Month: September 2022

Pop Music: Atlanta Rhythm Section Classics IV

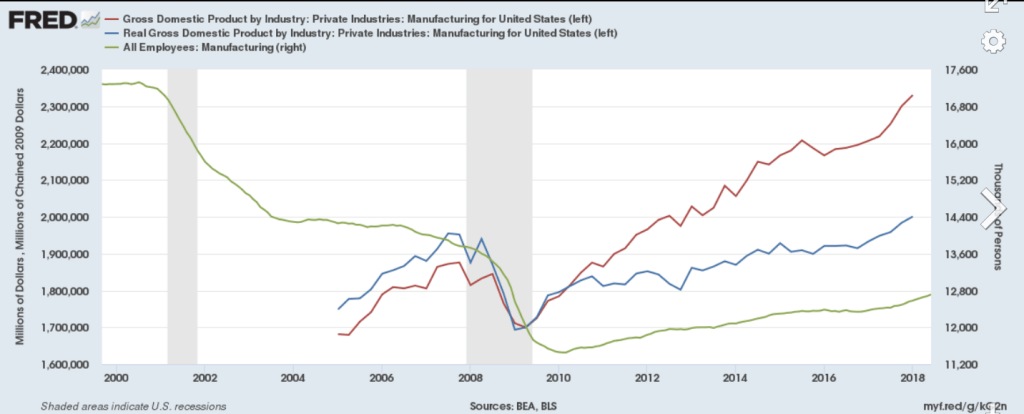

Good News: US Manufacturing Output Continues to Grow

US manufacturing output continues to increase year over year, despite the reduction in employment.

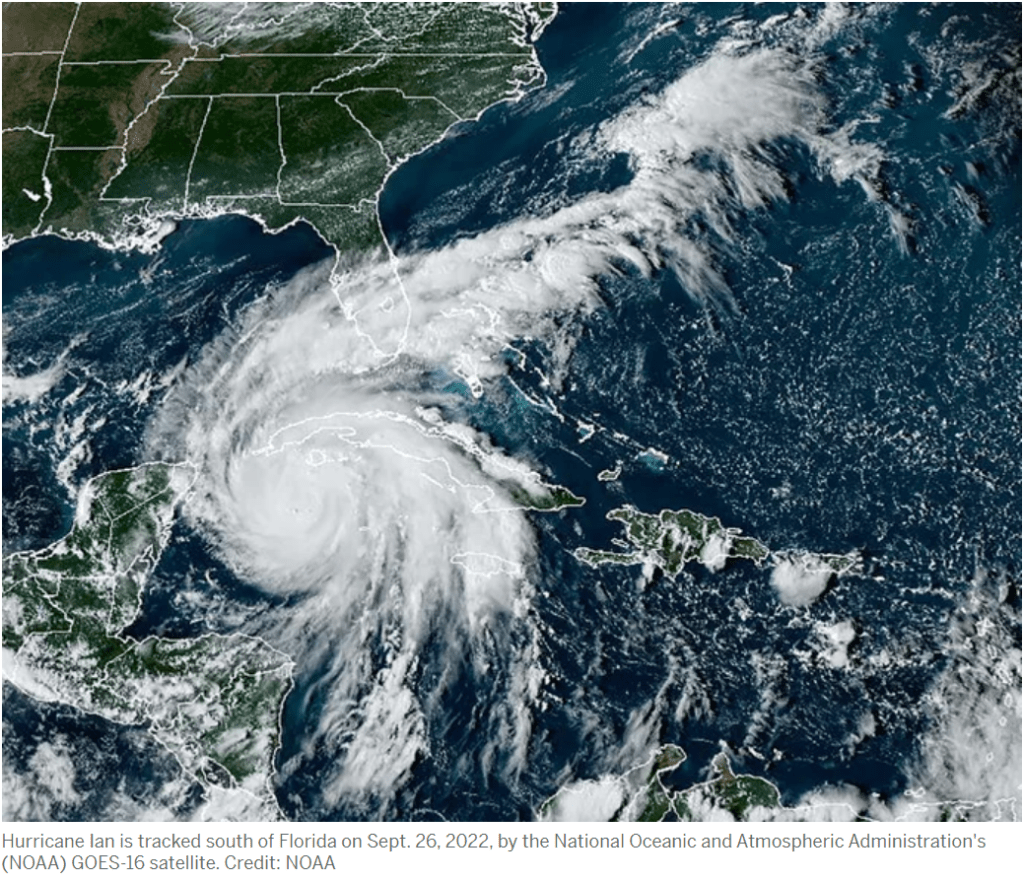

Good News: Weather Forecast Accuracy Is Much Better

Everyone complains about “the weather” and the “weather forecast”, but forecasting accuracy has improved markedly since 1980, which was already at least twice as accurate of the best (pre-computer) forecasts of the 1940’s and 1950’s.

Unfortunately, there is no really simple intuitive way to gauge the improving accuracy, but scientists have provided a variety of measures to indicate the relative improvement.

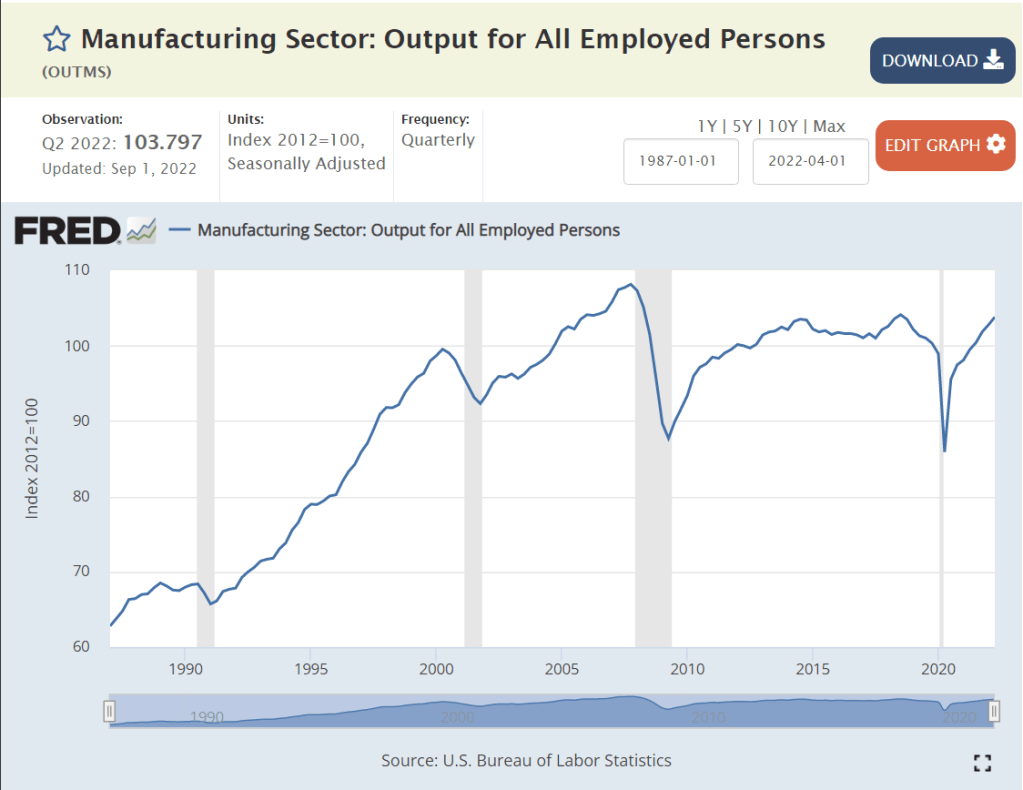

Improved Accuracy

36 hour and 72 hour forecast accuracy doubled in the 40 years between 1975 and 2015.

The same level of forecast accuracy was available 8 days out in 2010 as it was 5.5 days out in 1980.

The correlation between forecast and actual weather has improved consistently between 1981 and 2019 for 3-5-7-10 day forecasts. A 5-day forecast today is as accurate as a 1 day forecast in 1980. 9-10 day forecasts are useful today.

A seven-day forecast can accurately predict the weather about 80 percent of the time and a five-day forecast can accurately predict the weather approximately 90 percent of the time. However, a 10-day—or longer—forecast is only right about half the time.

https://scijinks.gov/forecast-reliability/

a five-day forecast is accurate about 80% (link resides outside ibm) of the time. A one-day temperature forecast is typically accurate within 2.5 degrees.

https://www.ibm.com/weather/industries/broadcast-media/complete-guide-accurate-weather-forcasting

Short-term five-day forecasts are nearly as accurate as two-day projections were three decades ago.

