Recovery from Covid Pandemic

https://fred.stlouisfed.org/series/GDPC1

https://fred.stlouisfed.org/series/PAYEMS

https://www.cnbc.com/2022/10/07/jobs-report-september-2022.html

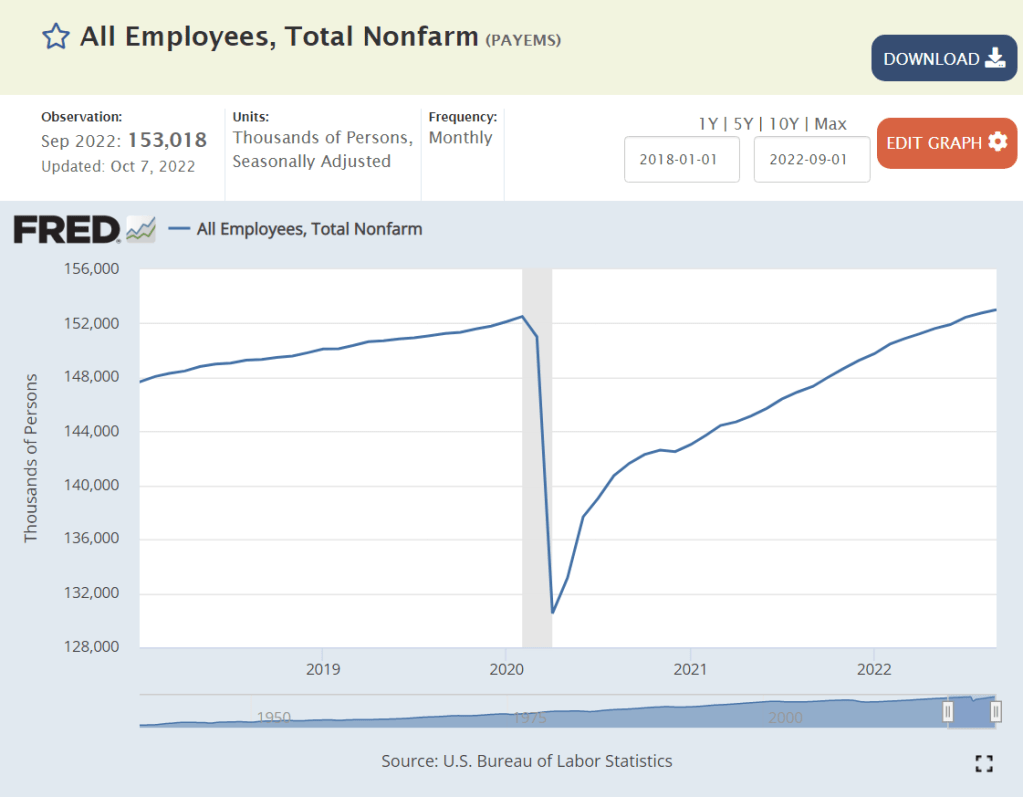

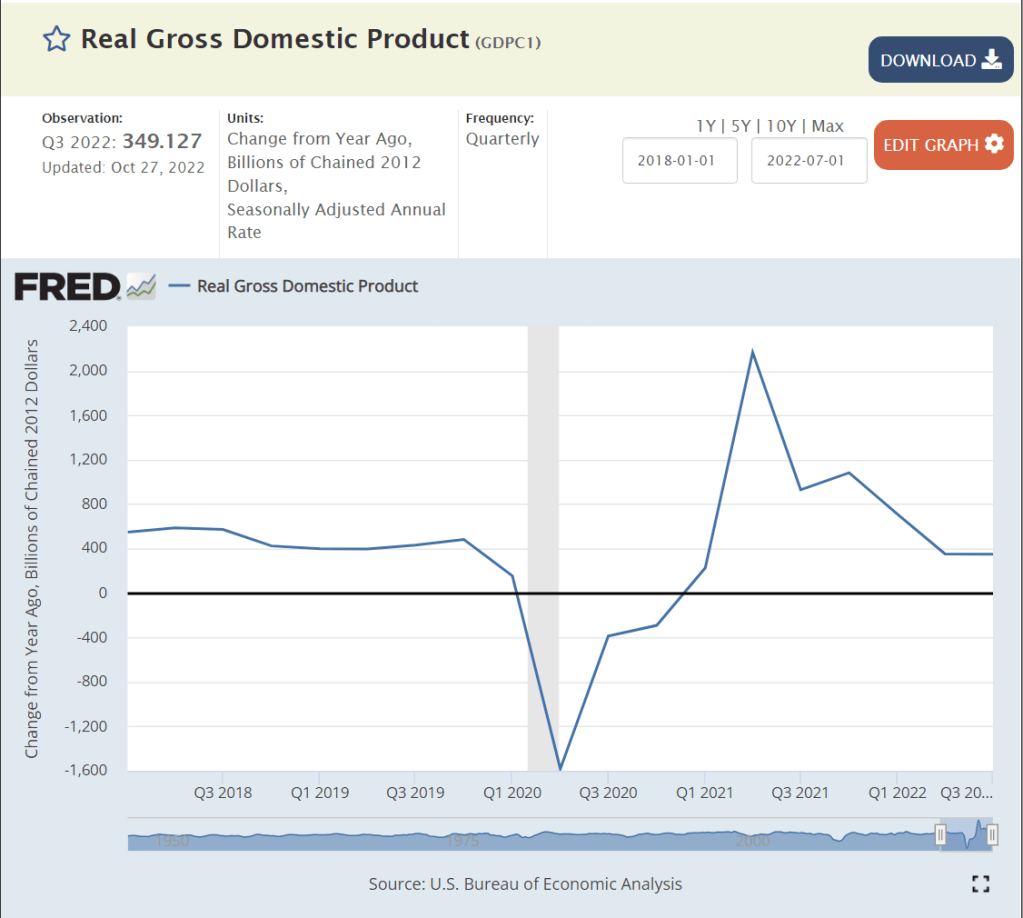

Real, inflation adjusted, GDP has quickly resumed its long-term growth rate. GDP grew in the 3rd quarter and on an annual basis has continued to grow through the 3rd quarter of 2022. Employment recovered more slowly, but has exceeded the pre-pandemic peak. Very solid job growth has continued through September, 2022.

