, removing 4M jobs each year. New firms and new establishments add the new jobs required to fill the 2M net new jobs each year. This does not happen automatically or precisely, but overall, through time, the pattern is clear.

The US job market has grown from 90-150M positions during the last 40 years.

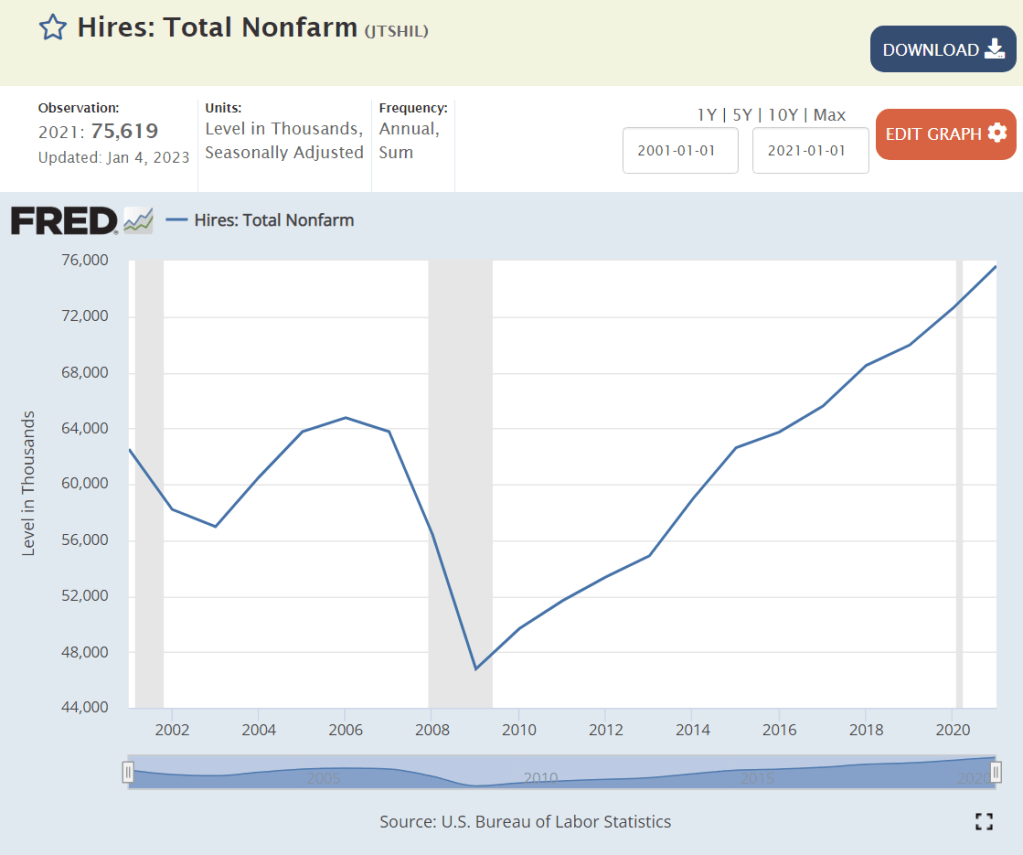

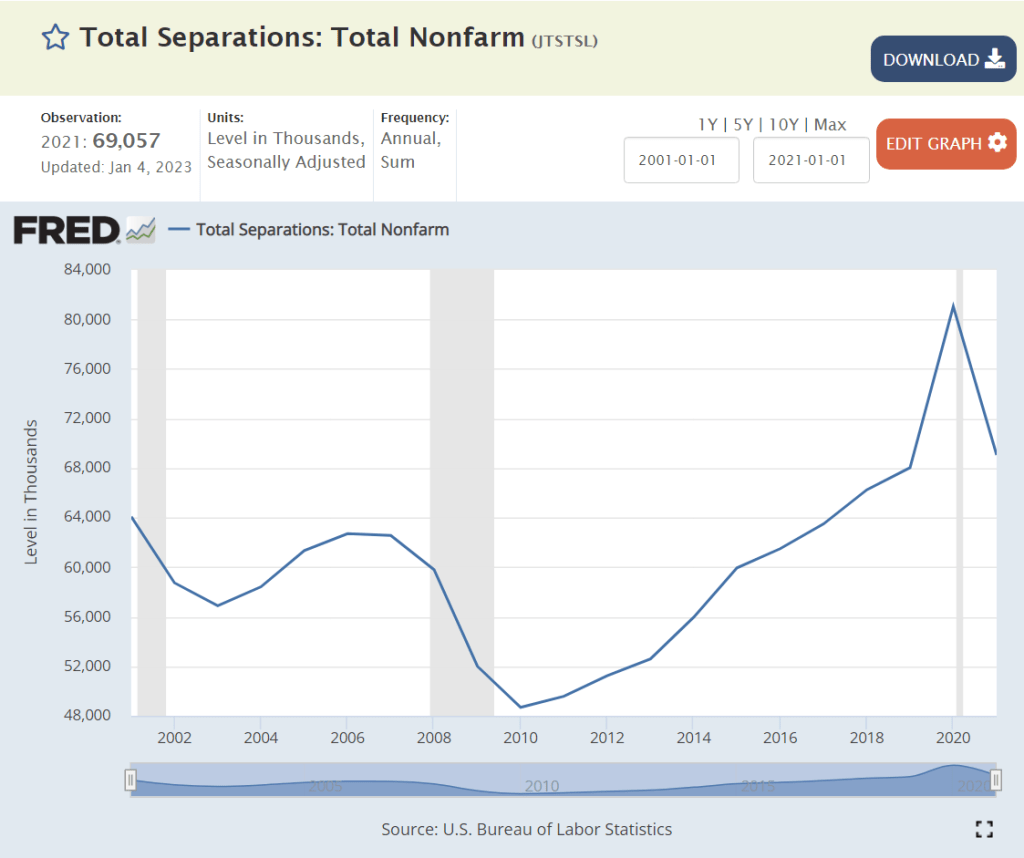

Firms hire 75M people each year. The typical job tenure is just 2 years.

Separations and hires generally move together. The net 2M jobs added annually is a small fraction of employment, hires, separations, gross job adds and gross job losses.

Establishment births exceed establishment deaths except during deep recessions.

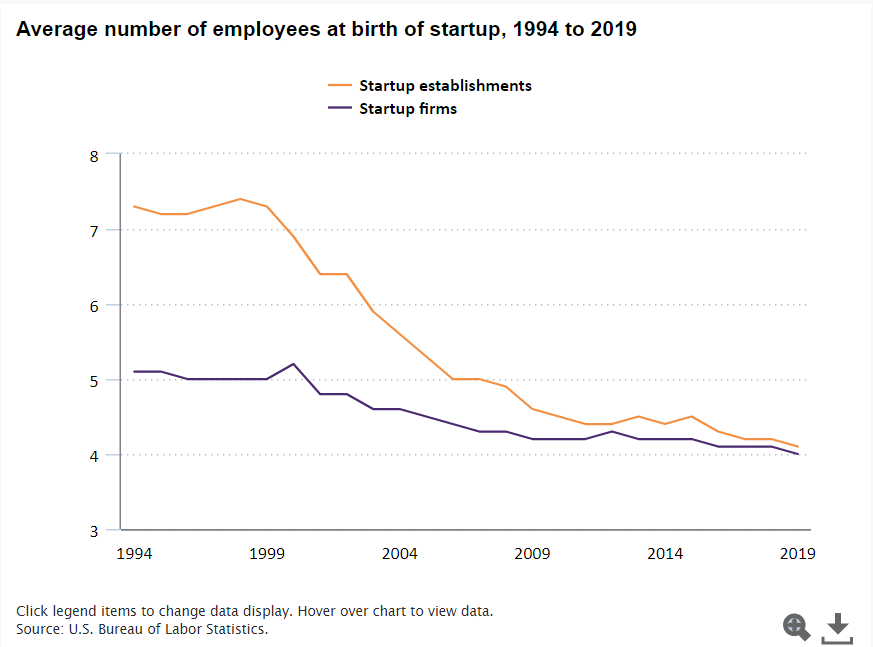

New firms have high failure rates. Fortunately, firms that survive their first year have high percentage rates of new hires. They start with a small number of employees (4) and grow rapidly. The survival rate improves with the age of the firm and the employment growth rate of surviving firms tends to decline as they grow. The combined effect is that 80% of the new employees added by startup firms remain after 10 years. This employment survival rate has been improving in the last 15 years, partially offsetting the reduced number of start-up businesses.

https://www.bls.gov/spotlight/2022/business-employment-dynamics-by-age-and-size/home.htm

The first-year survival rate has remained roughly the same at 80% for 25 years.