The forecast error rate has dropped by anywhere from about 70% (for a 24-hour forecast) to about 90% (for a 72-hour forecast) since 1970. To put that in perspective, the average error for a 72-hour forecast was about 450 miles off in 1970. Today, it’s about 50 miles off.

History of Weather Forecasting

https://www.britannica.com/science/weather-forecasting/Long-range-forecasting

https://www.newyorker.com/magazine/2019/07/01/why-weather-forecasting-keeps-getting-better

https://celebrating200years.noaa.gov/foundations/numerical_wx_pred/welcome.html#intro

https://public.wmo.int/en/bulletin/weather-and-climate-forecasting-chronicle-revolution

Glorious Weather Forecasting Future

https://www.ibm.com/weather/industries/broadcast-media/complete-guide-accurate-weather-forcasting

https://www.nae.edu/244878/Future-of-Weather-Forecasting

https://celebrating200years.noaa.gov/foundations/numerical_wx_pred/welcome.html#ahead

https://www.wired.com/story/weather-forecasting-artifical-intelligence/

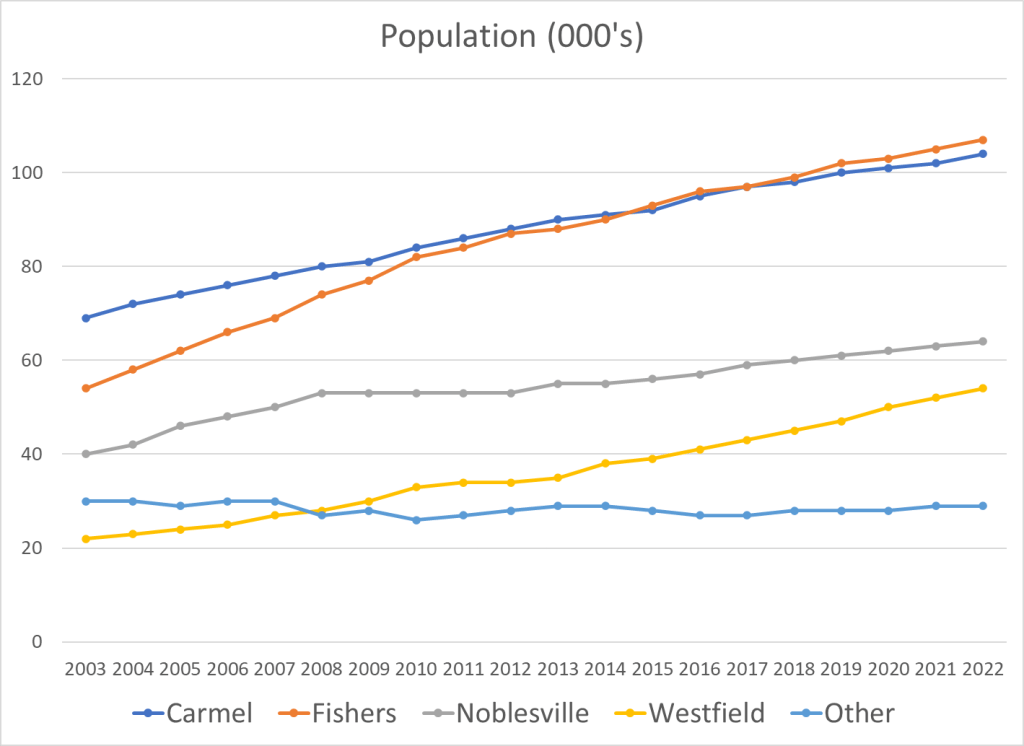

Hamilton County Growth Continues

Fishers has overtaken Carmel to become the largest city. Westfield is growing at the fastest percentage rate, with Noblesville close behind.

The county continues to add about 7,000 people each year to its base of 360,000, the fourth largest county in Indiana.

https://www.stats.indiana.edu/population/sub_cnty_estimates/2020/e2020_townships.asp

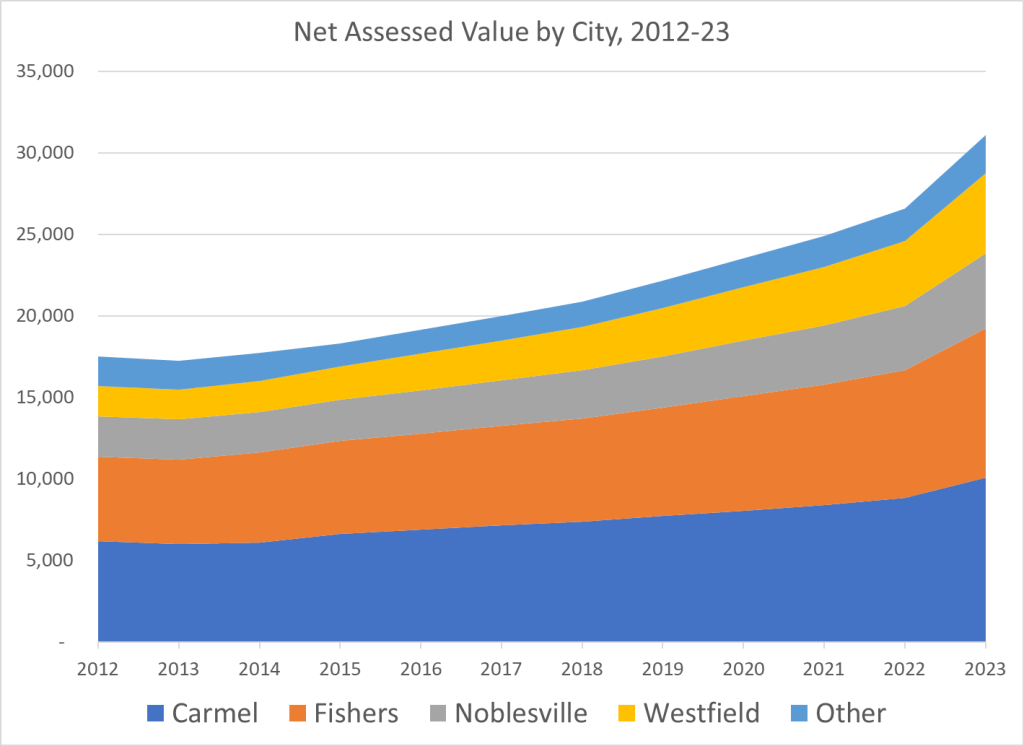

The net assessed valuation for property taxes has grown in line with the population, with faster growth in the last 5 years.

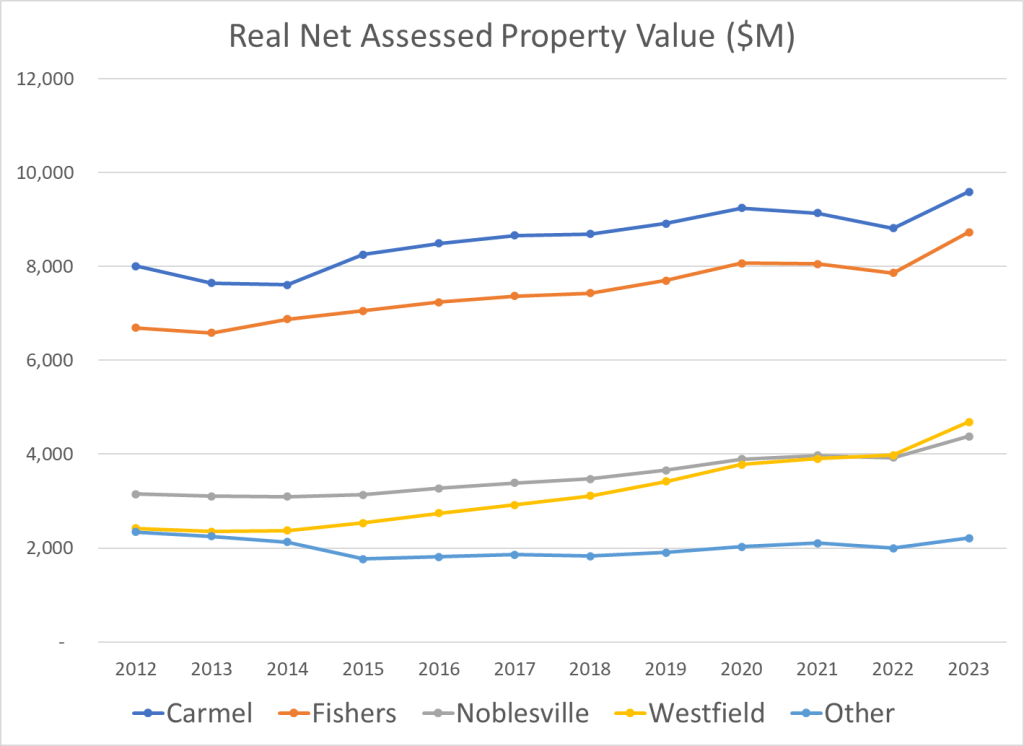

Property values have grown less rapidly, but still significantly, on an inflation adjusted basis.

