- Tax cuts. Corporate rates cut from 35% to 21%, closer to OECD norms. Incentives for returning profits to US. Higher income tax rate cuts.

- Regulation cuts. Environment, business, banking, labor.

- Lower environmental standards. Withdraw from Paris climate deal. Methane limits. Wetlands. Vehicle milage and emissions standards.

- New limits to welfare benefits: Medicare and SNAP.

- Antitrust investigations for telecommunications, media, internet, network advantaged firms.

- Increased use of Congressional Review Act (1996) to allow Congress to vote down newly implemented regulations.

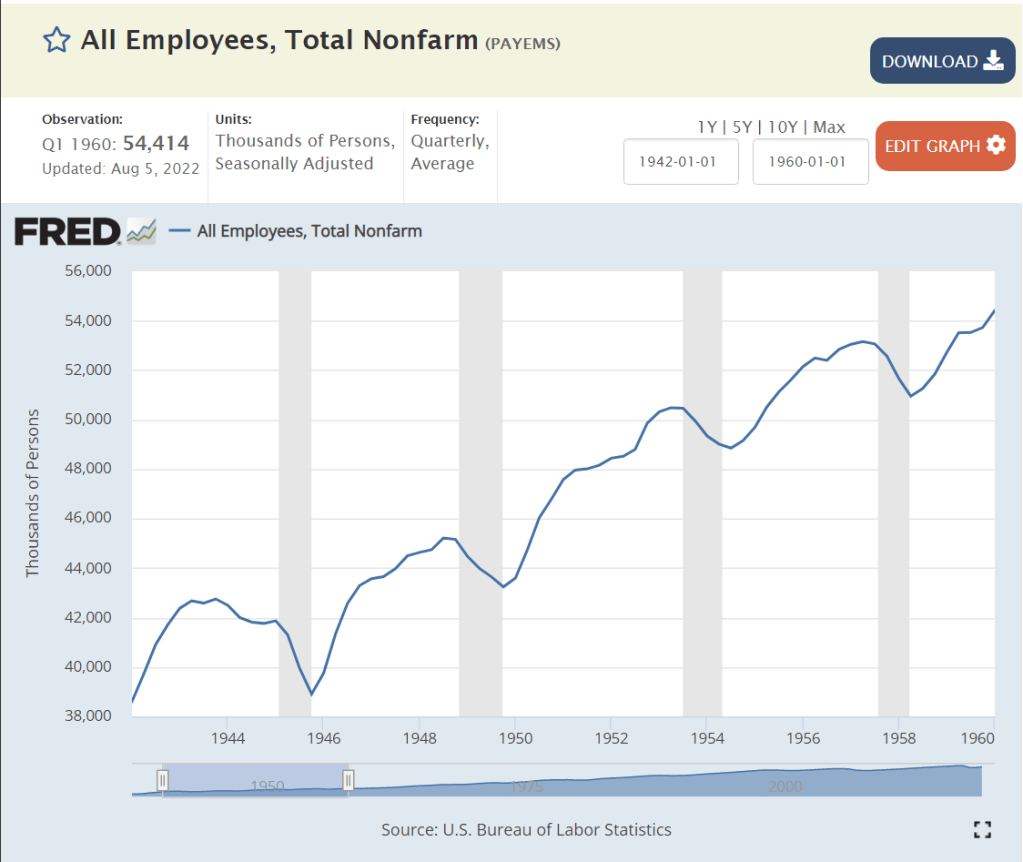

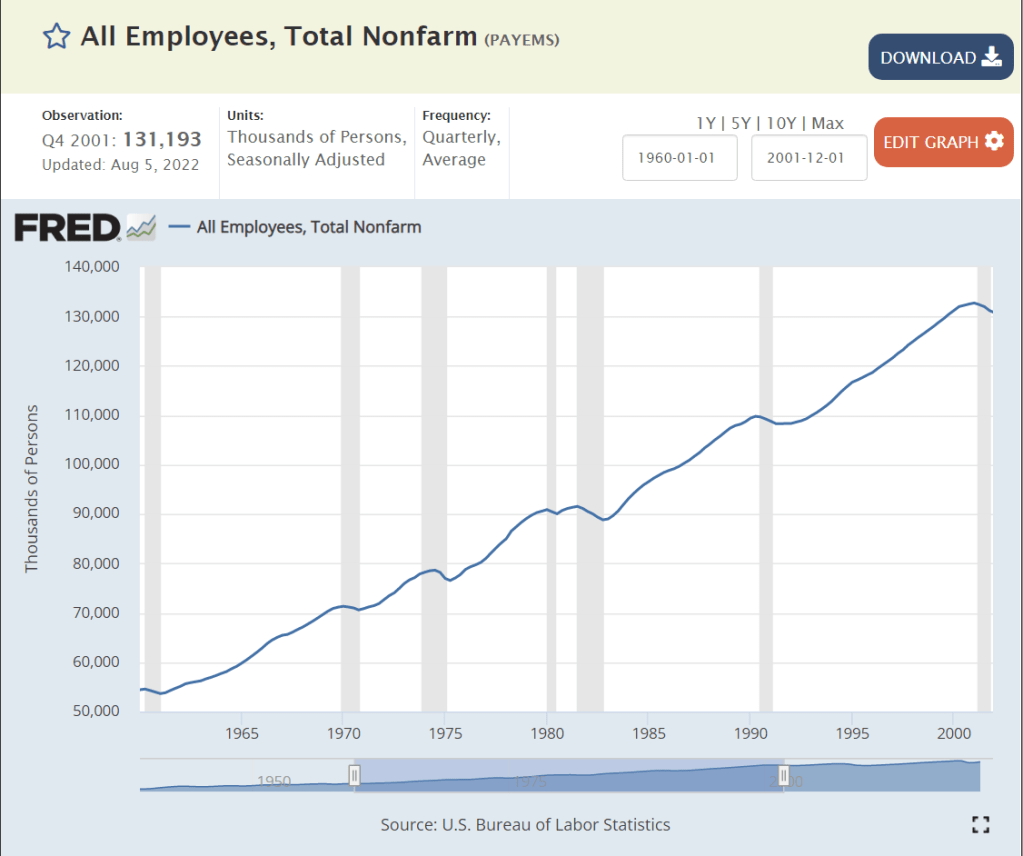

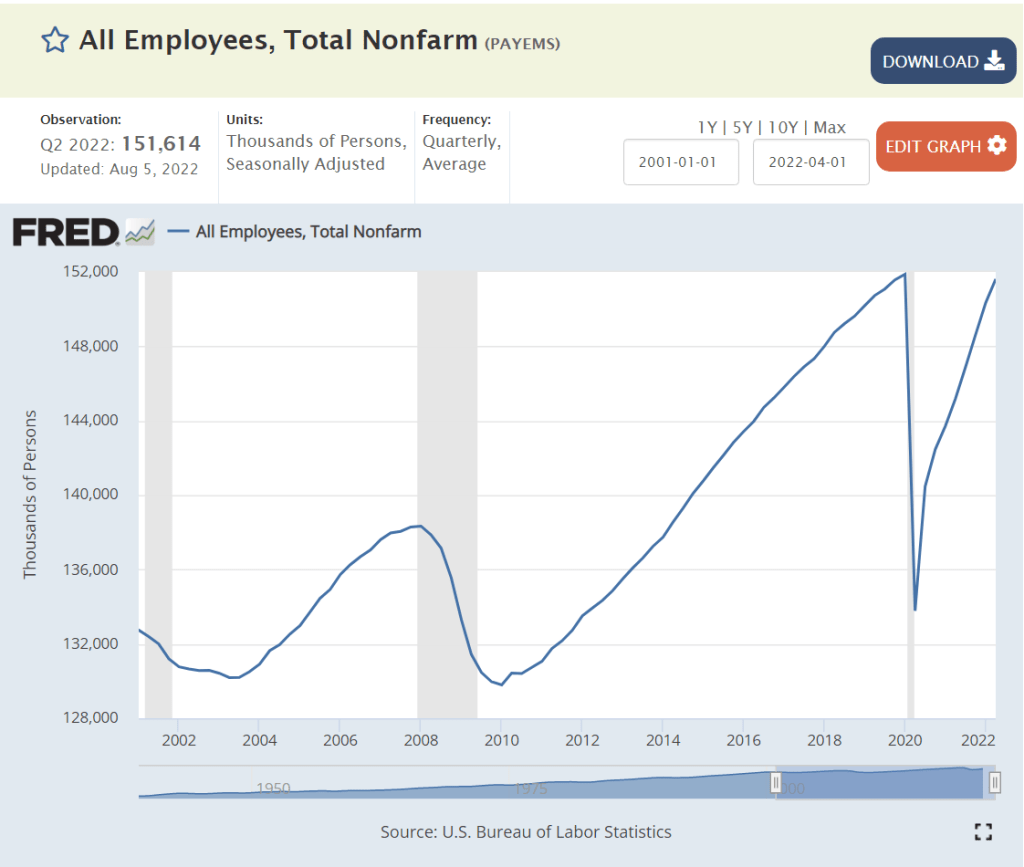

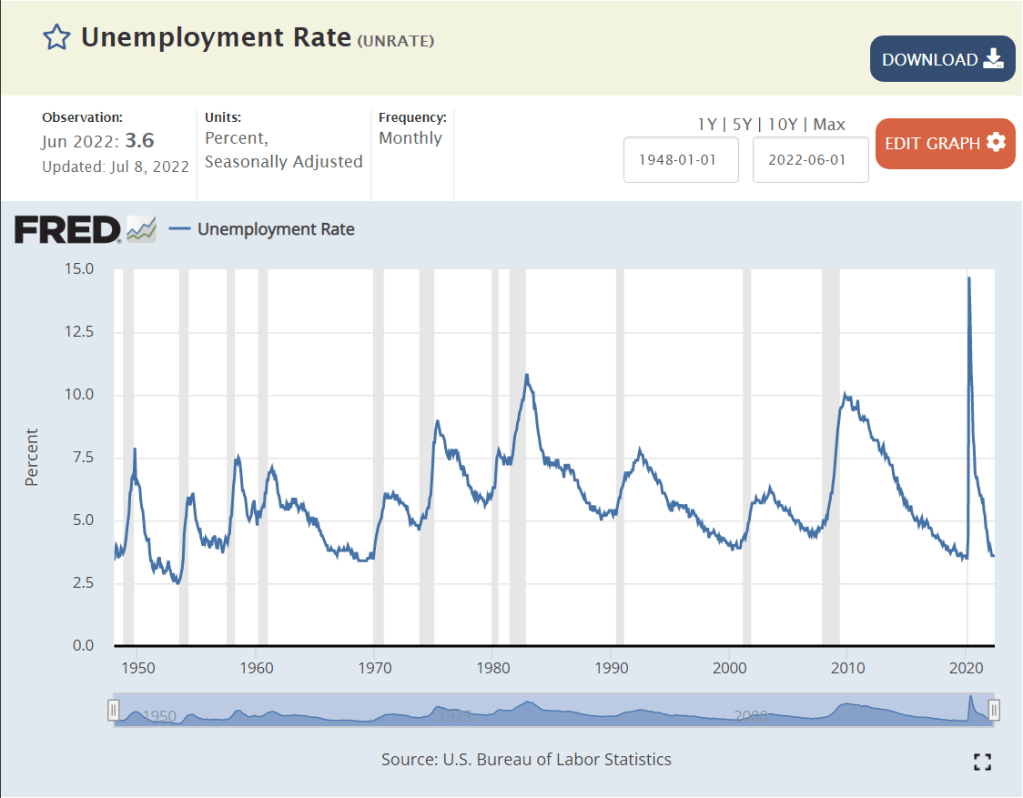

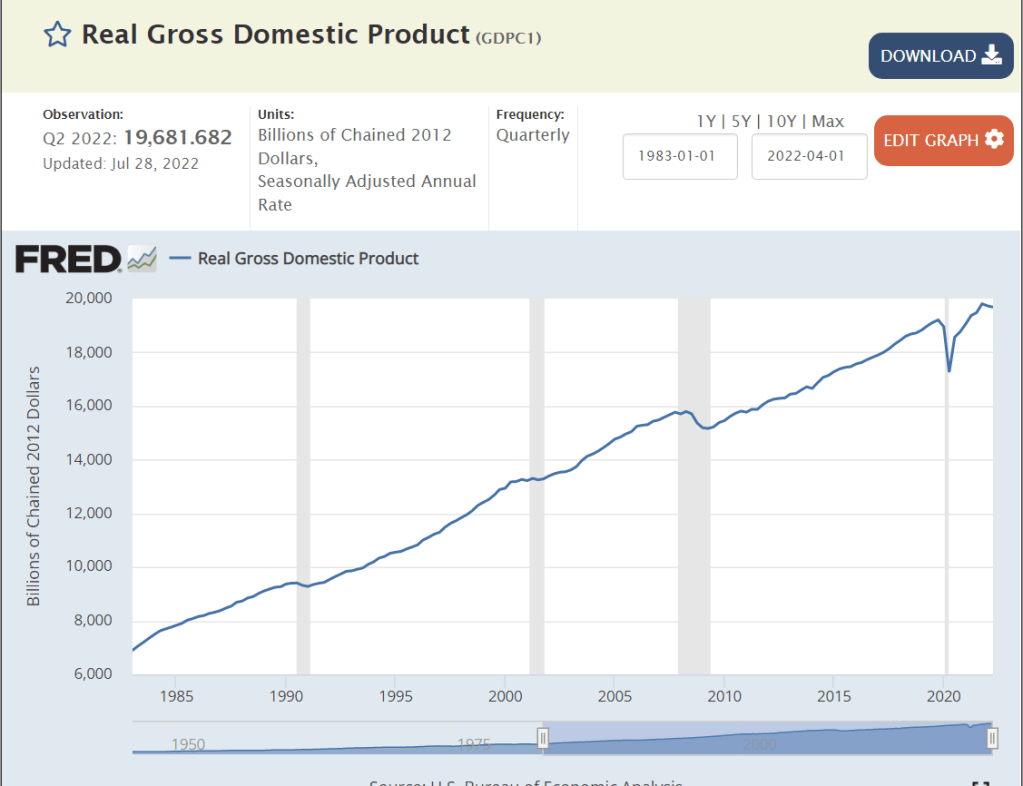

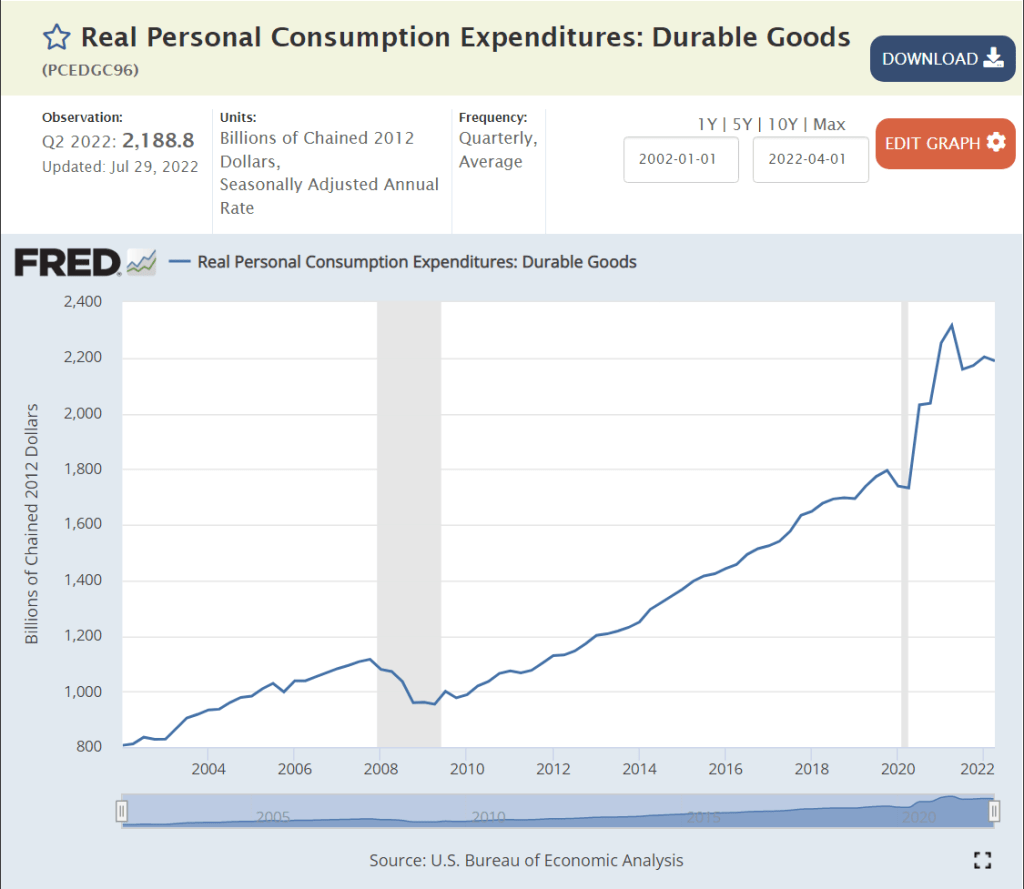

- Economic recovery continued for 3 more years. 2.5% annual growth. 3.5% unemployment. Stock market gains. 6.5M jobs added. Tighter labor market. Increased wages. Minority and lower income gains.

- Bipartisan Covid relief spending for individuals and firms.

