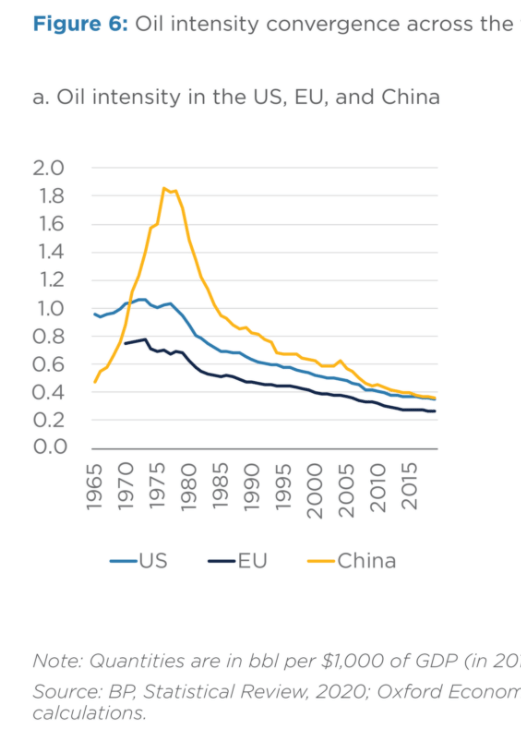

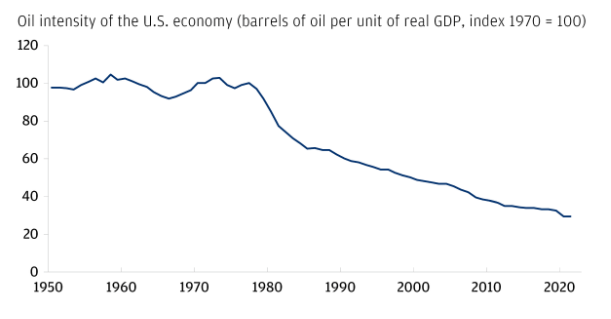

World Oil Dependency is Less than One-Half What It Was

https://www.energypolicy.columbia.edu/research/report/oil-intensity-curiously-steady-decline-oil-gdp

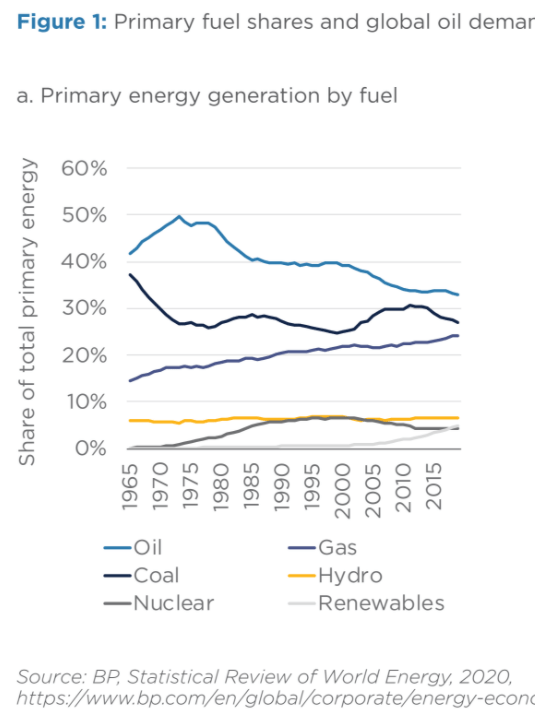

Oil Matters, But Other Energy Sources are Growing

https://www.energypolicy.columbia.edu/research/report/oil-intensity-curiously-steady-decline-oil-gdp

Oil Intensity is Declining on Many Continents

https://www.energypolicy.columbia.edu/research/report/oil-intensity-curiously-steady-decline-oil-gdp

https://www.northerntrust.com/africa/insights-research/2022/weekly-economic-commentary/oil-intensity

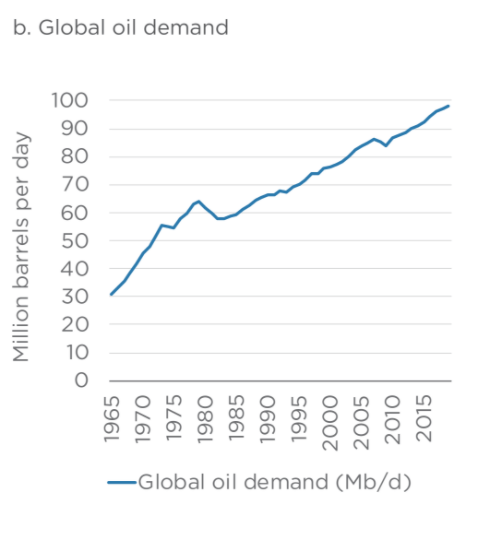

Oil Intensity Has Declined Even While Demand Has Grown

https://www.energypolicy.columbia.edu/research/report/oil-intensity-curiously-steady-decline-oil-gdp

