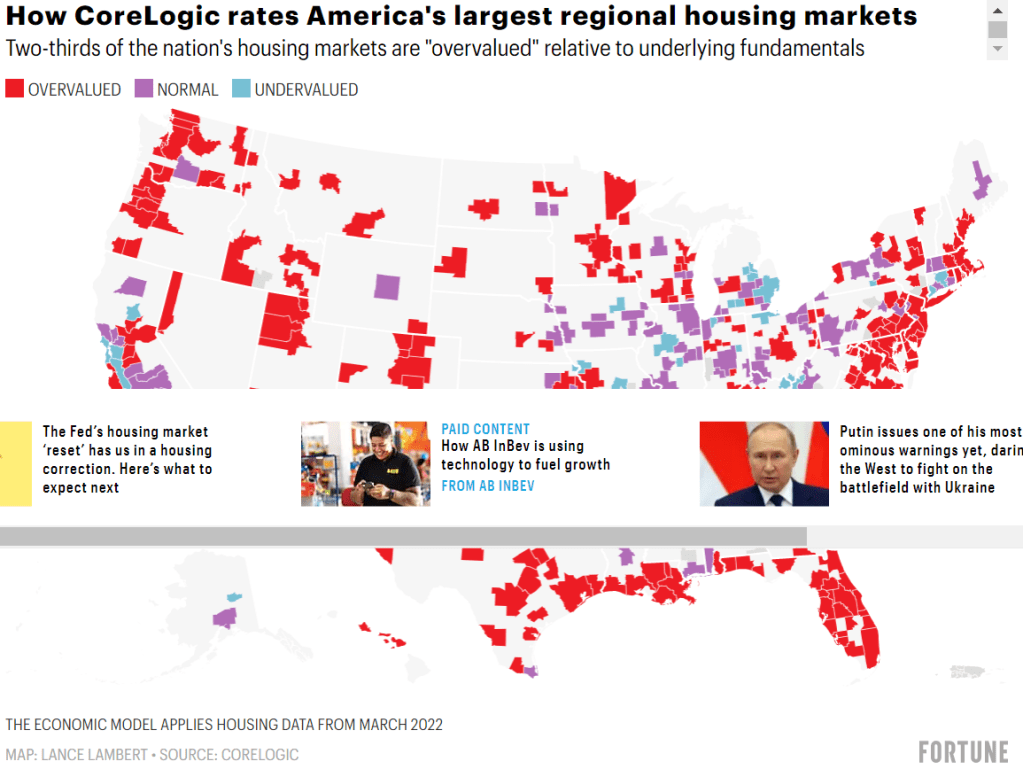

The Housing Market is Tighter than Ever

20% housing price inflation.

Typical house sells in one month.

Listings down by 70%.

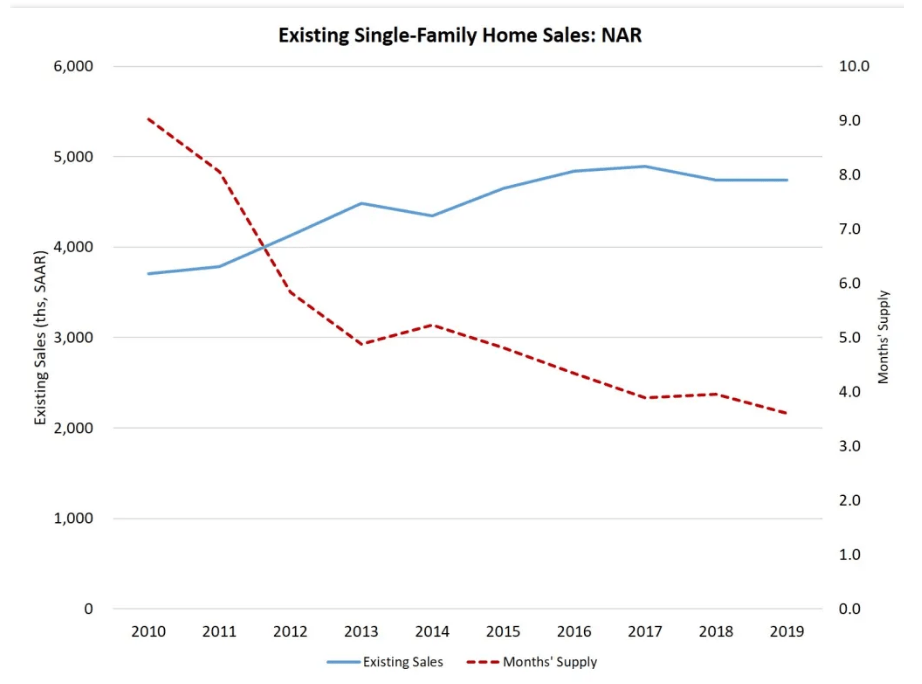

Existing homes available for sale cut in half, even before the recent decline.