https://fred.stlouisfed.org/series/CPIAUCSL#0

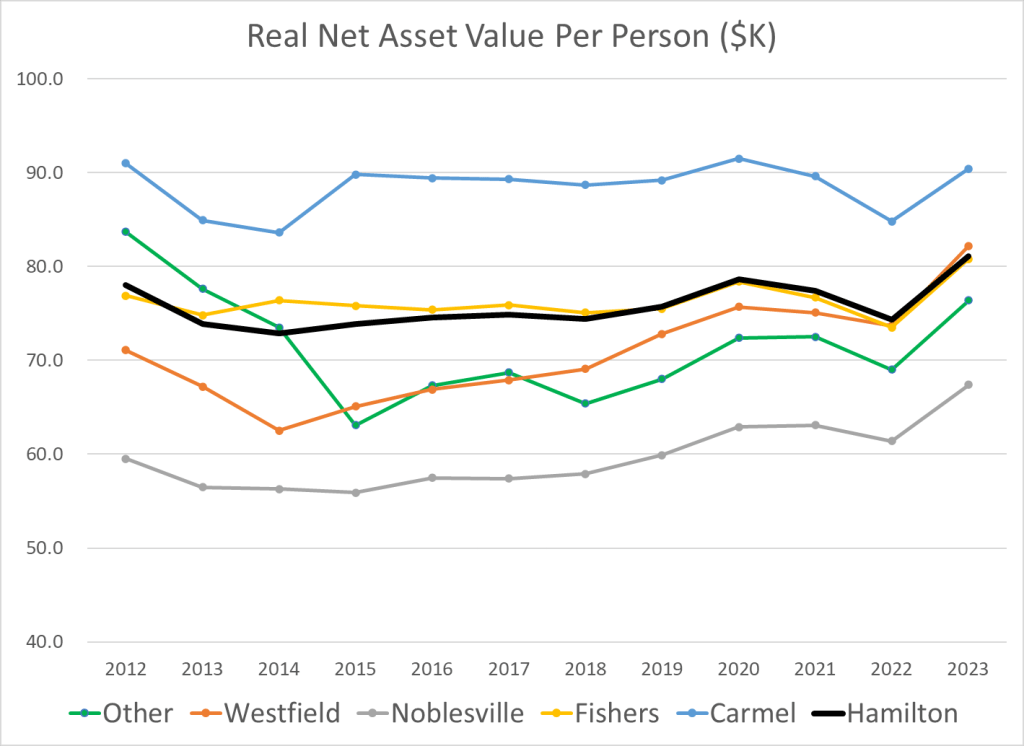

The real property value per person has remained roughly flat as the county has grown during the last decade. Carmel has higher real estate values and Noblesville has lower real estate values.

Real estate taxes levied by the county itself increased for payments due in 2020, but the real taxes per person remain 20% lower than they were in the “teens”. The county consolidated the provision of certain “emergency” services from the towns and cities in 2020.

https://www.hamiltoncounty.in.gov/ArchiveCenter/ViewFile/Item/214

https://www.hamiltoncounty.in.gov/ArchiveCenter/ViewFile/Item/95

https://gateway.ifionline.org/public/pts/pts-overview.aspx

Summary

Hamilton County’s growth looks to continue at a sustainable rate, with open land in Fall Creek, Westfield, Noblesville available for development.

Besame Mucho: A Classic Song, 16

Classic Mexican Versions

Ringing …

Crooning …

Clocking …

Strumming …

Layering …

Imperial …

Anglo Echoes

Pop …

Rockabilly …

Alien …

Cinematic …

Modern Versions

Resonant …

Clean …

Layered …

Emotive …

Alluring …

Perhaps, The Very Best

Operatic …

Good News: Election Fraud is Not a Fact-Based Issue in the US

Claims of election fraud have a long history in the US. They exist for 3 reasons. Losers hate to lose. Fraud claims support efforts to restrict voting by opponents. Fraud claims undermine the legitimacy of US democratic processes (Russia).

TRUTH

Historically, without “checks and balances” or other controls, political parties and machines had taken advantage to ensure that they won. We’re mostly talking about 1820-1900. Even in the 20th century, there were states and cities where one party had control and could “deliver” votes at the city, state or national level. This kind of fraud largely ended by the 1960’s based on journalists, lawyers, political opponents and activists overturning this corruption of democracy. Then and now, the numbers of fraudulent votes were very small as a percentage of the votes cast, less than 1%. Fraudulent votes are effective in a democracy only when their small share can tip the election. Most claims of voter fraud are based on a misunderstanding of voting, statistics or logic.

History

In 2007, before the partisan push for photo-ID’s and Trump’s 2016 and 2020 pre-emptive and post-emptive claims of fraud, the Brennan Institute consolidated the research and concluded that voter fraud was statistically irrelevant, 1 in 10,000 or 1 in 1,000 at the most.

file:///C:/Users/tkapo/Downloads/Report_Truth-About-Voter-Fraud.pdf

NO MATERIAL VOTER FRAUD (Even McConnell)

https://www.brennancenter.org/our-work/research-reports/debunking-voter-fraud-myth

https://www.reuters.com/article/usa-election-voter-fraud-facts-explainer-idINKBN2601H5

https://www.cnn.com/factsfirst/politics/factcheck_8b1382ba-4b0e-4d9c-b933-adcbced94e98

https://www.pnas.org/doi/10.1073/pnas.2103619118

https://www.npr.org/2022/09/04/1120904265/claims-voter-fraud-donald-trump

https://apnews.com/article/barr-no-widespread-election-fraud-b1f1488796c9a98c4b1a9061a6c7f49d

https://www.cisa.gov/rumorcontrol

https://www.voanews.com/a/2020-usa-votes_how-widespread-voter-fraud-us/6195819.html

https://www.snopes.com/tag/voter-fraud-rumors/

YES, Material Fraud

https://www.heritage.org/voterfraud

https://www.foxnews.com/category/politics/elections/voter-fraud-concerns

Summary

We are blessed with an incredibly low level of election fraud in the US for the last 50 years. With a simple two-party system, partisans from both sides have ensured that fraudulent voting is difficult to do, highly punished if discovered and easy to discover (and therefor highly disincentivized). US voting is largely managed at the lowest levels: counties, cities, precincts, where citizens know their neighbors. It is effective because enough Americans of various political beliefs today believe in this process and volunteer their time to make it effective.

Analysis

Republicans generally take a negative view of human nature, expecting individuals to actively pursue their self-interest. Hence, they expect that Democrats, with influence over the election process in some venues, will take steps to optimize their results. In an earlier age this was partially true. But, in the modern world (post 1920’s), several factors work against this direct pursuit of self-interest. The country’s laws make voting fraud a felony with significant penalties. Local election officials are elected. In a two-party system it is relatively easy to engage both parties to monitor the election process. The US has very many lawyers ready to assist their preferred party. Election results are public. Statistically improbable results are very easy to identify today. Each precinct has a historical preference which is unlikely to change materially in any single election, so any fraudulent voting is easily identified.

