Milliman Summary of 100 Largest Plans Offers Best Details

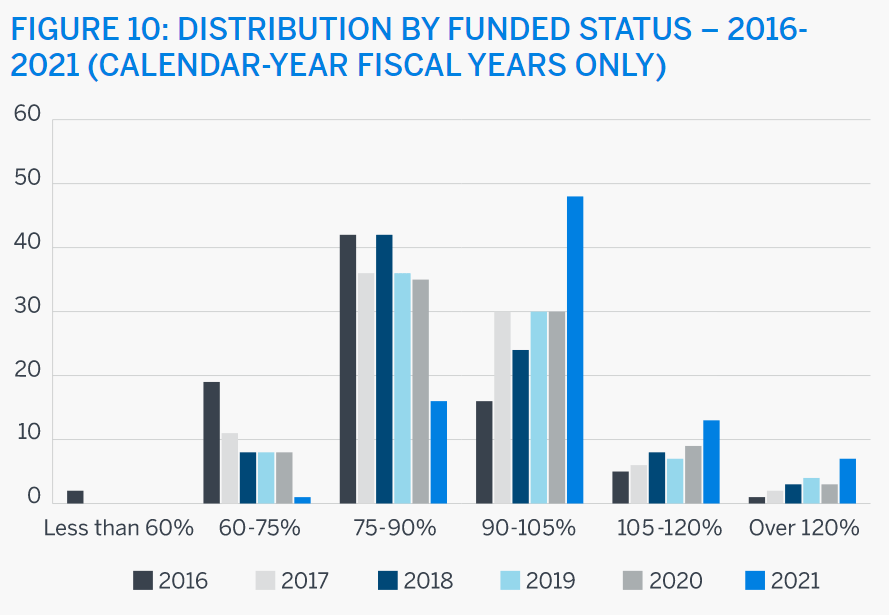

Just 5% of the largest plans have a funded status (assets/liabilities) less than 80%.

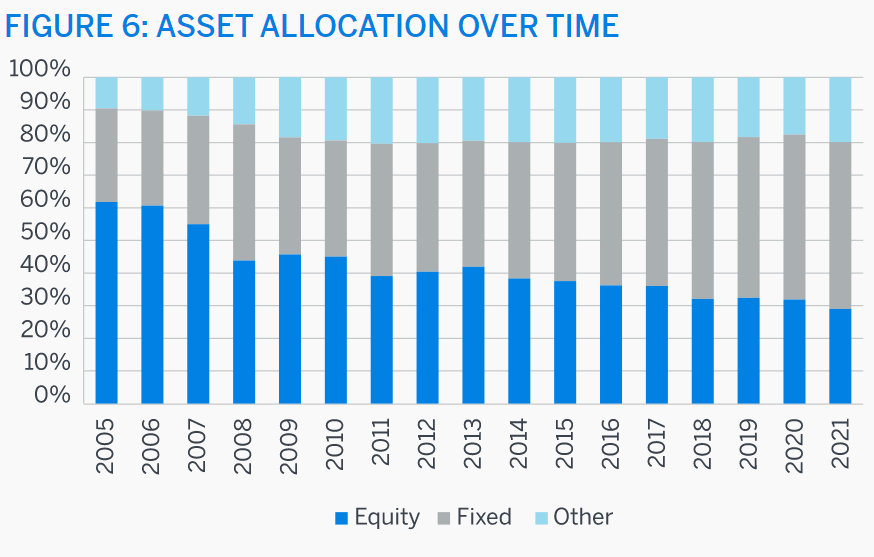

This is in spite of an increase in lower risk/lower return fixed income/bond funding growing from 30% to 50% of invested assets.

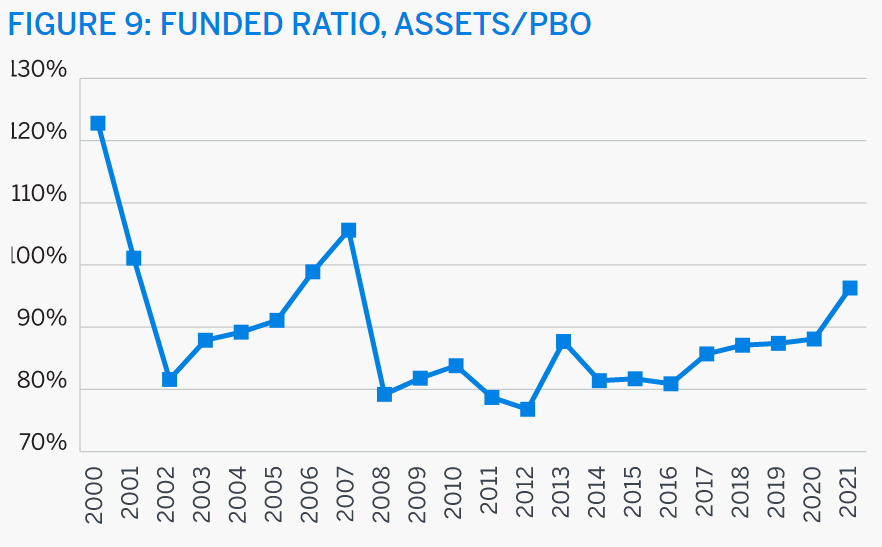

Plan assets took a big hit in 2008 but have slowly recovered.