Even with record prices, new listings lagged during 2020-22.

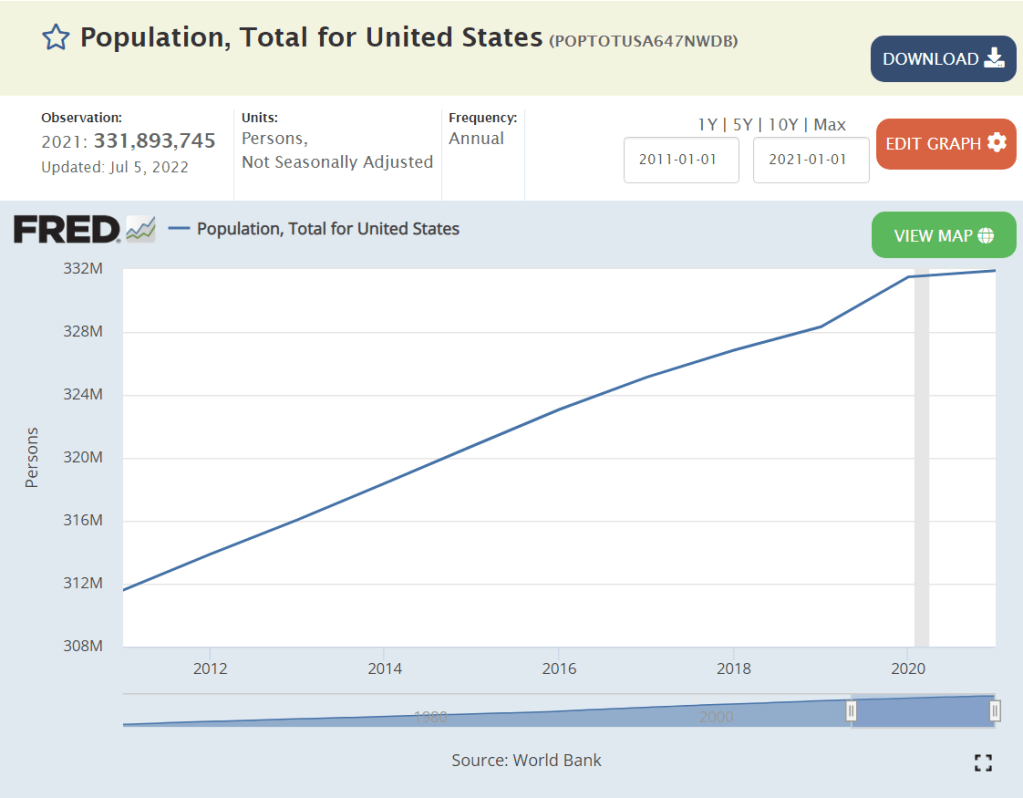

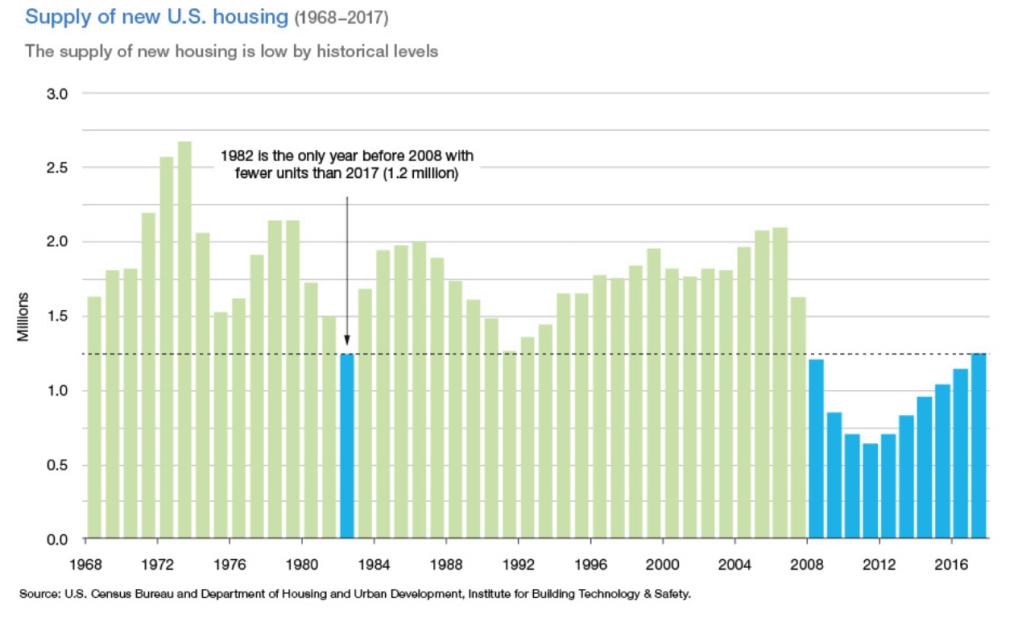

The supply of new homes available for sale, has remained flat at 300,000 for the last 50 years, while the population has grown by 50%.