Good News: More Retirees

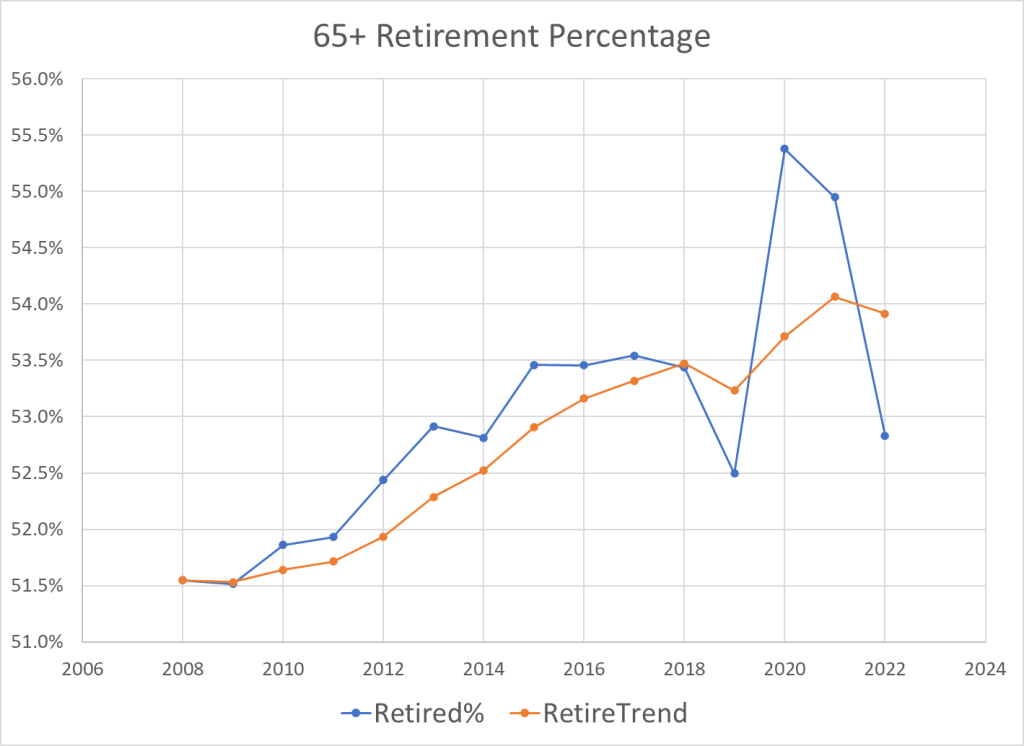

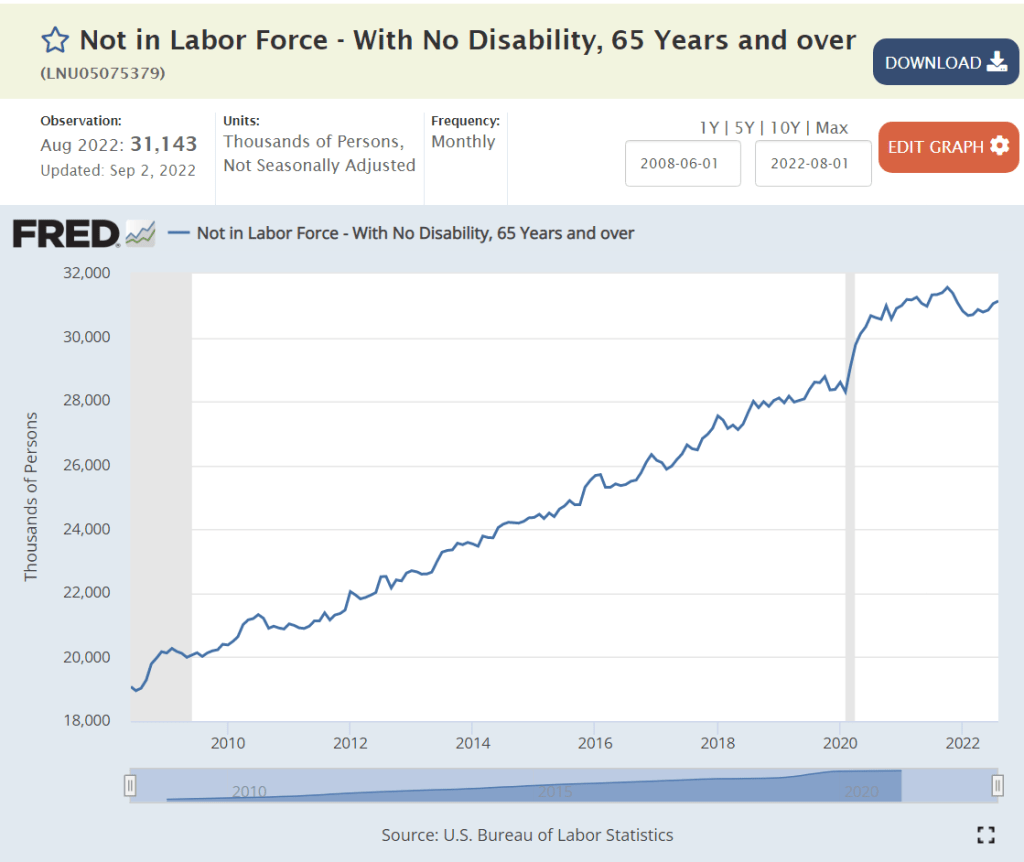

The number of retirees, aged 65+, has increased by more than 50% since 2008, from 20M to almost 31M.

The retirement age population has grown by 4% of the total population in the last 14 years.

The retired 65+ population has grown a little faster than the total 65+ age group. The initial pandemic impact in 2020 was a 5% increase in the retirement rate, indicating about a 2.6M increase in early retirements in 2020.

The retirement rate in 2020 was about 2% higher than the trend, indicating an extra 1.2M extra retirees. The percentage of retired individuals has since fallen back below the trend line.

The “retired” measure returned (close) to its trend line by June, 2022.

Early estimates of the impact of the pandemic on retirement age workers indicated 2-3 million “extra” workers retired during this time.

https://www.cnn.com/2021/12/18/business/labor-shortage-boomers-millennials-nightcap/index.html

https://www.cbsnews.com/news/retirement-covid-pandemic-unretire-labor-shortage/

https://research.stlouisfed.org/publications/economic-synopses/2021/10/15/the-covid-retirement-boom

https://www.stlouisfed.org/on-the-economy/2021/december/excess-retirements-covid-19-pandemic

https://www.axios.com/2021/10/29/millions-of-baby-boomers-retired-early-during-the-pandemic

Later estimates indicated about 1M early retirements, and then a reversal in late 2021 – 22 as individuals chose to defer their retirements due to the uncertain economic conditions.

https://www.plansponsor.com/study-shows-baby-boomers-pushed-workforce/

Bloomberg noted that new Social Security filings did not increase, so even though there were some retirement candidates with adequate resources to delay claiming Social Security benefits, it was unlikely that there were 3M extra early retirees.

CNBC documented the late Pandemic swing towards more potential retirees deferring this step.

The Washington Post documented the early retirees returning to work and the variability of retirement choices versus the long-term trend lines.

The Washington Post’s approach shows a peak of 2 million extra retirees, falling back to about one-half million in 2022.

Summary

The US economy, political system and social norms have supported the number of aged 65+ retirees growing from 20 million to more than 30 million since 2008. Some of the increase in “retirees” at the start of the pandemic was not voluntary and some retirees have returned to work in the last year as the labor market remains tight and workers worry more about economic conditions. However, overall, an extra 10 million individuals have chosen to retire from active employment and enjoy their retirement years.

Houston, We Have A Problem. Corporate Profit Growth Has No Limit

https://abc13.com/houston-we-have-a-problem-weve-had-remember-when-history/1869513/

