Hotel capacity increased by 50% from 1995 to 2019.

Demand grew at the same 50% rate, although not always in lockstep.

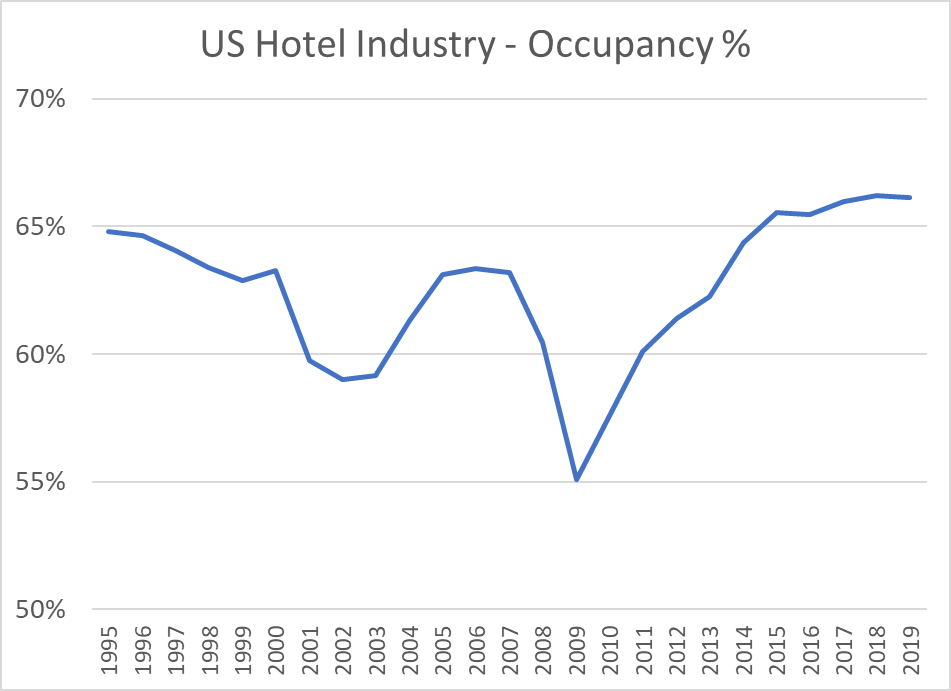

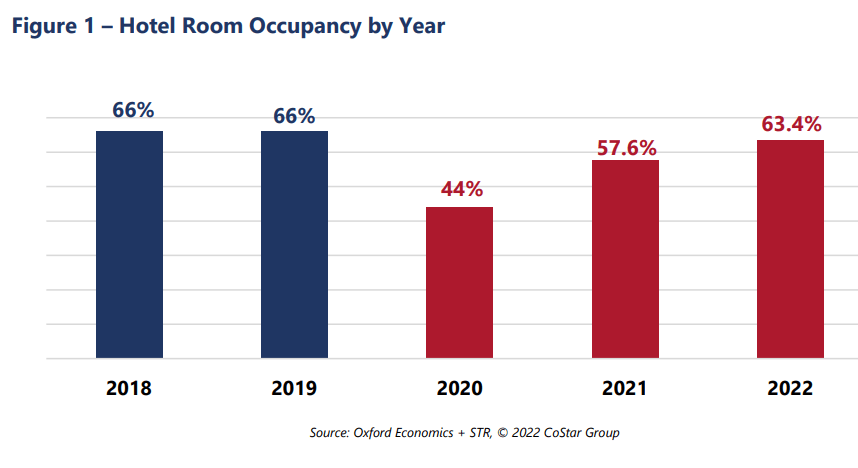

Occupancy averaged a healthy 63% (almost two-thirds) through this period, with significant differences due to changes in construction and the economy.

The price per room averaged about $125 per night in real 2020 dollars, again varying based on supply and demand, but overall, relatively constant.