- Home building increased during Trump term and afterwards.

- More “Middle Americans” believed that they were heard and represented.

- NAFTA agreement renegotiated.

- China relations re-evaluated. Higher tariffs on both sides. Technology limits.

- Presidential “bully pulpit” used to maintain some US jobs.

- Legislation and executive orders used to support US steel, coal and manufacturing businesses and employment.

- Legislation passed to improve visibility to tax shelters and tax fraud enforcement.

- Agriculture industry subsidies offered to offset trade costs.

- Trade deals with South Korea, Japan and EU.

- Enhanced trade policy for communications, IT, technology and AI.

- Increased military spending.

- Revised defense strategy focused on China and Russia.

- Flexed US military muscle in limited attacks.

- Actions reduced Islamic State threats to low level.

- Supported Israel diplomatic relations with 4 Arab states.

- US troops withdrawn from Afghanistan, Syria and Iraq.

- Opposition to dictators in Cuba, Venezuela, China and Nicaragua.

- Reduced support for international organizations such as WHO.

- Built 80 miles of new wall and 300 miles of enhanced walls on Mexico border.

- Negotiated improved coordination with Mexico and Central American nations regarding immigration.

- Reduced legal immigration from all countries.

- Reduced opportunities for asylum seekers.

- Used “zero tolerance” family separation policies to disincentivize immigrants.

- Removed Affordable Care Act individual mandate.

- Streamlined FDA approval process and made financial commitments to ensure rapid COVID vaccine development.

- Took steps to reduce drug price inflation.

- Invested in opioid drug addiction prevention and correction.

- Enacted market friendly policies and regulations to expand domestic energy development, furthering American energy independence.

- Supported the bipartisan First Step Act which reduces minimum sentences and supports recovery from incarceration.

- Invested in historically Black colleges and universities and vocational education (Perkins).

- Made small steps to support “school choice”.

- Appointed 3 conservative Supreme Court justices and 225 federal justices.

Trump Presidential Results

Economic Policy

- Deficit spending is permanently entrenched. 3-5-7% annual budget deficits do not appear to have major economic downsides in investment crowding out or inflation.

- Tax cuts do not generate extra growth, investment, productivity or economic resiliency. They transfer dollars to the recipients.

- Concentrated supply chains (China) are subject to significant trade, logistics, military and emergency risks which must be managed.

Foreign Policy

- U.S. remains the leading superpower and can pursue its own goals with less allied cooperation and attention to “niceties”, at least in the short run. See NATO, Japan, Korea, climate.

- China is the number one competitor.

- U.S. and Russia relations are no longer based on Cold War issues. The “Hawks versus Doves” dimension competes with domestic political parties.

- Negotiating with nuclear states (Iran, North Korea) is very difficult, even for a superpower.

- Europe has its own international interests. It will pursue them. It cannot rely upon the U.S. for its defense.

Domestic Policy

- Bipartisan immigration policy may be impossible.

- Supreme Court and judicial politicization may drive structural changes/reforms.

- Racial relations and inequality will be a top political issue for decades.

- Wedge issues – abortion, guns, school content/choice, liberty, gay rights – will remain a focus of both parties.

- Traditional social security, Medicare and Medicaid are untouchable.

- Obamacare is now essentially untouchable. Lower income citizens will have health insurance.

