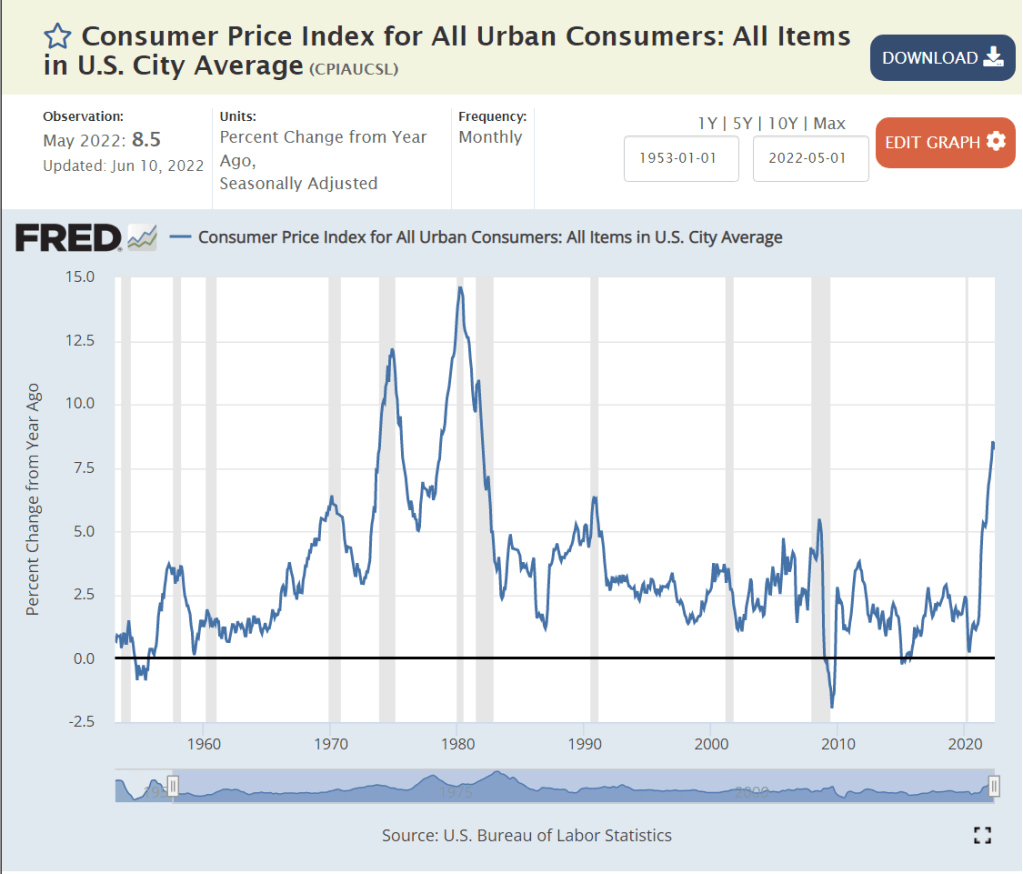

I was a wide-eyed young adult when the US last experienced 12% and 15% inflation rates. Our current situation is very different from that sad time 50 years ago. Fiscal policy was much looser, with LBJ pursuing a both “guns and butter” policy and Nixon following along. Monetary policy was slightly accommodating in the 70’s, comparable to today. The “supply shock” in the 70’s was much larger. The US was then much more dependent on foreign oil imports. Today the US is roughly “energy independent”, so subject to global price changes only. In the 1970’s, labor unions had some degree of power against the largest manufacturing concerns and used that power to attempt to maintain workers’ wages. There is no similar labor power today.