Real Consumer Spending

https://fred.stlouisfed.org/series/PCESC96

https://fred.stlouisfed.org/series/PCEDG

https://fred.stlouisfed.org/series/PCEC96

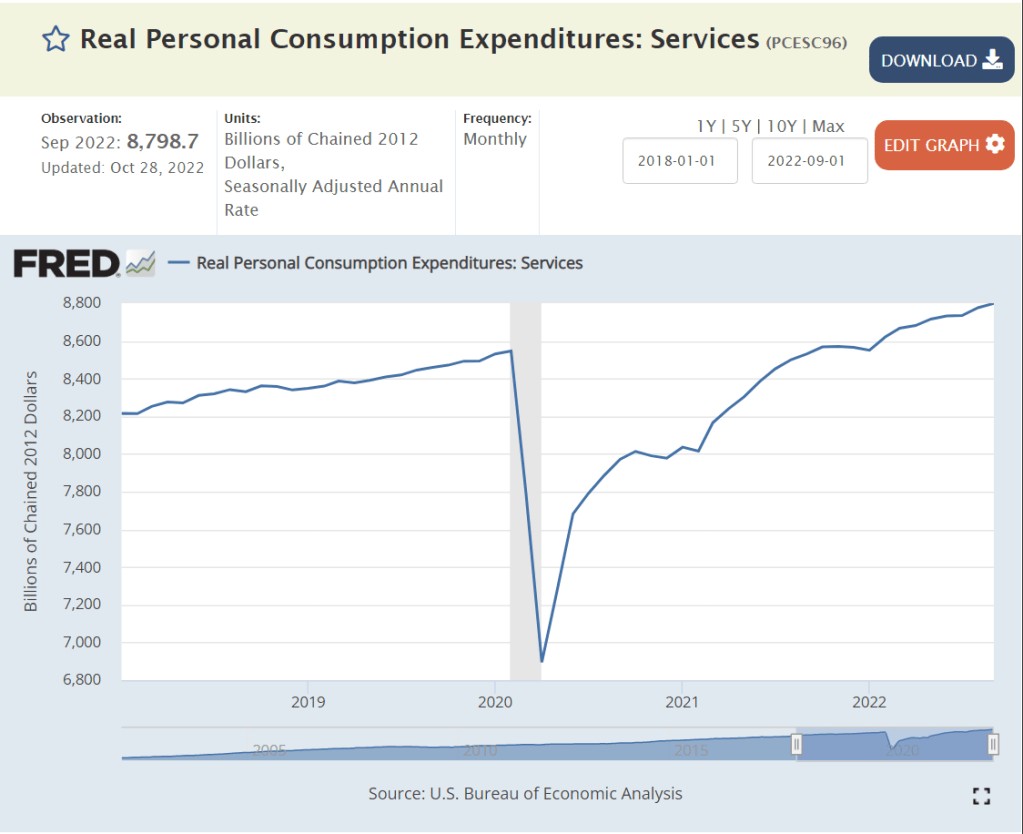

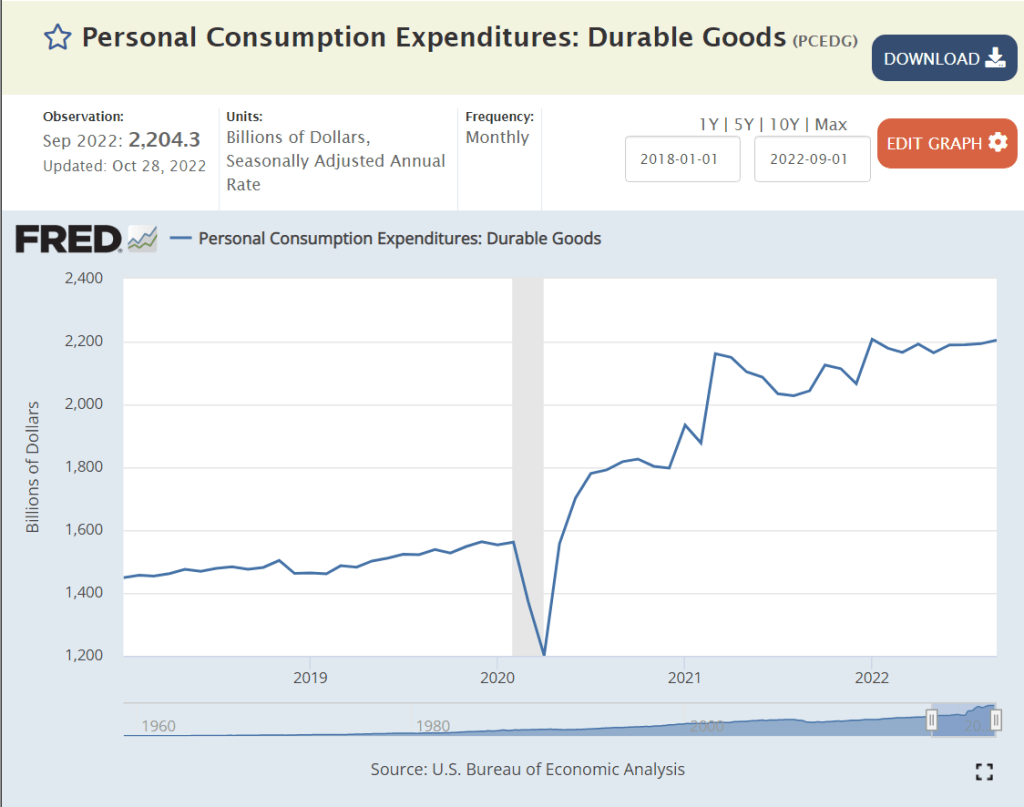

Real, inflation-adjusted, consumer spending quickly recovered from the pandemic and continues to grow. Consumers have enough income and savings to spend more, despite inflation challenges.