The home vacancy rate is at one-half of its historic level.

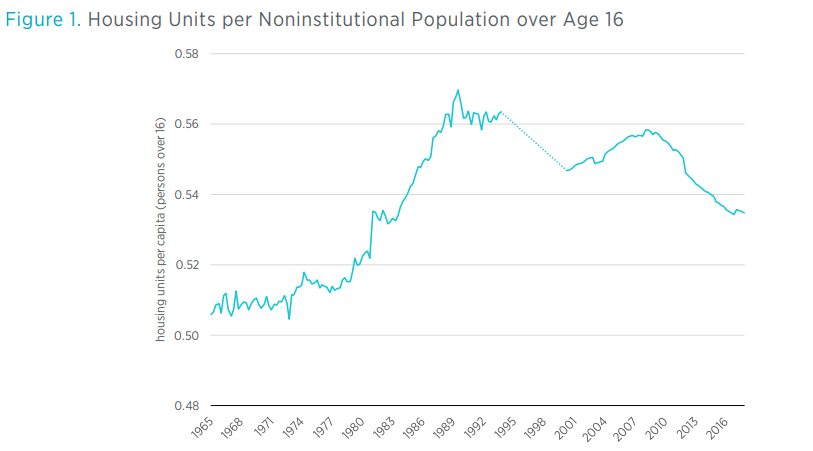

Housing Units

The ratio of housing units to population in 2021 is 0.38, a little higher than the 0.37 in 2001.