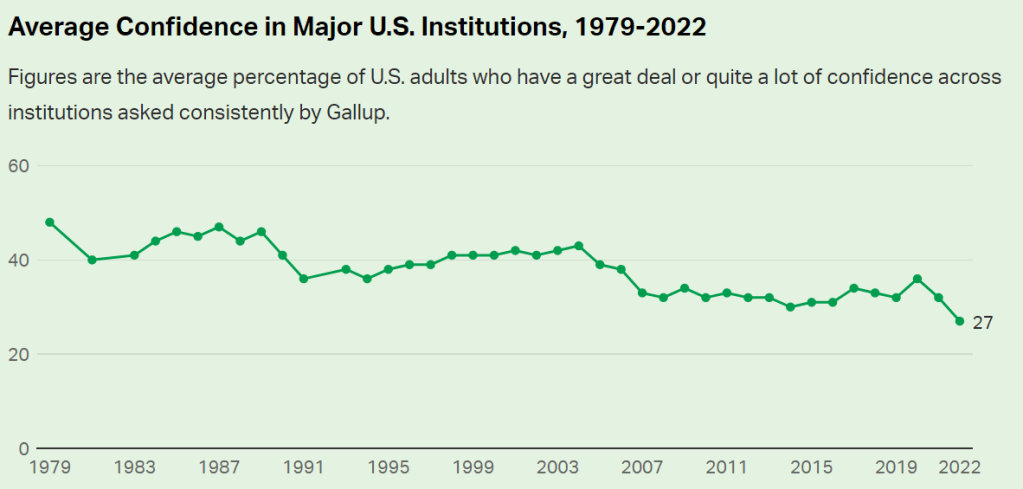

Democracy at Risk

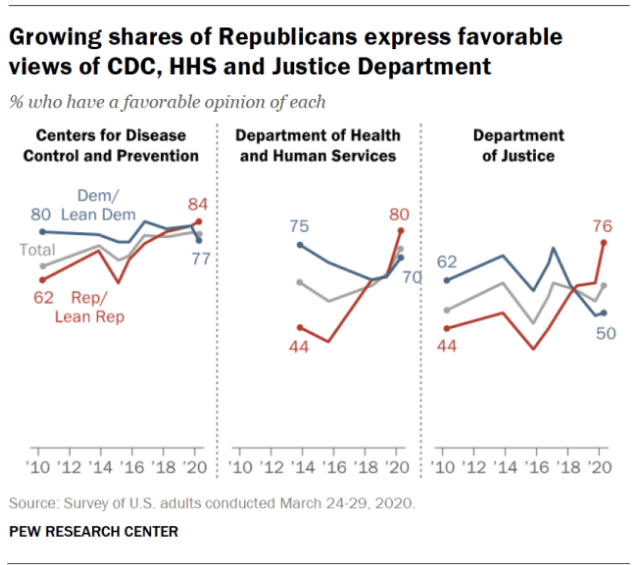

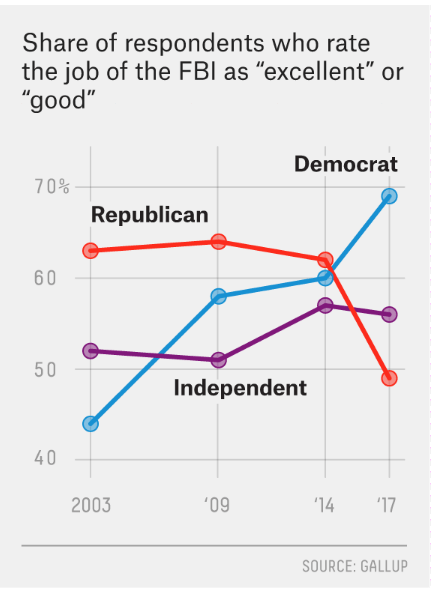

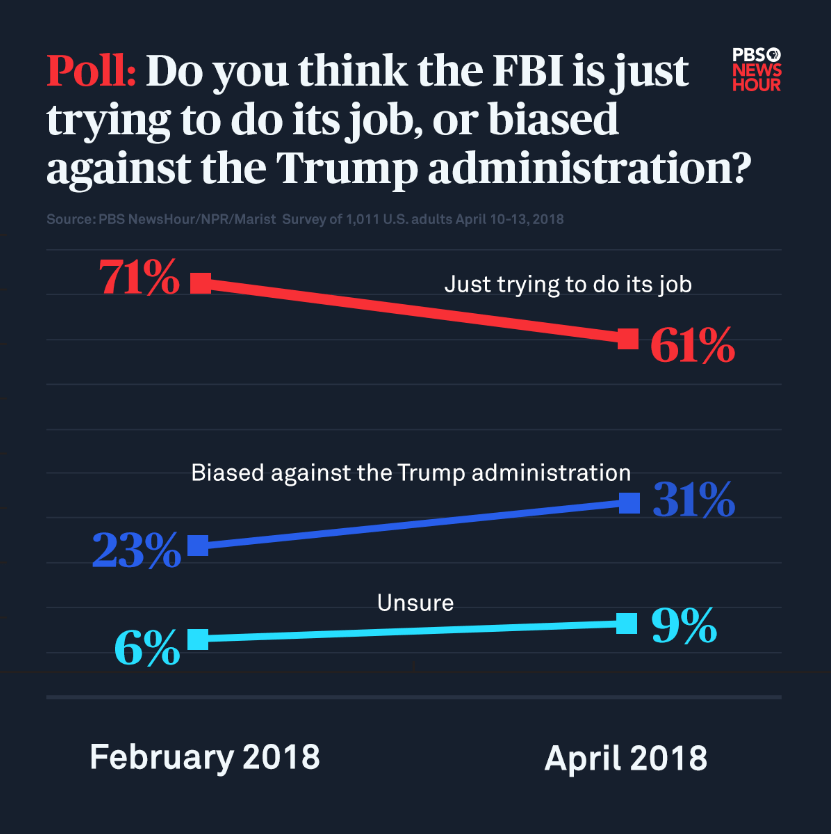

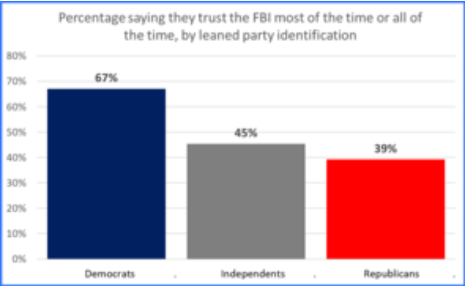

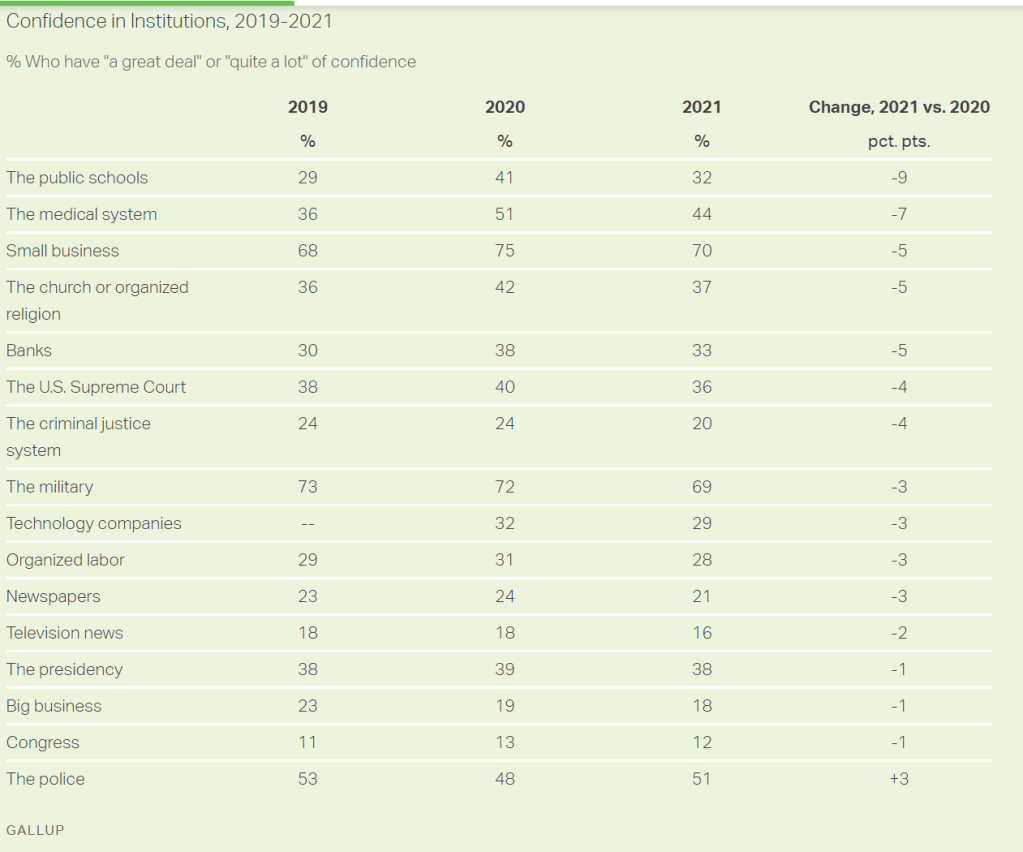

- Legitimacy of media, press, free speech threatened.

- Government employees, courts, justice system, law enforcement threatened.

- Schools, universities and teachers threatened.

- Legitimacy of voting processes threatened.

- Illiberal democracy, authoritarianism have more support.

- Gerrymandering, voting rules, campaign funding rules undercut public confidence.

- Voter participation has increased in response.

Communications Policy

- Media attention is priceless and can be manipulated by extreme statements and behavior.

- Traditional media “fairness” approach (quotes from both sides) can be manipulated to support unsupportable claims.

- Every media outlet or actor has some degree of bias. Consumers are more aware, but many choose to only reinforce existing beliefs.