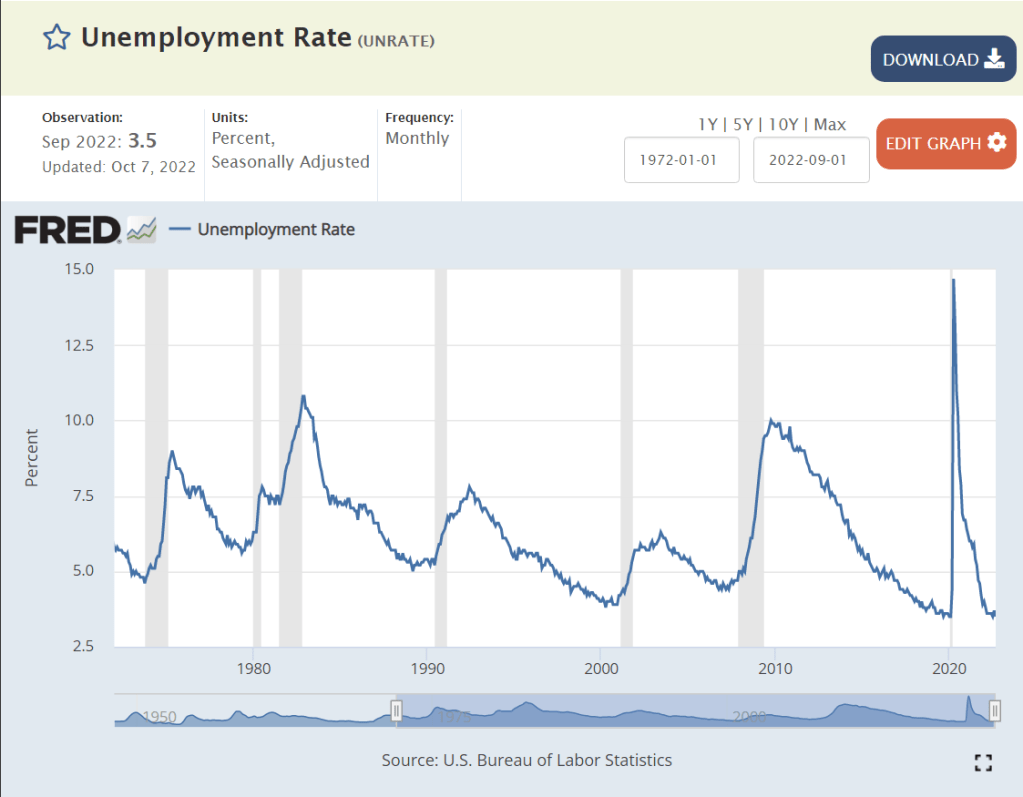

Best Labor Market in 50 Years

https://fred.stlouisfed.org/series/UNRATE

https://fred.stlouisfed.org/series/JTSJOL

https://fred.stlouisfed.org/series/LNU01300060

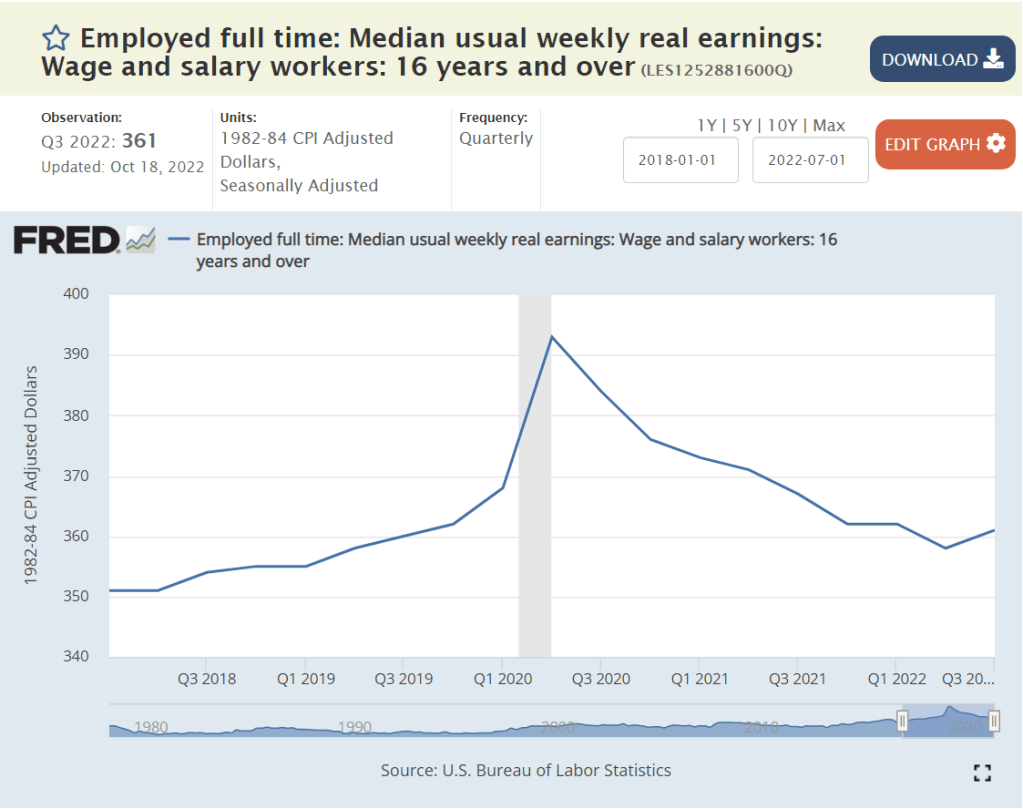

https://fred.stlouisfed.org/series/LES1252881600Q

This is the labor market we have been waiting for since I graduated from high school in 1974. Record low unemployment, twice as many job openings and real wages above those of 2018-19, after inflation.