The ratio of new employer businesses to population dropped significantly after the Great Recession, but has recovered in the last 4 years.

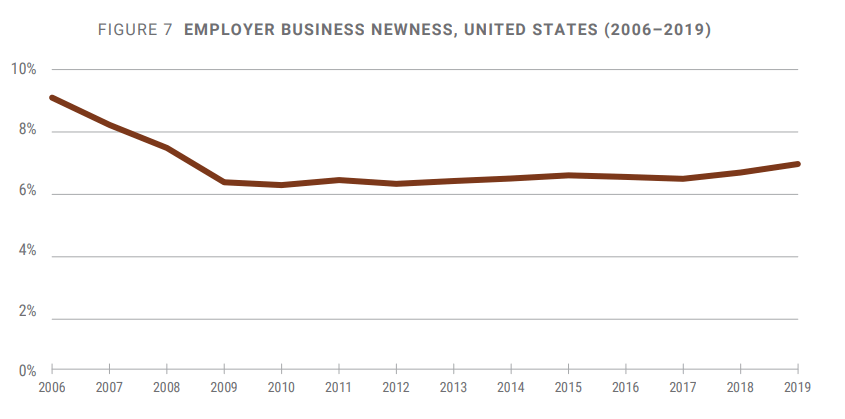

The share of “new employer businesses” dropped after the Great Recession and has not fully recovered.

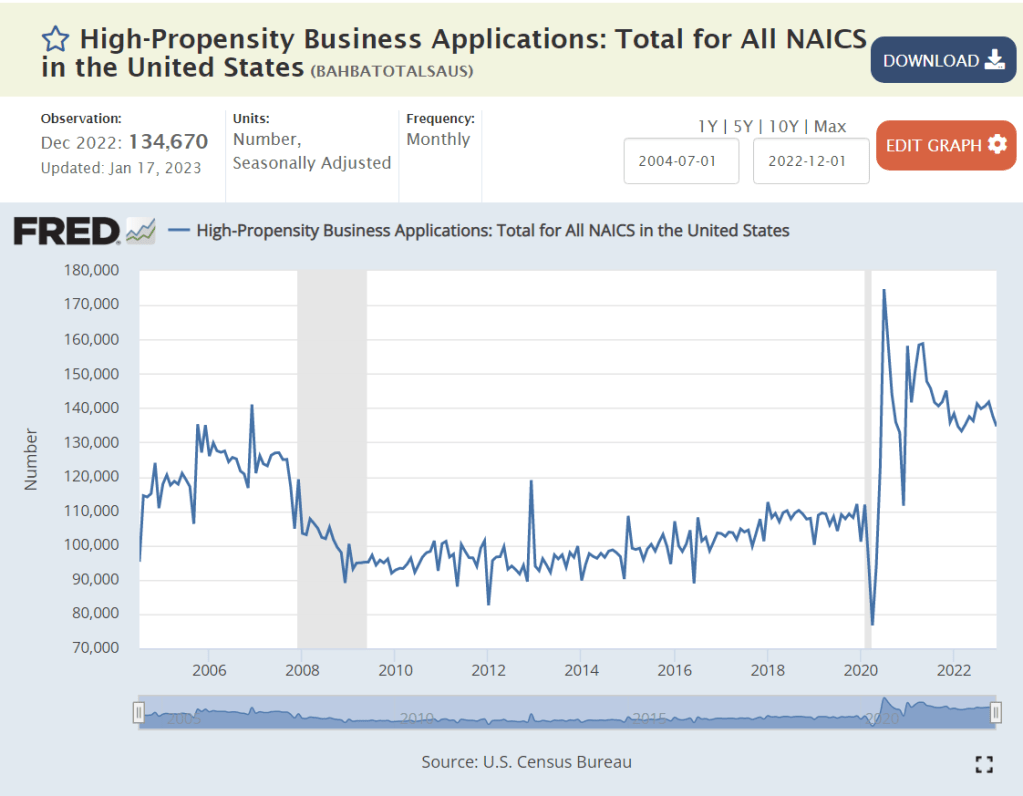

The number of application for new business tax ids increased significantly after the Great Recession and jumped by 50% after the pandemic.