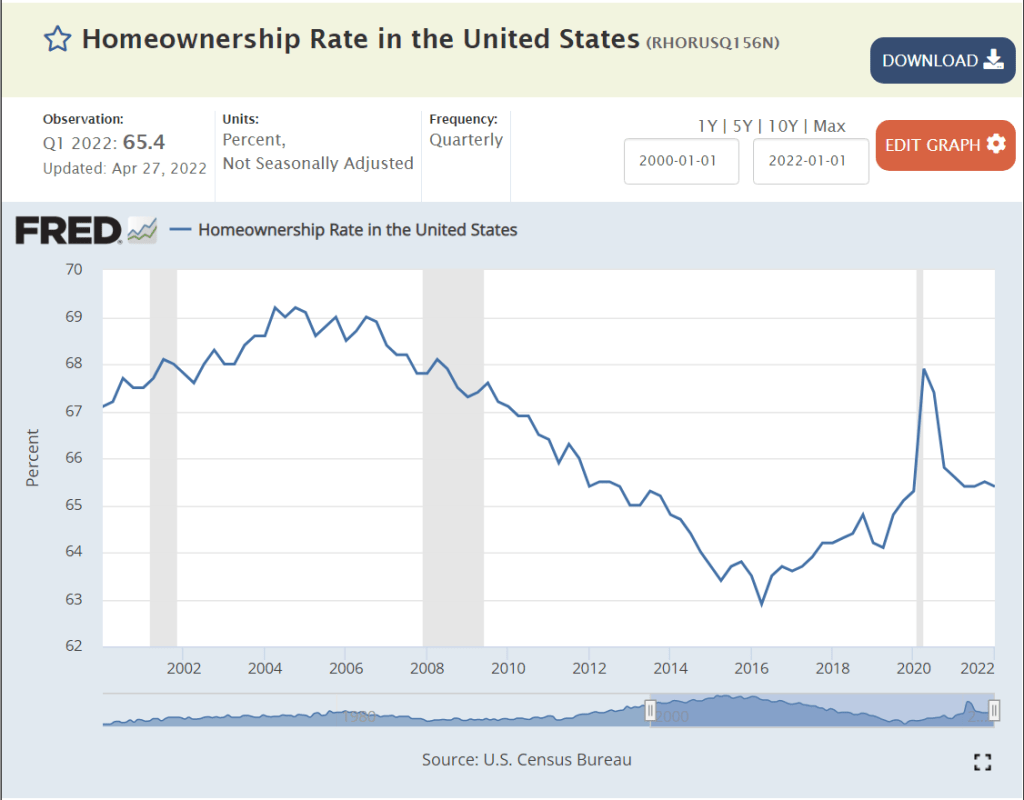

The “American dream” of single family home-ownership remains. Buyers continue to try to recover from the decline from 69% in 2006 to less that 64% in 2015.

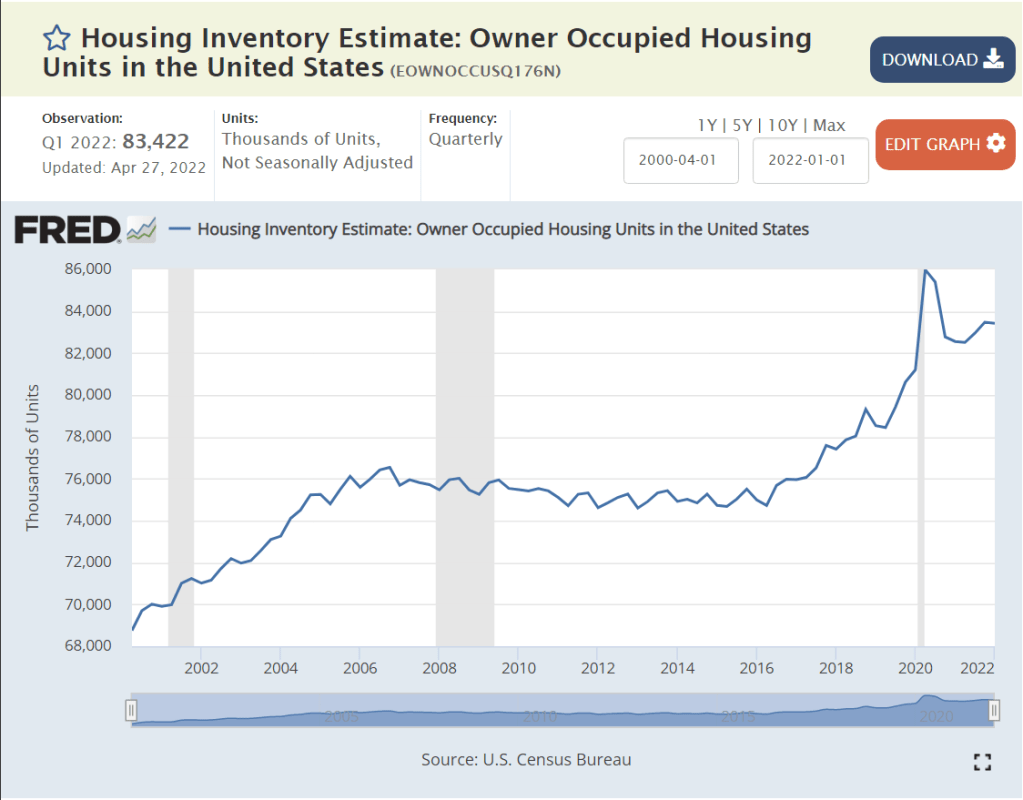

The number of owner-occupied (single-family) homes reached a peak of 76 million in 2006 and then flat-lined for eleven (11) years through 2017. An estimated 8 million homes have been added in the last 5 years, about 1.8M per year after zero per year for 11 years.