The Growing Economy

https://fred.stlouisfed.org/series/GDPC1#0

https://fred.stlouisfed.org/series/EXPGS

https://fred.stlouisfed.org/series/IEAMGSN

https://fred.stlouisfed.org/series/DTWEXBGS#0

https://fred.stlouisfed.org/series/OUTMS

https://fred.stlouisfed.org/series/MANEMP

https://fred.stlouisfed.org/series/B1448C1A027NBEA

https://fred.stlouisfed.org/series/B359RC1Q027SBEA

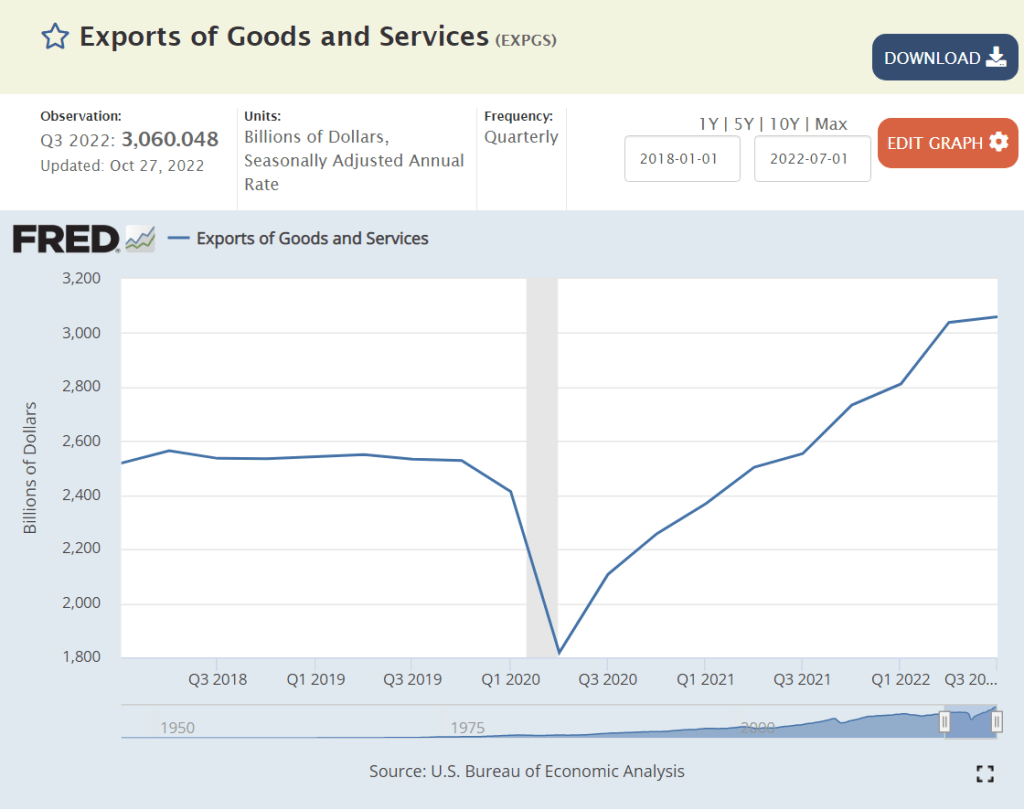