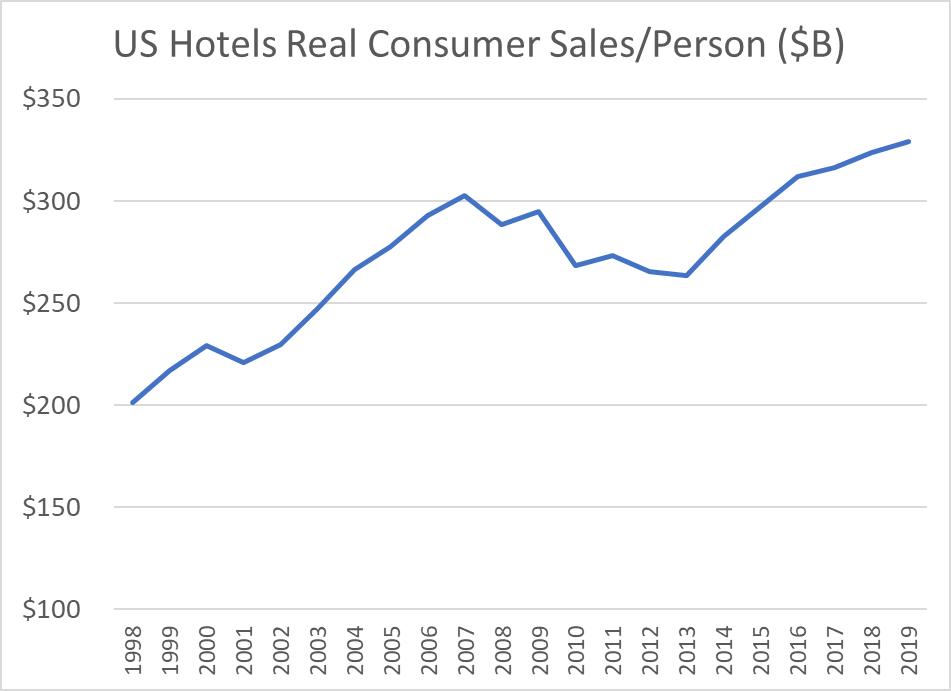

Total hotel industry real revenue ($2020) for the 21 years from 1998 through 2019 increased by a little less than 50% according to Bureau of Economic Analysis (BEA) figures.

Real consumer only (leisure) sales increased by nearly 100% during this period.

Real consumer sales per person increased by about two-thirds.

Resources

https://apps.bea.gov/scb/2022/02-february/0222-travel-tourism-satellite-account.htm

https://www.bea.gov/tourism-satellite-accounts-data-sheets

https://fred.stlouisfed.org/series/CPIAUCSL#0

https://www.multpl.com/united-states-population/table/by-year

Other Historical Views

Domestic leisure travel doubled in the first 40 years of the 20th century.