Introduction

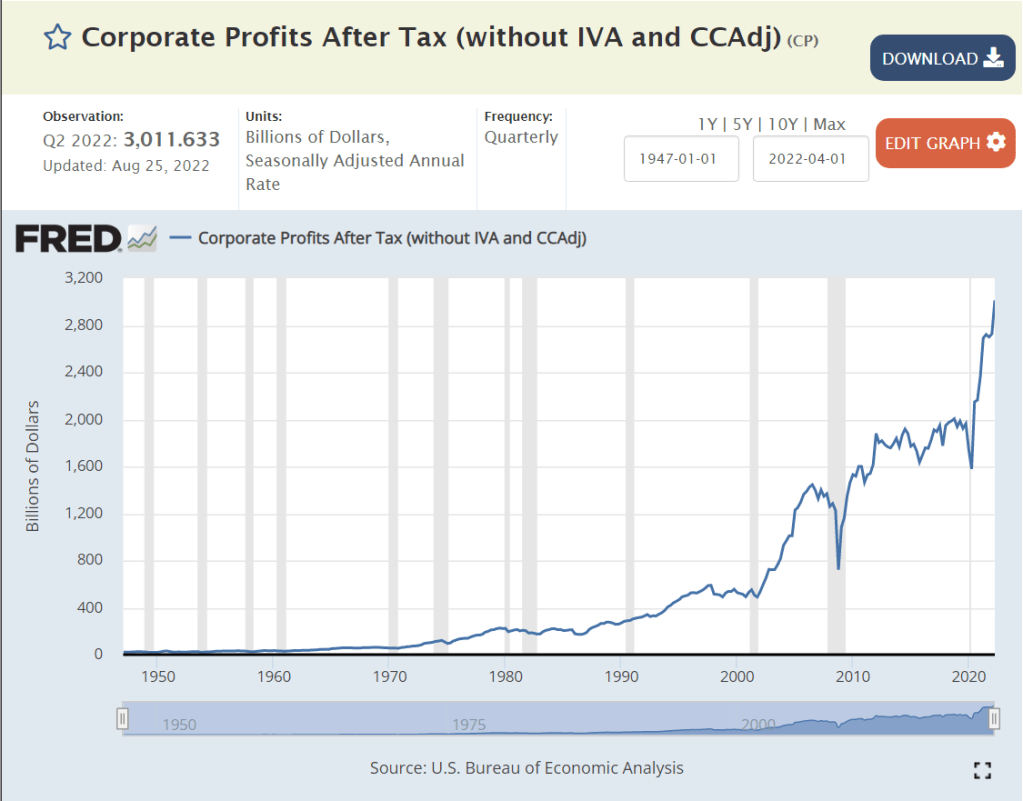

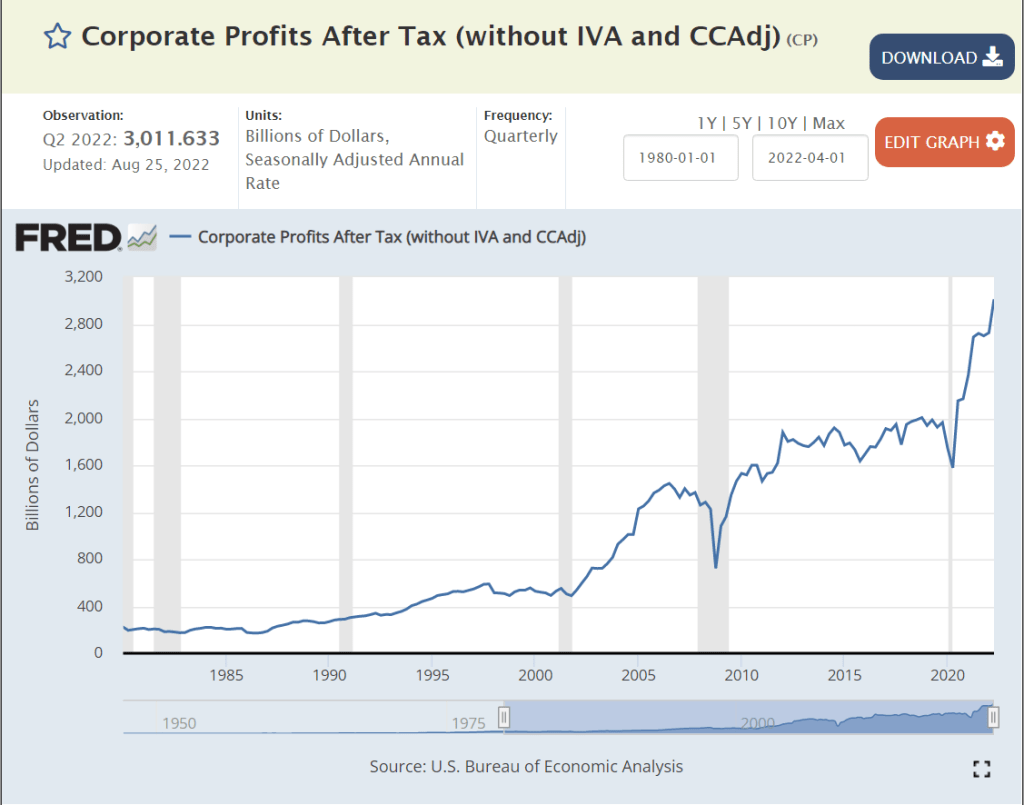

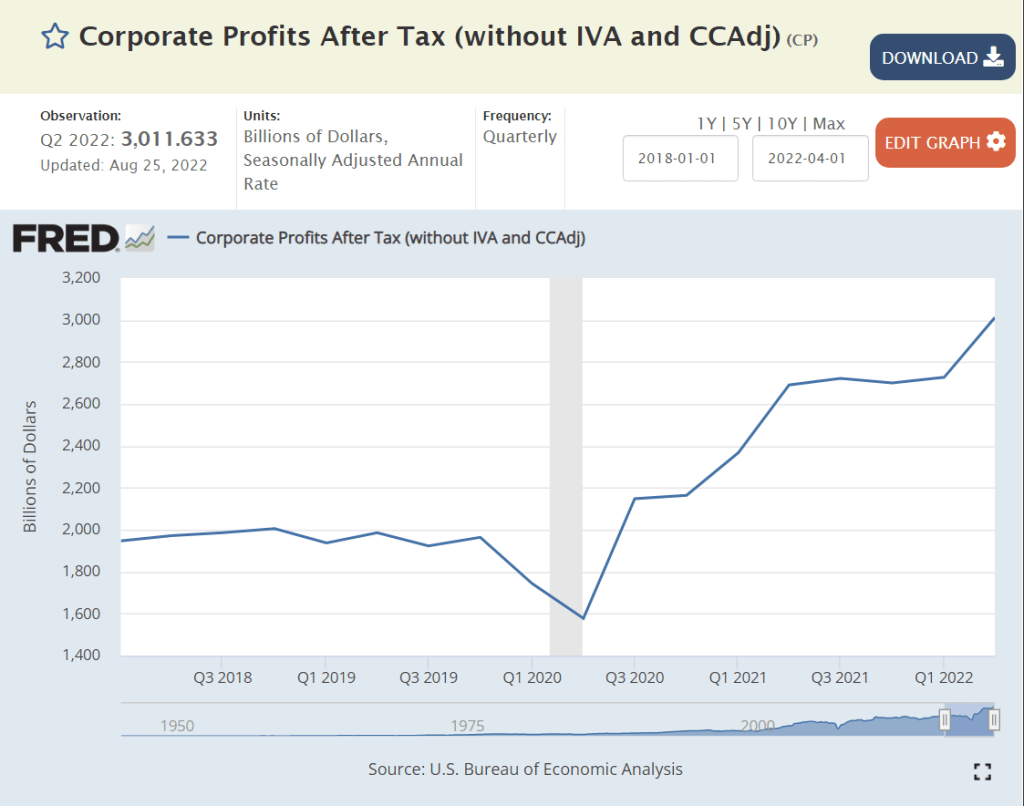

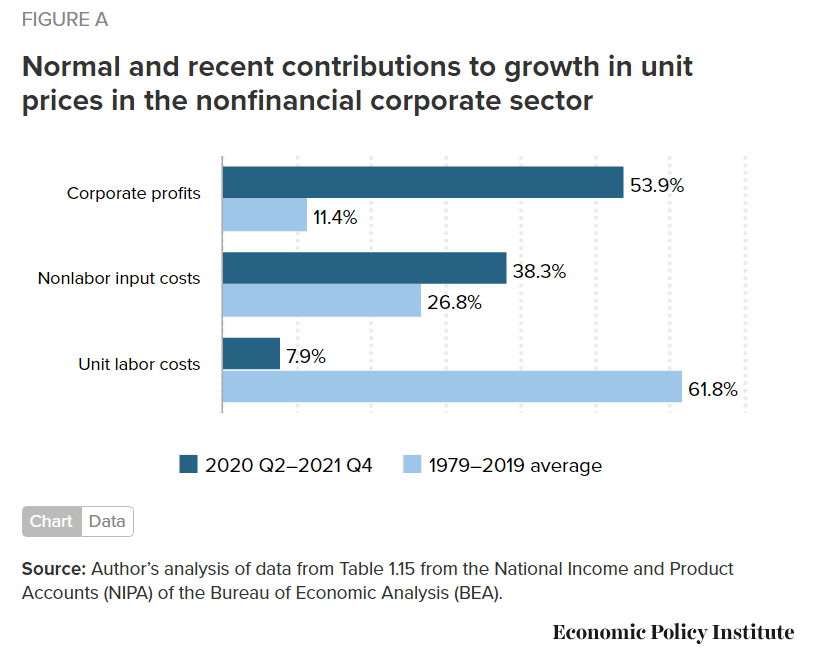

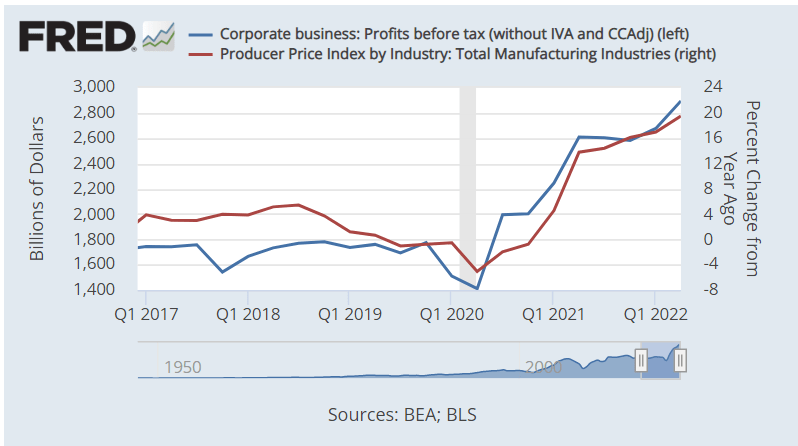

US Corporate profits grew from $1.9 Trillion(T) on an annual basis in the second quarter of 2019 before the pandemic to $3.0T in the second quarter of 2022; plus $1.1T (+57%)!!! US nominal gross domestic product (GDP) grew by 17%, from $21.3T to $24.9T, an increase of $3.6T. Real, inflation-adjusted, GDP grew by just 4%, accounting for a $0.8T increase in the real economy. Inflation grew by 13%, causing the other $2.8T of measured GDP. The $1.1T of increased corporate profits represents 39% of the inflation which has occurred in the last 3 years.