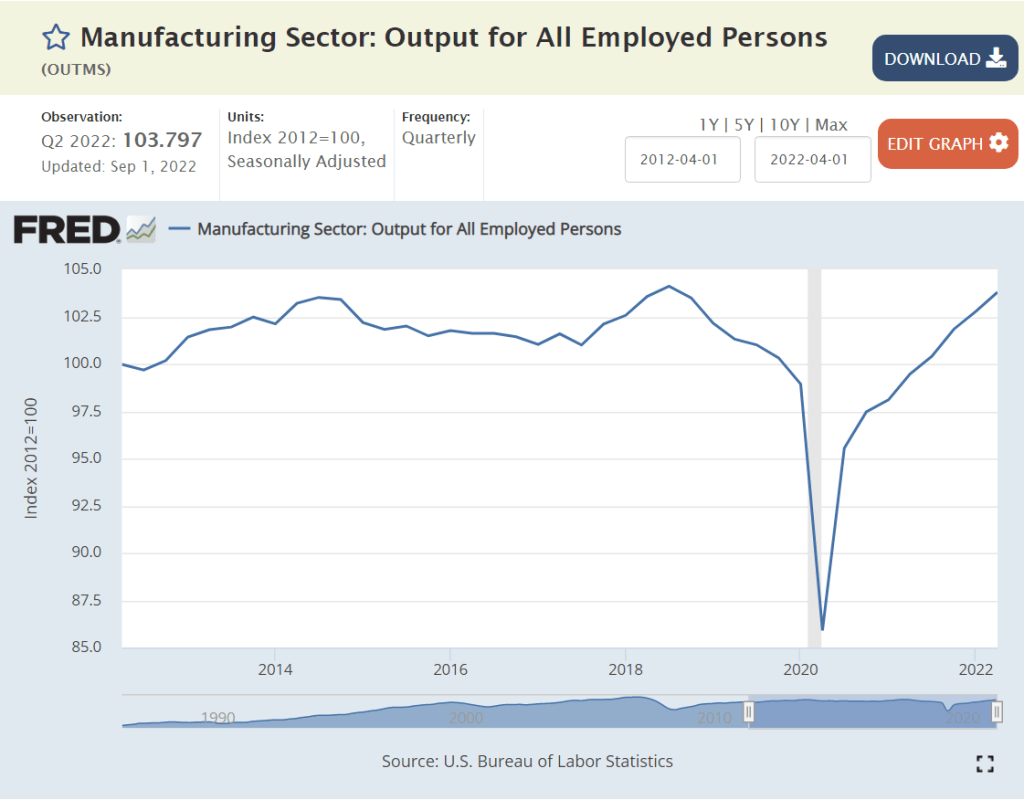

The overall US economy continues to grow, faster than other countries, including China. Exports are up by 20% as US companies continue their competitive wins. This is in spite of a much stronger US dollar. Imports are also up by more than 20%, providing consumers with the best of all global choices. Manufacturing output and employment have recovered to pre-pandemic levels. Farm incomes and output are up significantly.