Average Inflation is at a Recent High of 8%

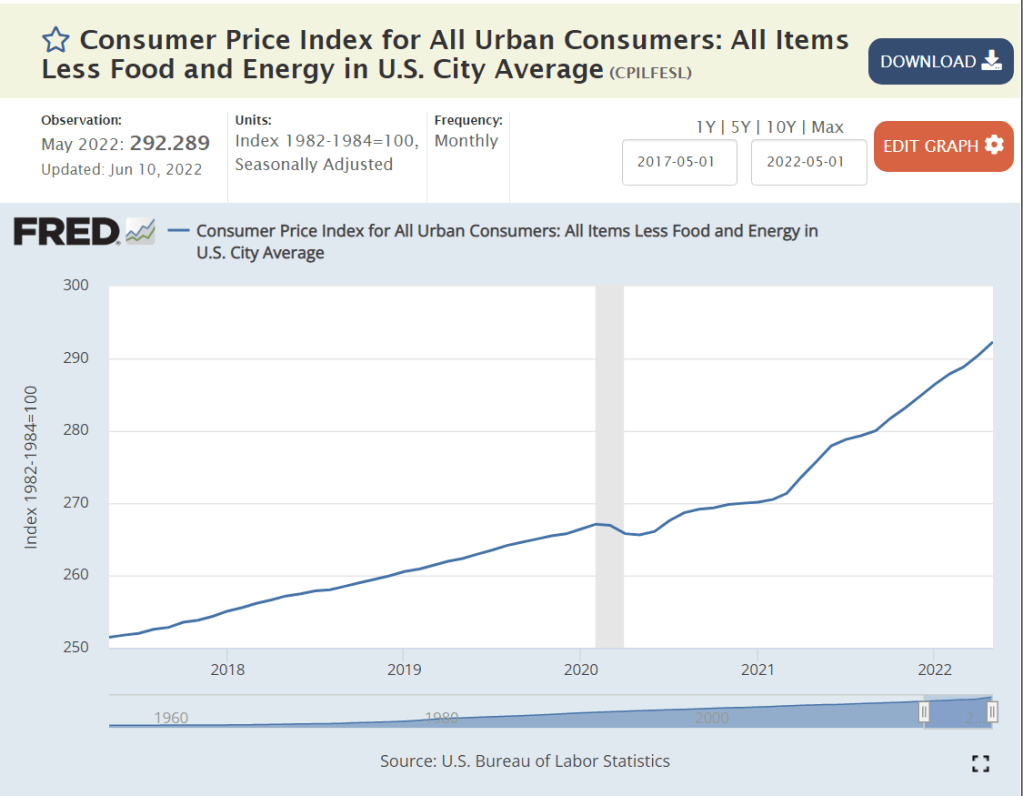

Core Inflation, Excluding Food and Energy is Growing at 6%

The inflection point is March, 2021. 2-3% inflation before then. 6% inflation in the last year. 6% is much higher than the 2% trend of the last 2-3 decades, but not a harbinger of spiraling inflation or wage-price spirals or cost-push inflation.

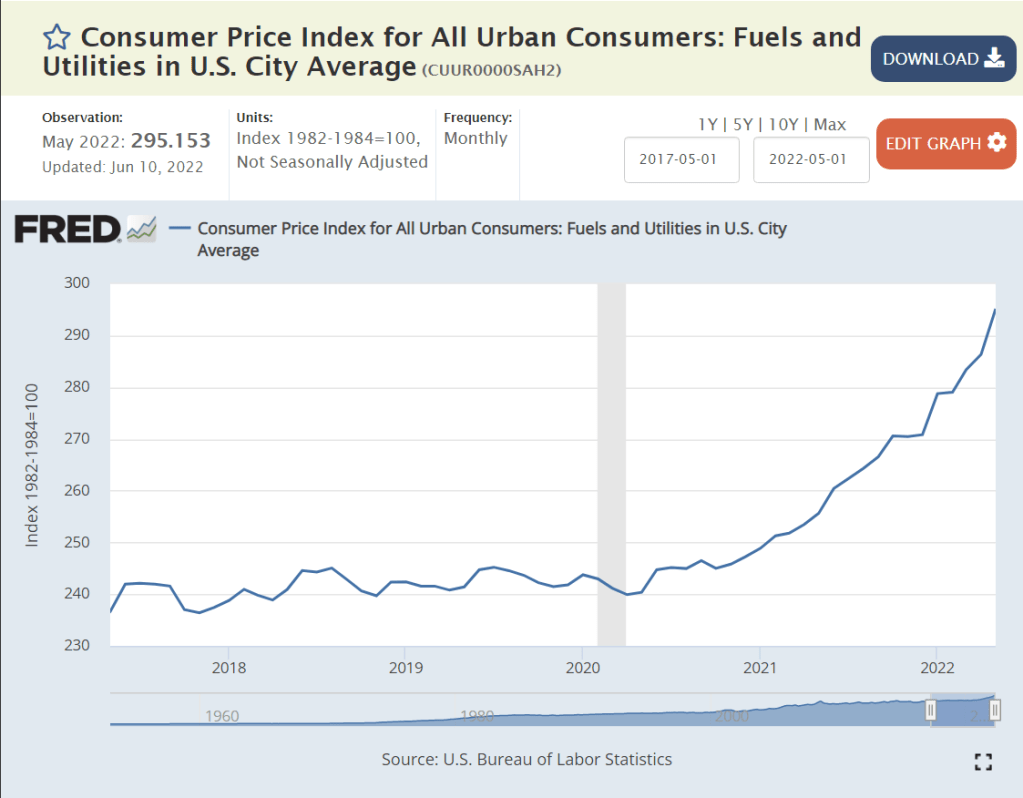

Inflation is Driven by Historically Highly Variable 1) Energy, 2) Commodities and 3) Food Prices.