Historically, 80% funded was considered to be “fully funded”. Corporations increased contributions after 2008 to slowly ensure plan funding ratios would increase. The 96% level in 2021 is unusually high, driven by many years of increased corporate cash contributions and higher than expected investment returns that have offset planned future investment returns which have dropped from 9% to 6.5%, thereby decreasing the ability of firms to simply rely upon investment returns to fund their pension liabilities.

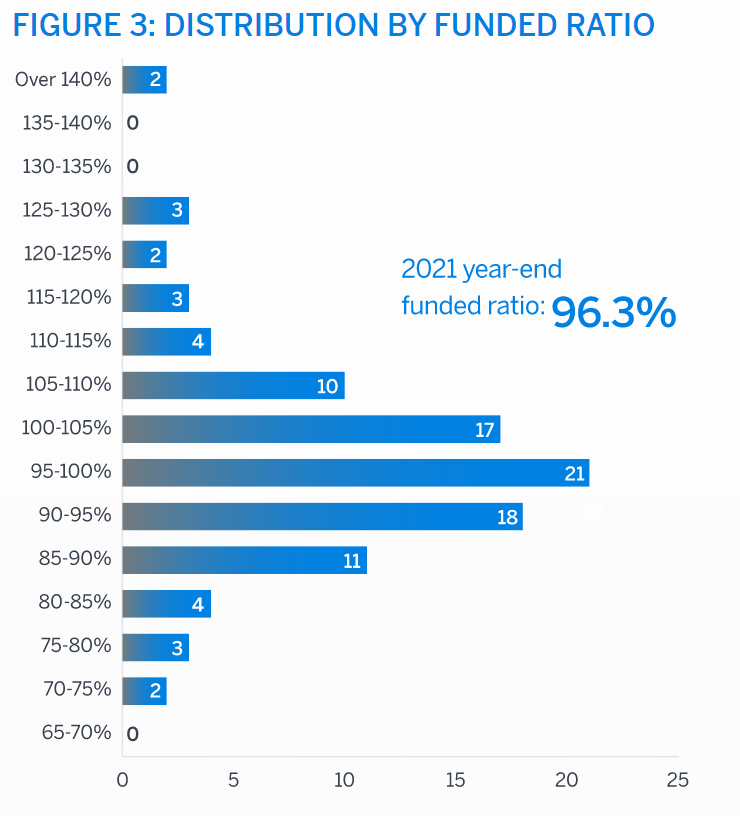

Almost one-half of the largest firms have funded ratios of 90-105%, a very safe level. More firms have greater than 105% funding than have less than 90% funding.

Pension accounting is a complex and subjective area. Cash contributions have consistently exceeded the accounting basis expenses recognized. This reflects a conservative actual funding strategy.

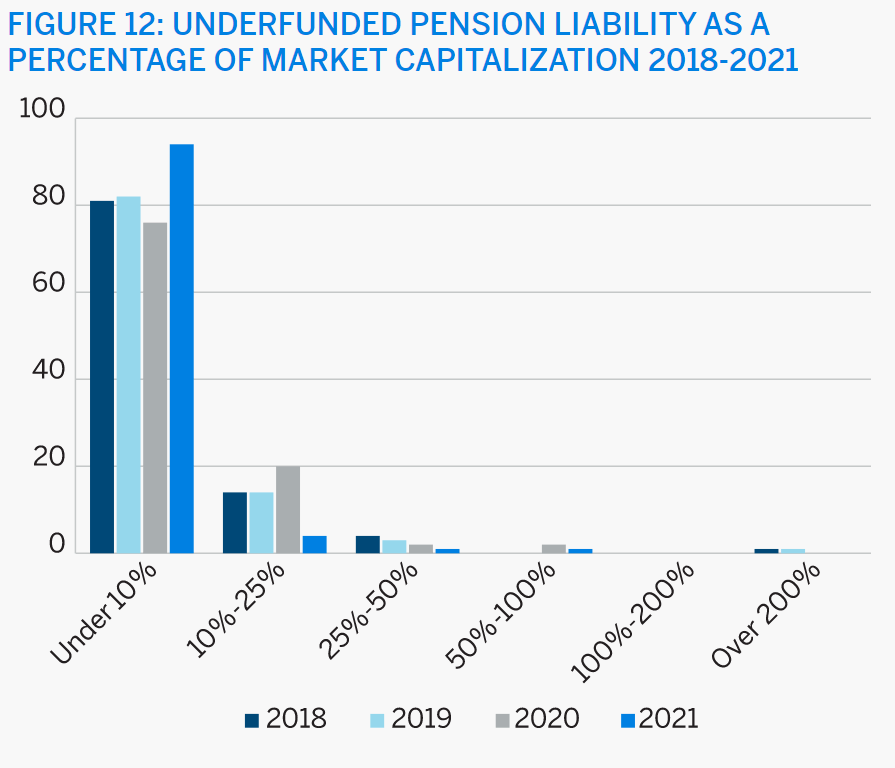

The net unfunded pension liability is an immaterial share of the value of major corporations.

Blackrock summarizes funded status for 200 large defined benefit pension plans. The funded ratio declined in 2008 and has slowly recovered. It reached 95% in 2021.

Mercer summarizes 1,500 defined benefit pension plans. 80% funded is pretty typical since the Great Recession. Mercer reports 97% funded status at the end of 2021.

Summary

Defined benefit pension plans are an increasingly smaller share of all retirement savings plans. However, corporations are funding their future liabilities at a fully adequate level.