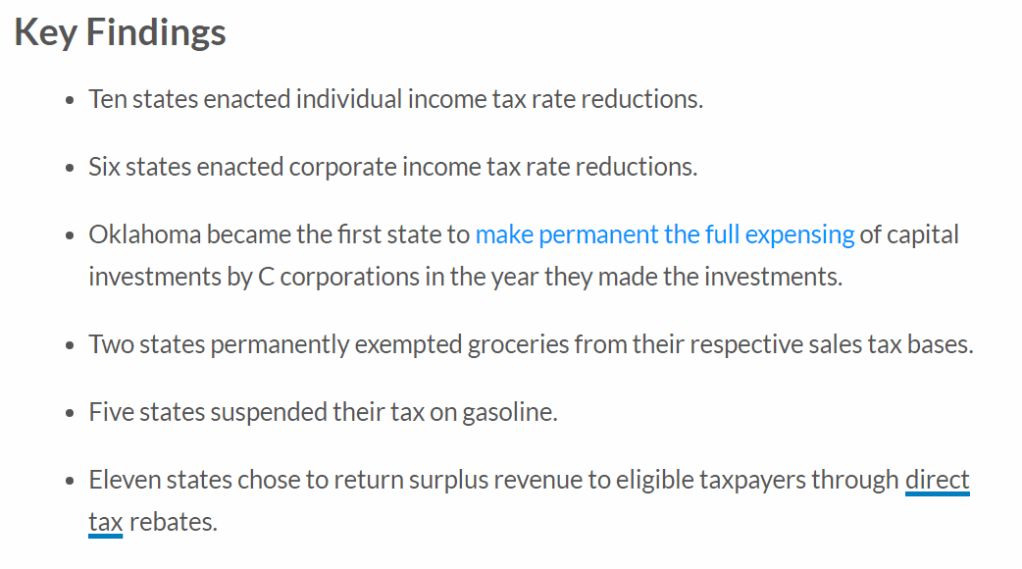

Government Deficits Are Way Down

https://bipartisanpolicy.org/report/deficit-tracker/

The federal budget deficit has been cut in half, with fiscal year 2022 back to the 2019 level. States have strongly recovered from the pandemic with increased revenues and slowly growing expenditures. State reserve funds are at record levels. 11 states had enough reserves to provide rebates to their taxpayers.

Personal Assets Are Way Up!

https://fred.stlouisfed.org/series/SP500#0

https://fred.stlouisfed.org/series/MSPUS

https://fred.stlouisfed.org/series/CUSR0000SETA02

https://fred.stlouisfed.org/series/LNS11324230

https://fred.stlouisfed.org/series/CP

Retirement savings is at a record high. House values are up by one-third. The US stock market is up by one-third, despite the significant declines in 2022. Used car values are up by one-third. Retirement after age 55 remains very attainable for a majority of individuals. This growth in personal asset values has taken place while corporate profits have increased by one-half.