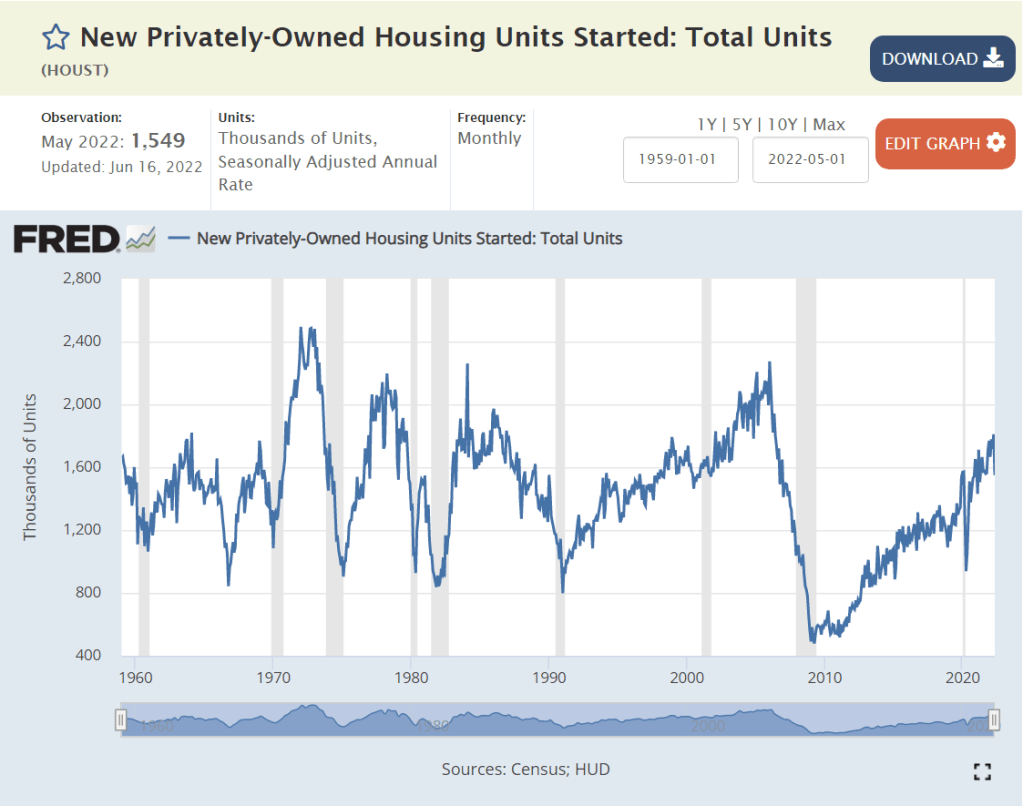

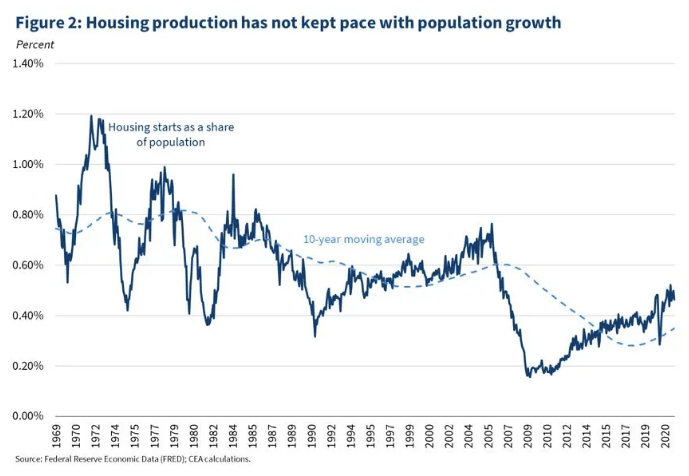

Supply Has Not Recovered from the Great Recession

A thorough analysis of supply and demand would include dozens of factors and 100 metro housing markets. However, at the simple trend-based macro level, we see 1.5-1.6 million units per year added from 1960-2010. We see a trough from 2007-2020 with a deficit of more than 5 million missing housing starts.