https://data.bls.gov/pdq/SurveyOutputServlet

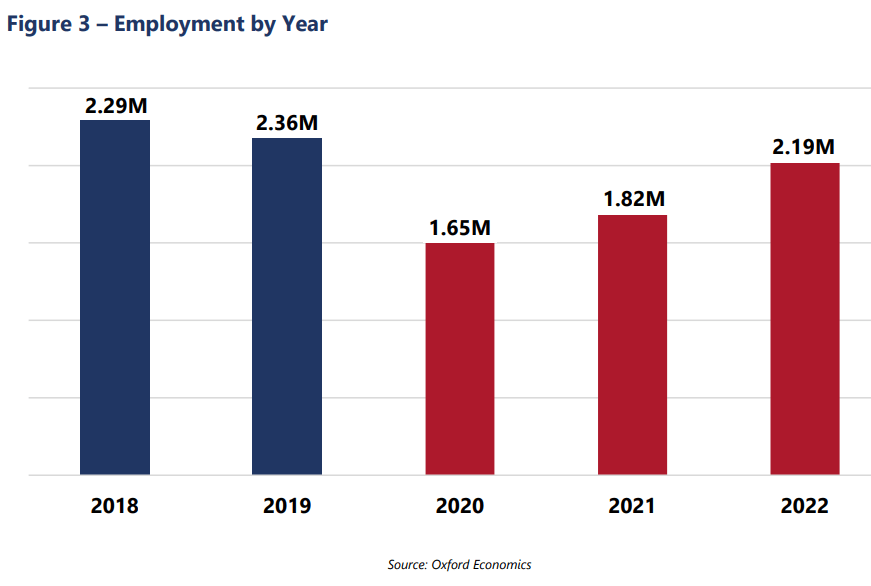

Hotel industry operating statistics before 1995 are not readily available. The tremendous growth of the industry in the last 30 years of the twentieth century is illustrated by the more than three-fold growth in industry employment, from one-half million to 1.8 million. Note that employment did not follow the growth of rooms during the first 20 years of the next century.

Oxford Economics developed an industry promotion brochure in 2019 that has some longer-term data. Total real (inflation adjusted) revenue is up more than 4 times in 40 years. Our 1995-2018 data shows relatively small changes in average hotel prices. I suspect that there were “real” increases from 1978 – 1995 as the industry was growing quickly in response to consumer demand.

A similar measure, gross domestic product (GDP), or production value added, net of the cost of inputs, increased 3-fold in 40 years.

Consumer spending on accommodations has increased about 3 times as fast as GDP overall in the last 40 years.

Hotel purchases as a share of total consumer spending has increased by more than 80% in these 40 years.

Overall demand for hotel rooms per citizen for all uses (personal, business, government and foreign travelers) has increased by 20% across 30 years. Personal and foreign travel have grown at a faster rate.

https://www.hvs.com/article/8587-How-Many-Rooms-Is-Too-Many-Per-capita-Demand-and-the-Hotel-Cycle

Short-term Rentals

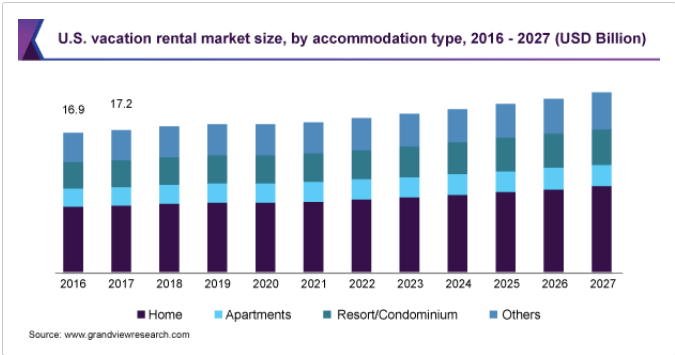

The short-term rental market (personal vacation rentals, Airbnb) has grown from zero to 10% of the hotel room volume and appears to have years of growth ahead of it. This growth is not included in the industry summary figures.

https://www.grandviewresearch.com/industry-analysis/vacation-rental-market

Pandemic Impact and Future

Occupancy is forecast to return to the historical average of 63% for 2022 and increase further in the following years. The industry “lost” more than $100B of revenues due to the pandemic, so analysts estimate that the industry will return to “normal” employment, prices, profitability and reserves by 2025.

https://www.pwc.com/us/en/industries/hospitality-leisure/us-hospitality-directions.html

Summary

Consumer access to hotels and private rentals has increased by 3 or 4 times in the last 50 years, at a faster rate in the first 25 years, and somewhat slower in the last 25 years. Hotel business models at 63% occupancy seem to justify continued capital investments in new supply. Prices have been relatively flat for 25 years. Competition between brands, pricing segments, corporations and private owners seem to be effective at providing adequate capacity and service options at competitive prices.

[…] Good News: Growing US Hotel Capacity, More Consumer Choice […]

[…] Good News: US Economy is 29 Times as Large as in 1900! Good News: Pets in the USA Good News: Growing US Hotel Capacity, More Consumer Choice Good News: Apparel Prices Good News: Average US Car is 12 Years Old Good News: […]