Analysis

Let’s look at the growth of US corporate profits from a half-dozen starting points to try to put this into perspective.

| Year | Profit | Real Profit | Annl Incr Stage | Cum Annl Incr |

|---|---|---|---|---|

| 1970 | 55 | 142 | ||

| 1980 | 273 | 271 | 7% | 6.7% |

| 1995 | 468 | 307 | 1% | 3.1% |

| 2006 | 1,388 | 628 | 8% | 4.5% |

| 2012 | 1,880 | 819 | 3% | 4.3% |

| 2018 | 1,947 | 775 | -1% | 3.6% |

| 2022 | 3,012 | 1,023 | 7% | 3.9% |

US corporate profits reached $3 Trillion in 2022, up from essentially zero in 1950. I’ve selected 7 peak profit years to outline this growth. Nominal profits increased from $55B in 1970 to $3.0T in 2022. In real, inflation-adjusted terms, profits have grown from $142B to $1,023B, a 7-fold increase in 52 years! Annual profit growth has been erratic, increasing by a high of 8% from 1995 to 2006 and a low of -1% from 2012 to 2018. The cumulative annual real profit growth has stayed near 4% throughout the period. 4% compounded for 52 years is a little more than 7x.

The US population grew from 200.3M to 338.3M during this period, 1.0% per year. So, corporate earnings grew by 3% per year above the rate of population growth for 52 years!!!! This kind of compound growth rate cannot continue for long periods of time without greatly impacting other sectors of the economy.

https://www.macrotrends.net/countries/USA/united-states/population

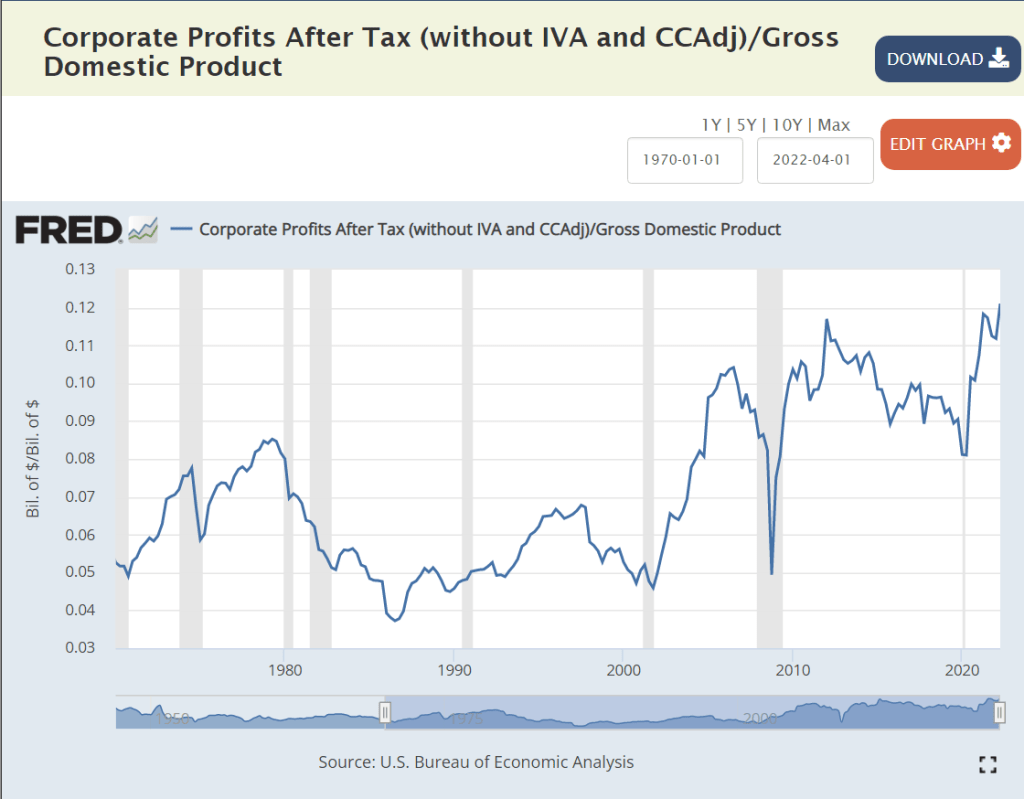

Corporate profits fluctuated in the 4-6% of GDP range from 1947 through 2000. Profits jumped up to 10% of GDP by 2010 and have largely remained at this two-fold elevated level for a decade. Profits reached a new record of 12% in 2022!

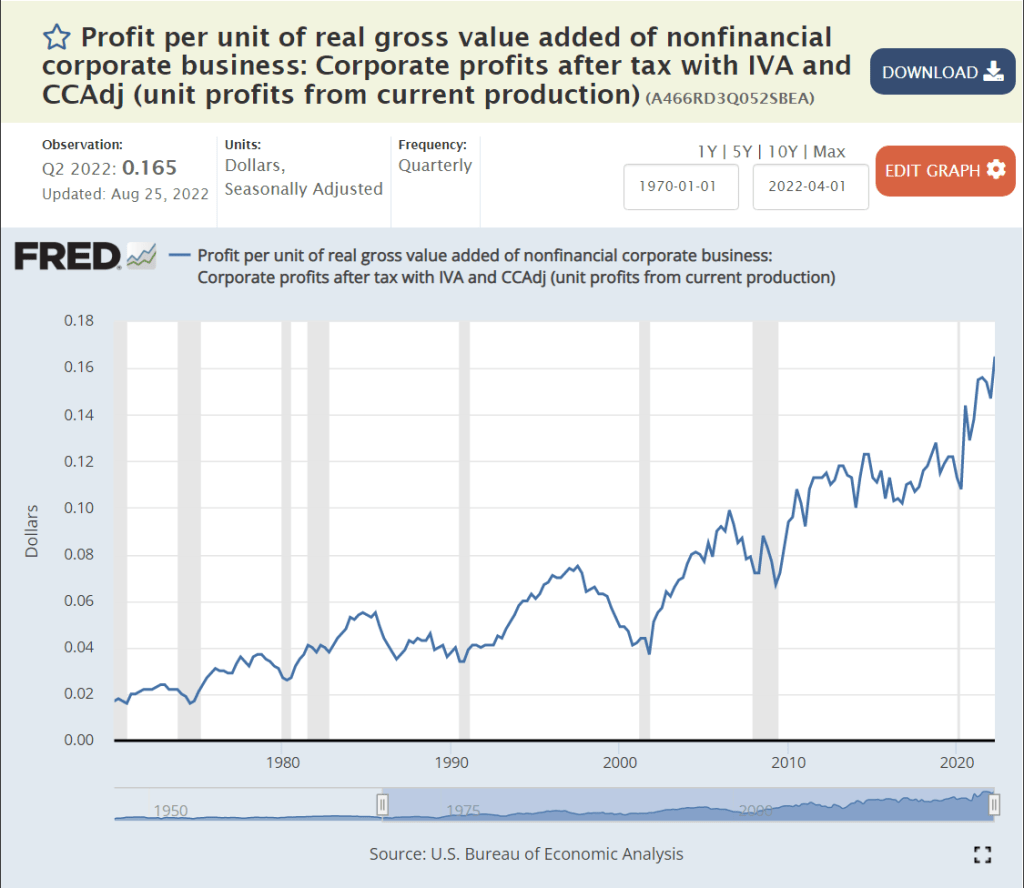

This measure shows profits growing eight-fold since 1970. (I’m going to ignore the detailed differences between the various measures of profit. They are important, but not necessary to see the major growth in profits, which is broadly consistent across the various measures.)

A tighter measure of corporate profits shows an increase from 4.5% to 7% of GDP, even before the most recent profit growth.