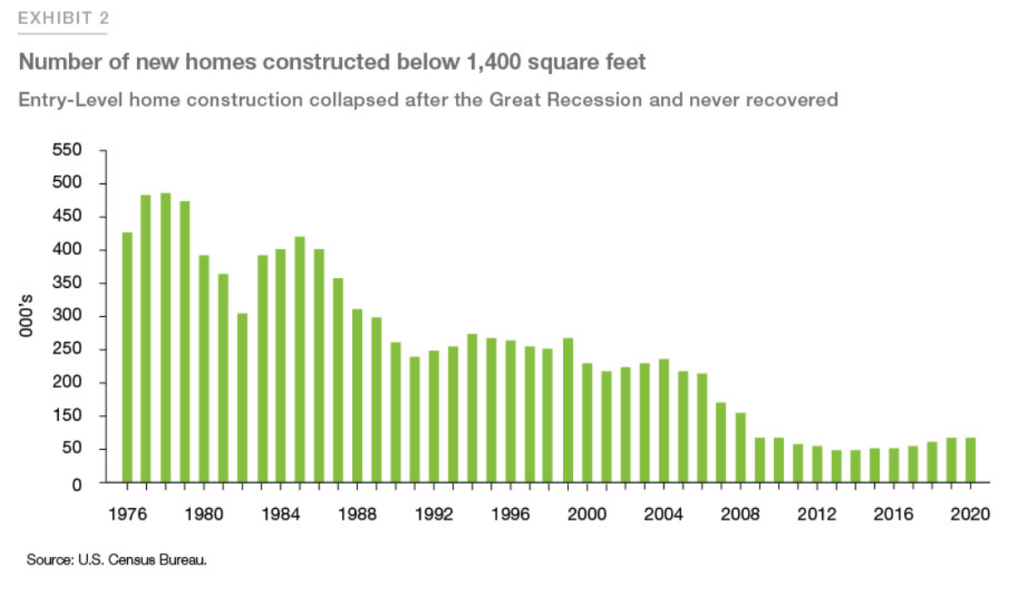

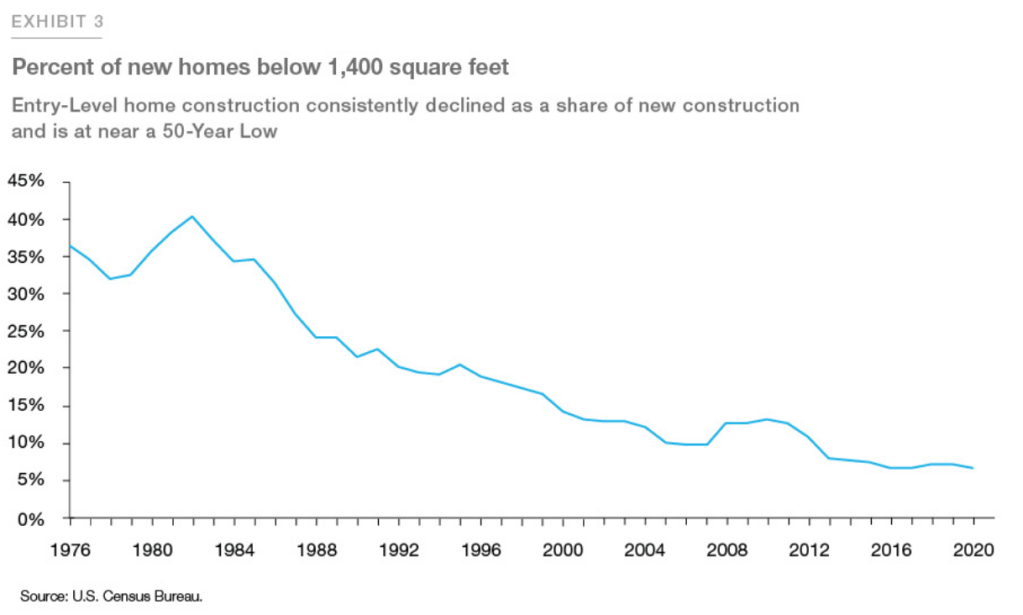

Even Worse, Starter Homes and Manufactured Housing Have Almost Disappeared, Driving an Affordability “Crisis”.

https://myhome.freddiemac.com/blog/research-and-analysis/20211013-starter-homes

Aging of the Housing Stock: The 2010-19 Decade Was a Huge Outlier

During every decade, except WW II, the US added 10 million+ housing units. They have an expected life of nearly 100 years.

The US added less than one-half of the usual amount in the teens, driving the median housing stock (owner-occupied) age up from 33 to 39 years. So, it’s even more than the 5 million housing units that weren’t built. The whole stock is older. More units require maintenance. More people are waiting to have the new or “newer” home ownership experience.