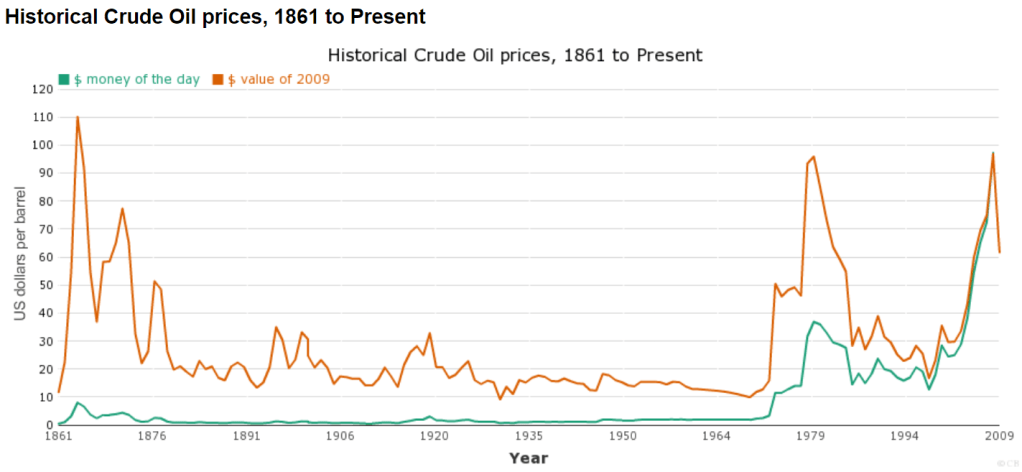

Context of Historical Real Prices

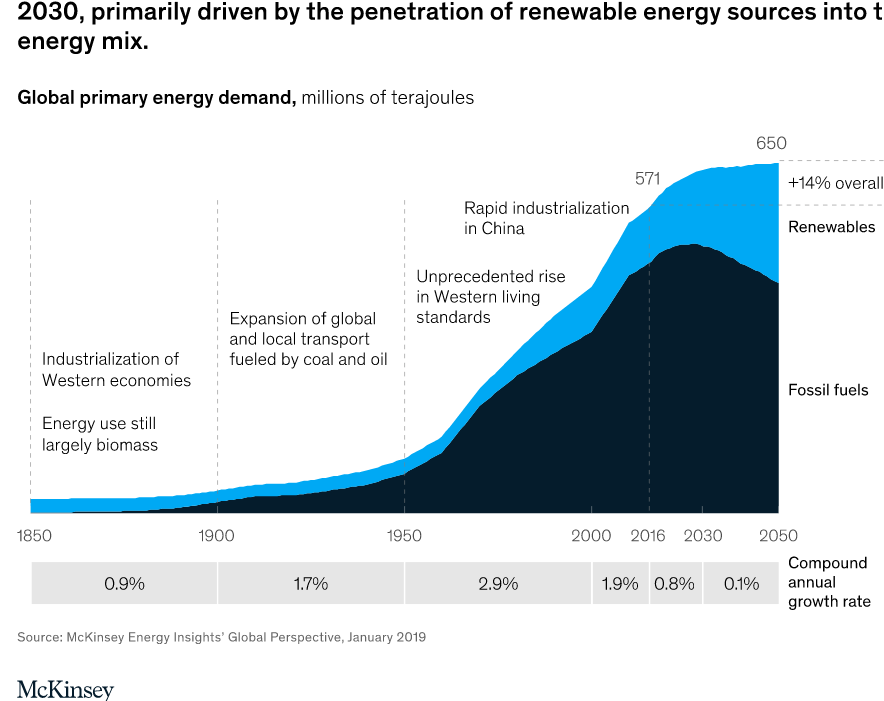

Future Global Oil Intensity is Declining

https://www.energypolicy.columbia.edu/research/report/oil-intensity-curiously-steady-decline-oil-gdp

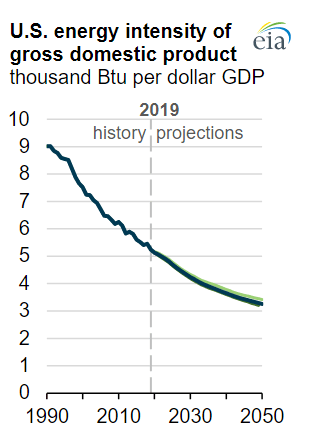

Energy intensity is down as the service economy becomes a greater share of GDP, energy efficiency improves for consumer and industrial uses, electricity power grows with its inherently higher efficiency, and renewable energy grows as a source of power.