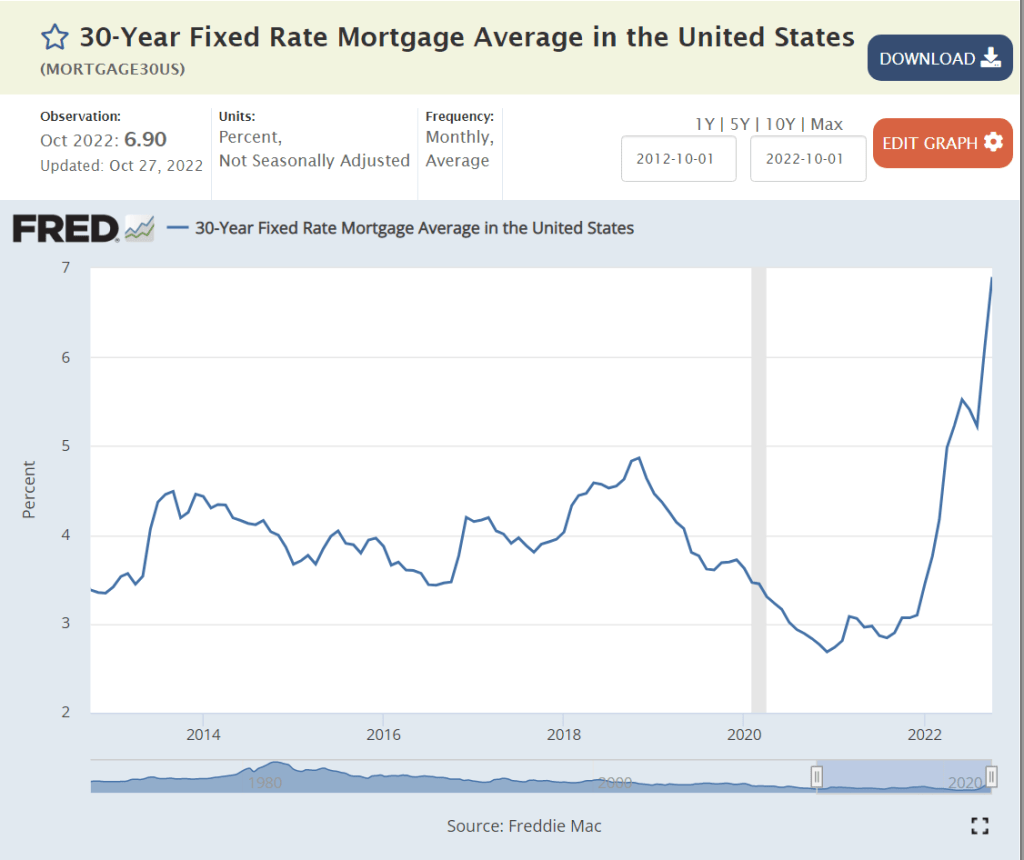

Fewer Downsides

https://fred.stlouisfed.org/series/MORTGAGE30US#0

https://fred.stlouisfed.org/series/DRSFRMACBS

https://fred.stlouisfed.org/series/DRCCLACBS

https://www.axios.com/2022/09/14/child-poverty-rate-census

Most Americans today have fixed rate mortgages at 2.5%-3%-4%, locking in advantageous low mortgage payments for 10-30 years. New home buyers and those who must move and get a new mortgage do face 7% interest rates. Mortgage delinquencies are down by 80% and credit card delinquencies are down by one-third. Child poverty, after transfers, is at a record low.

Summary/Interpretation

The news media and politicians want to highlight the negative aspects of the US economy: higher inflation, lower personal savings rates, higher mortgage rates, higher home and apartment rents and prices (lower affordability).

It’s important to put all of the pieces in perspective. Inflation is higher and threatens fixed income and low-income households. Households are using up their extra pandemic period savings. The real estate market is slowing, but prices remain high. Economic growth is close to zero, so there are relatively fewer open positions and net new jobs created. There is a threat of a mild recession continuing through the second half of 2023. BUT …

The overall economy has quickly recovered from the pandemic and exceeded record pre-pandemic levels. Recall that the post-Great Recession recovery continued for almost a full decade. The economy recovered from the record pandemic lock downs and “lost jobs” faster than anyone expected.

Economic growth was low, marginally below the arbitrary 0.0% level in the first and second quarters, but recovered to 2% in the third quarter. Annual GDP growth is likely to be in the -1% to +1% level for the next 3-4 quarters as the Federal Reserve Bank’s increased interest rates work through the economy. We may have an “official recession”, but households will encounter limited negative effects.

The labor market is likely to continue its very positive status. Firms still have 10 million open positions that they expect will EACH deliver positive net economic results. We have a labor shortage. At some point, business Republicans will join Democrats to revise restrictive immigration rules and other policies that limit labor force participation.

Firms, businesses, retirement plans and state governments are in very solid economic shape. Assets are very high, liabilities are low. Net assets are at record levels. The Federal government budget deficit is back to the pre-pandemic level.

There is no evidence of a wage-price spiral of inflation. The president and most Democrats seem to accept the Federal Reserve Bank’s actions to increase interest rates, slow the economy and return inflation to its prior 30 years of modest 2%.

Behavioral economists have repeatedly shown that most people are much more sensitive to losses and risks than they are to economic gains. Hence, it is natural to focus on higher inflation and slower growth and discount the many other positive results.

The US economy quickly recovered from the severe pandemic recession with less collateral damage than anyone expected. The growth in the money supply and federal spending/transfers to ensure that we avoided a business, banking and personal meltdown drove a faster than expected recovery resulting in supply chain disruptions, labor shortages and inflation. The “experts” were slow to identify this situation and take offsetting policy steps. Fortunately, fiscal and monetary policy during 2022 have been tight, slowing the economy. We are in the difficult months of transition. No one knows if the steps taken so far are adequate, exactly right or too much. We need another 3 quarters to decide.

[…] I Can’t Find Any Recession! Has Inflation “Turned the Corner”? Good News: The US Economy A Very Robust Long-term US Labor Market (1970-2021) Dynamic Labor Market: 1970 A […]

[…] Good News: The US Economy […]