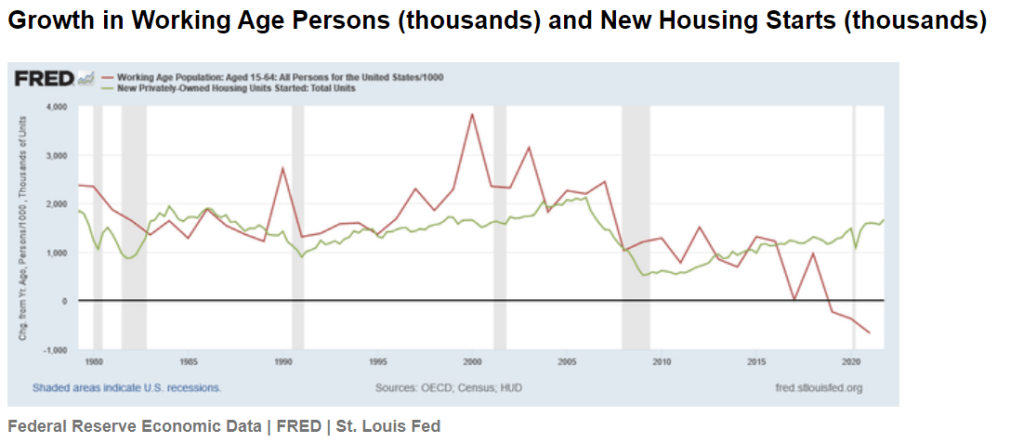

Many Ratios Echo the Simple “Missing” Housing Stock Claim

Housing units per capita has declined. New housing starts have not kept up with population growth.

Compared with the overall size of the market, housing starts have become a smaller and smaller share.

The last graph is most persuasive for me. Housing starts are less than one-half of what they were in the 1970’s. That’s a big drop. It’s possible that consumers have just chosen to consume less housing and more of other goods and services, but that does not appear to be the case.

Overall, we’re missing 5-8 million units out of 128 million units in a market that is struggling to deliver 1.6 million units to meet the normal demand.

The Freddie Mac experts come up with a smaller number, just 3.8 million.

https://www.freddiemac.com/research/insight/20181205-major-challenge-to-u.s.-housing-supply

https://www.freddiemac.com/research/insight/20210507-housing-supply

Contrary Views: Supply is OK, Too Much Short-term Demand

As noted earlier, the total housing units per capita ratio is relatively consistent. “Everybody gotta be somewhere”. The total housing units level has grown, with rental units replacing the desired and missing single-family units. The other graphs are comparing two rates of change and concluding that the rates of change are roughly equal, so there cannot be a shortage. I believe that the very deep and historically unprecedented (except for WW II) catastrophic decline in single family home construction from 2006-2020 created a material deficit in the stock of single family homes. The very weak economic recovery after the “Great Recession” held back new household formation and effective demand for new single family homes, so the construction industry did not recover back to its prior level for a full decade or more. The deficit remains.

Summary

One of the most important concepts in Economics 101 is “stocks and flows”. Stocks are a summary quantity at a single point in time, like all of the gallons of water in Lake Erie behind Niagara Falls. Flows are a quantity per unit of time, like the gallons of water flowing over Niagara Falls per minute, hour or day. Our economy contains both “stocks and flows”, especially relevant in the housing market. The flow of new home construction (single family or multi-family) is one of the most volatile components of GDP (flow of $ produced per year).

Historically, major changes in home construction have driven a majority of all business cycle declines. Bank runs and changes in interest rates account for another one-third. Supply shocks and international trade/currency changes account for the remainder.

Most markets “clear” in a relatively short time period and we collectively quickly benefit from the increases in prices that attract producers and drive consumers to find “next best” options and from the decreases in prices that force producers to leave an industry and reallocate capital elsewhere and the relative increase in consumer demand that limits price declines.

Unfortunately, the real estate industry works across much longer time frames. Consumers “want” to own single-family homes, but they can rent or live with relatives for many years. Construction firms are unable to quickly increase their supply capacity when demand increases. This is an industry where “learning by doing” remains a core factor.

The construction industry was truly “decimated” in 2006-7-8. One-half, two-thirds, three-fourths or four-fifths of all firms in any local market (general contractors and suppliers) were bankrupted. It has been slow to recover as banks were “burned” by construction loans and slow to extend credit to anyone.

The remaining construction firms reached new “critical mass” by 2017 and have been expanding rapidly, subject to zoning, land acquisition, labor and materials constraints.

Nonetheless, the cumulative supply deficit is quite large and will drive housing price increases for many years, perhaps another decade!