The doubling of global energy prices since the end of 2020 is apparent. This was driven by the unexpectedly rapid global recovery from the pandemic (good news, overall) and the supply crimp from the Russian invasion of Ukraine. Energy is a 7% weight in consumer prices, so a doubling has a tremendous effect.

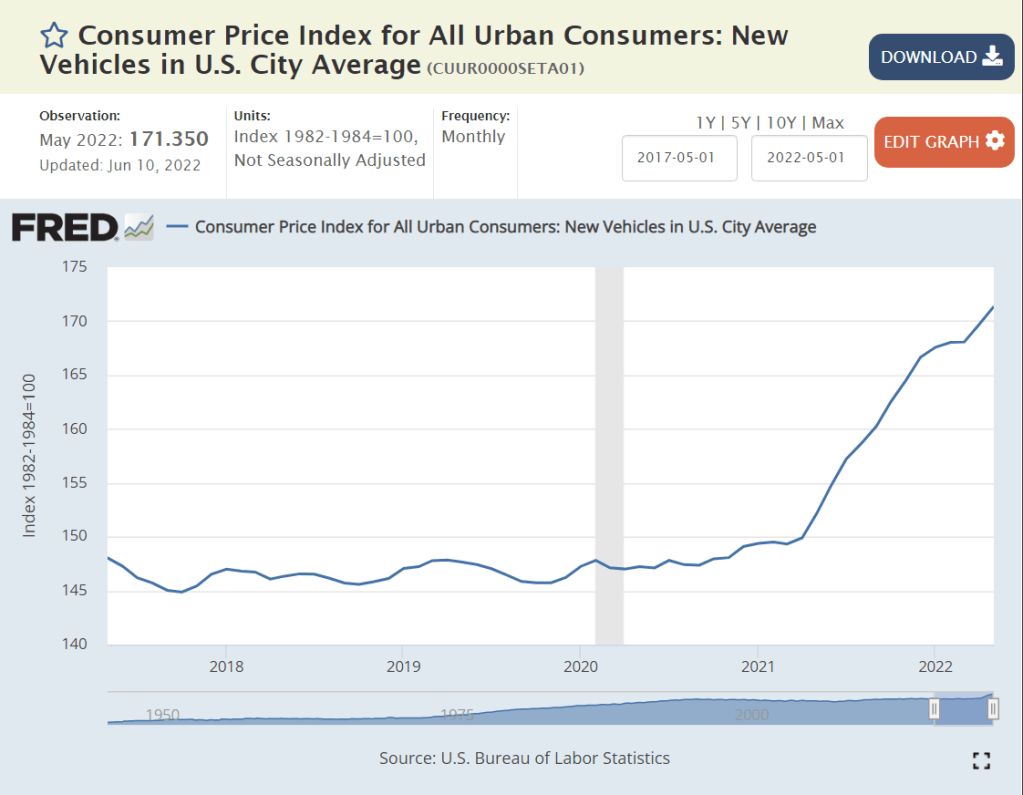

US demand for durable goods spiked by 50% within the pandemic, as in-person services were unavailable. This completely unexpected increase in demand for final goods drove a completely unexpected demand for commodity inputs, resulting in much higher prices that continue through today.

https://fred.stlouisfed.org/series/CPIFABSL

Food price increases also spiked. The pandemic interrupted direct agriculture and food processing labor inputs. Raw food inflation reached 16%, while “away from home” food prices grew by just 7%.

Lodging and Vehicle Prices Spiked Due to the Stop/Start Nature of the Pandemic Economy.

Lodging and used car inflation exceeded 20% but is now slowing. New car prices increased by 12%, but this price increase is back down to a 7% annual rate.

But, All Other Sectors Have Experienced “Normal” – Non-accelerating 6% or Lower Price Increases.

6%.

3-4%.

3-5%.

4-5%.

Drugs 2%. Medical Services 6%.

Communication and IT continue their price decreases after a small increase.

1-2% annual inflation.

Household furnishings, up 9% like other consumer durables.

Food away from home, up 6-7%, despite the incredible disruptions in the last 2-3 years.

Summary

Energy, food and commodities prices have increased sharply in the last year. The other dozen price indices have increased by 5-6-7% and then flattened off. Loose fiscal and monetary policy, combined with commodities price spikes have driven quite high consumer price inflation for the last 6-9 months. Inflation will drop from 8% to 6% in the 3rd quarter and then to 4% in the 4th quarter and then lower into 2023.

There is no indication of rapidly increasing prices or a wage-price spiral. US labor unions don’t have the power to respond to the recent unexpected increase in consumer prices with a demand for equal or higher wage increases. Wages have increased by 5% in the last 2 years as inflation has spiked to 8%.