An alternate measure of just “domesticly earned” corporate profits shows a flatter trend.

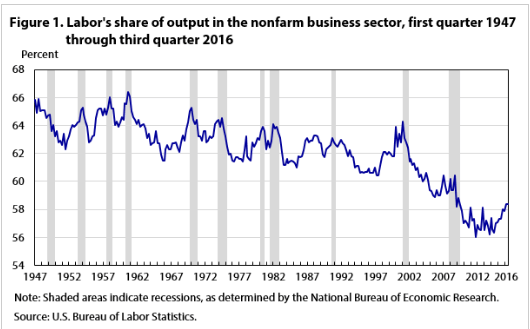

Another way to consider profits is to view its complement, the share of national income received by labor.

By this measure, labor has lost 10% of its income, while capital has gained 10% since 1980.

6% of GDP was moved from labor to capital.

Consulting firm McKinsey shows an 8% of GDP transfer and provides 5 explanations.

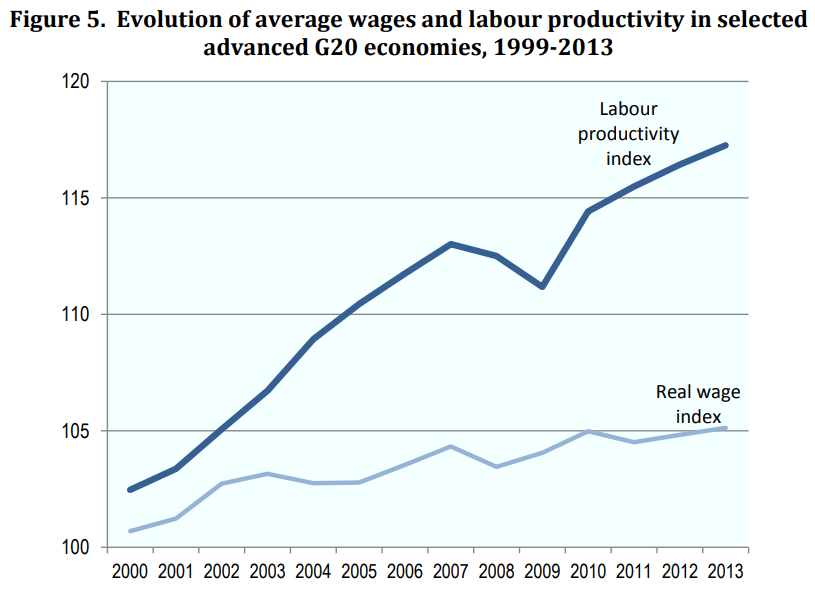

Most analyses of the growth in profits and decline in relative wages note that labor productivity has continued to rise by 2% or more annually, but labor has received almost no portion of those gains in the last 30 years.

Labor share of total income has dropped by 15% in the long-run by this measure.

This author calculates a 6-8% decline for labor.

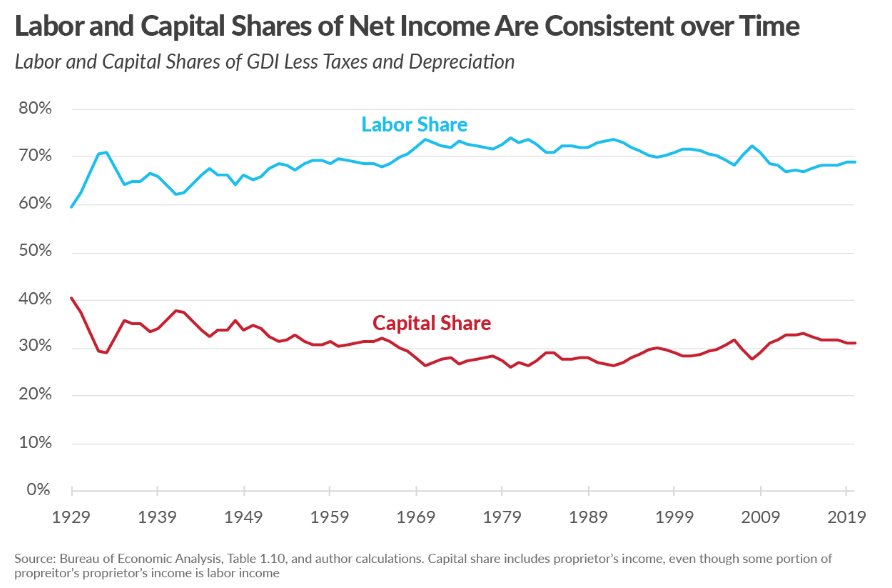

A right-leaning think tank adjusts the data and claims that labor’s share remains constant in the long-run. The Tax Foundation does delve into the various measures of income and provides arguments for their preferred measure.

Stock prices tend to follow profits. The S&P 500 index has grown by 50% in the last 2 years (despite the recent decline), reflecting the amazing growth in corporate profits during a “once in a century” pandemic driven recession.

S&P 500 company earnings (a subset of total profits earned) continued to grow strongly through and after the pandemic.

This investment advisor says that profits increased by 5% of GDP.

Median REAL, inflation-adjusted, earnings remained flat at $330/week from 1979 through 2014, a period of 35 years! This is during periods where profits were growing at 4% per year in REAL terms. In the last 8 years, REAL wages have increased by 9%, a bit better than 1% per year on average.

The media has published many articles, especially noting the increase of profits, overall, since before the pandemic. This is a popular topic because the result is certainly counterintuitive and because President Biden and the more left-leaning national Democrats have been criticizing corporations for “price gauging” and causing the recent inflation spike.

https://www.cbsnews.com/news/corporate-profits-boom-may-lead-to-higher-wages/

A variety of sources provide compelling data and logic to indicate that corporations are “taking advantage of” the post-pandemic inflation caused by supply chain issues and expansive fiscal and monetary policies to boost prices at rates faster than their costs of inputs (suppliers, labor, capital).

https://abcnews.go.com/US/record-corporate-profits-driving-inflation/story?id=87121327

Most economists and analysts point to the increased concentration of firms (fewer) by industry increasing their pricing power and allowing them to raise prices during periods of change.

https://academic.oup.com/rof/article/23/4/697/5477414

https://www.uschamber.com/finance/antitrust/industrial-concentration-in-the-united-states-2002-2017

This is pretty dense and dry stuff. There is a general consensus among economists who focus on this topic that concentration and pricing power have risen very significantly. This is partly due to the simple aging of industries with fewer players left standing. The winners in a world of global competition are simply “much better” than the losers so they continue to take market share. US anti-trust enforcement in the last 40 years has been very limited, following the theory that “open competition” in the long run (Schumpeter’s creative destruction) eventually undermines leading companies with innovative products, processes and market strategies.

The US Chamber of Commerce argues that industry concentration has not increased, noting that consumer choices in broadly defined industries have increased greatly through time.

https://www.uschamber.com/finance/antitrust/industrial-concentration-in-the-united-states-2002-2017

Summary

By a dozen measures, profit has consistently grown as a share of the American economy in the last 40-50 years. This necessarily means that the share of output and income received by labor is much smaller as a percentage of the total pie. The recent surprising ability of American corporations to effectively work through the pandemic supply chain disruptions, lose more than 10% of their labor force, increase nominal wages significantly, encounter severe input price inflation and still engineer price increases to come out much further ahead on profits is a major story for our time.

It is attracting attention to what I believe is an even more important story: the ability of corporations to incrementally capture nearly all of the increased value added by the productive American economy across 40-50 years and share very little with labor. This structural advantage of a very effective corporate sector “doing its job” within the relatively low-tax and low-regulation US political context is now completely proven.

In an ideal world, we would be developing and considering serious policy options that would limit this excess power without “killing the goose that lays the golden eggs”. Unfortunately, the Republican party remains focused on tax and regulation cuts as the main economic tools and the Democratic party alternates between 1960-70’s era Biden “centrist” policies and much further-left Bernie Sanders style policies.