- The president has the opportunity to control/influence the attention of the media.

- Facts and objectivity are not respected by some media voices. The pattern of communications statements and framing of subjects can be much more important than content.

- Political actors are not held accountable for false claims or exaggerated promises. Claims and promises are just tools to motivate the faithful.

Rules of Politics

- President has tremendous power. International agreements. Regulations. Executive orders. Bully pulpit. Political party discipline. Using power seems to have little downside.

- Only winning matters. Not popularity, broad support, bipartisanship, appearances, fairness, mud, litigation, critics, impeachment, norms, tradition or relations.

- Polarization strategy is more effective than building a central coalition. Motivating your team to vote is more important than persuading independent voters.

- Candidate character does not matter. Politicians are salesmen and saleswomen. They are lawyers. They are tools, not statesmen.

- Party/team winning is most important factor. 400,000 covid deaths were not enough to spark a revolution. Deaths were traded off against economic opportunity without negative political impact.

- Harry Truman’s “buck stops here” responsibility position is not required. No one was responsible for Covid results.

- Administrative competence is not required to hold office or to run the federal government (so far). Slow appointments, fast cabinet turnover, acting secretaries, department heads that oppose the role of their departments.

- President represents his team and interests, not the whole country.

Party Policy

- Philosophical conservatives have departed the Republican party and lost influence.

- Moderate Republicans (RINO) have mostly departed, have no political candidates and no influence in the national party.

- Extremist groups (race, religion, military, nationalist) are not opposed.

- Traditional business interests have much less influence (immigration, social issues, antitrust, trade limits, industrial policy, presidential threats, banking, bailouts).

- Pragmatic policies and legislation remain largely unimportant. No party platform for 2020. Everyone in the party “knows” basic positions on all issues. No budget policy debates. No health care alternative to Obamacare. No abortion policy. Statements of preference and intent and belief are more important than wonkish details.

- Highlighting the threats and follies of the most leftist Democrats is the most effective means to motivate true believers and maintain support of more independent minded voters.

- Only a few federal level policies really matter. Tax and regulation cuts. Social wedge issues. Most other topics can be “managed” with small policy victories and messaging.

- Party discipline is essential. Republicans are obligated to support the political winners in their party, not to represent all Republicans or all Americans or to “solve problems”.

- Managing the voting system (districts, rules, methods) is as important as policies, candidates, fundraising and communications strategies.

Summary

Trump has revolutionized modern American politics. The Reagan revolution consolidated conservative voters, clearly aligning them with the Republican party. The Gingrich revolution further separated the two parties, emphasizing winning and party allegiance. Republican candidates and voters engaged in a reinforcing cycle of “purist” policy aims such as no tax increases, “drill baby drill” environmentalism, banning abortions, and “bomb baby bomb” anti-terrorism. The Great Recession and the tea party further motivated populist leaning voters to demand populist policies and appeals. Trump modified many historical Main Street and Wall Street Republican policies to make the party better embrace the populist mood and “make American great again”.

Trump’s “only results matter” approach has further transformed the party and the nation. His presidency delivered some key political accomplishments. It also produced many “results” that will shape American politics, economics, society and debate for years to come.

https://www.bbc.com/news/world-us-canada-37982000

https://www.politifact.com/truth-o-meter/promises/trumpometer/

https://trumpwhitehouse.archives.gov/trump-administration-accomplishments/

https://www.vox.com/policy-and-politics/2019/12/2/20970521/trump-administration-achievements

https://www.propublica.org/article/the-government-donald-trump-left-behind

https://www.mcleancountyrepublicans.org/trump_administration_accomplishments

https://www.washingtonpost.com/outlook/2021/01/20/trump-legacy/

https://apnews.com/article/fact-check-donald-trump-farewell-remarks-f911b5ea84a2b69291aa6f52b9ef6318

https://www.barnesandnoble.com/w/trump-got-it-done-jack-t-adams/1139526046

https://www.thedailybeast.com/even-liberals-have-to-admit-trump-had-real-successes-on-the-economy

https://www.cbsnews.com/news/trump-view-historians/

https://www.belfercenter.org/publication/trump-legacy-and-its-consequences

https://www.cnn.com/2021/08/30/politics/trump-legacy-fake-news/index.html

https://www.cfr.org/article/donald-trumps-costly-legacy

https://www.pbs.org/newshour/show/what-will-trumps-legacy-be-after-leaving-office

https://www.yahoo.com/video/what-is-president-trumps-legacy-203123599.html