The Census Bureau also tracks a subset of the total new business applications based upon industry classification that is a better predictor of actual businesses eventually started. This measure shows modest growth after the Great Recession and a 30% spike after the pandemic.

About 10% of new business applications become new businesses. Hence, the rate of new business formation to be reported for 2022 is expected to be very high.

https://www.nber.org/digest/202109/business-formation-surged-during-pandemic-and-remains-strong

https://www.oberlo.com/statistics/how-many-new-businesses-start-each-year

https://bipartisanpolicy.org/blog/trends-in-new-business-creation/

https://bipartisanpolicy.org/blog/trends-in-new-business-creation/

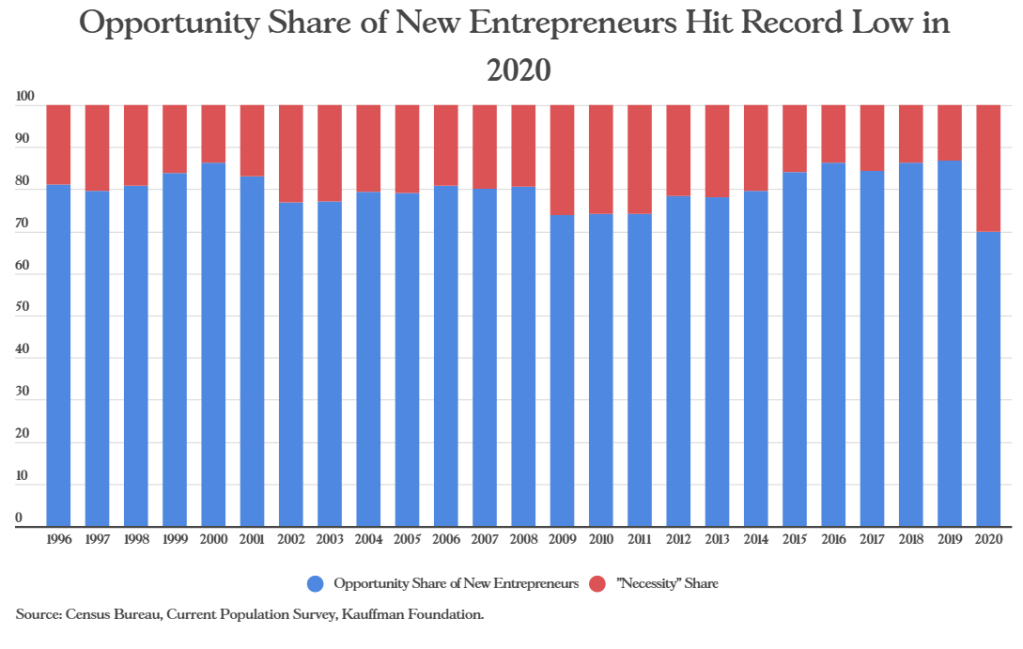

About 80% of new businesses are formed based on opportunity and 20% based on necessity. Kauffman estimates that 2020 business formation was 30% based on necessity.

Summary

The US economy continues to generate 2 million new jobs in each non-recession year, even more in boom periods like the last 2 years. Firms and establishments are born, grow and die. The net employment growth rate for established firms is less than zero in their first 5-10 years and then slightly positive. The annual death rate of existing firms and establishments is relatively low, but on a 150M employee base it is 4M per year. The new jobs added by startup firms and new establishments allow the total number of employees to grow in normal years.

There is no “iron law of employment” that requires new firms or establishments to be created in numbers greater than the job losses. There is no law that requires surviving young firms to nearly offset job losses by young firms that die at a high rate. There is no law that requires mature firms (10 years old+) to add new employees or to die at slow rates. But these results have been consistent or improving for the last 40 years. I look forward to continued success.

[…] Are We Heading Towards 2% Inflation? Firms and Jobs 3: It’s Complicated Good News: Firms and Jobs Good News: US Startups Still Create Many Jobs (!!!) Good News: The US Economy is Still […]

[…] More Leisure Time for Gaming Good News: Healthy State & Local Government Finances Good News: Firms and Jobs Good News: US Startups Still Create Many Jobs (!!!) Good News: Emergency Medical Services […]

[…] Good News: Firms and Jobs […]