11 Million Open Jobs! 2 Jobs for Every Applicant

Available Positions

| Industry | 2007 Pos | 2019 Pos | 2022 Pos | Adds |

|---|---|---|---|---|

| Govt | 12.2 | 12.5 | 11.8 | -.4 |

| Other | 5.4 | 5.9 | 5.6 | .2 |

| Construct | 7.7 | 7.5 | 7.6 | -.1 |

| Manufacturing | 14.2 | 12.8 | 12.7 | -1.5 |

| Mining | .7 | .7 | .6 | -.1 |

| Logistics | 5.0 | 6.1 | 6.9 | 1.9 |

| Education | 3.0 | 3.8 | 3.7 | .7 |

| Health | 15.3 | 20.3 | 20.4 | 5.1 |

| Leisure | 13.3 | 16.5 | 15.1 | 1.8 |

| State/Local Educn | 10.2 | 10.4 | 10.2 | 0 |

| Finance | 8.4 | 8.7 | 8.9 | .5 |

| Information | 3.0 | 2.8 | 2.9 | -.1 |

| Profl Svcs | 17.8 | 20.9 | 21.8 | 4.0 |

| Retail | 15.7 | 15.6 | 15.8 | .1 |

| Wholesale | 5.9 | 5.8 | 5.8 | -.1 |

| Total | 137.8 | 150.3 | 149.8 | 12.0 |

| Industry | 2007 Open | 2019 Open | 2022 Open | More Open |

|---|---|---|---|---|

| Government | .3 | .5 | .7 | .4 |

| Other | .2 | .2 | .4 | .3 |

| Construction | .2 | .3 | .4 | .2 |

| Manufacturing | .3 | .5 | .9 | .5 |

| Mining | 0 | 0 | 0 | 0 |

| Logistics | .1 | .3 | .5 | .4 |

| Education | .1 | .1 | .2 | .1 |

| Health | .7 | 1.2 | 1.9 | 1.2 |

| Leisure | .6 | 1.0 | 1.6 | 1.0 |

| State/Local Ed | .1 | .2 | .3 | .2 |

| Finance | .3 | .4 | .5 | .2 |

| IT | .1 | .1 | .2 | .1 |

| Profl Svcs | .9 | 1.3 | 2.0 | 1.2 |

| Retail | .5 | .9 | 1.1 | 0,6 |

| Wholesale | .2 | .2 | .3 | .1 |

| Total | 3.6 | 7.1 | 11.2 | 6.6 |

Open Positions as a Percent of Jobs Available

| Industry | 2007 Rate | 2019 Rate | 2022 Rate |

|---|---|---|---|

| Government | 2.4 | 3.6 | 5.4 |

| Other | 3.1 | 4.0 | 7.3 |

| Construction | 2.2 | 3.8 | 4.8 |

| Manufacturing | 2.3 | 3.4 | 6.4 |

| Mining | 2.1 | 3.8 | 5.6 |

| Logistics | 2.7 | 4.8 | 7.4 |

| Education Svcs | 2.4 | 2.9 | 4.9 |

| Health | 4.3 | 5.4 | 8.6 |

| Leisure | 4.3 | 5.7 | 9.8 |

| State/Local Ed | 1.3 | 2.0 | 3.2 |

| Finance | 3.5 | 4.2 | 5.4 |

| IT | 4.6 | 4.7 | 6.7 |

| Profl Svcs | 4.8 | 5.7 | 8.6 |

| Retail | 3.0 | 5.2 | 6.4 |

| Wholesale | 2.9 | 3.5 | 5.0 |

| Total | 3.3 | 4.5 | 7.0 |

Open Positions by Industry, 2021-22

The Department of Labor’s monthly survey provides various measures by industry. I’ve broken down the data into 15 industry segments. Eight (8) of these segments account for 5/6ths of all positions and I’ll focus on these 8.

The number of open jobs in the last year, July, 2021 – July 2022, is lead by Professional Services (2.0), Health (1.9), Leisure (1.6), Retail (1.1), Manufacturing (0.9), Government (0.7), Logistics (0.5) and Finance (0.5).

Seven industries accounted for 5/6ths of the increase from 4.6M openings in 2006-7 to 11.2M open jobs today. Health (1.2), Profl Svcs (1.2), Leisure (1.0), Retail (0.6), Manufacturing (0.5), Government (0.4) and Logistics (0.4) are the open job gainers.

The pre-pandemic increase averaged 40% of the total 15-year increase for most industries. The Manufacturing industry showed job declines between 2006 and before the Pandemic, so 80% of it’s openings increase has been since the pre-Pandemic peak. The Business and Professional Services industry has also grown faster since the Pandemic, with 68% of its job growth in recent years. The Retail industry shows an opposite pattern, with 60% of it’s job growth before the Pandemic and a relatively weaker 40% post-Pandemic (on-line sales growth impact).

Total Positions Available by Industry

Total positions increased by 12M, from 138M in 2006-7 to 150M in the last year. Just 4 industries account for all of the growth, lead by Health (5.1), Profl Svcs (4.0), Logistics (1.9) and Leisure/Hospitality (1.8). The migration from ag/extraction to manufacturing to pure services is accelerating.

Open Positions Rate by Industry

The open positions rate more than doubled, from 3.3% in 2006-7 to 4.5% in 2018-19 to 7.0% in the last year. Unfortunately, the larger and growing industry sectors have above average open position rates. Leisure and hospitality shows an incredible/unsustainable 9.8% job openings rate. Professional and business services and Health Care report nearly as high 8.6% vacancy rates. The Logistics industry has a higher than usual rate of 7.4% as it adds jobs at a faster rate in the home delivery era. The Retail and Manufacturing industries show elevated 6.4% open jobs rates. The Government and Finance industries exhibit 5.4% openings rates.

Changes in the Job Openings Rate

The overall job openings rate more than doubled from 2006-7 to the last year, from 3.3% to 7.0%. Keep in mind that 2006-7 was the peak of that business cycle with job openings at a cyclical low point. The Leisure and Hospitality industry had the largest increase, from its usually relatively high 4.3% to an “other worldly” 9.8%. The pandemic drove down travel and it has slowly recovered. The Logistics industry displayed the second highest increase, from 2.7% (it’s usual Manufacturing-like rate) to 7.4% as the Pandemic drove individual shipments to consumers. The Health Care industry continued its labor intensive growth, doubling from 4.3% to 8.6% of open positions. The Manufacturing industry evolved from its usual low 2.3% all the way up to 6.4% as labor demand in other industries grew and attracted its workers. The Professional and Business Services industry kept growing, resulting in a 3.8% increase in unfilled roles, from a typically high 4.8% to a very high 8.6%. The Retail and Government sectors had lower increases at 3%. The Finance sector had a lower than average 2% increase in open jobs.

Just a “Mix” Variance?

The US economy is very dynamic. Industries with low, medium and high job openings rates in 2006-7 each employed about 45M people. The low job openings rate industries (Govt, Manufacturing, Mining, and Educn Svcs) actually LOST 1.4M positions between 2007 and 2022. The middle rate of job openings industries (Logistics, finance, trade, other) added 2.6% net new jobs (1.7M). The high job openings rate industries (Health, Leisure, IT and Profl/Bus Svcs) added an incredible 10.8M jobs (22%)! The US has moved from agriculture to extractive to manufacturing to services employment. The personal and professional services industries are both the fastest growing and the most difficult to staff today.

What Happens During a Mild Recession?

Business and Professional Services openings drop by 3% of the total or 600K people. Health industry jobs decline by a smaller 1% as they are less sensitive to the business cycle, falling by 100K. Leisure and Hospitality are very understaffed and this is harming their growth. They might trim their employment by 2% or 300K positions. The Retail industry is in a long-run decline, so a 2% decline is likely, eliminating 300K jobs. Manufacturing is more cyclical than other industries, so its labor demand will fall more sharply, 3%, removing 400K job postings. The Government sector is somewhat buffered from recession pressures, so job openings might fall just 1% or 100K. Logistics firms are struggling to deliver, so a 2% job decline is the most I see, cutting another 100K positions. The Finance sector has been less volatile, so I estimate a 1% decline and 100K dip.. The remaining industries are likely to fall in tandem, requiring an additional 400K open jobs decline to meet budgets. This total 2.4M open position trim reduces the balance to 8.8M, far above the 7.1M pre-Pandemic level in 2018-19. I don’t think that the labor market will play its usual role in transmitting/amplifying negative finance, banking, housing, international trade, energy and other disruptions through the American economy.

Summary

The US economy was at “full employment” in 2006-7 with just 4.6M unfilled positions. The extended recovery after the Great Recession delivered an even lower unemployment rate, but it also delivered a much increased 7.1M open positions. The post-Pandemic economy has returned to an amazing 3.5% unemployment rate, but the unfilled position count has climbed to a much higher 11.2M and stayed there. The current 7% vacancy rate is largely driven by 6 of the 15 industries with the highest rates: Leisure (9.8%), Health (8.6%), Profl Svcs (8.6%), Logistics (7.4%), Manufacturing (6.4%) and Retail (6.4%). American business is slowly learning to manage with a tight labor very market. Demand for labor should fall significantly in the future as firms employ greater technology, processes, capital goods and imports.

NOT.