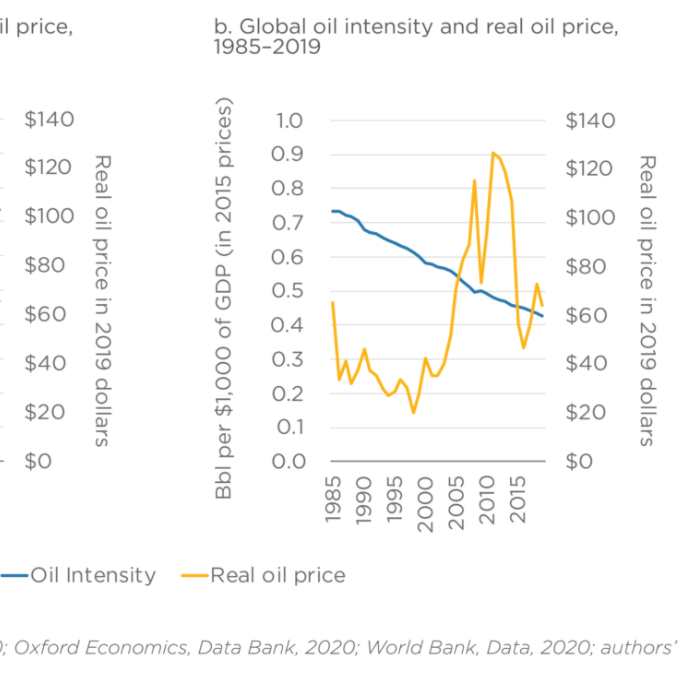

Recent Global Oil Price Spikes Had Limited Impact

https://www.energypolicy.columbia.edu/research/report/oil-intensity-curiously-steady-decline-oil-gdp

US Economy Energy/Oil Intensity Improves

https://www.eia.gov/outlooks/aeo/consumption/sub-topic-03.php

https://www.eia.gov/todayinenergy/detail.php?id=42895

Future Energy Intensity Improvements in All US Sectors

https://www.eia.gov/todayinenergy/detail.php?id=42895

https://www.eia.gov/outlooks/aeo/consumption/sub-topic-03.php

https://www.northerntrust.com/africa/insights-research/2022/weekly-economic-commentary/oil-intensity

Risks

US consumer price index still weights motor fuel consumption at 4%, so spikes in market prices effect consumers and politics.

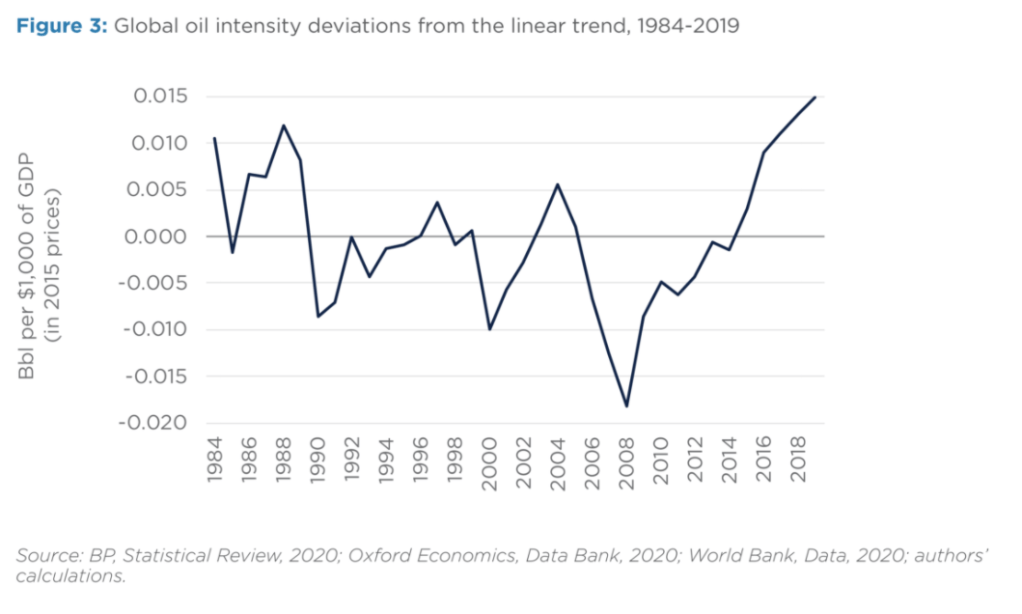

The long-term downward trend in oil required per dollar of GDP slowed after 2014.

https://www.energypolicy.columbia.edu/research/report/oil-intensity-curiously-steady-decline-oil-gdp

It’s possible that ALL energy prices may increase, especially during the transition to renewable energy sources.

Finally, individual country risks still matter: Russia, Iran, Venezuela and Saudi Arabia.

Summary

The Oil Shocks of the 1970’s were due to a drastic shift in the pricing power of the OPEC countries following 30 years of greatly accelerated global demand for oil while it was priced attractively. Demand and supply have both grown in the last 50 years. The role of oil in the global and US economies (compared with real output/GDP) has dropped by more than one-half. Increased oil prices can and will have a significant effect today, but less than one-half of that in the past. Long-run trends indicate that the role of oil as a critical resource will continue to decline, although there remain risks as the world closes coal and nuclear power plants and makes the investments required for a renewable energy world.

[…] https://tomkapostasy.com/2022/04/05/good-news-oil-2022-is-not-1972/ […]

[…] Good News: US Is Energy Self-Sufficient Good News: Real Gas Prices Flat for 40 Years Good News: Oil 2022 is not Oil 1972! Good News: State Pension Funding is at a 13 Year High! Good News: US Pension Plan Assets […]